|

市场调查报告书

商品编码

1851347

智慧标籤:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Smart Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

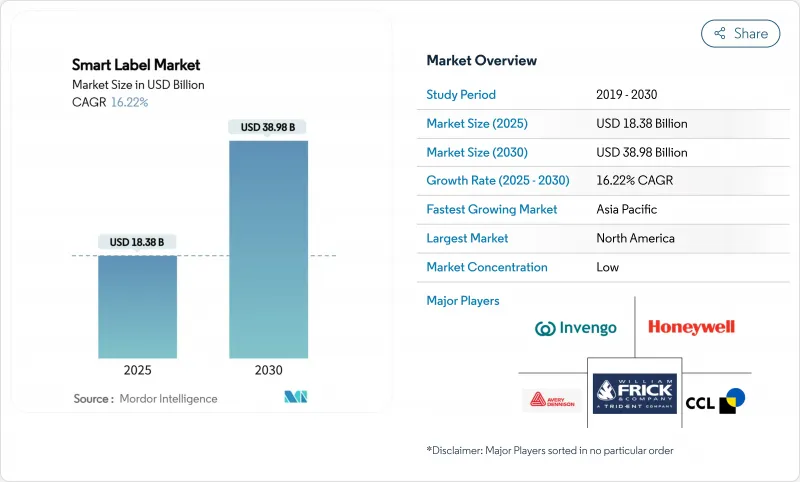

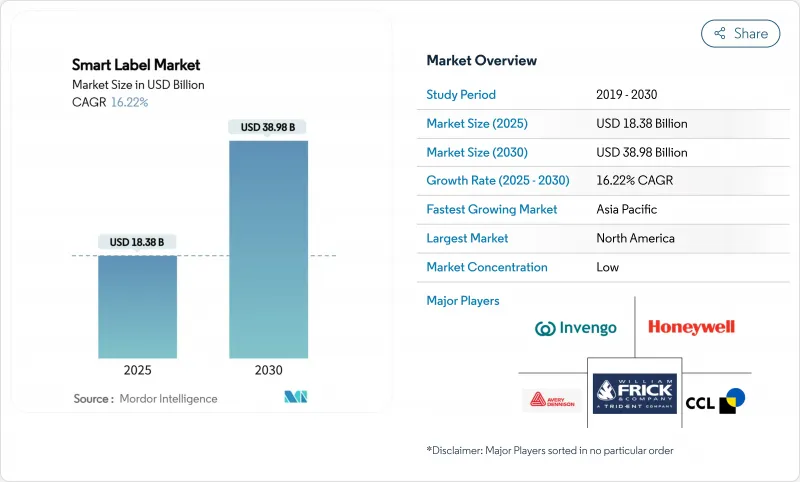

预计到 2025 年,智慧标籤市场规模将达到 183.8 亿美元,到 2030 年将达到 389.8 亿美元,年复合成长率为 16.22%。

这一成长反映了监管要求、无线射频识别 (RFID) 和近距离场通讯(NFC) 技术的进步,以及对端到端供应链透明度日益增长的需求。美国食品药物管理局 (FDA) 的《药品供应链安全法案》下的药品序列化、欧盟的《包装和包装废弃物法规》(PPWR)(其中包含数位产品护照的概念)以及沃尔玛等零售商主导的RFID 项目,共同构成了一项不容妥协的合基准。企业正在透过整合云端分析、区块链认证和环境物联网感测器来应对这项挑战,这些技术将被动标籤转化为数据丰富的资产,从而实现跨行业的即时库存可见性、动态定价和状态监控。

全球智慧标籤市场趋势与洞察

RFID技术在库存视觉化方面的应用日益广泛

沃尔玛强制要求在数千个库存单元上安装超高频 (UHF) RFID 标籤,迫使供应商维修生产线,推动了整个产业对 RAIN RFID 编码解决方案的投资。供应商能够持续掌握库存信息,并将这些信息直接导入製造执行系统 (MES),从而减少物料短缺,并提高数位双胞胎调度效率。高通计划将 RAIN RFID 嵌入智慧型手机,这将很快使每台消费性电子设备都成为读取器,从而无需固定的扫描器基础设施,并加速小型零售商的采用。同时,更小的天线现在支援 10 英尺的读取范围,从而实现无缝结帐,改善客户体验。

药品供应链中对防伪措施的需求日益增长

当《药品供应链安全法案》(DSCSA)于2024年11月全面生效时,贸易伙伴将被要求在产品交付前验证序列化标识符,这就需要对标籤进行升级,使其结合NFC晶片、区块链加密和电子纸显示防篡改资讯和剂量资讯。例如,Ynvisible公司的ConnectedLabel每年可对超过一百万个药品包装进行近乎即时的温度追踪。在美国以外,印度已强制要求在畅销药品上使用QR码,这标誌着序列化正从合规性转向差异化,以保障病人安全。

小型零售商的初始硬体和整合成本较高

ESL标籤每个成本为11-12美元,因此在数千个SKU上部署需要大量资金投入。小型零售商还必须为POS系统升级和员工培训预留预算,儘管ESL标籤具有节省人力成本的潜力,但其普及速度仍然较慢。订阅模式正在兴起,但仍处于起步阶段。

细分市场分析

到2024年,RFID将占据智慧标籤市场38.32%的份额,这得益于其在零售和物流领域成熟的扩充性。 NFC目前规模较小,但预计将以20.13%的复合年增长率成长,因为它利用了智慧型手机在全球的普及,实现了触碰式验证。因此,与NFC相关的智慧标籤市场规模将快速成长,尤其是在透过区块链整合实现防篡改奢侈品认证方面。电子商品防盗系统依然强劲,而感测标籤则凭藉其在低温运输和环境合规应用方面的潜力而日益增长。整体而言,技术变革正从被动识别转向多功能感测器和互动工具。

意法半导体 (STMicroelectronics) 的 ST25Connect 专案进一步增强了消费者互动体验,使 NFC 标籤能够应用于医疗设备、葡萄酒、化妆品等领域,在提供个人化内容的同时收集互动分析资料。将低成本感测器整合到嵌体中,进一步模糊了追踪、状态监测和客户通讯之间的界限,推动 RFID 和 NFC 技术走向融合创新之路。

预计到2024年,零售业将维持31.03%的收入份额,反映出门市已开始广泛采用RFID项目,且电子标籤(ESL)覆盖范围不断扩大。然而,医疗保健和製药智慧标籤市场规模将以19.67%的复合年增长率成长,成为所有产业中成长最快的产业。序列化期限和温控物流的需求正促使医院、药房和委託製造嵌入智慧标籤,以实现端到端的可追溯性。物流供应商和第三方物流公司(3PL)也正在采用蜂窝和蓝牙低功耗(BLE)混合标籤,以实现交付文件的即时自动化。

费森尤斯卡比的「资料矩阵+RFID」倡议展示了在重症监护医院环境中,药物核查如何减少人为错误。临床试验的数位化标籤消除了因语言差异导致的人工重新贴标,提高了患者依从性,并简化了监管审核。食品和饮料製造商也积极进行类似工作,以应对美国食品药物管理局(FDA)的《食品安全现代化法案》(FSMA)第204条关于可追溯性的强制性要求。

智慧标籤市场报告按技术(RFID、EAS、NFC、感测标籤、ESL 等)、最终用户(零售、医疗保健、物流、製造等)、组件(集成电路、电池、天线等)、应用(追踪、安全、低温运输、定价等)、外形规格(贴纸、吊牌等)和地区(北美、欧洲、亚太、中东和非洲、南美)进行细分。市场预测以美元计价。

区域分析

2024年,北美将占全球销售额的37.84%,这主要得益于美国在零售业率先采用RFID技术以及具有法律约束力的DSCSA序列化蓝图。联邦政府持续投资,力争2030年将国内半导体产量提高三倍,将缓解近期导致晶片短缺而延误的局面。加拿大和墨西哥将受益于近岸外包的增加和跨境贸易的整合,而艾利丹尼森在克雷塔罗投资1亿美元的工厂将满足日益增长的智慧标籤需求。

欧洲是全球第二大区域集团,其发展主要受永续性相关法规的推动。即将出台的《可回收物和废弃物条例》(PPWR)将强制要求使用数位识别码来评估可回收性,而德国的电动车电池护照试点计画则巩固了RFID技术在汽车价值链中的应用。Konica Minolta预测,到2027年,欧洲RFID标籤市场规模将达到25亿欧元(约28亿美元)。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到18.73%。中国向7000家食品生产商推广二维条码、印度的塑胶废弃物QR码溯源以及日本的工业5.0奖励都为该地区的发展注入了强劲动力。 5G的扩展和计画中的6G将为环境物联网提供网路骨干,并支援无电池感测器的大规模应用。儘管存在地缘政治风险,但台湾和韩国晶片製造地的集中优势使其在供应方面占据优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩大RFID在库存可见性方面的应用

- 药品供应链中对防伪措施的需求日益增长

- 全通路零售的兴起需要即时定价。

- 扩大物联网物流的应用

- 用于低温运输完整性的印刷式无电池感测器标籤的出现

- 欧盟ESG包装强制令(PPWR 2026)加速智慧标籤整合

- 市场限制

- 小型零售商的初始硬体和整合成本较高

- 缺乏通用的互通性标准

- 半导体供应限制正在减缓UHF频段射频识别积体电路的供应。

- 资料隐私法规限制了NFC消费者互动分析

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 透过技术

- RFID

- 电子商品防盗系统(EAS)

- 近距离场通讯(NFC)

- 感测标籤(温度、气体等)

- 电子货架标籤(ESL)

- 其他新兴技术(二维码、蓝牙低功耗)

- 按最终用户行业划分

- 零售

- 医疗保健和製药

- 物流/运输

- 製造业和工业

- 饮食

- 其他终端用户产业

- 按组件

- 微控制器/积体电路

- 电池和电源装置

- 天线和收发器

- 感应器

- 软体和中介软体

- 基材和保护材料

- 透过使用

- 资产和库存追踪

- 防盗和安全

- 低温运输监测

- 动态定价和促销

- 品牌认证与消费者参与

- 在製品管理

- 按标籤外形规格

- 湿式嵌体/贴纸标籤

- 吊牌

- 套模标籤

- 纺织品和服装标籤

- 可列印柔性感测器标籤

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Avery Dennison Corporation

- CCL Industries Inc.

- Zebra Technologies Corp.

- Honeywell International Inc.

- SATO Holdings Corp.

- William Frick & Company

- Invengo Information Technology Co. Ltd.

- Scanbuy Inc.

- Alien Technology LLC

- Roambee Corporation

- Smartrac(NXP)

- SES-imagotag SA

- Pricer AB

- Thinfilm Electronics ASA

- Digimarc Corporation

- Tapwow LLC

- Stora Enso Oyj

- Identiv Inc.

- Impinj Inc.

- Checkpoint Systems Inc.

- Confidex Ltd.

- NXP Semiconductors NV

第七章 市场机会与未来展望

The smart label market size is valued at USD 18.38 billion in 2025 and is forecast to reach USD 38.98 billion by 2030, advancing at a 16.22% CAGR.

This growth reflects the intersection of regulatory mandates, advances in radio-frequency identification (RFID) and near-field communication (NFC) technologies, and rising demand for end-to-end supply-chain transparency. Pharmaceutical serialization under the FDA's Drug Supply Chain Security Act, the European Union's Packaging and Packaging Waste Regulation (PPWR) that embeds digital-product-passport concepts, and retailer-driven RFID programs such as Walmart's have together created a non-negotiable compliance baseline. Companies are responding by integrating cloud analytics, blockchain authentication, and ambient IoT sensors that convert passive labels into data-rich assets, enabling real-time inventory visibility, dynamic pricing, and condition monitoring across industries.

Global Smart Label Market Trends and Insights

Growing RFID Adoption for Inventory Visibility

Walmart's mandate for ultra-high-frequency (UHF) RFID tags on thousands of stock-keeping units has pushed suppliers to retrofit production lines, catalyzing sector-wide investment in RAIN RFID encoding solutions. Suppliers gain perpetual stock visibility that feeds directly into manufacturing execution systems, reducing material shortages and unlocking digital-twin scheduling efficiencies. Qualcomm's plan to embed RAIN RFID in smartphones will soon turn every consumer device into a reader, eliminating the need for fixed scanner infrastructure and accelerating small-retailer adoption. Meanwhile, antenna miniaturization now supports 10-foot read ranges, enabling frictionless checkout zones that elevate customer experience.

Rising Demand for Anti-Counterfeiting in Pharma Supply Chains

Full enforcement of the DSCSA in November 2024 requires trading partners to verify serialized identifiers before product hand-off, prompting label upgrades that combine NFC chips, blockchain encryption, and e-paper displays for tamper evidence and dosage information. Ynvisible's ConnectedLabel, for instance, supports near real-time temperature tracking on over 1 million pharma packs annually. Outside the United States, India has ordered QR codes on the top-selling medicines, illustrating how serialization is moving from compliance exercise to patient-safety differentiator.

High Initial Hardware and Integration Costs for Small Retailers

ESLs cost USD 11-12 per tag, creating steep capital requirements when rolled out across thousands of SKUs. Smaller retailers must also budget for point-of-sale upgrades and staff training, delaying adoption despite labor-saving potential. Subscription models are emerging but remain nascent.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Omnichannel Retail Requiring Real-Time Pricing

- Increasing Penetration of IoT-Enabled Logistics

- Semiconductor Supply Constraints Delaying UHF RFID IC Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RFID accounted for 38.32% of the smart label market share in 2024, underpinned by proven scalability in retail and logistics. NFC, though smaller today, is projected for 20.13% CAGR because it exploits the global ubiquity of smartphones for tap-to-verify experiences. The smart label market size tied to NFC therefore shows the steepest absolute dollar expansion, especially in luxury authentication where blockchain integration delivers tamper-evident provenance. Electronic article surveillance remains steady, whereas sensing labels gain momentum through cold-chain and environmental compliance use cases. Overall, technology migration is moving from passive identification toward multifunction sensors and engagement tools.

Greater consumer interactivity is being unlocked by STMicroelectronics' ST25Connect program, enabling NFC tags in medical devices, wine, and cosmetics to deliver personalized content while capturing engagement analytics. Integrating low-cost sensors within inlays further blurs lines between tracking, condition monitoring, and customer communication, placing RFID and NFC on convergent innovation paths.

Retail retained 31.03% revenue share in 2024, reflecting early adoption of store-wide RFID programs and growing ESL footprints. However, the smart label market size linked to healthcare and pharmaceuticals is set to grow at 19.67% CAGR, the fastest across industries. Serialization deadlines and the need for temperature-controlled logistics drive hospitals, pharmacies, and contract manufacturers to embed smart labels for end-to-end traceability. Logistics providers and 3PLs also deploy hybrid cellular-BLE labels to automate hand-off documentation in real time.

Fresenius Kabi's Data Matrix plus RFID initiative illustrates how medication verification cuts human error in high-acuity hospital environments. Digital display labels for clinical trials eliminate manual relabeling across language variants, improving patient compliance and simplifying regulatory audits. Similar dynamics extend to food and beverage players gearing up for the FDA's FSMA 204 traceability mandates.

The Smart Label Market Report is Segmented by Technology (RFID, EAS, NFC, Sensing Labels, ESL, and More), End-User (Retail, Healthcare, Logistics, Manufacturing, and More), Component (ICs, Batteries, Antennas, and More), Application (Tracking, Security, Cold-Chain, Pricing, and More), Form Factor (Stickers, Tags, and More), and Geography (North America, Europe, APAC, MEA, South America). Market Forecasts in Value (USD).

Geography Analysis

North America held 37.84% of global revenue in 2024, anchored by the United States' early adoption of RFID in retail and the legally binding DSCSA serialization roadmap. Continued federal investment aimed at tripling domestic semiconductor output by 2030 will reduce chip shortages that have recently slowed deployment schedules. Canada and Mexico benefit from integrated cross-border commerce as near-shoring picks up, while Avery Dennison's USD 100 million Queretaro facility is set to meet rising regional demand for smart labels.

Europe represents the second-largest regional block, buoyed by sustainability-centric regulation. The forthcoming PPWR mandates digital identifiers for recyclability scoring, and Germany's battery-passport pilot for electric vehicles solidifies RFID within automotive value chains. Konica Minolta forecasts the European RFID label market to reach EUR 2.5 billion (USD 2.8 billion) by 2027, reflecting widespread adoption in consumer goods, healthcare, and industrial sectors.

Asia-Pacific is the fastest-growing geography with an 18.73% CAGR through 2030. China's 2D-barcode rollout across 7,000 food producers, India's QR-code traceability for plastic waste, and Japan's industry-5.0 incentives together generate outsized momentum. Growing 5G and planned 6G coverage provides the network backbone for ambient IoT, supporting large-volume adoption of battery-free sensors. Chip manufacturing concentration in Taiwan and South Korea offers supply advantages, although geopolitical risk remains a variable.

- Avery Dennison Corporation

- CCL Industries Inc.

- Zebra Technologies Corp.

- Honeywell International Inc.

- SATO Holdings Corp.

- William Frick & Company

- Invengo Information Technology Co. Ltd.

- Scanbuy Inc.

- Alien Technology LLC

- Roambee Corporation

- Smartrac (NXP)

- SES-imagotag SA

- Pricer AB

- Thinfilm Electronics ASA

- Digimarc Corporation

- Tapwow LLC

- Stora Enso Oyj

- Identiv Inc.

- Impinj Inc.

- Checkpoint Systems Inc.

- Confidex Ltd.

- NXP Semiconductors N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing RFID adoption for inventory visibility

- 4.2.2 Rising demand for anti-counterfeiting in pharma supply chains

- 4.2.3 Expansion of omnichannel retail requiring real-time pricing

- 4.2.4 Increasing penetration of IoT-enabled logistics

- 4.2.5 Emergence of printed battery-free sensor labels for cold-chain integrity

- 4.2.6 EU ESG packaging mandates (PPWR 2026) accelerating smart-label integration

- 4.3 Market Restraints

- 4.3.1 High initial hardware and integration costs for small retailers

- 4.3.2 Lack of universal interoperability standards

- 4.3.3 Semiconductor supply constraints delaying UHF RFID IC availability

- 4.3.4 Data-privacy regulations limiting NFC consumer-engagement analytics

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 RFID

- 5.1.2 Electronic Article Surveillance (EAS)

- 5.1.3 Near Field Communication (NFC)

- 5.1.4 Sensing Labels (Temp, Gas, etc.)

- 5.1.5 Electronic Shelf Label (ESL)

- 5.1.6 Other Emerging (QR, BLE)

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 Healthcare and Pharmaceuticals

- 5.2.3 Logistics and Transportation

- 5.2.4 Manufacturing and Industrial

- 5.2.5 Food and Beverage

- 5.2.6 Other End-user Industry

- 5.3 By Component

- 5.3.1 Micro-controllers / ICs

- 5.3.2 Batteries and Power Units

- 5.3.3 Antennas and Transceivers

- 5.3.4 Sensors

- 5.3.5 Software and Middleware

- 5.3.6 Substrate and Protective Materials

- 5.4 By Application

- 5.4.1 Asset and Inventory Tracking

- 5.4.2 Anti-theft and Security

- 5.4.3 Cold-chain Monitoring

- 5.4.4 Dynamic Pricing and Promotion

- 5.4.5 Brand Authentication and Consumer Engagement

- 5.4.6 Work-in-Process Management

- 5.5 By Label Form Factor

- 5.5.1 Wet-inlay / Sticker Labels

- 5.5.2 Hang Tags

- 5.5.3 In-mold Labels

- 5.5.4 Textile and Apparel Labels

- 5.5.5 Printable Flexible Sensor Labels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 Zebra Technologies Corp.

- 6.4.4 Honeywell International Inc.

- 6.4.5 SATO Holdings Corp.

- 6.4.6 William Frick & Company

- 6.4.7 Invengo Information Technology Co. Ltd.

- 6.4.8 Scanbuy Inc.

- 6.4.9 Alien Technology LLC

- 6.4.10 Roambee Corporation

- 6.4.11 Smartrac (NXP)

- 6.4.12 SES-imagotag SA

- 6.4.13 Pricer AB

- 6.4.14 Thinfilm Electronics ASA

- 6.4.15 Digimarc Corporation

- 6.4.16 Tapwow LLC

- 6.4.17 Stora Enso Oyj

- 6.4.18 Identiv Inc.

- 6.4.19 Impinj Inc.

- 6.4.20 Checkpoint Systems Inc.

- 6.4.21 Confidex Ltd.

- 6.4.22 NXP Semiconductors N.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment