|

市场调查报告书

商品编码

1686288

电信塔:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Telecom Towers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

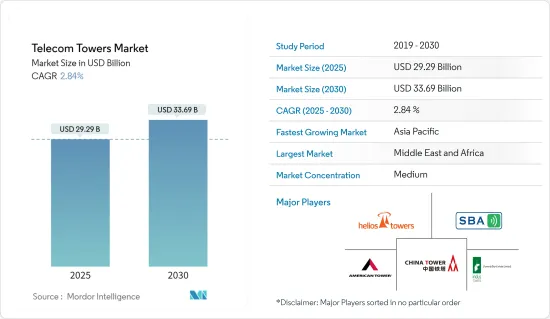

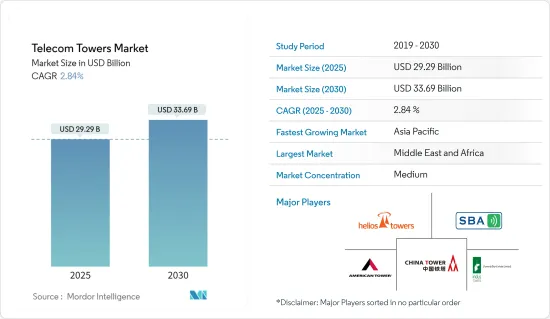

预计 2025 年电信塔市场规模为 292.9 亿美元,到 2030 年将达到 336.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.84%。

全球高速互联网服务的日益普及以及全球智慧型手机和智慧型设备用户数量的激增是预计将影响未来几年全球电信塔市场成长轨蹟的一些主要驱动因素。

主要亮点

- 电信塔对于5G技术至关重要。这是因为通讯业者意识到共用和/或租赁基础设施比从头开始便宜得多,而塔式业务可能会提供一些最划算的交易。由于 5G 网路的主导地位需要大量增建基建设施,因此铁塔公司正在重新获得重要性。这表明行动网路营运商需要现代化,投资者正在 5G 股票市场寻找能够带来快速回报的新机会。

- 此外,塔台营运商现在看到了智慧城市的大量成长机会,其中许多营运商希望在特定城市提供端到端通讯基础设施。 Towercos 可以为智慧城市提供多种选择,包括被动基础设施、小型基地台、Wi-Fi 和光纤连接。许多塔公司已经开始安装智慧桿,它可以保证更好的蜂窝覆盖并增强美观度。这些电线杆可以出租给网路营运商和政府,用于安装监控和交通控制系统,以及提供 Wi-Fi 和智慧照明服务。

- 更重视改善农村地区的网路连接是推动这些地区通讯基础设施部署和改善的主要因素之一,从而促进市场成长。

- 通讯塔需要不间断电源来确保全天候网路可用性,主要由电力、电池和柴油发电机供电。电信塔对环境的影响一直是个主要问题。行动通讯塔的辐射是一个严重的问题,被认为是一种看不见的、难以察觉的污染物。此外,使用柴油等不可再生能源会严重污染环境。

- 随着一切恢復正常,建设活动也将再次回升。整体来看,电讯业是受新冠疫情影响最小的主要产业之一。这是由于随着越来越多的人开始在家工作并且对视讯会议的依赖增加,通讯服务消费大幅增加。该地区大多数电讯都报告收益因此增加。

电信塔市场趋势

屋顶生长

- 行动通讯业者(MNO) 需要进行大量基础设施投资来扩展 5G,而屋顶基础设施对于这些投资至关重要。对于希望增强网路密度、扩大容量和覆盖范围的 MNO 来说,建筑物建筑幕墙和屋顶是理想的房地产。 5G 网路天线将能够透过更宽阔的视线将 5G 讯号直接传送到城市环境中屋顶上的客户。这种方法可确保地面上和周围建筑物边界附近的人员和设备能够接收 5G 讯号。

- 随着行动网路营运商提升 5G 功能,屋顶将发挥关键作用。 5G 的发展需要行动网路营运商 (MNO) 进行大量的基础设施投资,而屋顶基础设施将在这项投资中发挥至关重要的作用。例如,爱立信预计,5G 未来几年将快速成长,到 2028 年用户数量将达到约 47 亿。

- 此外,2023 年 10 月,DISH 计划在白原市中心巴克大道 5 号 16 楼 Residence Inn 酒店的屋顶上安装三根天线。 Westage 位于饭店后方的 Rockledge Ave. 25 号。 DISH Wireless 在公寓附近的屋顶上安装了无线通讯天线。

- 据美国塔公司(ATC)称,将包括基地台和小型基地台在内的无线传输数量增加一倍以服务5G市场将需要主要相关人员投入大量资金。该公司表示,美国各地的行动讯号塔数量将从 78 万座增加到 100 多万座。预计此类发展将在预测期内推动市场发展。

中东和非洲将成长

- 该地区电信塔的成长主要受到政府的「沙乌地阿拉伯2030愿景」、主要行动网路营运商对5G行动网路的开发和扩展以及由此带来的行动用户数量的增加的推动。

- 有利的立法、政府资金和倡议已使沙乌地阿拉伯成为向 5G 转型的数位中心和提供者。例如,STC 的 Mena HUB 投资 10 亿美元用于区域连接和基础设施建设,以支持沙乌地阿拉伯蓬勃发展的数位和云端产业。

- 为了建立数位埃及并实现向数位化社会的过渡,通讯和资讯技术部(MCIT)一直致力于创建安全、可靠和可访问的基础设施。

- 尼日利亚通讯委员会(NCC)为通讯产业制定了强有力的法规、指南或支持法律。其中之一就是《桅杆与塔架安装技术规范指南》(2009年)。建设电信塔的公司必须遵守法规和指导方针才能在该国顺利运作。

通讯塔产业概况

电信塔市场半固体,由几家大型参与者组成,例如美国铁塔公司、Helios Towers PLC、Indus Towers Limited(Bharti Infratel)、中国铁塔公司和 SBA Communications Corporation。目前,只有少数几家大公司在市场市场占有率上占据主导地位。这些电信塔市场的领导者正在透过策略联盟和收购电信塔新兴企业来扩大基本客群。这导致市场集中度处于中等水平,少数占主导地位的公司受益于较大的市场占有率和盈利。

- 2024 年 3 月:领先的网路服务供应商 Hi-COM Network Private Limited 与 Indus Towers Limited 建立策略合作伙伴关係,以加强其通讯基础设施并推动永续性计画。 Indus Towers Limited 由 Bharti Infratel Limited 和 Indus Towers Limited 合併而成,一直为通讯业提供强大的基础设施。透过此次合作,Hi-COM 将利用其专业知识帮助 Indus Towers 建造新塔并升级现有塔,以满足通讯业日益增长的需求。

- 2024 年 1 月,美国塔公司 (ATC) 宣布与 IBM 建立策略合作伙伴关係,以加速在边缘部署混合多重云端运算平台。透过此次合作,American Tower 将扩展其中立託管的 Access Edge资料中心生态系统,以涵盖 IBM 混合云功能和红帽公司 OpenShift。两家公司计划携手合作,透过物联网、5G、人工智慧和网路自动化等技术,帮助客户满足颠覆性数位转型不断变化的需求和期望。

- 2023 年 12 月,AT&T 公司将与爱立信合作部署商业规模的开放无线接取网路(Open RAN)。该合作旨在建立强大的网路基础设施提供者和供应商生态系统。目标是降低网路成本、提高营运效率并鼓励对快速扩展的宽频网路的持续投资。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场动态

- 市场驱动因素

- 连结农村地区/改善连结性

- 改善并满足不断增长的资料需求

- 市场限制

- 对塔供电系统的环境担忧

- 电信业者之间的铁塔共享

第六章 技术简介

- 技术简介

第七章市场区隔

- 按燃料类型

- 可再生

- 不可可再生

- 按塔类型

- 格子形杆塔

- 引导者塔

- 单极塔

- 隐形塔

- 按安装位置

- 屋顶

- 地面安装

- 拥有者

- 营运商所有

- 合资企业

- 私人

- MNO专属式

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 瑞士

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 越南

- 马来西亚

- 菲律宾

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中东和非洲

- 沙乌地阿拉伯

- 埃及

- 阿尔及利亚

- 奈及利亚

- 南非

- 坦尚尼亚

- 摩洛哥

- 其他中东和非洲地区

- 北美洲

第八章竞争格局

- 公司简介

- American tower corporation

- Helios Towers PLC

- Indus Towers Limited(Bharti Infratel)

- China Tower Corporation

- SBA Communications Corporation

- AT&T Inc.

- T-Mobile US Inc.

- GTL Infrastructure Limited

- IHS Towers(IHS Holding Limited)

- Tawal Com SA

- Cellnex Telecom SA

- Deutsche Funkturm GMBH(Deutsche Telekom Group)

- Vantage Towers AG

- Orange SA

- Telenor ASA

- ZZong Pakistan(China Mobile Limited)

- Telkom Indonesia

- Telxius Telecom SA

- Telesites SAB de CV(OPSIMEX)

第九章投资分析

第十章 投资分析 未来市场展望

The Telecom Towers Market size is estimated at USD 29.29 billion in 2025, and is expected to reach USD 33.69 billion by 2030, at a CAGR of 2.84% during the forecast period (2025-2030).

The increasing penetration of high-speed internet services globally and the sharp rise in the number of smartphone and smart device users worldwide are some of the key driving factors expected to affect the growth trajectory of the global telecom tower market in the next years.

Key Highlights

- Telecom towers are crucial in the 5G technology because telecom companies are learning that sharing and/or lending infrastructure is less expensive than starting from scratch, and tower businesses may provide the best bargains. Towercos are regaining importance as 5G networks' advantages necessitate a vast amount of additional infrastructure. This indicates that mobile network operators need to modernize, and investors are eager to identify fresh chances that could result in rapid returns in the 5G stock market.

- Moreover, tower businesses now have more opportunities for growth due to smart cities, and many of them are aiming to provide end-to-end communications infrastructure in the chosen cities. Towercos can provide various options for smart cities, including passive infrastructure, small cells, Wi-Fi, and fiber connectivity. Smart poles, which guarantee improved cellular coverage and enhance aesthetic value, have already begun to be installed by many tower firms. These poles can be leased to network operators and the government to install surveillance and traffic management systems and offer Wi-Fi and smart lighting services.

- The increasing emphasis on improving internet connectivity to rural areas is one of the major factors driving the deployment and improvisation of the telecom infrastructure in these areas, thereby aiding the market's growth.

- Telecom towers require an uninterrupted power supply to ensure 24x7 network availability, fulfilled mainly by electricity, batteries, and diesel generators. The environmental impacts of telecom towers have always been a significant concern. Radiation from mobile towers has been an important issue, and it is recognized as an unseen and subtle pollutant affecting life forms in multiple ways. Moreover, using non-renewable sources to run power systems, such as diesel, significantly pollutes the environment.

- With things returning to normalcy, the construction activities are set to return on track again. Overall, the telecom industry was among the major industries that experienced minimal impact from the COVID-19 pandemic. The primary region behind this was the significant increase in consumption of telecommunication services as more people started working from home and reliance on video conferencing to hold meetings increased. Most of the telecom operators in the region have reported an increase in their revenue due to this.

Telecom Towers Market Trends

Rooftop to Witness Growth

- Mobile network operators (MNOs) will need to make significant infrastructure investments for 5G to expand, and rooftop infrastructure will be essential to these investments. Building facades and rooftops are ideal real estate for MNOs wishing to densify their networks and expand their capacity or coverage. Antennas on the 5G network can deliver 5G signals straight to customers through a more significant line of sight on rooftops in an urban setting. In this approach, 5G reception can be reliably obtained by people and devices on the ground and close to the boundaries of surrounding buildings.

- As mobile network operators upsurge 5G capabilities, rooftops will play a key role. The growth of 5G will require massive infrastructural investment by mobile network operators (MNOs), and rooftop infrastructure is going to play a pivotal role in this investment. For instance, according to Ericsson, the rapid growth of 5G is expected over the coming years, with the number of subscriptions forecast to reach almost 4.7 billion by 2028.

- Moreover, in October 2023, DISH intended to install three antennas on the roof of the 16-story Residence Inn Hotel at 5 Barker Ave. in downtown White Plains. The Westage is behind the hotel at 25 Rockledge Ave. DISH Wireless installed wireless telecommunication antennas on a rooftop near the condo.

- According to American Tower Corp (ATC), large expenditures will be required from key stakeholders for the number of wireless transmission points, including base stations and small cells, to double to serve the 5G market. It was stated that the number of mobile towers in the nation would soon increase from 780,000 wireless transmission points to over a million. Such developments are expected to drive the market studied over the forecast period.

Middle East and Africa to Witness the Growth

- The region's telecom tower growth is primarily driven by the government's Saudi Vision 2030, as well as the development and extension of 5G mobile networks by major mobile network operators and the subsequent rise in mobile subscriptions.

- Saudi Arabia has transformed into a digital center and a provider in transitioning to 5G due to favorable laws, government funding, and initiatives. For instance, STC's Mena HUB, a USD 1 billion investment in regional connectivity and infrastructure, will assist Saudi Arabia's fast-growing digital and cloud industry.

- Seeking to build Digital Egypt and achieve the transition to a digital society, the Ministry of Communications and Information Technology (MCIT) has been working to build an infrastructure that is secure, reliable, and accessible.

- The Nigerian Communications Commission (NCC) developed robust Regulations and Guidelines or subsidiary laws for the telecommunications sector. One such regulation is the Guidelines on Technical Specifications for Installation of Masts and Towers, 2009. Companies installing telecom towers need to follow the regulations and guidelines for conducting smooth business in the country

Telecom Towers Industry Overview

The telecom tower market is semi-consolidated and consists of several major players, such as American Tower Corporation, Helios Towers PLC, Indus Towers Limited (Bharti Infratel), China Tower Corporation, and SBA Communications Corporation. Only some significant players currently dominate the market in terms of market share. These major players in the telecom tower market are expanding their customer base internationally through strategic collaborations and acquisitions of telecom tower startups. This has led to a moderately high market concentration, with a few dominant players benefiting from significant market share and profitability.

- March 2024: Hi-COM Network Private Limited, a leading internet service provider, partnered strategically with Indus Towers Limited to enhance telecommunications infrastructure and advance sustainability initiatives. Indus Towers Limited, formed from the merger of Bharti Infratel Limited and Indus Towers, has provided robust infrastructure for the telecommunications sector. Through this collaboration, Hi-COM will leverage its expertise to assist Indus Towers in constructing new towers and upgrading existing ones to meet the increasing demands of the industry.

- January 2024: American Tower Corporation (ATC) announced a strategic collaboration with IBM to accelerate the deployment of a hybrid, multi-cloud computing platform at the edge. Through this collaboration, American Tower intends to expand its neutral-host, Access Edge Data Center ecosystem to include IBM Hybrid Cloud capabilities and Red Hat OpenShift. The two companies are set to work together to help clients address their evolving customer requirements and expectations around innovative digital transformation by enabling technologies such as IoT, 5G, AI, and network automation.

- December 2023: AT&T Inc. partnered with Ericsson to deploy a commercial-scale open radio access network (Open RAN). This collaboration aims to establish a robust ecosystem of network infrastructure providers and suppliers. The objective is to drive down network costs, enhance operational efficiencies, and facilitate sustained investments in the rapidly expanding broadband network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Connecting/Improving Connectivity to Rural Areas

- 5.1.2 Improving and Catering to Increasing Data Needs

- 5.2 Market Restraints

- 5.2.1 Environmental Concerns about Power Supply Systems to Towers

- 5.2.2 Tower-sharing between Telecom Companies

6 TECHNOLOGY SNAPSHOT

- 6.1 Technology Snapshot

7 MARKET SEGMENTATION

- 7.1 By Fuel Type

- 7.1.1 Renewable

- 7.1.2 Non-renewable

- 7.2 By Type of Tower

- 7.2.1 Lattice Tower

- 7.2.2 Guyed Tower

- 7.2.3 Monopole Towers

- 7.2.4 Stealth Towers

- 7.3 By Installation

- 7.3.1 Rooftop

- 7.3.2 Ground-based

- 7.4 By Ownership

- 7.4.1 Operator-owned

- 7.4.2 Joint Venture

- 7.4.3 Private-owned

- 7.4.4 MNO Captive

- 7.5 By Geography

- 7.5.1 North America

- 7.5.1.1 United States

- 7.5.1.2 Canada

- 7.5.2 Europe

- 7.5.2.1 United Kingdom

- 7.5.2.2 Germany

- 7.5.2.3 France

- 7.5.2.4 Italy

- 7.5.2.5 Spain

- 7.5.2.6 Netherlands

- 7.5.2.7 Sweden

- 7.5.2.8 Switzerland

- 7.5.2.9 Rest of Europe

- 7.5.3 Asia-Pacific

- 7.5.3.1 China

- 7.5.3.2 India

- 7.5.3.3 Japan

- 7.5.3.4 South Korea

- 7.5.3.5 Indonesia

- 7.5.3.6 Vietnam

- 7.5.3.7 Malaysia

- 7.5.3.8 Philippines

- 7.5.3.9 Australia and New Zealand

- 7.5.3.10 Rest of Asia-Pacific

- 7.5.4 Latin America

- 7.5.4.1 Brazil

- 7.5.4.2 Mexico

- 7.5.4.3 Argentina

- 7.5.4.4 Rest of Latin America

- 7.5.5 Middle East and Africa

- 7.5.5.1 Saudi Arabia

- 7.5.5.2 Egypt

- 7.5.5.3 Algeria

- 7.5.5.4 Nigeria

- 7.5.5.5 South Africa

- 7.5.5.6 Tanzania

- 7.5.5.7 Morocco

- 7.5.5.8 Rest of Middle East and Africa

- 7.5.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 American tower corporation

- 8.1.2 Helios Towers PLC

- 8.1.3 Indus Towers Limited (Bharti Infratel)

- 8.1.4 China Tower Corporation

- 8.1.5 SBA Communications Corporation

- 8.1.6 AT&T Inc.

- 8.1.7 T-Mobile US Inc.

- 8.1.8 GTL Infrastructure Limited

- 8.1.9 IHS Towers (IHS Holding Limited)

- 8.1.10 Tawal Com SA

- 8.1.11 Cellnex Telecom SA

- 8.1.12 Deutsche Funkturm GMBH (Deutsche Telekom Group)

- 8.1.13 Vantage Towers AG

- 8.1.14 Orange SA

- 8.1.15 Telenor ASA

- 8.1.16 ZZong Pakistan (China Mobile Limited)

- 8.1.17 Telkom Indonesia

- 8.1.18 Telxius Telecom SA

- 8.1.19 Telesites SAB de CV (OPSIMEX)