|

市场调查报告书

商品编码

1851456

奈米物联网:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Internet Of Nano Things - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

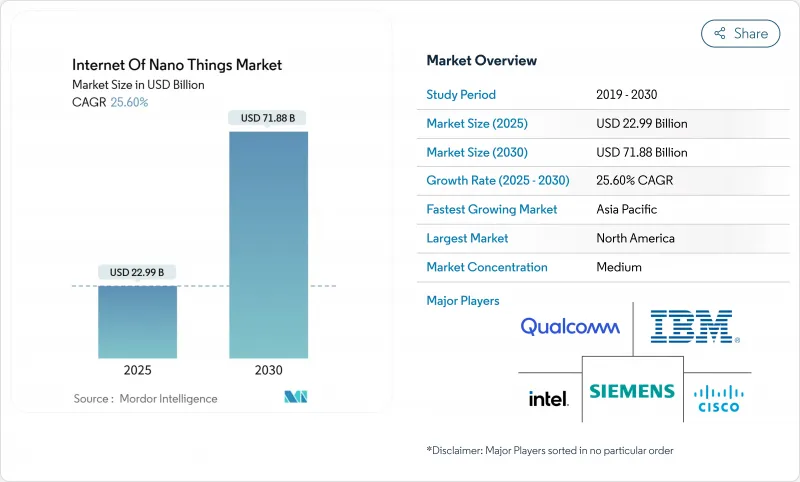

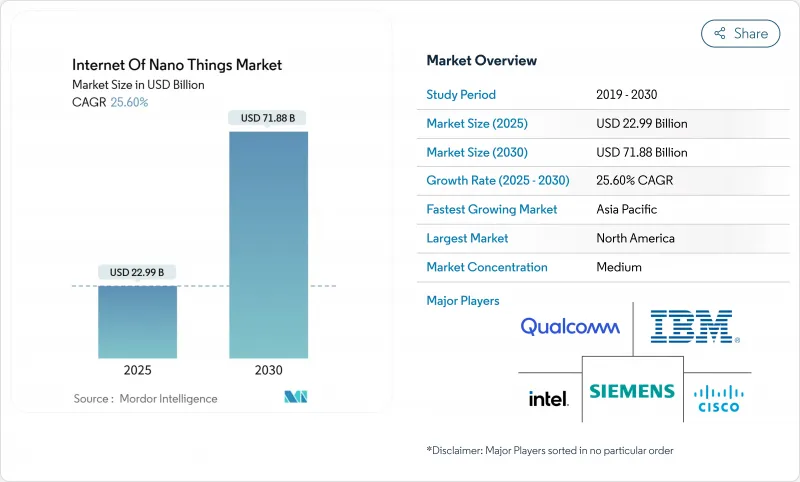

预计到 2025 年,奈米物联网市场规模将达到 229.9 亿美元,到 2030 年将达到 718.8 亿美元,预测期(2025-2030 年)复合年增长率为 25.60%。

这一成长反映了兆赫波段奈米天线设计的商业化、超低功耗奈米碳管管感测器的部署,以及奈米级通讯协定快速融入主流无线网路。各国政府正在资助基于奈米感测器的疫情监测框架,而私人投资则加速了人工智慧主导的编配平台的发展,这些平台能够将分子级数据转化为可操作的洞察。儘管硬体支出仍占总总支出的近一半,但随着企业将分析置于设备之上,软体平台的扩张速度明显更快。从区域来看,北美在联邦研究津贴和早期兆赫频谱分配方面处于领先地位,而亚太地区则展现出最强劲的成长势头,因为半导体中心正在将奈米感测器网路纳入其工业4.0蓝图。随着半导体巨头利用现有晶圆厂和新兴企业部署颠覆性的分子通讯协定栈,竞争压力正在加剧,但高昂的製造成本和分散的频谱政策仍然是显着的阻力。

全球奈米物联网市场趋势与洞察

奈米技术的快速发展使得超低功耗感测器成为可能。

基于奈米碳管的装置能够利用环境能量,克服了传统电池的局限性,并缩短了维护週期。麻省理工学院的工程师已经展示了植物驱动的奈米感测器,它们透过光合作用产生自身能量,检验了其远端部署的能源自主性。氮化硼奈米管纤维构成了耐热网络,能够在严苛的工业环境中保持性能劣化。结合人工智慧加速的材料发现技术(例如Material Nexus公司在无稀土永磁体方面的突破性进展),技术创新週期已从数年缩短至数月。这些进步催生了从精密农业到危险环境监测等广泛的应用,推动了奈米物联网市场的长期成长。

即时健康监测穿戴式装置的需求日益增长

Nanowear公司奈米感测器心臟贴片获得FDA批准,凸显了奈米技术医疗设备在监管方面的重要性。采用奈米碳管薄膜製成的连续血糖监测仪,在保持皮肤贴片般隐蔽外形规格的同时,其精度已可媲美实验室水平。多分析物贴片可同时监测电解质、乳酸和皮质醇水平,从而支持降低慢性病治疗成本的预防保健模式。部署这些设备的医疗机构报告称,败血症的检出率更高,重症监护室(ICU)住院时间更短,这进一步巩固了医疗保健行业对不断增长的奈米物联网市场的重要贡献。预计到2024年,该细分市场的收入份额将达到30.3%,显示市场需求根深蒂固,其他产业也必须重视这一领域。

奈米尺度下严重的资料安全与隐私风险

奈米感测器缺乏传统加密所需的运算余量,这使其面临巨大的攻击面,可能危及医院、工厂和市政网路的安全。植入式医疗奈米感测器尤其脆弱;被劫持的血糖监测仪可能篡改测量结果,危及患者健康。 GDPR 将奈米感测器数据视为高风险数据,并要求获得明确同意,而这对于自主运作的亚毫米级设备而言难以实现。量子抗性轻量级加密技术仍处于概念验证阶段,进一步扩大了安全漏洞,并导致奈米物联网市场的预期复合年增长率下降 4.3%。

细分市场分析

预计到2024年,硬体将占奈米物联网市场总收入的47.6%,该市场主要集中在关键的实体设备、天线和网关。然而,随着分析平台利用大量的分子数据,软体领域正以28.6%的复合年增长率蓬勃发展。服务领域虽然仍处于起步阶段,但正经历两位数的成长,因为企业需要咨询专业知识来将奈米设备与旧有系统整合。陶氏化学和卡维斯公司在热感界面材料方面的合作,展现了专业知识如何转化为利润丰厚的服务领域。

软体繁荣正在重新定义价值获取方式。硬体商品化导致硬体净利率萎缩,而管理数十亿个终端的编配堆迭则需要高额授权。云端供应商正在整合奈米设备API,吸引开发者使用整合安全、人工智慧和生命週期管理的平台。在预测期内,奈米物联网市场规模及其软体收入将缩小与硬体的差距,从而重塑整个生态系统的竞争格局。

医疗保健产业仍将是奈米感测器应用最广泛的领域,预计2024年将占总收入的30.3%,该产业将利用奈米感测器进行持续的生命征象监测、植入监测和智慧药物输送。同时,智慧城市计画到2030年将以27.6%的复合年增长率成长,市政当局将部署奈米感测器网路用于空气品质分析、洩漏检测和智慧交通控制。在製造业,嵌入生产线的奈米感测器可将即时分子资料传输到预测性维护系统;而物流公司则会在货柜内安装奈米感测器,以检验低温运输合规性。

环保机构将采用奈米感测器浮标,以传统感测器无法企及的十亿分之一分辨率检测污染物。农业相关企业将喷洒植物组织奈米感测器,以便及早发现营养缺乏情况,从而减少化肥用量和水资源浪费。这些发展表明,垂直多元化正在加速奈米物联网在实体经济中的市场渗透。

奈米物联网市场按组件(硬体、软体、服务)、最终用户(医疗保健、物流和运输、国防和航太、製造业及其他)、通讯技术(电磁波、分子通讯、奈米RFID/NFC及其他)、部署模式(本地部署、云端部署、混合部署)和地区进行细分。市场预测以美元计价。

区域分析

2024年,北美将维持38.6%的收入份额,这主要得益于联邦津贴、兆赫频段的早期分配以及具备奈米级生产能力的半导体晶圆厂的建立。美国国家标准与技术研究院(NIST)物联网咨询委员会将明确相关标准并加速商业试点计画。然而,高昂的人事费用和资本支出正在挤压净利率,奈米製造工程师的人才储备也面临挑战。美国将重点发展国防、航太和先进医疗植入,而加拿大则将投资于自然资源管理的环境监测。

到2030年,亚太地区将以28.1%的复合年增长率增长,这反映了该地区积极的工业4.0计划、强大的电子供应链以及不断扩大的5G覆盖范围。中国将透过将奈米感测器整合到製造和化学工厂中来提高产量比率和安全性,从而推动製造业采用奈米技术;而日本的医疗技术公司将率先开发生物相容性植入。韩国将在电讯展现领先地位,试办建设支持6G的奈米网状网路。区域各国政府正在补贴奈米研发,加速产品上市速度,并加剧市场竞争。由此产生的规模优势将在本十年末缩小亚太地区和北美地区纳米物联网市场规模之间的差距。

欧洲持续支持并影响塑造全球规范的资料隐私和永续性框架。 「地平线欧洲」计画已累计1亿欧元用于边缘人工智慧和物联网研究,其中一部分将用于奈米装置互通性研究。德国正在精密製造业部署奈米感测器,英国则在测试基于石墨烯的健康贴片。南美洲以及中东和非洲等新兴地区正选择性地投资环境和基础设施监测,利用奈米感测器以低生命週期成本实现高精度监测的优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 奈米技术的快速发展使得超低功耗感测器成为可能。

- 即时健康监测穿戴式装置的需求日益增长

- 工业4.0和智慧製造的日益普及

- 5G/6G和边缘运算基础设施的普及

- 兆赫波段奈米天线突破性进展可降低讯号衰减

- 政府资助的利用奈米感测器的疫情监测网络

- 市场限制

- 奈米尺度下严重的资料安全与隐私风险

- 奈米製造的高资本成本和复杂性

- 应用于人体时,生物相容性和长期细胞毒性是需要考虑的问题。

- 缺乏标准化的兆赫频率法规阻碍了其应用。

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力:波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 最终用户

- 卫生保健

- 物流/运输

- 国防/航太

- 製造业

- 能源与电力

- 环境监测

- 零售

- 农业

- 智慧城市和基础设施

- 其他最终用户

- 透过通讯技术

- 电磁

- 分子通讯

- Nano RFID/NFC

- 奈米感测器网路

- 奈米卫星通讯

- 其他的

- 按部署模式

- 本地部署

- 云

- 杂交种

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Intel Corporation

- Cisco Systems, Inc.

- Qualcomm Technologies, Inc.

- Siemens AG

- Schneider Electric SE

- SAP SE

- Juniper Networks, Inc.

- Nokia Corporation

- Honeywell International Inc.

- Analog Devices, Inc.

- STMicroelectronics NV

- Nanoscale Components, Inc.

- NanoSensors, Inc.

- Agilent Technologies, Inc.

- TeraSense Group, Inc.

- Graphenea, Inc.

- Litmus Automation, Inc.

- ON Semiconductor Corporation

- Microchip Technology Inc.

- Camtek Ltd.

- NeuraLace Medical, Inc.

- Nanolike SAS

- Ambiq Micro, Inc.

- Synapse Wireless, Inc.

第七章 投资分析

第八章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Internet of Nano Things Market size is estimated at USD 22.99 billion in 2025, and is expected to reach USD 71.88 billion by 2030, at a CAGR of 25.60% during the forecast period (2025-2030).

The surge reflects the commercialisation of terahertz-band nano-antenna designs, the roll-out of ultra-low power carbon-nanotube sensors, and the rapid convergence of nanoscale communication protocols with mainstream wireless networks. Governments are funding pandemic surveillance frameworks built on nanosensors, while private investment is accelerating AI-driven orchestration platforms that translate molecular-level data into actionable insight. Hardware continues to account for almost half of all spending, but software platforms are expanding at a markedly faster pace as enterprises prioritise analytics over devices. Regionally, North America leads on account of federal research grants and early terahertz spectrum allocation, yet Asia-Pacific exhibits the strongest growth as semiconductor hubs embed nanosensor networks into Industry 4.0 roadmaps. Competitive pressure is intensifying as semiconductor majors leverage existing fabs while start-ups introduce disruptive molecular communication stacks, but steep fabrication costs and fragmented spectrum policies remain notable headwinds.

Global Internet Of Nano Things Market Trends and Insights

Rapid Advancements in Nanotechnology Enabling Ultra-Low Power Sensors

Carbon-nanotube-based devices now harvest ambient energy, removing conventional battery constraints and slashing maintenance cycles. MIT engineers demonstrated plant-powered nanosensors that self-energize through photosynthesis, validating energy autonomy for remote deployments. Boron nitride nanotube fibres provide heat-tolerant networks that withstand harsh industrial settings without degradation. Coupled with AI-accelerated materials discovery, exemplified by Materials Nexus' rare-earth-free permanent magnet breakthrough, innovation cycles have shrunk from years to months. These advances unlock applications ranging from precision agriculture to hazardous-environment monitoring, underpinning the long-term growth of the Internet of Nano Things market.

Growing Demand for Real-Time Health Monitoring Wearables

FDA clearance of Nanowear's nanosensor cardiac patch underscores regulatory validation for nano-enabled medical devices. Continuous glucose monitors built on carbon-nanotube films now rival laboratory accuracy while retaining discreet, skin-patch form factors. Multi-analyte patches track electrolytes, lactate, and cortisol simultaneously, supporting preventive care models that lower chronic-disease costs. Hospitals integrating these devices report earlier sepsis detection and shorter ICU stays, reinforcing healthcare's contribution to the Internet of Nano Things market expansion. The sector's 30.3% revenue share in 2024 signals entrenched demand that other verticals must challenge.

Severe Data Security and Privacy Risks at Nanoscale

Nanosensors lack the compute headroom for traditional encryption, exposing attack surfaces that could compromise hospital, factory, or municipal networks. Implantable medical nanosensors are especially vulnerable; a hijacked glucose monitor can falsify readings, endangering patients. GDPR treats nanosensor data as high-risk, mandating explicit consent that is difficult to implement on autonomous sub-millimetre devices. Quantum-resistant lightweight ciphers remain at proof-of-concept stages, widening the security gap and exerting a negative 4.3% pull on forecast CAGR for the Internet of Nano Things market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Industry 4.0 and Smart Manufacturing

- Proliferation of 5G/6G and Edge Computing Infrastructure

- High Capital Costs and Complexity of Nano-Fabrication

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware generated 47.6% of 2024 revenue, anchoring the Internet of Nano Things market in essential physical devices, antennas, and gateways. Yet the software segment is racing ahead at a 28.6% CAGR as analytics platforms capitalise on torrents of molecular data. Services remain nascent but record double-digit growth because enterprises require consulting expertise to integrate nano-devices with legacy systems. Dow's collaboration with Carbice on thermal interface materials shows how specialised know-how is turning into high-margin service lines.

The software boom is redefining value capture: hardware margins compress as commoditisation sets in, while orchestration stacks that manage billions of endpoints command premium licences. Cloud vendors embed nano-device APIs, drawing developers into unified platforms that bundle security, AI, and lifecycle management. Over the forecast horizon, the Internet of Nano Things market size linked to software revenues is projected to narrow the gap on hardware, recalibrating competitive strategies across the ecosystem.

Healthcare contributed 30.3% of 2024 revenue and remains the largest adopter, leveraging nanosensors for continuous vitals monitoring, implant surveillance, and smart drug delivery. Smart-city programmes, however, will expand at 27.6% CAGR to 2030 as municipalities deploy nanosensor meshes for air-quality analytics, water-leak detection, and intelligent traffic control. In manufacturing, nanosensors embedded on production lines feed real-time molecular data into predictive-maintenance engines, while logistics firms fit nanosensors inside containers to verify cold-chain compliance.

Environmental agencies adopt nanosensor buoys that detect pollutants at parts-per-billion resolution, a capability classical sensors lack. Agriculture outfits scatter plant-tissue nanosensors that signal nutrient deficits early, cutting fertiliser usage and water waste. These deployments illustrate how vertical diversification is accelerating overall Internet of Nano Things market penetration across the real economy.

Internet of Nano Things Market is Segmented by Component (Hardware, Software, and Services), End-User (Healthcare, Logistics and Transportation, Defense and Aerospace, Manufacturing, and More), Communication Technology (Electromagnetic, Molecular Communication, Nano RFID/NFC, and More), Deployment Model (On-Premise, Cloud, and Hybrid), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.6% revenue share in 2024, buoyed by federal grants, early terahertz spectrum allocation, and entrenched semiconductor fabs capable of nano-class production. The NIST IoT Advisory Board provides clarity around standards, accelerating commercial pilots. However, high labour costs and capital outlays squeeze margins, and the talent pipeline struggles to supply nano-manufacturing technicians. The United States focuses on defence, aerospace, and advanced healthcare implants, while Canada channels resources into environmental monitoring for natural-resource stewardship.

Asia-Pacific will post a 28.1% CAGR to 2030, reflecting aggressive Industry 4.0 incentives, deep electronics supply chains, and expansive 5G footprints. China drives manufacturing uptake, embedding nanosensors inside fabs and chemical plants to boost yield and safety, while Japan's med-tech firms pioneer bio-compatible nano implants. South Korea exploits telecom leadership to pilot 6G-ready nano-mesh networks. Regional governments subsidise nano R&D, compressing time-to-market and intensifying competition. The resulting scale advantages will narrow the Internet of Nano Things market size gap between Asia-Pacific and North America by decade end.

Europe remains influential, championing data privacy and sustainability frameworks that shape global norms. Horizon Europe has earmarked EUR 100 million for edge-AI and IoT research, with part allocated to nano-device interoperability. Germany deploys nanosensors in precision manufacturing, and the United Kingdom tests graphene-based health patches. Emerging regions in South America and the Middle East, and Africa invest selectively in environmental and infrastructure monitoring, capitalising on nanosensors' ability to deliver high granularity at lower lifecycle costs.

- IBM Corporation

- Intel Corporation

- Cisco Systems, Inc.

- Qualcomm Technologies, Inc.

- Siemens AG

- Schneider Electric SE

- SAP SE

- Juniper Networks, Inc.

- Nokia Corporation

- Honeywell International Inc.

- Analog Devices, Inc.

- STMicroelectronics N.V.

- Nanoscale Components, Inc.

- NanoSensors, Inc.

- Agilent Technologies, Inc.

- TeraSense Group, Inc.

- Graphenea, Inc.

- Litmus Automation, Inc.

- ON Semiconductor Corporation

- Microchip Technology Inc.

- Camtek Ltd.

- NeuraLace Medical, Inc.

- Nanolike SAS

- Ambiq Micro, Inc.

- Synapse Wireless, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid advancements in nanotechnology enabling ultra-low power sensors

- 4.2.2 Growing demand for real-time health monitoring wearables

- 4.2.3 Increasing adoption of Industry 4.0 and smart manufacturing

- 4.2.4 Proliferation of 5G/6G and edge computing infrastructure

- 4.2.5 Emerging terahertz-band nano-antenna breakthroughs reducing signal attenuation

- 4.2.6 Government-funded pandemic surveillance networks leveraging nanosensors

- 4.3 Market Restraints

- 4.3.1 Severe data security and privacy risks at nanoscale

- 4.3.2 High capital costs and complexity of nano-fabrication

- 4.3.3 Biocompatibility and long-term cytotoxicity concerns in human body deployments

- 4.3.4 Lack of standardized terahertz spectrum regulations causing deployment delays

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End-user

- 5.2.1 Healthcare

- 5.2.2 Logistics and Transportation

- 5.2.3 Defense and Aerospace

- 5.2.4 Manufacturing

- 5.2.5 Energy and Power

- 5.2.6 Environmental Monitoring

- 5.2.7 Retail

- 5.2.8 Agriculture

- 5.2.9 Smart Cities and Infrastructure

- 5.2.10 Other End-users

- 5.3 By Communication Technology

- 5.3.1 Electromagnetic

- 5.3.2 Molecular Communication

- 5.3.3 Nano RFID/NFC

- 5.3.4 Nano Sensor Networks

- 5.3.5 Nano Satellite Communication

- 5.3.6 Others

- 5.4 By Deployment Model

- 5.4.1 On-Premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Intel Corporation

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 Qualcomm Technologies, Inc.

- 6.4.5 Siemens AG

- 6.4.6 Schneider Electric SE

- 6.4.7 SAP SE

- 6.4.8 Juniper Networks, Inc.

- 6.4.9 Nokia Corporation

- 6.4.10 Honeywell International Inc.

- 6.4.11 Analog Devices, Inc.

- 6.4.12 STMicroelectronics N.V.

- 6.4.13 Nanoscale Components, Inc.

- 6.4.14 NanoSensors, Inc.

- 6.4.15 Agilent Technologies, Inc.

- 6.4.16 TeraSense Group, Inc.

- 6.4.17 Graphenea, Inc.

- 6.4.18 Litmus Automation, Inc.

- 6.4.19 ON Semiconductor Corporation

- 6.4.20 Microchip Technology Inc.

- 6.4.21 Camtek Ltd.

- 6.4.22 NeuraLace Medical, Inc.

- 6.4.23 Nanolike SAS

- 6.4.24 Ambiq Micro, Inc.

- 6.4.25 Synapse Wireless, Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 White-Space and Unmet-Need Assessment