|

市场调查报告书

商品编码

1549730

BOPP 薄膜:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)BOPP Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

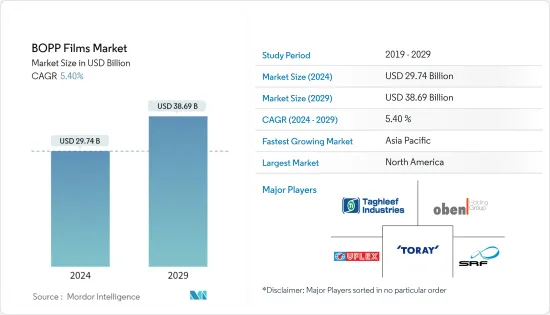

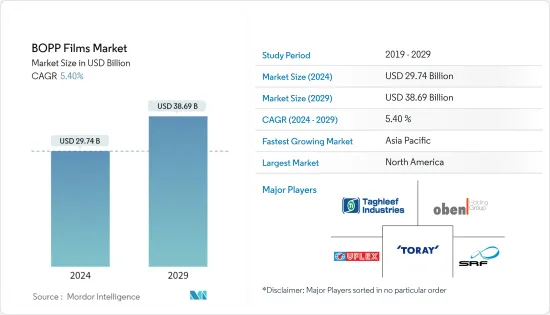

BOPP薄膜市场规模预计到2024年为297.4亿美元,预计到2029年将达到386.9亿美元,在预测期内(2024-2029年)复合年增长率为5.40%。

BOPP 薄膜通常用于需要提高防潮性、光学透明度和拉伸强度的应用,例如医疗包装、食品和饮料包装以及个人保健产品包装。多种因素促进了 BOPP(双轴延伸聚丙烯)薄膜的发展,包括多功能性、耐用性、成本效益和环境效益。食品和饮料、药品和化妆品等行业对软包装解决方案的需求不断增长,进一步推动了市场成长。

主要亮点

- BOPP 因其极端的多功能性而成为一种高成长的薄膜材料。 BOPP是一种重要的聚丙烯薄膜。蜡纸和铝箔的有效替代品。导致 BOPP 薄膜用途和应用范围扩大的主要因素之一是其与其他塑胶薄膜相比碳排放相对较低。由于熔点较低,BOPP 薄膜从一种形状转变为另一种形状所需的能量较少。

- 随着越来越多的人永久参与家庭办公室趋势,家里的食品消费和零食可能会继续高于新冠疫情之前的水平。因此,食品包装预计仍将是 BOPP 薄膜的重要最终用途领域。对通常用于食品、製药和其他市场的优质商品薄膜的需求预计将推动未来的需求。近年来,BOPP 薄膜在电气和电子市场的包装使用量有所增加,也提供光泽和雾面格式。

- 2023年9月,Tredegar公司以1.16亿美元将其软包装薄膜「Terphane」业务出售给Oben集团。製造地位于Cabo de Santo Agostinho,总部位于巴西圣保罗,出口至29个国家。此次交易完成后,奥本将提高其BOPET薄膜产能,并为扩大其在美国和巴西的其他薄膜,特别是BOPP产能提供机会,使其成为竞争激烈的柔性薄膜领域的全球参与者巩固了其市场地位。

- 由 BOPP 薄膜製成的袋子和小袋越来越受欢迎,因为它们环保、价格实惠且 100% 可回收。 BOPP 袋和小袋的视觉吸引力为其所包装的产品增添了一层额外的广告效果。食品和饮料、电子商务的扩张、经济的改善以及可支配收入的增加促进了包装商品(包括包装食品)消费的增加,这需要包装来保护商品免受污染和损坏。这种趋势可能会提高供应商的製造能力,并促进多年来研究的市场的成长。

- 2024年4月,凸版和印度凸版特种薄膜(TSF)开发了GL-SP,一种基于双轴延伸聚丙烯(BOPP)的阻隔薄膜。 GL-SP是凸版集团用于永续包装的透明沉淀阻隔膜GL BARRIER1系列产品的新成员,据说在全球市场上占有很高的份额。凸版和 TSF 将开始销售用于干内容物包装的“GL-SP”,主要销往美洲、欧洲、印度和东协市场。

- BOPP 薄膜市场面临着几个可能影响未来成长和盈利的关键挑战。这些挑战包括替代包装材料的可用性以及威胁 BOPP 薄膜的替代包装材料的采用,例如生物基塑胶、可堆肥材料和其他柔性薄膜。如果这些替代材料是环保的并且提供类似或更好的性能,它们就有潜力争夺市场占有率。此外,消费者偏好和行为的改变也会影响包装趋势。如果消费者出于健康考量、便利性或永续性而寻求替代包装形式和材料,BOPP 薄膜市场可能会受到影响。

- COVID-19 大流行双轴延伸聚丙烯薄膜市场产生了重大影响。由于国际贸易限制、封锁措施和运输挑战,疫情导致受访市场的供应链中断。生产设施关闭和物流限制导致原材料采购和成品交付延迟,影响了 BOPP 薄膜的整个生产和分销。日本经济的快速成长和可支配收入的增加导致个人消费的增加。尤其是在都市区,便利性和美观扮演着重要的角色。 BOPP 薄膜具有出色的印刷适性和视觉吸引力,使其成为包装的理想选择。

- 过去五年,印度产能几乎翻了一番。这是由于零售业的开放、中阶的成长以及包装食品和其他商品的消费者支出的相应增加。近期BOPP投资大幅增加,年标牌产能超过4.5万吨。此外,根据美国农业部的数据,2023年,全球各类乳製品产量超过5.49亿吨。相比之下,同年起司产量超过2,200万吨,黄油产量超过1,100万吨。食品业此类新兴市场的开拓可能会为所研究的市场带来更多机会。

BOPP薄膜市场趋势

产业市场可望推动成长

- BOPP薄膜因其多样化的性能和应用而在工业领域发挥重要作用。 BOPP薄膜用于包装、层压、标籤、黏剂、电容器等工业领域。这些薄膜用作层压材料,可增强海报、目录、小册子和包装盒等印刷材料的外观、强度和耐用性。

- 2024 年 1 月,包装、合成纸和标籤以及层压应用等特种薄膜领域的国际领导者 Cosmofilm 推出了用于电容器应用的金属化电气额定 BOPP 薄膜。这些薄膜主要用于製造多种类型的交流电和直流电容器。这些电容器用于各种工业应用,包括汽车、电动车、电子、电力电子和可再生能源系统。

- BOPP薄膜是聚烯的一种。 BOPP 薄膜,即使与聚乙烯薄膜层压,在废弃物流再处理中也表现出广泛的接受度。在许多应用中,BOPP 薄膜的消耗变得更加永续性,但以牺牲其他聚合物为代价。将有机黏土和奈米复合材料与 BOPP 结合可提高阻隔性能。 PVA(聚乙烯醇)和MA(顺丁烯二酸酐)是最小化薄膜透氧渗透性最适合的材料。

- 製造过程中不断的技术创新促进了先进BOPP薄膜的开发,这些薄膜具有增强的性能,例如提高的密封强度、改进的阻隔性能和增加的透明度,扩大了在工业环境中的应用范围。根据 MOSPI 的数据,2023 财年印度製造业工业生产指数为 137.1。与上年度相比成长了4.7%。

- 由于印度经济的高速发展,印度BOPP市场也呈现高速发展。这是由于除食品和饮料行业外,零售、製药和化妆品业务的日益发展。电商领域是BOPP自黏胶带的重要应用领域之一,具有优异的机械和光学性能。

- 在印度,由于生产成本较低,企业正在增加产量以满足不断增加的BOPP需求。例如,Cosmo Films 宣布将把 BOPP 产能提高到 35,000 兆吨,并有望实现商业化。同样,Jindal Polyfilms 也计划将产能提高至 44,000 吨。

北美占据主要市场占有率

- 许多北美 BOPP 薄膜供应商正在改变产品系列,以满足该地区对包装解决方案不断增长的需求。 BOPP 薄膜为产品包装提供透明度,可协助客户快速检查产品,成为推动该地区采用并帮助市场成长的关键因素。

- 由于食品保质期延长、密封过程无毒以及在包装过程中保持产品品质和永续性等需求,该地区对包装食品的需求不断增长正在推动市场成长。根据有机贸易协会预测,2023年美国有机包装食品消费额预计将达232亿美元,2025年将超过250亿美元。

- 零售店是北美最重要的食品收益来源。 BOPP 薄膜等软包装产品重量轻,可最大程度地减少运输产品所需的工作量,为消费者提供便利的购物体验。由于其多功能性、自订品质、资源节约效率和永续性,它已成为该地区首选的包装形式。根据美国人口普查局的数据,2023 年美国食品和饮料商店销售额约为 9,850 亿美元。餐饮业和饮酒场所的销售额略高,约 1.1 兆美元。

- 该地区也是重要的肉类出口国和消费国。遍布全国的强大零售连锁店大量供应猪肉和肉类产品,刺激了市场。由于对更稳定的保质期的需求,预计 BOPP 薄膜的需求将会增加。 BOPP薄膜有助于提高包装薄膜的耐热性、氧气透过率、透湿性等阻隔性。

- 在美国,消费者意识的增强和有利的政府法规预计将在预测期内增加对永续和生物分解性包装的需求。根据美国环保署统计,美国每年产生约 8,000 万吨包装废弃物。大约一半的包装废弃物来自食品和饮料。该机构表示,雀巢和联合利华等食品公司排放了大部分塑胶废弃物。

- 双轴延伸聚丙烯(BOPP) 薄膜市场趋势强烈强调永续包装解决方案。消费者意识的增强和监管压力正在推动可回收和环保产品的转变。品牌专注于透明标籤来传达产品讯息,以满足有环保意识的消费者的需求。

BOPP薄膜产业概况

BOPP薄膜市场正走向碎片化。以下选手参加。 Taghleef Industries、Uflex Limited、SRF Limited、Oben Holding Group、Toray Industries Inc. 等多家全球和地区包装企业都在这个市场上竞争。

- 2024年3月成立的完全子公司凸版株式会社与印度凸版特种薄膜私人有限公司(TSF)合作开发了基于双轴延伸聚丙烯(BOPP)的阻隔膜“GL-SP”,并将于近期开始生产。 GL-SP是凸版集团的透明沉淀阻隔膜「GL BARRIER1」系列永续包装产品中的独特产品,在全球市场占有率很高。

- 2024 年 2 月:Innovia Films 宣布扩大其自由浮动聚烯收缩薄膜系列。这种新型薄膜是一种由聚烯(WAPO) 製成的低密度白色薄膜,在印刷过程中保持浮力。这种不透明薄膜有助于收缩套管的不透光特性,从而可应用于乳製品、营养品、食品补充品和化妆品等光敏感行业的容器。该影片将在位于波兰普沃茨克的欧洲 Innovia 工厂製作。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 主要宏观经济趋势对市场的影响

第五章市场动态

- 市场驱动因素

- 包装食品的需求不断增长

- 由于环境法规,对软包装材料(相对于硬包装材料)的需求不断增加

- 新兴地区需求稳定成长

- 市场挑战

- 对一些主要市场利用率低和产能过剩的担忧

- 其他环保薄膜的威胁日益严重

第六章 市场细分

- 按最终用户产业

- 食品

- 饮料

- 製药/医疗

- 工业的

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Toray Industries Inc.

- Taghleef Industries LLC

- SRF Limited

- NAN YA Plastics Corporation

- Vacmet India Limited

- Uflex Ltd

- Polyplex Corporation Ltd

- Trefan Group

- Oben Holding Group

- Tatrafan SRO

- Jindal Poly Film

- Biofilm SA

- Altopro SA de CV

第八章投资分析

第9章市场的未来

The BOPP Films Market size is estimated at USD 29.74 billion in 2024, and is expected to reach USD 38.69 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

BOPP film is commonly used for applications that require moisture resistance, optical clarity, and increased tensile strength, such as medical packaging, food and beverage packaging, and personal care product packaging. Several factors contribute to the growth of BOPP (biaxially oriented polypropylene) films, including their versatility, durability, cost-effectiveness, and environmental benefits. The increasing need for flexible packaging solutions in diverse industries, such as food and beverage, pharmaceuticals, and cosmetics, further drives the market's growth.

Key Highlights

- BOPP has become a high-growth film material due to its extreme versatility. BOPP is an essential polypropylene film. It is an effective alternative to waxed paper and aluminum foil. One of the primary factors that has led to BOPP film use and application growth is their relatively low carbon footprint compared to other plastic films. Because of their low melting point, BOPP films require less energy to convert from one form to another.

- At-home food consumption and snacking may remain higher than in the pre-COVID period as more people permanently join the home-office trend. Owing to this, food packaging is expected to continue to be the critical end-use sector for BOPP films. The demand for fine commodity film, usually used in food, pharmaceutical, and other market, is expected to drive future demand. In recent years, the electrical and electronics market has also increased the use of BOPP films in packaging, which are also available in glossy and matte formats.

- In September 2023, Tredegar Corporation sold its flexible packaging films "Terphane" business to Oben Group with a net transaction of USD 116 million. The manufacturing sites are in Cabo de Santo Agostinho, headquartered in Sao Paulo, Brazil, and exports to 29 countries. With the completion of this transaction, Oben strengthened its place as a global player in the highly competitive flexible films market by increasing the production capacity of BOPET films and offering an opportunity to enlarge the production capacity for other films, especially BOPP, in the United States and Brazil.

- The bags and pouches made of BOPP films are becoming increasingly popular since they are environmentally friendly, reasonably priced, and 100% recyclable. The visual appeal of BOPP bags and pouches adds an extra layer of advertising to the goods used for packaging. The expansion of food and beverage, e-commerce, the improving economy, and increased disposable income contributed to increased consumption of packaged goods (including packaged food), which need packaging to protect the commodities from contamination and damage. This tendency will likely increase the vendor's manufacturing capacity and boost the growth of the market studied over the years.

- In April 2024, Toppan and India-based Toppan Speciality Films (TSF) developed GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP) as the substrate. GL-SP is a recent addition to the range of products for sustainable packaging in the Toppan Group's GL BARRIER1 series of transparent vapor-deposited barrier films, which enjoy a significant share of the global market, according to the company. Toppan and TSF will launch sales of GL-SP for packaging dry content, focusing on markets in the Americas, Europe, India, and the ASEAN region.

- The BOPP films market faces several significant challenges that could impact its growth and profitability in the future. These challenges include the availability of substitute packaging materials and the adoption of alternative packaging materials, such as bio-based plastics, compostable materials, and other flexible films, which threaten BOPP films. They could compete for market share if these alternatives offer comparable or superior properties while being more environmentally friendly. In addition, changing consumer preferences and behaviors can influence packaging trends. If consumers demand alternative packaging formats or materials due to health concerns, convenience, or sustainability, the market for BOPP films might be affected.

- The COVID-19 pandemic has significantly impacted the biaxially oriented polypropylene film market. The pandemic caused supply chain disruptions in the market studied due to international trade restrictions, lockdown measures, and transportation challenges. Production facility closures and logistical restrictions caused delays in raw material procurement and finished product delivery, impacting the overall production and distribution of BOPP films. The rapid growth of the country's economy and increasing disposable income lead to a rise in consumer spending. This has propelled the demand for packaged goods, especially in urban areas, where convenience and aesthetics play essential roles. BOPP films offer better printability and visual appeal, making packaging ideal.

- Over the last five years, India's capacity has around doubled, owing to the opening up of its retail sector, an increase in the middle classes, and accompanying consumer spending on packaged food and other commodities. Recent BOPP investments have been substantially high, with a yearly nameplate capacity of more than 45,000 tons. Furthermore, according to the US Department of Agriculture, in 2023, over 549 million metric tons of cow's milk was produced worldwide among various dairy products. In comparison, the production volume of cheese and butter was over 22 and 11 million metric tons in the same year. Such developments in the food sector may create more opportunities in the market studied.

BOPP Films Market Trends

Industrial Vertical Expected to Drive Growth

- BOPP films play a crucial role in the industrial sector due to their versatile properties and applications. They are required in the industrial sector for several things, such as packaging, lamination, labeling, adhesives, and capacitors. These films are used as a lamination material to enhance the appearance, strength, and durability of printed materials such as posters, catalogs, brochures, and packaging boxes.

- In January 2024, Cosmo Films, an international leader in specialty films for packaging, synthetic paper, and labeling, in addition to lamination applications, launched metalized electrical evaluation BOPP films for capacitor application. These films are mainly used to produce numerous types of AC and DC capacitors. These capacitors have varied industrial applications, ranging from automobiles, electric vehicles, electronics, power electronics, and renewable power systems.

- BOPP film is a fragment of the broader polyolefin chemical family. It denotes that it can be laminated with polyethylene film and still be extensively accepted in the reprocessing waste stream. In numerous applications, the consumption of BOPP film has furthered from the sustainability boost at the expense of other polymers. When organoclay and nanocomposite materials are combined with BOPP, their barrier properties are improved. PVA (poly(vinyl alcohol)) and MA (maleic anhydride) are the most appropriate materials for minimizing the oxygen penetrability of the films.

- Continuous innovations in manufacturing processes have led to the development of advanced BOPP films with enhanced properties, such as improved seal strength, higher barrier performance, and better clarity, expanding their applicability in industrial settings. According to MOSPI, the industrial production index for the manufacturing sector across India in the financial year of 2023 stood at 137.1. This was a growth of 4.7% as compared to the previous financial year.

- Because of the high development rate in India's economy, the country's BOPP market is observing a high development rate because of the increasing development of the retail, pharmaceutical, and cosmetic businesses apart from the food and beverage industries. The e-commerce sector has one of the significant applications of BOPP self-adhesive tapes in the country, as it offers superior mechanical and optical features.

- In India, on account of the small cost of production, the players are increasing their production volumes to meet the snowballing demand for BOPP. For instance, Cosmo Films has announced an upsurge in its production capacity of BOPP to 0.035 million megatons, which is anticipated to be commercialized. Similarly, Jindal Polyfilms is anticipated to increase its production capacity to 0.044 million megatons.

North America Accounts for Significant Market Share

- Many vendors of BOPP films in North America are changing their product portfolios to handle the increasing requirement for packaging solutions in the region. BOPP films that provide transparency in product packaging help customers quickly examine the product and have been an important factor in driving its adoption and aiding the market's growth in the area.

- The rising demand for packaged food in the region has driven the market's growth, owing to the need for the increased shelf-life of food products, non-toxicity during sealing, and the need to maintain product quality and sustainability during packaging processes. According to the Organic Trade Association, the US consumption of organic packaged food amounted to USD 23.20 billion in 2023, and it is forecasted to reach over USD 25 billion by 2025.

- Retail outlets are North America's most significant revenue-generating medium for food products. Flexible packaging products, such as BOPP films, offer consumers a convenient shopping experience, as they are lightweight and minimize the effort required to carry the products. They emerged as the preferred form of packaging in the region due to their versatility, custom qualities, efficiency in conserving resources, and sustainability. According to the US Census Bureau, in 2023, sales of food and beverage stores in the United States amounted to approximately USD 985 billion. Sales of food services and drinking places were slightly higher, at around USD 1.1 trillion.

- The region is also a significant exporter and consumer of meat products. The vast availability of pork and meat products across the nation's widespread and intense retail chains bolstered the market. With the demand for a more considerable stable-shelf time, the demand for BOPP films is expected to increase. BOPP films are instrumental in improving the packaging films' thermal resistance and barrier properties, like oxygen transmission and water vapor transmission rates.

- In the United States, increasing awareness among consumers and favorable government regulations are anticipated to drive the demand for sustainable, biodegradable packaging during the forecast period. According to the United States Environmental Protection Agency, the United States generates almost 80 million metric tons of packaging waste annually. About half of the packaging waste comes from food and beverage products. The agency mentioned that food corporations like Nestle and Unilever generate most plastic waste.

- The biaxially oriented polypropylene (BOPP) films market trend strongly highlights sustainable packaging solutions. With increasing consumer awareness and regulatory pressure, there is a shift toward recyclable and eco-friendly. Brands focus on transparent labeling to convey product information, catering to environmentally conscious consumers.

BOPP Films Industry Overview

The BOPP film market is moving toward fragmentation. Players such as Taghleef Industries, Uflex Limited, SRF Limited, Oben Holding Group, Toray Industries Inc., and more are operating in the market. Packaging comprises several global and regional players vying for attention in a contested market.

- March 2024: TOPPAN Inc., a TOPPAN Group company and a wholly owned subsidiary of TOPPAN Holdings Inc., and India-based TOPPAN Speciality Films Private Limited (TSF) developed GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP) as the substrate and will soon launch production and sales. GL-SP is a unique addition to the range of products for sustainable packaging in the TOPPAN Group's GL BARRIER1 series of transparent vapor-deposited barrier films, which enjoy a significant share of the global market.

- February 2024: Innovia Films announced the extension of its product range for floatable polyolefin shrink films. The new film is a low-density white film made from polyolefin (WAPO) that maintains floatability when printed. The opaque film contributes to the shrink sleeves' light-blocking properties that can later be applied to containers for light-sensitive industries such as dairy, nutritional products, food supplements, and cosmetics. The film will be produced at the European Innovia site in Plock, Poland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Packaged Food

- 5.1.2 Environmental Regulation Paving Way for Flexible Packaging Requirements (Over Rigid Packaging Materials)

- 5.1.3 Steady Rise in Demand from Emerging Regions

- 5.2 Market Challenges

- 5.2.1 Poor Utilization and Overcapacity Remains a Concern in a Few Major Markets

- 5.2.2 Growing Threat from Other Environmentally Friendly Films

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Food

- 6.1.2 Beverage

- 6.1.3 Pharmaceutical and Medical

- 6.1.4 Industrial

- 6.1.5 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.5.3 Egypt

- 6.2.5.4 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toray Industries Inc.

- 7.1.2 Taghleef Industries LLC

- 7.1.3 SRF Limited

- 7.1.4 NAN YA Plastics Corporation

- 7.1.5 Vacmet India Limited

- 7.1.6 Uflex Ltd

- 7.1.7 Polyplex Corporation Ltd

- 7.1.8 Trefan Group

- 7.1.9 Oben Holding Group

- 7.1.10 Tatrafan SRO

- 7.1.11 Jindal Poly Film

- 7.1.12 Biofilm SA

- 7.1.13 Altopro SA de CV