|

市场调查报告书

商品编码

1549741

语言服务:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Language Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

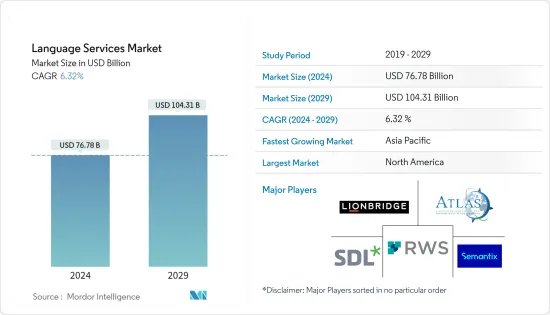

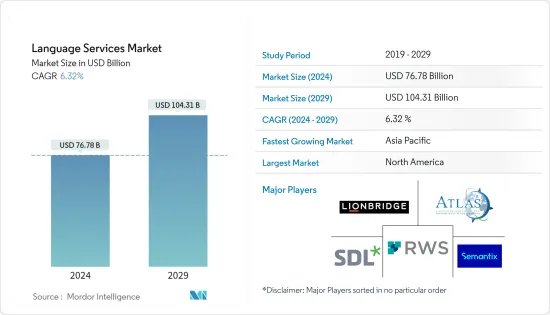

语言服务市场规模预计到2024年为767.8亿美元,预计到2029年将达到1043.1亿美元,在预测期内(2024-2029年)复合年增长率为6.32%,预计将会增长。

主要亮点

- 推动语言服务需求的主要因素包括业务的快速全球化、内容的日益数位化以及对个人化和国际客户服务的需求不断增长。

- 科大讯飞是一家提供翻译服务的中国语音辨识公司,已成功从国有投资基金国新控股和安徽铁路发展基金等投资者资金筹措了4.07 亿美元(28 亿元)。该公司表示,这笔资金筹措将用于增强其翻译输出以及人工智慧翻译引擎的输出。这些新兴市场的开拓为预测期内的市场成长提供了巨大的空间,特别是对于新兴企业。

- 语言服务的需求不再集中在大型跨国公司。儘管如此,地方政府和州政府,包括小型企业、大公司和其他组织,仍在增加笔译、口译和其他语言服务的使用。

- 过去几十年来,国际贸易稳步扩大,包括自由贸易协定的激增,导致世界贸易实质上爆炸性增长。此外,由于海外竞争的加剧以及政府的各项倡议,所有大大小小的公司都在积极寻求海外市场的商机。

- 国际行销趋势预计也将加速语言服务市场的成长。有了这些服务,企业现在可以透过网路以低成本接触到世界各地不断增长的受众。随着这些观众越来越多地由外国人组成,预计该市场将进一步成长。

- 网路使用量的增加,加上内容行销趋势,正在为语言产业开闢新的途径。针对外国受众的 PPC 广告和社群媒体行销也以惊人的速度扩张。世界各地经营的社群网站和多个部落格也提供了有效的内容行销平台,包括报导、资讯图表、影片和多媒体作品。所有这些内容都经过在地化以获得最佳效果,这是推动市场的主要因素之一。

- 此外,该市场正在见证众多企业加强其市场地位的併购活动。例如,今年 10 月,Acolad Life Sciences 与 Alphanumeric 合作,支持生命科学公司满足其国际通讯需求,包括全球客服中心的电话口译 (OPI)。

- 受疫情影响,世界各地的人们都因「居家令」而被迫家用。 YouTube、Netflix、社群媒体和亚马逊的用户数量激增,产生了全球对更多内容的需求。这意味着对可以远端工作的翻译人员的需求不断增长。

- 另一个原因是,对抗病毒和治疗患者的经验的积极交流已成为医疗保健、病毒学、免疫学、流行病学等领域研究人员之间全球讨论和资讯交流的驱动力。预计对翻译人员的需求最高的是医学领域。

- 2024 年 3 月,ABC Language Services 与康乃狄克州 Language Link 合併。此次合併将使 ABC Language Services 能够更好地满足政府机构、律师事务所、医疗实务、公共服务、企业和其他企业等客户的翻译需求。两家公司继续以其现有名称运营,但现在共用所有资源和业务。

- COVID-19大流行导致的封锁规定迫使全世界都留在家用,这为网路贸易的发展提供了坚实的动力。 Netflix、YouTube、Amazon Prime、社群媒体等应用程式的用户数量快速成长。因此,全球需要更多内容,这对译者来说是个好消息。

语言服务市场的趋势

翻译服务预计将大幅成长

- 在语言服务中,翻译服务在促进不同语言使用者之间的沟通方面发挥着重要作用。这些服务包括口头和手语通信,根据国际标准化组织 (ISO) 的定义,将口头或手语讯息呈现为另一种语言,同时保留来源语言内容所指事物的含义。

- 随着我们与客户的联繫越来越紧密,我们为满足他们的需求而提供的翻译服务范围正在不断扩大,无论他们的语言偏好如何。根据历史资料,各家公司选择翻译服务是为了提供国内外客户舒适感。

- 翻译服务通常需要整合的云端运算平台和巨量资料分析才能从任何地方存取资料。结果是更大的储存容量和更高的效率。

- 随着越来越多的企业提供线上服务,对网站和网路内容翻译的需求也在增加。世界各地的企业都寻求翻译服务来服务其客户并满足他们的需求。个人也使用此类服务,但只有一小部分人这样做。

- 最新数据显示,每分钟约有 300 小时的影片内容上传到 YouTube,用户每天观看约 50 亿个影片。此外,大约 70% 的 YouTube 观众来自美国以外的非英语国家。这一趋势正在推动大规模影片翻译和在地化的需求。译后编辑机器翻译 (PEMT) 预计将成为预测期内翻译服务领域的主要趋势。

北美占最大市场占有率

- 由于其日益多样化,北美的语言服务市场预计将显着成长。随着该地区人口结构的变化和多样性的增加,该地区所有行业对有效语言服务的需求预计都会增加,为了满足多样化人口的需求,有能力的笔译员和口译员的存在至关重要。

- 多元文化行销的出现已成为当今的重要议题,预计将推动对语言服务的需求。由于人口结构的变化,针对不同社群的行销策略已成为一些以前仅依赖单一语言的公司的首要任务。

- 根据美国人口普查局的数据,美国使用超过 350 种语言。由于移民的增加,亚洲人口也在增加。新的移民趋势正在扩大为这些人群提供服务的语言服务市场。

- 了解每个地区当前的语言趋势以及它们如何继续塑造市场和国家对于透过专业的语言服务向多元文化消费者提供更有效的沟通是必要的,它可以帮助公司了解性别正在迅速增加。

- 市场企业正试图透过多种措施增强自身竞争力,包括多次併购活动、产品创新、强化研发、开拓海外市场等。例如,人工智慧、机器学习 ML、自动语音辨识(ASR)、神经机器翻译 (NMT) 和自然语言理解 (NLU) 技术领域的领导者 AppTek 宣布与 TransPerfect 建立新的合作关係。 AppTek 强大的 ASR 引擎与 TransPerfect 的专业翻译和在地化服务相结合,缩短了计划交付时间,并进一步改善了客户工作流程。

语言服务业概述

由于多家供应商在国内和国际市场提供服务,语言服务市场竞争非常激烈。市场分散化,主要企业纷纷采取产品创新、併购等策略,主要是为了扩大服务组合,维持市场竞争力。主要参与企业包括 Atlas Language Service Inc.、Lionbridge Technologies Inc.、RWS Holdings PLC 和 SDL PLC。

2024 年 6 月,这家总部位于利默里克的公司加入了英国Valorem 集团。总部位于利默里克的口译软体公司 Translit 已加入 Valorem Group,并与总部位于曼彻斯特的口译服务供应商DA Languages 合併。与 DA Languages 的合作加强了 Translit 提供卓越语言解决方案的承诺。

2024 年 2 月,BLEND 收购了以色列领先的在地化供应商 Manpower Language Solutions (MLS)。透过将 MLS 的以色列市场专业知识与 BLEND 的全球能力相结合,我们的目标是增强我们的服务并使我们的客户在每个地区取得成功。 MLS 客户可以受益于更好的服务,包括 120 多种语言的视讯和音讯本地化。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 提高全球企业的影响力将使市场繁荣

- 线上和线下内容的增加正在推动市场

- 市场挑战

- 开放原始码语言服务工具的成长

- COVID-19 对语言服务市场的影响

第六章 重大技术投入

- 云端技术

- 人工智慧

- 网路安全

- 数位服务

第七章 市场区隔

- 按类型

- 翻译服务

- 在地化服务

- 口译服务

- 其他服务

- 按行业分类

- 生命科学(製药、医疗设备、生物技术、CRO)

- 媒体娱乐(OTT、游戏、票房、付费电视)

- 法律、金融、专利

- 电子商务

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚洲

- 印度

- 中国

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第八章 竞争格局

- 公司简介

- Atlas Language Services Inc.

- Globe language Services Inc.

- Lionbridge Technologies Inc.

- RWS Holdings PLC

- SDL PLC

- Semantix AB

- Summa Linguae Technologies

- Teleperformance SE

- TransPerfect Global Inc.

- Welocalize Inc.

第九章投资分析

第十章市场机会与未来趋势

The Language Services Market size is estimated at USD 76.78 billion in 2024, and is expected to reach USD 104.31 billion by 2029, growing at a CAGR of 6.32% during the forecast period (2024-2029).

Key Highlights

- The primary factors driving the demand for language services include the rapidly increasing globalization among businesses, the incremental rise of digitizing content, and the increased customer service that's becoming more personalized and international.

- Iflytek, a speech recognition company based out of China that provides translation services, successfully raised USD 407 million (CNY 2.8 billion) from its investors, including the state-run investment fund China Reform Holdings and the Anhui Railway Development Fund. The company claims that the funding will be used to enhance the translation output, along with the output of the AI translation engine. Such developments provide significant scope for the market's growth during the forecast period, especially for startups.

- The demand for language services is no longer concentrated on large multinational corporations. Still, small and large businesses and local and state governments, including other organizations, have increased their use of translation, interpretation, and other language services.

- International trade has steadily expanded over the past few decades, including the proliferation of free trade agreements that have led to a virtual explosion of global trade worldwide. Moreover, the increasing foreign competition and various government initiatives have led all kinds of businesses, irrespective of size, to take initiatives regarding opportunities available to them in foreign markets.

- The ongoing trends in international marketing are also expected to accelerate the growth in the language services market. With these services, companies are now able to reach increasing audiences across the globe at a lower cost through the web. The market is expected to grow even further as these audiences are increasingly composed of foreign people.

- The increase in internet usage, combined with the trend toward content marketing, has opened up new avenues for the language industry. PPC advertising and social media marketing aimed at foreign audiences are also expanding at remarkable rates. Social networking sites and multiple blogs that are active across the world are also providing platforms for effective content marketing that include articles, infographics, videos, and multimedia productions. All this content is localized for optimum effectiveness, which is one of the major factors driving the market.

- Moreover, the market is witnessing multiple M&A activities by the players to strengthen their market positions. For instance, in October this year, in order to assist life sciences organizations with their needs for international communication, including over-the-phone interpreting (OPI) for global call centers, Acolad Life Sciences teamed up with Alphanumeric.

- The lockdown restrictions amidst the pandemic forced the entire world to stay at home, which gave a strong impetus to developing trade and entertainment on the Internet. YouTube, Netflix, social media, and Amazon witnessed a surge in the number of users, producing the need for more content globally. That implies a higher demand for the services of translators, whose work is much easier to organize remotely.

- Another reason is the active exchange of experiences in fighting against the virus and treating patients, which drove the global discussion and information exchange between researchers in healthcare, virology, immunology, epidemiology, etc. The highest demand for translators may be expected from the medical sector.

- In March 2024, ABC Language Services merged with Language Link of Connecticut. The merger enabled ABC Language Services to better meet the translation needs of its clients, which comprise government agencies, law firms, medical practices, social services, corporations, and other businesses. Both companies continued to operate under their existing names, but now, they share all of their resources and operations.

- The lockdown restrictions amidst the COVID-19 pandemic forced the entire world to stay at home, which has given a solid impetus for developing trade via the Internet. Applications like Netflix, YouTube, Amazon Prime, and social media have witnessed a user surge. This has resulted in an increased need for more content globally and has served as good news for translators, owing to increased demand for their services while providing the ease of being organized remotely.

Language Services Market Trends

Translation Services is Expected to Witness Significant Growth

- Within language services translation services play a key role in facilitating communication between users of different languages. These services encompass both spoken and signed communication and follow the International Standards Organization (ISO) definition that states the rendering of a spoken or signed message into another language by preserving the meaning of the source language content.

- The growing customer outreach has enhanced the scope of translation services to fulfill the customers' needs, barring language preferences. Historical data signifies that various companies are opting for translation services to provide comfort to their national and international clients.

- Translation services usually require an integrated cloud computing platform and big data analytics to ensure data access from anywhere. This also results in increased storage capacity and more efficiency.

- With more and more companies offering their services online, the need for websites and web content translation has grown. Businesses globally are seeking translation services to serve their customers and keep up with their demands. While individuals are also using this type of service, the share of such usage is minimal.

- According to the latest figures, around 300 hours of video content is being uploaded to YouTube every minute, and approximately 5 billion videos are being watched daily by users. Also, about 70% of YouTube viewers are from outside the United States and are non-English speaking people. This trend is increasing the demand for video translations and localizations on a large scale. The post-editing of machine translations (PEMT) is expected to be a major trend in the translation services domain during the forecast period.

North America Holds Largest Market Share

- The language services market in the North American region is expected to witness significant growth owing to its increasing diversity. As the region's population continues to shift and become more diverse, the need for effective language services is expected to increase in all industries across the region, and qualified translators and interpreters are crucial in serving the needs of this increasingly diverse population.

- The advent of multicultural marketing has become an important topic these days, and it is expected to drive the demand for language services. The region's changing demographics have made marketing strategies to diverse communities a priority for multiple businesses that previously relied only on a single language.

- According to the US Census Bureau, more than 350 languages are spoken in the United States. The Asian population is also rising owing to increased immigration. New immigration trends are expanding the language services market to serve these populations.

- Understanding the current language trends in their region and how they continue to shape the market and the country helps organizations understand the rapidly rising need for providing multicultural consumers with much more effective communication through professional language services.

- The players in the market are looking to strengthen their competitiveness through various efforts such as multiple M&A activities, product innovation, increased R&D, and exploration of overseas markets. For instance, AppTek, a leader in AI, Machine Learning ML, Automatic Speech Recognition (ASR), Neural Machine Translation (NMT), and Natural Language Understanding (NLU) technologies, announced a new partnership with TransPerfect. The combined capabilities of AppTek's powerful ASR engine and TransPerfect's specialized translation and localization services will further improve customer workflows by reducing project turnaround times.

Language Services Industry Overview

The language services market is highly competitive as multiple vendors provide their services in domestic and international markets. The market appears to be fragmented, with the significant players adopting strategies, like product innovation and mergers and acquisitions, primarily to expand their service portfolio and to stay competitive in the market landscape. Some of the major players in the market are Atlas Language Service Inc., Lionbridge Technologies Inc., RWS Holdings PLC, and SDL PLC, among others.

In June 2024, a LIMERICK-based company joined the UK-based Valorem Group. Translate, an interpreter software company headquartered in Limerick, joined the Valorem Group while also merging with fellow group member DA Languages, a Manchester-based interpreting service provider. Their partnership with DA Languages reinforces Translit's commitment to providing exceptional language solutions.

In February 2024, BLEND recently acquired Manpower Language Solutions (MLS), Israel's key localization provider. By combining MLS's expertise in the Israeli market with BLEND's global proficiency, they aim to enhance their services and empower clients to succeed in any locale. MLS's clients will benefit from improved offerings, including video and audio localization in over 120 languages.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Global Corporate Presence will flourish the market.

- 5.1.2 Increase in Online and Offline Content will drive the market.

- 5.2 Market Challenges

- 5.2.1 Growth of Open-source Language Service Tools

- 5.3 Impact of COVID-19 on Language Service Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Translation Services

- 7.1.2 Localization Services

- 7.1.3 Interpreting Services

- 7.1.4 Other Services

- 7.2 By End-user Vertical

- 7.2.1 Life Sciences (Pharmaceuticals, Medical Devices, Biotechnology, CROs)

- 7.2.2 Media and Entertainment (OTT, Games, Box Office, Pay TV)

- 7.2.3 Legal, Finance, and Patents

- 7.2.4 E-commerce

- 7.2.5 Other End-user Verticals

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 United Kingdom

- 7.3.2.3 France

- 7.3.2.4 Italy

- 7.3.3 Asia

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Japan

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Atlas Language Services Inc.

- 8.1.2 Globe language Services Inc.

- 8.1.3 Lionbridge Technologies Inc.

- 8.1.4 RWS Holdings PLC

- 8.1.5 SDL PLC

- 8.1.6 Semantix AB

- 8.1.7 Summa Linguae Technologies

- 8.1.8 Teleperformance SE

- 8.1.9 TransPerfect Global Inc.

- 8.1.10 Welocalize Inc.