|

市场调查报告书

商品编码

1549797

电感器:市场占有率分析、产业趋势、成长预测(2024-2029)Inductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

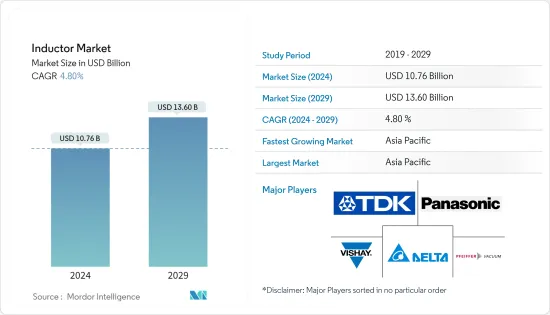

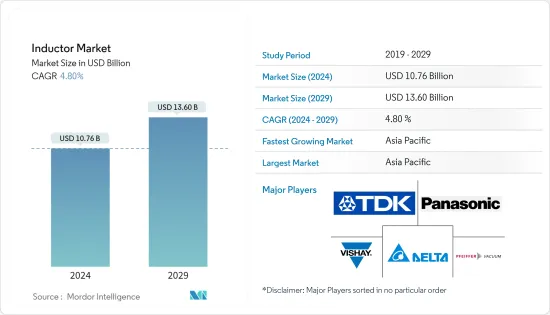

预计2024年电感器市场规模为107.6亿美元,预计2029年将达136亿美元,在市场预测期间(2024-2029年)复合年增长率为4.80%。

由于技术进步和各行业应用的增加,电感器市场的重要性显着增加。电感器是电路中的重要元件,主要用于在磁场中能源储存。它在汽车、航太、通讯、消费性电子等领域的广泛应用凸显了其重要角色。市场的发展受到电感器技术创新的影响,特别是为了满足对节能係统和小型电子产品日益增长的需求。有几个因素正在影响这个市场的动态,包括供应链的复杂性、材料成本和快速的技术进步。

消费性电子科技创新快速成长

主要亮点

- 科技快速进步:家用电子电器科技创新的快速步伐是塑造电感器市场的关键因素。随着设备变得更小、更复杂,对更小、更有效率的电感器的需求也在增加。随着智慧型手机、平板电脑、穿戴式装置和其他行动装置的激增,这种趋势尤其明显,所有这些装置都需要高性能元件才能实现最佳功能。此外,智慧家庭设备和物联网 (IoT) 应用的兴起显着增加了对先进电感器的需求。将这些组件整合到家用电子电器中可以提高能源效率、改善电源管理并提高整体效能。

- 小型化和效率:更小、更高性能设备的激增导致了电感器设计和製造流程的显着进步。目前正在开发高频电感器,以满足现代电子设备的特定需求,从而在不牺牲性能的情况下实现更紧凑的电路设计。这一趋势清楚地表明了市场对提供紧凑、高效的组件的关注,以满足行业对小型化的需求。

- 物联网和智慧型设备:物联网设备的激增为感应器製造商带来了新的机会。这些设备通常以低功耗运行,需要组件来有效管理电源,而电感器在其设计中发挥关键作用。不断扩大的物联网生态系统继续推动对节能电感器的需求,这些电感器可以支援这些设备的低功耗要求。

- 能源效率:随着消费者和监管机构都需要更节能的产品,製造商正在专注于开发有助于降低功耗的感测器。这对于电池供电的设备尤其重要,因为高效的电源管理非常重要。电感器设计中对能源效率的重视是一个重要趋势,与更广泛的产业永续性和减少能源使用的趋势一致。

节能係统的需求不断增长

主要亮点

- 汽车产业:汽车产业向电动车(EV)的转变显着增加了对高效能电感器的需求。这些组件对于电动车内的各种电力电子系统至关重要,例如车载充电器、DC-DC 转换器和逆变器。电感器在优化功率转换和更有效地管理能源方面发挥关键作用。随着电动车普及率的提高,对能够满足汽车应用严格的效率要求的先进电感器的需求持续增长。

- 可再生能源系统:太阳能和风力发电等可再生能源系统的扩张也推动了对高效能电感器的需求。这些系统严重依赖电力电子设备进行能量转换和管理,其中电感器作为关键组件,以确保高效的能量传输并最大限度地减少损失。对可再生能源的推动与该行业对永续性和开发节能技术的关注是一致的。

- 工业自动化:工业环境中向自动化和智慧製造流程的转变增加了对能够处理更高功率等级同时保持效率的电感器的需求。随着工业采用更先进的自动化技术,电感器在确保可靠、高效运作方面的作用变得越来越重要。工业应用对高性能电感器的需求反映了各个领域自动化和数位转型的更广泛趋势。

电感器市场趋势

汽车产业预计将显着成长

- 高频电感快速扩张迹象:全球电感市场预计将显着成长,尤其是高频电感领域。随着通讯、汽车和消费性电子等行业采用 5G、电动车 (EV) 和高级驾驶辅助系统 (ADAS) 等先进技术,对高频电感器的需求预计将快速增长。这些元件对于确保高速、高效能电子设备的最佳性能至关重要,也是产业参与者的重点关注领域。

- 技术进步推动成长:高频电感器市场的成长主要是由製造流程和材料的不断进步所推动的。这些创新提高了电感器的性能、耐用性和可靠性,使其更适合要求严格的应用。包括高频电感器在内的功率电感器领域在各个领域的电源管理应用中尤其重要,进一步推动了市场的成长。

- 电感器设计创新:随着对紧凑、高效元件的需求增加,供应商越来越注重开发创新的电感器设计。这些进步正在改变竞争格局,主要製造商正在大力投资研发以保持竞争力。小型化趋势,特别是智慧型手机和无线模组等小型通讯设备中的应用,也正在推动这种技术创新并促进整体市场成长。

- 价格趋势与市场动态:高频电感器需求的增加正在影响价格趋势,原料成本和製造流程的波动也会影响市场。然而,规模经济和製造技术的改进预计将稳定价格并增加各行业高频电感器的可用性。高频电感器的整体市场前景仍然看好,技术进步和不断增长的需求提供了显着的成长机会。

亚太地区预计将主导市场

- 蓬勃发展的电子产业:由于电子产业的蓬勃发展,亚太地区预计将实现最高的成长率并主导全球电感器市场。中国、日本和韩国等国家正在透过对半导体製造、家用电子电器和汽车产业的大量投资来推动这一成长。该地区强大的製造基地和主要感应器供应商的存在提供了竞争优势,使我们能够有效地满足不断增长的全球需求。

- 采用先进技术:5G、物联网和电动车等先进技术的快速采用正在推动亚太地区对感应器的需求。行业资料显示,该地区的电感器市场规模正在迅速扩大,其中功率电感器和高频电感器在支援该地区广泛的通讯基础设施和汽车工业方面发挥关键作用。该地区电动和混合动力汽车的成长尤其推动了对这些零件的需求。

- 强调创新与永续性:不断增加的研发投资是推动亚太感应器市场的关键因素。当地企业处于开发新感应器类型和应用的前沿,增加了该地区的市场占有率。对永续製造方法和节能电感器开发的关注符合全球永续性趋势,进一步提振了市场前景。

- 强劲的市场预测:亚太地区强劲的市场预测得到电子製造和技术创新领先地位的支持。随着该地区不断创新和整合先进技术,对电感器的需求预计将增加,从而推动市场成长并巩固亚太地区作为全球电感器市场领导者的地位。该地区对智慧城市倡议和汽车行业成长的关注进一步促进了这一积极的市场轨迹。

感应器产业概况

市场分散:感应器市场高度分散,许多全球和地区公司构成了竞争格局。市场竞争涉及各种规模的公司,不存在任何一家公司明显占据主导地位的情况。Panasonic Corporation、村田製作所等企业集团以及 Coilcraft Inc. 和 Sumida Corporation 等专业公司的出现,体现了市场的多样性。这种碎片化表明没有一家公司拥有较大的市场占有率,从而创造了激烈的竞争和差异化机会。

提供多元化产品的市场领导:TDK Corporation、Vishay Intertechnology Inc. 和 Pulse Electronics(YAGEO 公司的子公司)等主要企业在塑造全球电感器市场方面发挥关键作用。这些公司透过广泛的产品系列、技术创新和策略性收购确立了自己的地位。 TDK 公司和村田製作所以透过大力投资研发来保持竞争力而闻名。同时,Delta电子和太阳诱电等公司利用其技术专长和全球影响力为汽车、消费电子和通讯等广泛行业提供服务。

未来成功的策略 在竞争激烈的感应器市场中,各公司都专注于创新、品质改进和策略伙伴关係,以获得优势。小型化、效率提高以及将电感器整合到复杂的电子系统中等趋势对于保持相关性至关重要。能够不断创新、适应新行业标准并满足对更小、更高性能电感器不断增长的需求的公司可能会取得成功。此外,向电感器需求不断增长的新兴市场和产业扩张将是维持成长的重要策略。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 加大家电技术创新力度

- 对节能电气和电子系统的需求不断增加

- 市场限制因素

- 原料成本上涨,特别是铜

第六章 市场细分

- 按类型

- 电力

- 按频率

- 按最终用户产业

- 车

- 航太/国防

- 通讯

- 消费性电子与计算

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- TDK Corporation

- Vishay Intertechnology Inc.

- Panasonic Corporation

- Delta Electronics

- Pulse Electronics(YAGEO Company)

- Sagami Elec Co. Ltd

- Taiyo Yuden Co. Ltd

- TE Connectivity Limited

- Murata Manufacturing Co. Ltd

- Sumida Corporation

- Coilcraft Inc.

第八章投资分析

第9章市场的未来

The Inductor Market size is estimated at USD 10.76 billion in 2024, and is expected to reach USD 13.60 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

The inductor market has seen a significant rise in importance, driven by technological advancements and increasing applications across various industries. Inductors, which are crucial components in electrical circuits, primarily serve the purpose of energy storage within a magnetic field. Their extensive use in sectors such as automotive, aerospace, communications, and consumer electronics highlights their indispensable role. The market's evolution has been shaped by innovations in inductor technology, especially in response to the growing demand for energy-efficient systems and miniaturized electronic devices. Several factors, including supply chain complexities, material costs, and rapid technological advancements, influence the dynamics of this market.

Innovation Surge in Consumer Electronics

Key Highlights

- Rapid Technological Advancements: The swift pace of innovation in consumer electronics is a pivotal factor shaping the inductor market. As devices become more compact and sophisticated, the demand for smaller, more efficient inductors has escalated. This trend is particularly evident in the proliferation of smartphones, tablets, wearables, and other portable devices, all of which require high-performance components for optimal functionality. Furthermore, the rise of smart home devices and IoT (Internet of Things) applications has significantly increased the need for advanced inductors. The integration of these components into consumer electronics ensures improved energy efficiency, better power management, and enhanced overall performance.

- Miniaturization and Efficiency: The push towards smaller, more powerful devices has driven substantial advancements in inductor design and manufacturing processes. High-frequency inductors are now being developed to meet the specific needs of modern electronics, allowing for more compact circuit designs without compromising performance. This trend underscores the market's focus on delivering compact, efficient components that align with the industry's demand for miniaturization.

- IoT and Smart Devices: The increasing adoption of IoT devices presents new opportunities for inductor manufacturers. These devices, which often operate on low power, require components that manage power efficiently, making inductors a critical part of their design. The expanding IoT ecosystem continues to drive the demand for energy-efficient inductors that can support the low-power requirements of these devices.

- Energy Efficiency: As consumers and regulators alike demand more energy-efficient products, manufacturers are focusing on developing inductors that contribute to lower power consumption. This is especially important in battery-powered devices, where efficient power management is crucial. The emphasis on energy efficiency in inductor design is a key trend that aligns with broader industry movements towards sustainability and reduced energy usage.

Growing Demand for Energy-Efficient Systems

Key Highlights

- Automotive Sector: The automotive industry's shift towards electric vehicles (EVs) has significantly increased the demand for high-efficiency inductors. These components are essential in various power electronic systems within EVs, including onboard chargers, DC-DC converters, and inverters. Inductors play a crucial role in optimizing power conversion and managing energy more effectively, which is vital for extending battery life and enhancing vehicle performance. The growing adoption of EVs continues to drive demand for advanced inductors that can meet the stringent efficiency requirements of automotive applications.

- Renewable Energy Systems: The expansion of renewable energy systems, such as solar and wind power, also propels the demand for efficient inductors. These systems rely heavily on power electronics to convert and manage energy, with inductors serving as key components in ensuring efficient energy transfer and minimizing losses. The push towards renewable energy aligns with the industry's focus on sustainability and the development of energy-efficient technologies.

- Industrial Automation: The move towards automation and smart manufacturing processes in industrial settings has led to an increased need for inductors capable of handling higher power levels while maintaining efficiency. As industries adopt more sophisticated automation technologies, the role of inductors in ensuring reliable and efficient operation becomes increasingly critical. The demand for high-performance inductors in industrial applications reflects the broader trend of automation and digital transformation across various sectors.

Inductor Market Trends

Automotive Industry Segment is Expected to Register Significant Growth

- High-Frequency Inductors Poised for Rapid Expansion: The global inductor market is poised for substantial growth, particularly in the high-frequency inductor segment. As industries such as telecommunications, automotive, and consumer electronics increasingly adopt advanced technologies like 5G, electric vehicles (EVs), and advanced driver-assistance systems (ADAS), the demand for high-frequency inductors is expected to surge. These components are essential for ensuring optimal performance in high-speed, high-efficiency electronic devices, making them a critical focus area for industry players.

- Technological Advancements Driving Growth: The growth in the high-frequency inductor market is significantly driven by ongoing advancements in manufacturing processes and materials. These innovations enhance the performance, durability, and reliability of inductors, making them more suitable for demanding applications. The power inductor segment, which includes high-frequency inductors, is particularly crucial in power management applications across various sectors, further driving market growth.

- Innovations in Inductor Design: As demand for compact and efficient components rises, suppliers are increasingly focused on developing innovative inductor designs. These advancements are reshaping the competitive landscape, with key players investing heavily in research and development to maintain a competitive edge. The trend towards miniaturization, particularly for applications in small communication devices like smartphones and wireless modules, is also driving this innovation, contributing to the overall growth of the market.

- Price Trends and Market Dynamics: The rising demand for high-frequency inductors is influencing price trends, with fluctuations in raw material costs and manufacturing processes potentially impacting the market. However, economies of scale and improvements in manufacturing technologies are expected to help stabilize prices, making these inductors more accessible across various industries. The overall market outlook for high-frequency inductors remains positive, with significant growth opportunities driven by technological advancements and increasing demand.

Asia-Pacific Region is Expected to Dominate the Market

- Booming Electronics Industry: The Asia-Pacific region is expected to dominate the global inductor market, registering the highest growth rate due to its thriving electronics industry. Countries such as China, Japan, and South Korea are leading this growth, driven by substantial investments in semiconductor manufacturing, consumer electronics, and the automotive sector. The region's strong manufacturing base and the presence of key inductor suppliers provide a competitive advantage, enabling it to meet growing global demand efficiently.

- Adoption of Advanced Technologies: The rapid adoption of advanced technologies such as 5G, IoT, and electric vehicles is fueling demand for inductors in the Asia-Pacific region. Industry data indicates that the market size for inductors in this region is expanding rapidly, with power and high-frequency inductors playing a critical role in supporting the region's extensive telecommunications infrastructure and automotive industry. The growth of electric and hybrid vehicles in the region is particularly driving the demand for these components.

- Focus on Innovation and Sustainability: Increased investment in research and development is a key factor driving the inductor market in Asia-Pacific. Local companies are at the forefront of developing new inductor types and applications, enhancing the region's market share. The focus on sustainable manufacturing practices and the development of energy-efficient inductors aligns with global trends towards sustainability, further boosting the market outlook.

- Strong Market Forecast: The Asia-Pacific region's strong market forecast is supported by its leadership in electronics manufacturing and technological innovation. As the region continues to innovate and integrate advanced technologies, the demand for inductors is expected to rise, driving market growth and solidifying Asia-Pacific's position as a global leader in the inductor market. The region's focus on smart city initiatives and the growing automotive sector further contribute to this positive market trajectory.

Inductor Industry Overview

Highly Fragmented Market: The inductor market is highly fragmented, with numerous global and regional players contributing to a competitive landscape. The market lacks clear dominance by any single company, with competition spread across multiple firms, both large and small. The presence of conglomerates such as Panasonic Corporation and Murata Manufacturing Co., Ltd., alongside specialized companies like Coilcraft Inc. and Sumida Corporation, illustrates the diverse nature of the market. This fragmentation suggests that no single company holds a substantial market share, leading to intense competition and opportunities for differentiation.

Market Leaders with Diverse Offerings: Leading companies like TDK Corporation, Vishay Intertechnology Inc., and Pulse Electronics (a subsidiary of YAGEO Company) play pivotal roles in shaping the global inductor market. These firms have established themselves through extensive product portfolios, innovation, and strategic acquisitions. TDK Corporation and Murata Manufacturing Co. Ltd. are known for their significant R&D investments, allowing them to maintain a competitive edge. Meanwhile, companies like Delta Electronics and Taiyo Yuden Co., Ltd. leverage their technological expertise and global presence to cater to a broad range of industries, including automotive, consumer electronics, and telecommunications.

Strategies for Future Success: In the highly competitive inductor market, companies are focusing on innovation, quality enhancement, and strategic partnerships to stay ahead. Trends such as miniaturization, increased efficiency, and the integration of inductors into complex electronic systems are crucial for maintaining relevance. Companies that can continuously innovate, adapt to new industry standards, and meet the growing demand for compact, high-performance inductors are likely to thrive. Additionally, expanding into emerging markets and industries with growing inductor demand will be a key strategy for sustaining growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Innovations in Consumer Electronics Products

- 5.1.2 Growing Demand for Energy Efficient Electrical and Electronic Systems

- 5.2 Market Restraints

- 5.2.1 Rising Cost of Raw Materials, Especially Copper

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Power

- 6.1.2 Frequency

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Communications

- 6.2.4 Consumer Electronics and Computing

- 6.2.5 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TDK Corporation

- 7.1.2 Vishay Intertechnology Inc.

- 7.1.3 Panasonic Corporation

- 7.1.4 Delta Electronics

- 7.1.5 Pulse Electronics (YAGEO Company)

- 7.1.6 Sagami Elec Co. Ltd

- 7.1.7 Taiyo Yuden Co. Ltd

- 7.1.8 TE Connectivity Limited

- 7.1.9 Murata Manufacturing Co. Ltd

- 7.1.10 Sumida Corporation

- 7.1.11 Coilcraft Inc.