|

市场调查报告书

商品编码

1549888

全球石头纸市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Stone Paper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

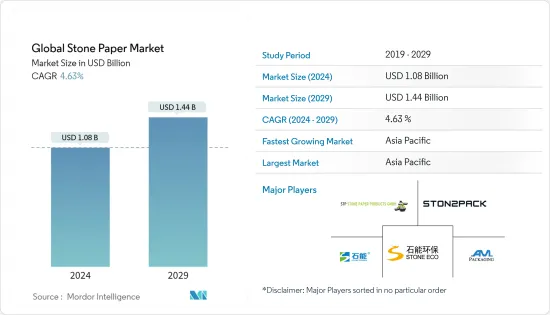

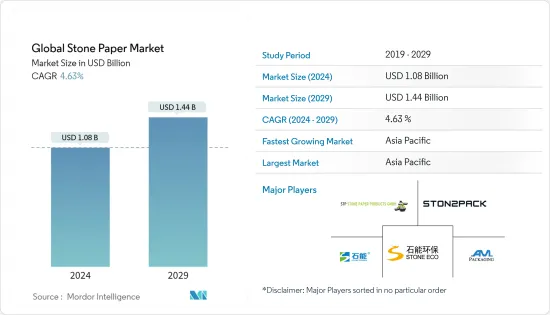

据预测,2024年全球石头纸市场规模预计为10.8亿美元,2029年达到14.4亿美元,在预测期内(2024-2029年)复合年增长率为4.63%。

主要亮点

- 由于人们对环境问题的认识不断增强以及对传统纸产品的永续替代品的兴趣日益浓厚,石头纸市场预计在未来几年将增长。石头纸以石灰石中的碳酸钙为基础,是传统木浆纸的更环保的替代品。这是因为石头纸的生产消费量较少的水和能源,并且具有较低的碳排放。

- 石头纸越来越受欢迎的主要因素之一是它的耐用性和防水、防油、防撕裂的性能。这些属性使其适用于各种应用,包括包装、标籤和印刷。此外,随着消费者和企业越来越多地采用环保做法,对石头纸的需求可能只会增加。

- 石头纸的投资成本比传统纸低40%,主要是因为生产时不需要水处理。生产高强度纸张不需要水,这大大降低了资本需求,同时也降低了能源需求。这些特性,加上石头纸的生产优势,预计将在不久的将来为市场带来流动性机会。

- 随着世界各国政府加强对一次性塑胶的监管并鼓励永续实践,石头纸市场将受益于有利的法规环境。石头纸袋和促销产品是传统塑胶购物袋的现代且环保的替代品。

- 石头纸市场也在产品开发方面不断创新,製造商不断探索新的形状和用途。结合OLED技术,石头纸袋可以转变为发光广告媒介,提供现代且引人注目的促销解决方案。这种创新组合不仅提供了传统塑胶的环保替代品,而且还提案了一种具有视觉衝击力且永续的广告材料方法。

石头纸市场趋势

软包装产业的高需求预计将推动市场

- 石头纸因其独特的性能和环保的特点而在软包装中越来越受欢迎。其灵活性可满足各种包装需求,其抗撕裂和防水性能可确保较长的使用寿命,特别是在食品等注重新鲜度的领域。随着加工食品市场的扩大,石头纸正在成为一种永续的替代品。与各种印刷方法的兼容性不仅扩大了其吸引力,而且还可以实现充满活力的设计。

- 根据中国连锁专利权协会(CCFA)统计,2023年中国已调理食品市场收益达7.6亿美元。石头纸具有冷冻级品质,即使在低温下也能保持耐用,这是食品包装的一个显着特征。此外,其表面适用于标准墨水,且重量轻,使其成为经济的选择,特别是对于注重成本的公司。

- 石头纸耐紫外线和化学物质,即使在恶劣的环境下也能确保包装的耐用性和易读性。它非常适合需要长保质期或户外暴露的产品,在强度、耐用性和防水性方面超越传统纸张,使其成为潮湿环境的合适选择。

- Stone Paper 在软包装领域的突破延伸到小袋、袋子、包装纸和标籤,重塑了永续包装模式。在箱包领域,它们作为环保、耐用和永续的选择而大放异彩,非常适合购物和促销用途。标籤对于品牌和传播至关重要,它受益于 Stone Paper 的印刷适应性和环保特性,提供了品质和环境友善性的结合。

- 2024年1月,深圳市石纸企业有限公司强调了石头纸的多功能性,可以适应多种印刷方式,从胶印到数位印刷再到柔印。卓越的印刷质量,具有清晰、复杂的图像,是复杂包装设计的理想选择。此外,与各种列印技术的兼容性使其能够无缝地融入您现有的流程。

亚太地区预计将经历最高成长

- 中国位于亚太地区的前沿,将在未来几年推动全球石头纸市场的成长。这种快速成长的主要驱动力是对环保包装的需求不断增长。中国拥有丰富的原料和竞争优势,为石头纸产业提供了良好的景观。

- 值得注意的是,大量製造商,尤其是新兴企业,正在积极开发创新产品。市场上的领先公司正在利用这些新兴企业的见解来扩大其在当地的影响力。我们正在透过向附近的书店、文具店和更广泛的包装领域供应石头纸来扩大我们的业务范围。

- 国家邮政局的报告显示,近十年来,我国宅配量大幅成长,2021年至2023年增幅大幅增加。然而,宅配的激增也引发了环境问题。不当的处置方法正在造成严重的污染问题。

- 国家邮政局倡议鼓励各部会、业务部门制定并实施三年行动计画。该目标雄心勃勃:到2025年终,全国所有邮政宅配门市必须逐步淘汰不可降解物品,包括塑胶袋、碎片、一次性塑胶和编织袋。这项倡议是中国实现发展更绿色、更循环的宅配包装的更广泛策略的基石。

- 中国对更环保的宅配包装的推动与石头纸市场的扩大并进。随着中国转向更永续的宅配包装生态系统,石头纸的环保特性呈现出一条有吸引力的成长之路。石头纸以其高可回收性和最小的碳排放而闻名,非常适合中国的绿色包装愿望。

- 宅配公司正积极采用石头纸来突显碳减排目标,促进永续性并提高可回收箱子的标准。这项策略合作不仅在石头纸市场发挥举足轻重的作用,也为传统材料提供了永续的替代品,支持了中国环保宅配包装的愿景。

石头纸产业概况

石头纸市场适度分散,有许多新参与企业。 STP Stone Paper Products GmbH、深圳石头纸企业、AM Packaging Company Limited、Stone Paper Printing and Packaging India LLP、深圳石头纸新生态材料是市场上的一些主要企业。此外,市场的主要发展如下:

- 2023年10月:深圳市石头纸业有限公司发表报导介绍批发石粉合成纸,该纸已成为印刷包装行业蔬菜包装的环保且灵活的解决方案。石粉纸卓越的耐用性是其显着特点,使其适合包装多种蔬菜,确保在运输和储存过程中得到保护。而且生产过程中使用无害的树脂,蔬菜不会接触到有害化学物质,既保证了安全又新鲜。

- 2023年1月:台湾龙门复合材料发表题为《居家经济爆发》的报导。台湾网路购物每年使用1亿多个包装盒(袋),产生1.8万吨包装废弃物。为了消除网购中过多的包装废弃物,我们正在利用创新概念创造新的环保包装材料回收系统。以石材复合材料(石头纸)製成的纸板製成的鱼箱可以在低温运输中取代瓦楞纸箱。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 软包装产业对石头纸的需求不断增加

- 环保产品越来越受欢迎

- 市场挑战

- 废纸回收利用

第六章 市场细分

- 按类型

- 双层矿物纸 (RPD)

- 丰富矿物质板双层涂层 (RBD)

- 按用途

- 包装

- 印刷

- 装饰

- 产业

- 商业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- STP Stone Paper Products GmbH

- Stone paper printing and packaging India LLP

- AM Packaging Company Limited

- Shenzhen Stone Paper Enterprise

- Taiwan Longmeng Composite Materials Co., Ltd.

- Pishgaman Sanat Sabz

- Sphera International

- Karst Stone Paper

- Armen Paper

- TBM Co. Ltd.

- Shenzhen Stone Paper New Eco Materials Co., Ltd.

The Global Stone Paper Market size is estimated at USD 1.08 billion in 2024, and is expected to reach USD 1.44 billion by 2029, growing at a CAGR of 4.63% during the forecast period (2024-2029).

Key Highlights

- The stone paper market is expected to witness growth in the coming years, driven by increasing environmental concerns and a growing emphasis on sustainable alternatives to traditional paper products. Stone paper, primarily composed of calcium carbonate derived from limestone, offers a more eco-friendly alternative to conventional wood pulp-based paper. This shift is attributed to its minimal environmental impact, as stone paper production consumes less water and energy and generates fewer carbon emissions.

- One of the key drivers behind the rising popularity of stone paper is its durability and resistance to water, oil, and tearing. These qualities make it well-suited for various applications, including packaging, labels, and printing. Additionally, as consumers and businesses increasingly adopt eco-friendly practices, the demand for stone paper will likely continue its upward trajectory.

- Stone paper incurs an investment cost 40% lower than traditional paper, a reduction primarily attributed to the absence of water treatment requirements in its production. The production of strong paper does not necessitate water, leading to a significant decrease in capital needs and concurrently reducing energy demands. These distinctive features, coupled with the production advantages of stone paper, are anticipated to create opportunities for liquidity in the market in the near future.

- As governments worldwide tighten regulations on single-use plastics and encourage sustaianble practices, the stone paper marketstands to benefit from a favorable regulatory environemnt. Stone paper bags and promotional items represent contemporary and environmetally friendly substitute for conventional plastic carrier bags.

- The stone paper market is also witnessing innovations in product development, with manufacturers exploring new formuations and applications. When coupled with OLED technology, stone paper bags can transform into illuminated advertising media, offering a modern and eye-catching promtional solution. This innovative combination not only provides an eco-conscious alternative to traditional plastic but also introduces a visually striking and sustaianble approach to promtional materials.

Stone Paper Market Trends

High Demand From Flexible Packaging Segment is Anticipated to Drive The Market

- Stone paper is gaining traction in flexible packaging due to its unique properties and eco-friendly profile. Its flexibility caters to diverse packaging needs, while its tear-resistant and waterproof attributes ensure longevity, especially in sectors like food, where freshness is critical. With the expanding processed food market, stone paper emerges as a sustainable alternative. Its compatibility with different printing methods not only broadens its appeal but also allows for vibrant designs.

- As per the China Chain Store & Franchise Association (CCFA), China's prepared food market raked in a revenue of USD 0.76 billion in 2023. Stone paper's freezer-grade quality, which maintains durability in low temperatures, is a standout feature for food packaging. Moreover, its surface is conducive to standard inks, and its lightweight nature makes it an economical choice, particularly for cost-conscious companies.

- Boasting resistance to UV rays and chemicals, stone paper ensures packaging durability and readability, even in challenging environments. It excels in products requiring extended shelf life or outdoor exposure, surpassing traditional paper in strength, durability, and water resistance, making it a preferred choice for moisture-prone settings.

- Stone paper's surge in flexible packaging extends to pouches, bags, wrappers, and labels, reshaping the sustainable packaging landscape. In the realm of bags, it shines as an eco-conscious, robust, and sustainable option, perfect for shopping or promotional purposes. Labels, pivotal for branding and information dissemination, benefit from stone paper's print adaptability and eco-friendly essence, offering a blend of quality and environmental mindfulness.

- In January 2024, Shenzhen Stone Paper Enterprise Ltd. underscored stone paper's versatility in accommodating various printing methods, ranging from offset to digital and flexographic. Its superior print quality, characterized by vivid and intricate images, positions it as a premier choice for sophisticated packaging designs. Furthermore, its compatibility with diverse printing techniques ensures a seamless fit into existing processes.

Asia Pacific is Set to Witness The Highest Growth

- China, at the forefront of the Asia Pacific region, is poised to lead the global stone paper market's growth in the coming years. This surge is predominantly fueled by the rising demand for eco-friendly packaging. With ample raw materials and competitive production costs, China offers an advantageous landscape for the stone paper industry.

- Notably, numerous manufacturers, particularly startups, are actively engaged in developing innovative products. Major players in the market are leveraging insights from these startups to bolster their local presence. They are expanding their reach by supplying stone paper to nearby bookstores, stationery outlets, and the broader packaging domain.

- China has seen a remarkable uptick in express delivery volumes over the last decade, soaring from 108.3 billion in 2021 to an impressive 108.3 billion in 2023, as reported by the State Post Bureau. However, this surge in express packages has also heightened environmental concerns. Improper disposal practices have led to significant pollution issues.

- The State Post Bureau is spearheading an initiative, urging provincial and business bureaus to craft and implement a three-year action plan. The goal is ambitious: by the end of 2025, all postal express outlets nationwide must phase out non-degradable items, including plastic bags, tips, disposable plastics, woven bags, and more. This initiative is a cornerstone of China's broader strategy for achieving greener and more circular development in express packaging.

- China's push for greener express packaging dovetails with the stone paper market's expansion. As the nation pivots towards a more sustainable express packaging ecosystem, the eco-friendly attributes of stone paper present a compelling growth avenue. Renowned for its recyclability and minimal carbon footprint, stone paper perfectly aligns with China's green packaging aspirations.

- Express delivery firms are actively embracing stone paper, emphasizing carbon reduction goals, fostering sustainability, and elevating recyclable box standards. This strategic alignment not only underscores the stone paper market's pivotal role but also underscores its support for China's vision of environmentally responsible express packaging, offering a sustainable alternative to traditional materials.

Stone Paper Industry Overview

The Stone Paper market is moderately fragmented due to many new players entering the market. A few major players in the market include STP Stone Paper Products GmbH, Shenzhen Stone Paper Enterprise, AM Packaging Company Limited, Stone Paper Printing and Packaging India LLP, and Shenzhen Stone Paper New Eco Materials Co., Ltd. Some of the key developments in the market are:

- October 2023: Shenzhen Stone Paper Enterprise Ltd. published an article showcasing its wholesale stone powder synthetic paper, which emerges as an eco-friendly and flexible solution for vegetable packaging within the printing and packaging industry. Stone paper's outstanding durability stands out as a notable feature, making it well-suited for packaging various vegetables and ensuring their protection during transportation and storage. Furthermore, the use of non-toxic resin in its production guarantees that no harmful chemicals come into contact with the vegetables, ensuring both safety and freshness.

- January 2023: Taiwan Longmeng Composite Materials Co., Ltd. published an article stating that, the stay-at-home economy has exploded. Online shopping in Taiwan uses more than 100 million packing boxes (bags) a year, generating 18,000 tons of packaging waste. In order to eliminate the excessive waste of online shopping packaging, through innovative thinking, create a new recycling system for environmentally friendly packaging materials. Corrugated cardboard made of stone composite material (stone paper), and then made into saury boxes, can replace corrugated cardboard boxes in the cold chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand of stone paper from the flexible packaging indsutry

- 5.1.2 Increasing popularity for eco-friendly products

- 5.2 Market Challenges

- 5.2.1 Recycling and utilization of waste paper

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rich Mineral Paper Double Coated (RPD)

- 6.1.2 Rich Mineral Board Double Coated (RBD)

- 6.2 By Application

- 6.2.1 Packaging

- 6.2.2 Printing

- 6.2.3 Decoration

- 6.2.4 Industrial

- 6.2.5 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STP Stone Paper Products GmbH

- 7.1.2 Stone paper printing and packaging India LLP

- 7.1.3 AM Packaging Company Limited

- 7.1.4 Shenzhen Stone Paper Enterprise

- 7.1.5 Taiwan Longmeng Composite Materials Co., Ltd.

- 7.1.6 Pishgaman Sanat Sabz

- 7.1.7 Sphera International

- 7.1.8 Karst Stone Paper

- 7.1.9 Armen Paper

- 7.1.10 TBM Co. Ltd.

- 7.1.11 Shenzhen Stone Paper New Eco Materials Co., Ltd.