|

市场调查报告书

商品编码

1549893

全球主动铜缆电缆 (ACC) 市场:市场占有率分析、产业趋势/统计、成长预测Global Active Copper Cables (ACC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2024) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

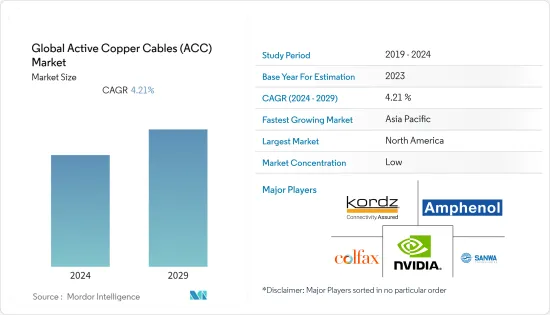

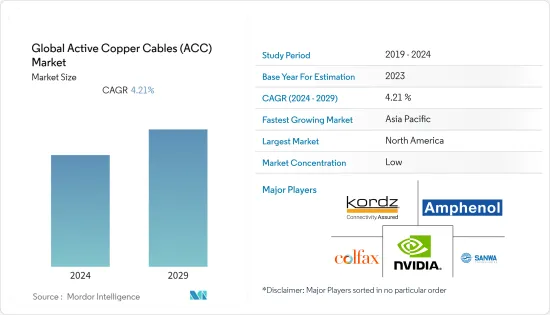

全球有源铜缆(ACC) 市场预计在预测期内复合年增长率为 4.21%。

有源铜缆(ACC) 市场目前正在经历强劲成长,由于资料中心、高效能电脑、大容量储存和其他应用的推动,预计将在全球范围内成长。

主要亮点

- 5G 的推出是为了满足对高效能通讯日益增长的需求,这对于推动数位营运至关重要。虽然 5G 的宽频波长可实现快速资料传输,但与 3G 和 4G 相比,讯号范围有限。因此,建构强大的5G网路需要密集的蜂巢塔,并依靠高速电缆进行讯号传输,从而增加了ACC市场的需求。

- GSMA 预测,到 2029 年,5G 连线将占所有行动连线的一半以上 (51%),并在 10 年内升至 56%,巩固 5G 作为主导连线技术的地位。 5G 的部署已经超过了之前所有行动技术,预计到 2023年终将达到超过 16 亿个连接,到 2030 年将达到 55 亿个连接。因此,随着5G的持续快速扩张,全球有源铜缆(ACC)市场预计在不久的将来将大幅成长。

- 电信业者正在下一波通讯基础设施押下重註。思科预测 5G 将比现今的平均行动连线快 13 倍。超越 5G 不仅带来速度,还带来更高的频宽、网路切片、人工智慧 (AI)、虚拟实境 (VR) 和云端运算增强功能。此外,许多国家已经建立了有线电视、电讯和宽频基础设施,为加速高速电缆的部署铺平了道路,从而推动了ACC市场的需求。

- 然而,原物料成本的上涨对有源铜缆电缆(ACC)的生产成本有显着影响。根据欧洲信用保险集团Credendo的报告,自2023年下半年以来,铜价一直稳定上涨。 2024年2月中旬,价格飙升超过20%,达到每吨近1万美元的两年高点,主要是因为铜矿石短缺。俄罗斯和乌克兰之间持续的衝突收紧了回收法规,并增加了燃料和能源成本。俄罗斯是全球领先的铜生产国和回收国,制裁、物流挑战和国内需求的综合影响将进一步加剧全球铜短缺,导致铜价达到前所未有的上涨水平。

全球有源铜缆(ACC)市场趋势

资料中心部署的扩大推动市场

- 随着按需服务越来越受欢迎,企业开始转向资料中心来满足其 IT 需求。由于企业对资料管理、备份、復原和电子邮件等基本工具的需求不断增加,资料中心正在发生显着的发展。对资料中心的需求激增,尤其是企业资料的需求,支持了市场的成长。

- 在全球范围内,超大规模资料中心不断兴起,满足了大量资料储存的需求,为企业带来了良好的前景。每个行业都在利用超大规模资料中心来提高运算能力、记忆体、网路和储存。这些中心的主要特点包括无缝扩展工作负载的能力和强大的实体基础设施。

- 此外,Flexera 2023 年云端状况报告发现,72% 的公司已将混合云端整合到业务中。然而,这种转变通常涉及放弃传统的私有云端或公有云设定。

- 印度和中国作为市场的领导者,正在大力投资资料中心建设。 AdaniConnex、Reliance、Sify、Atlassian、Yotta 和 AWS 等主要企业已宣布加强在印度资料中心的重大承诺。例如,亚马逊旗下的 AWS 部门宣布了一项到 2030 年将投资 127 亿美元的令人印象深刻的投资计划,凸显了积极的扩张计划。同时,Kotak Investment Advisors 的子公司 Kotak Alternate Assets 正在投资 8 亿美元,主要在印度的优质房地产市场开发 5 至 7 个大型资料中心资产,这为市场创造了巨大的机会。

- 印度资料中心市场投资快速成长,预计2025年将达到46亿美元。这一增长受到多种因素的共同支持,包括国内网路用户数量的快速增长、云端运算需求趋势、政府主导的数位化倡议以及数位服务供应商的本地化趋势。值得注意的是,与新兴市场相比,印度资料中心的开发和营运都具有成本效益。目前,我们的主要资料中心位于孟买、班加罗尔、清奈、德里 (NCR)、海得拉巴和普纳,并在加尔各答、喀拉拉邦和艾哈默德巴德开设了新资料中心。随着资料中心投资的成长,整个印度市场对相关基础设施服务(涵盖 IT、电气、机械和一般建筑)的需求也在增长。

北美占有很大份额

- 北美是全球最大的资料中心市场。此外,在北美资料中心市场,由于云端服务和数位转型的需求,超大规模资料中心的建置正在迅速增加。根据Cloudscene资料,截至2024年3月,美国以5,381个报告的资料中心位居全球第一。德国紧随其后,拥有 521 个中心,紧随其后的是英国,拥有 514 个中心。传统上,铜缆提供伺服器、路由器和交换器之间的大部分网路连结。

- 除了资料中心之外,美国5G网路市场也有望快速成长。美国是 AT&T、Verizon、 美国 Cellular 和 C Spire 等通讯巨头的所在地。根据 GSMA 2023 年北美行动经济报告,预计到 2030 年,北美蜂巢式物联网连线数将超过 5.35 亿。企业正在转向高速铜缆布线,以确保IT基础设施在未来不会遇到瓶颈。

- 工业环境中越来越多地采用私人 5G 基础设施预计将增加对 ACC 市场的需求。例如,2023年8月,爱立信、亚马逊网路服务(AWS)和日立美国研发部将在美国肯塔基州伯里亚的日立Astemo Americas电动汽车製造厂试办私人5G基础设施。这些行业通常需要专用的网路线路来确保可靠且不间断的连接。

- 北美也观察到专用 5G 网路趋势。 2024 年 2 月, IT基础设施服务供应商 Kindler 与 Hewlett Packard Enterprise (HPE) 建立全球策略联盟。 Kyndryl 与 HPE 子公司 Athonet 合作,主导LTE 和 5G 专用无线服务的共同开发和全球交付。同样,2024 年 4 月,交通基础设施特许经营公司 WorldVia Group 的技术平台 OpenVia Mobility 与着名数位业务和 IT 服务供应商 NTT 资料合作。两家公司正准备在美国道路上部署专用 5G 网路。私人 5G 渗透率预计将显着推动该地区的 ACC 市场,特别是在政府和私营部门。

- 2023年10月,美国联邦通讯委员会(FCC)启动了约182.8亿美元的重大投资,以加强农村宽频。该资金计画从 2024 年 1 月开始运行 15 年,旨在超过 70 万个地点安装 100/20Mbps 宽频,并加强 44 个州约 200 万个地点的服务。如此大规模的宽频部署预计将显着提振 ACC 市场。

全球有源铜缆(ACC) 产业概况

有源铜缆(ACC) 市场本质上是分散的。受调查的主要公司包括 NVIDIA Corporation、SANWA Technologies、Kordz International 和 Ampheno Corporation。市场公司正在采取合作伙伴关係、合约、创新和收购等策略来增强其服务产品并获得永续的竞争优势。

- 2024 年 2 月:用于宽频连接的高效能类比半导体产品的知名供应商 Spectra7 Microsystems Inc. 和台湾领先的连接器和电缆供应商 ACES Electronics 在加州圣克拉拉举行的年度大会上联手。会议暨展览上联合展示800G有源铜缆(ACC)的卓越能力。

- 2024 年 4 月:Fiber Stamp 发表最新产品 800G OSFP Breakout ACC。 Fiber Stamp声称其800G OSFP DAC和ACC符合OSFP MSA和IEEE802.3ck标准。这些电缆采用 16 对铜缆,可实现 8 通道、112GB/s 双向传输,同时保持速率向后相容性。最重要的是,这款产品与 NVIDIA 设备无缝集成,完全符合该公司的产品规格。 800G OSFP DAC系列支援长达3m,800G OSFP ACC系列将其范围延伸至5m,专门满足NVIDIA AI资料中心基础设施的需求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 宏观经济情境分析(景气衰退、俄罗斯/乌克兰危机等)

第五章市场动态

- 市场驱动因素

- 房屋建筑投资强劲

- 家电需求增加

- 市场挑战

- 在有限距离内使用

- 缺乏技术专长

- 价格和技术规格分析

- ACC 和 DAC(即被动电缆)的技术见解

- 世界贸易分析

- ACC各种资料传输速度的关键见解

- 深入了解 ACC 的各种外形规格

第六章 市场细分

- 按应用领域

- 资料中心

- 通讯

- 高效能运算 (HPC)

- 家电

- 工业用途

- 其他应用领域

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- NVIDIA Corporation

- JPC Connectivity

- Kordz International

- Amphenol

- Colfax International

- SANWA Technologies Co. Ltd

- TE Connectivity

- Mellanox Technologies

- Luxshare Precision Industry Co. Ltd

- Leoni AG

第八章 市场机会及未来趋势

The Global Active Copper Cables Market is expected to register a CAGR of 4.21% during the forecast period.

The active copper cables market is currently experiencing robust growth, and it is expected to grow owing to data centers, high-performance computers, mass storage devices, and other applications globally.

Key Highlights

- 5G implementation is poised to meet the escalating demand for efficient communication, which is crucial for enhancing digital operations. While 5G's broader wavelength enables rapid data transmission, its signals are limited in range compared to 3G and 4G. Consequently, a robust 5G network necessitates a dense array of cell towers, each reliant on high-speed cables for signal transmission, thereby bolstering the demand for the ACC market.

- GSMA forecasts that 5G connections will account for over half (51%) of all mobile connections by 2029, climbing to 56% by the decade's close, solidifying 5G as the leading connectivity technology. 5G has outpaced all previous mobile generations in its rollout, exceeding 1.6 billion connections by the end of 2023, and it is projected to reach 5.5 billion by 2030. Consequently, as 5G continues its rapid expansion, the global active copper cables market is poised for significant growth in the near future.

- Telecom companies are placing significant bets on the next wave of telecommunication infrastructure. Cisco predicts that 5G will deliver speeds 13 times faster than the current average mobile connection. Beyond speed, 5G promises expanded bandwidth, network slicing, and boosts in artificial intelligence (AI), virtual reality (VR), and cloud computing. Moreover, with cable TV, telecom, and broadband infrastructure already well-established in many countries, the groundwork is set to accelerate the deployment of high-speed cables, fueling demand in the ACC market.

- However, the rising costs of raw materials are significantly impacting the production expenses of active copper cables. As reported by Credendo, a European credit insurance group, copper prices have been steadily climbing since late 2023. By mid-February 2024, they surged by over 20%, hitting a two-year high of nearly USD 10,000 per ton, primarily driven by shortages in copper ore. The ongoing conflict between Russia and Ukraine has led to stricter recycling regulations and increased costs for fuel and energy, further elevating both production and recycling expenses. With Russia being a key global player in copper production and recycling, the combined effects of sanctions, logistical challenges, and domestic demand have exacerbated the global copper shortage, consequently pushing prices to unprecedented levels.

Global Active Copper Cables (ACC) Market Trends

Growing Deployment of Data Centers to Drive the Market

- As on-demand services gain prominence, enterprises increasingly turn to data centers to meet their IT needs. Data centers have evolved significantly, driven by organizations' heightened demands for data management, backup, recovery, and essential tools like email. This surge in data center demand, especially those catering to enterprise applications, underscores the market's growth.

- Worldwide, hyper-scale data centers are on the rise, responding to the need to store vast data volumes and presenting lucrative prospects for businesses. Industries across the board leverage hyper-scale data centers to bolster computing power, memory, networking, and storage. These centers' key features include the ability to seamlessly scale up workloads and robust physical infrastructure.

- In addition, the Flexera State of the Cloud Report 2023 revealed that 72% of companies had integrated hybrid clouds into their operations. However, this shift often involves transitioning away from traditional private and public cloud setups.

- India and China, prominent players in the market, are channeling significant investments into data center construction. Key players such as AdaniConnex, Reliance, Sify, Atlassian, Yotta, and AWS have unveiled major commitments to bolster India's data center landscape. For instance, AWS, a division of Amazon, has outlined a staggering USD 12.7 billion investment by 2030, underscoring its aggressive expansion plans. In a parallel move, Kotak Alternate Assets, under Kotak Investment Advisors, is injecting USD 800 million into the development of 5-7 sizable data center assets, focusing on prime real estate markets in India, providing the market studied a huge opportunity.

- India is poised to witness a surge in data center market investments, with projections indicating a climb to USD 4.6 billion by 2025. This growth is underpinned by a confluence of factors: a burgeoning domestic internet user base, escalating demands for cloud computing, government-led digitalization initiatives, and a trend toward localization among digital service providers. Notably, India's data center landscape enjoys a key advantage in cost efficiency, both in development and operation, when juxtaposed with more established markets. Presently, major data center clusters are concentrated in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune, with emerging hubs in Calcutta, Kerala, and Ahmedabad. As these investments in data centers expand, so does the demand for associated infrastructure services, spanning IT, electrical, mechanical, and general construction across the Indian market.

North America to Hold a Major Share

- North America has the largest data center market in the world. In addition, the data center market in North America is witnessing a surge in hyperscale data center construction, driven by the demand for cloud services and digital transformation. According to Cloudscene's data, as of March 2024, the United States leads globally with 5,381 reported data centers. Germany follows with 521 centers, closely trailed by the United Kingdom with 514. Copper cables have traditionally served most network links between servers, routers, and switches, and the growth of data centers is expected to drive the active copper cable market in the region.

- In addition to data centers, the 5G network market in the United States is poised for rapid growth. The United States stands as the headquarters for telecom powerhouses such as AT&T, Verizon, US Cellular, and C Spire. As per the GSMA Mobile Economy North America 2023 report, North America is projected to witness over 535 million cellular IoT connections by 2030. Enterprises are turning to high-speed copper cabling to future-proof their networks, guaranteeing that their IT infrastructure will not face bottlenecks in the years ahead.

- The growing adoption of private 5G infrastructure in industrial settings is set to boost the demand for the ACC market. For instance, Ericsson, Amazon Web Services (AWS), and Hitachi America R&D joined forces in August 2023 to trial a private 5G infrastructure at Hitachi Astemo Americas' electric vehicle manufacturing plant in Berea, Kentucky, United States. Such industries typically necessitate a dedicated, exclusive internet line to ensure reliable, uninterrupted connectivity.

- A trend has been observed in private 5G networks in North America. In February 2024, Kyndryl, an IT infrastructure services provider, formed a global strategic alliance with Hewlett Packard Enterprise (HPE). Collaborating with Athonet, a subsidiary of HPE, Kyndryl is spearheading the joint development and global delivery of LTE and 5G private wireless services. Similarly, in April 2024, Openvia Mobility, a technological platform within the Globalvia Group, a transport infrastructure concessions company, partnered with NTT DATA, a prominent digital business and IT services provider. Together, they are gearing up to deploy Private 5G networks along US roads. This widespread adoption of private 5G, especially in government and private sectors, is poised to significantly boost the ACC market in the region.

- In October 2023, the Federal Communications Commission (FCC) in the United States initiated a substantial investment of around USD 18.28 billion to bolster rural broadband. This funding, slated for a 15-year initiative starting January 2024, aims to bring 100/20 Mbps broadband to over 700,000 locations and enhance the same service for about 2 million locations across 44 states. Such a massive broadband rollout is poised to significantly boost the ACC market.

Global Active Copper Cables (ACC) Industry Overview

The active copper cables (ACC) market is fragmented in nature. Some major players in the market studied are NVIDIA Corporation, SANWA Technologies Co. Ltd, Kordz International, and Amphenol Corporation, among others. Players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

- February 2024: Spectra7 Microsystems Inc., a prominent supplier of high-performance analog semiconductor products for broadband connectivity, and ACES Electronics Co. Ltd, a major connector and cable supplier based in Taiwan, jointly showcased the exceptional capabilities of their 800G active copper cables at the annual DesignCon Conference Exhibition in Santa Clara, California.

- April 2024: FIBERSTAMP unveiled its latest offering, the 800G OSFP Breakout ACC. Fiberstamp asserts that its 800G OSFP DAC and ACC adhere to the OSFP MSA and IEEE802.3ck standards. These cables utilize 16 pairs of copper cables, enabling an 8-channel, 112 GB/s two-way transmission, all while maintaining rate backward compatibility. Notably, the product seamlessly integrates with NVIDIA's equipment, aligning perfectly with their product specifications. The 800G OSFP DAC line supports up to 3 m, while the 800G OSFP ACC line extends that reach to 5 m, catering specifically to the demands of Nvidia's AI data center infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Macro-Economic Scenarios (Recession, Russia-Ukraine Crisis, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Robust Investments in Building Construction

- 5.1.2 Increase in Demand for Consumer Electronics

- 5.2 Market Challenges

- 5.2.1 Usage for Limited Distance

- 5.2.2 Lack of Technical Expertise

- 5.3 Analysis of Pricing and Technical Specifications

- 5.4 Technology Insights into ACC and Direct Attach Cables (i.e. Passive Cables)

- 5.5 Global Trade Analysis

- 5.6 Key Insights into Various Data Transmission Speeds of ACC

- 5.7 Key Insights into Various Form Factors of ACC

6 MARKET SEGMENTATION

- 6.1 By Application Area

- 6.1.1 Data Center

- 6.1.2 Telecommunication

- 6.1.3 High-Performance Computing (HPC)

- 6.1.4 Consumer Electronics

- 6.1.5 Industrial Applications

- 6.1.6 Other Application Areas

- 6.2 By Region

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NVIDIA Corporation

- 7.1.2 JPC Connectivity

- 7.1.3 Kordz International

- 7.1.4 Amphenol

- 7.1.5 Colfax International

- 7.1.6 SANWA Technologies Co. Ltd

- 7.1.7 TE Connectivity

- 7.1.8 Mellanox Technologies

- 7.1.9 Luxshare Precision Industry Co. Ltd

- 7.1.10 Leoni AG