|

市场调查报告书

商品编码

1549899

全球主动光缆 (AOC):市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)Global Active Optical Cables (AOC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

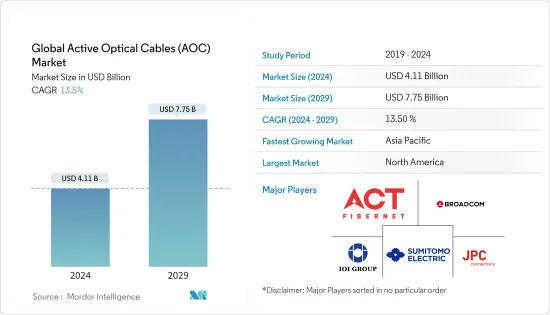

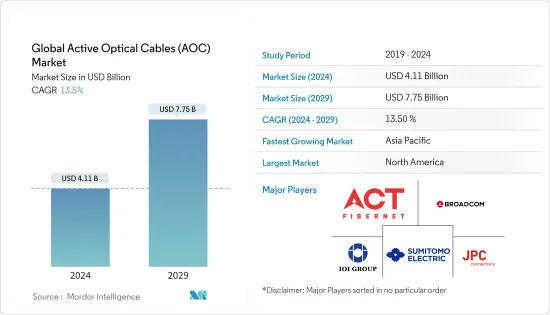

预计2024年全球主动光缆(AOC)市场规模为41.1亿美元,2029年预计将达到77.5亿美元,复合年成长率预计为13.5%。

主动式光缆市场目前正在经历强劲成长,由于云端基础服务、数位化、5G、资料中心和其他应用的大规模实施,预计将进一步成长。

主要亮点

- 主动式光缆 (AOC) 市场主要是由资料中心、通讯和消费性电子产品等各种应用中对高速资料传输的需求不断成长所推动的。各种应用程式不断成长的资料需求预计将推动 AOC 市场的需求。

- 由于云端技术、数位化的大规模应用以及AI/ML需求的不断增加,资料中心市场正在快速成长。根据通讯服务供应商Cloudscene的数据,截至2023年12月,全球约有10,978个资料中心,且这个数字正在迅速增加。资料中心需要强大且快速的网路连线。因此,资料中心市场的成长预计也将推动AOC市场。

- 5G 的推出旨在满足对高效通讯不断成长的需求,这对于推动数位业务至关重要。虽然 5G 的宽频波长可实现快速资料传输,但与 3G 和 4G 相比,讯号范围有限。因此,强大的 5G 网路需要密集的蜂巢塔,并依靠高速电缆进行讯号传输,从而推动 AOC 市场的需求。

- GSMA 预测,到 2029 年,5G 连线将占所有行动连线的一半以上 (51%),并在 10 年内升至 56%,巩固 5G 作为主导连线技术的地位。 5G 的部署已经超过了之前所有行动技术,预计到 2023年终将达到超过 16 亿个连接,到 2030 年将达到 55 亿个连接。因此,随着5G持续快速扩张,全球主动式光缆市场预计在不久的将来会显着成长。

- 光纤传输安全性和敏感资料应用中潜在漏洞的担忧可能会阻碍 AOC 的广泛采用。此外,与传统铜缆相比,AOC 通常会带来更大的维护和维修挑战,特别是在需要快速服务介入的区域。

全球主动光缆(AOC)市场趋势

资料中心对主动光缆的需求增加推动市场

- 近年来,受全行业高速资料传输需求激增的推动,全球主动式光缆(AOC)市场出现了显着成长。随着技术的进步,高效、可靠的连接解决方案比以往任何时候都更重要。主动式光缆 (AOC) 作为高速电缆解决方案脱颖而出,它将雷射和光电二极体等主动元件直接整合到电缆组件中。这些组件对于促进光讯号在光纤电缆上的传输至关重要。在资料中心领域,术语「200G AOC」是指专门设计用于支援 200Gigabit每秒 (Gbps)资料速率的电缆。

- 此外,在需要大量运算能力的高效能运算 (HPC) 环境中,200G AOC 有助于处理器和储存单元之间的快速资料交换。企业正在利用高效能运算进行平行处理,以帮助运行人工智慧和资料分析等高阶程式。资料中心,特别是那些专注于人工智慧和机器学习的资料中心,可以从 HPC 中受益匪浅。

- 组织内部云端运算的兴起正在显着推动资料中心市场的发展。根据 Flexera 2023 年云端状态报告,72% 的企业已采用混合云端。然而,这种转变通常意味着超越传统的私有云端或公共云端基础架构。

- 主动式光缆 (AOC) 对于连接资料中心缆线架和交换器至关重要,可实现交换器和伺服器之间的无缝通讯。资料中心通常会先安装交换机,然后再部署结构化布线,最后选择合适的互连产品进行网路存取。对于短距离(定义为 10G 为 90 公尺或更短,40G 为 10 公尺或更短),铜缆是最具成本效益的选择。对于 10G 500 公尺以下和 40G 150 公尺以下的中距离,多模 VCSEL(垂直共振腔面射型雷射)收发器是首选,通常辅以 AOC。

- 印度资料中心市场预计将大幅扩张,到 2025 年将达到 46 亿美元。这一成长的推动因素包括该国网际网路用户数量的增加、云端处理需求的增加、政府促进数位化的举措以及数位服务提供商向本地化的转变。值得注意的是,印度资料中心产业无论在市场开拓或营运阶段,与新兴市场相比都具有显着的成本优势。目前,我们主要的资料中心地点主要位于孟买、班加罗尔、清奈、德里 (NCR)、海得拉巴和普纳,新资料中心将在加尔各答、喀拉拉邦和艾哈默德巴德建立。随着资料中心投资的成长,印度各地对包括 IT、电气、机械和一般建筑在内的辅助基础设施服务的需求也在成长。

北美占有很大占有率

- 北美拥有全球最大的资料中心市场,目前超大规模资料中心的建设大幅增加。这一激增的主要驱动力是对云端服务不断成长的需求和持续的数位转型。根据Cloudscene发布的截至2024年3月的最新资料,美国拥有5,381个资料中心,位居全球第一。德国以 521 名紧随其后,英国以 514 名紧随其后。从历史上看,铜缆一直用于伺服器、路由器和交换器之间的网路连结。随着资料中心的扩张,该地区对有源铜布线的需求持续成长。

- 美国对新资料中心的需求仍然强劲,每週都会宣布新计划。 2024年3月,亚马逊宣布计画斥资6.5亿美元收购伯威克核能发电厂附近的资料中心。这个想法得到了 Talen Energy 的证实,该公司在塞勒姆镇经营萨斯奎哈纳蒸气发电厂,并将由亚马逊的网路服务部门牵头开发新资料中心。

- 美国高速网路的开拓也是推动全球AOC市场的主要因素。美国农业部 (USDA) 已承诺提供总计 9,700 万美元帮助企业建立人脉。这些网路针对的是未达到美国政府目标的目标(即到 2027 年为所有美国家庭提供 100 Mbps 的下载速度和 20 Mbps 的上传速度)或缺乏连线的地区。此措施将增强对 11 个州 22,000 名用户的服务。

- 位于 Green City 的酵母密苏里州农村电话公司获得了 1,370 万美元的贷款,用于将 6 个交换机从铜缆技术过渡到光纤到户技术。该计划将安装大约 500 路由英里的光纤,以改善对 1,063 个用户的服务。

- 2023年10月,美国联邦通讯委员会(FCC)开始大规模投资约182.8亿美元,用于加强农村宽频基础设施。该资金将分配给从 2024 年 1 月开始的为期 15 年的计划,目标是在超过 700,000 个地点部署 100/20Mbps 宽频。它还旨在升级 44 个州约 200 万个地点的现有服务。这一雄心勃勃的宽频扩张可能会对 AOC 市场产生重大影响。

全球主动光缆(AOC)产业概况

主动式光缆 (AOC) 市场较为分散。研究市场的主要参与者包括 ACT、Broadcom Inc.、Sumitomo Electric 和 JPC Connectivity。市场上的公司正在采取联盟、合约、创新和收购等策略来增强服务产品并获得永续的竞争优势。

- 2024 年 1 月 领先的光纤解决方案供应商 OFS 宣布其最新创新产品 LaserWave 双频 OM4+ 多模光纤。这款多模光纤加入了广受好评的 OM4 和 OM5 系列,在频宽、衰减和几何形状方面树立了新标准。 LaserWave 双频 OM4+ 是一款专为双向 (BiDi) 应用精心打造的优质且经济高效的光纤。此光纤设计用于为高密度、低功耗、多模链路供电。它在 850nm 和 910nm 波长的性能也与 OM5 一样,这使得它对于双向传输至关重要。这可确保一致的 100 公尺覆盖范围,这是Terabit BiDi 乙太网路(包括 800G-SR4.2 和 1.6T-SR8.2)等尖端应用的基本指标。

- 2024年1月,澳洲电信国际公司与跨太平洋网路公司(TPN)合作部署Echo电缆系统,这是第一条直接连接美国和新加坡的海底电缆。 Echo 电缆的第一段是关岛和美国之间的专用光纤链路,计划于 2024 年中期开通,后续段计划于 2025 年开通。建成后,它将无缝连接加州、雅加达、新加坡和关岛。 Telstra强调,该系统不仅开拓了新的路线,而且还承诺提供低延迟、高速度和强大弹性的网路基础设施。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第1章简介

- 研究假设和市场定义

- 调查范围

第2章调查方法

第3章执行摘要

第4章市场洞察

- 市场概况

- 宏观经济情境分析(景气衰退、俄罗斯/乌克兰危机等)

- 评估 COVID-19 大流行的影响和恢復

第5章市场动态

- 市场促进因素

- 电讯领域向更快光纤网路的转变

- 对宽频化的需求不断增加

- 资料中心对主动式光缆的需求增加

- 数位化和5G连接的高渗透率

- 市场挑战

- 高初始成本和光纤网路安全光纤骇客

- 对电力消耗的担忧

- 缺乏技术专长

- 价格和技术规格分析

- 关于直连接线(有源和无源)与主动光缆的技术见解

- 世界贸易分析

- 对 AOC 最常见外形规格规格的重要见解

- 深入了解 AOC 中的各种通讯协定类型

第6章 市场细分

- 按用途

- 资料中心

- 通讯

- 高效能运算 (HPC)

- 家用电子产品

- 工业应用

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第7章 竞争格局

- 公司简介

- JPC Connectivity

- Shenzhen Sopto Technology Co. Ltd

- Linkreal Co. Ltd

- Broadcom

- Sumitomo Electric Lightwave Inc.

- Black Box

- ACT

- IOI Technology Corporation

- ETU-Link Technology Co. Ltd

- Amphenol Corporation

第8章 市场机会及未来趋势

The Global Active Optical Cables Market size is estimated at USD 4.11 billion in 2024, and is expected to reach USD 7.75 billion by 2029, growing at a CAGR of 13.5% during the forecast period (2024-2029).

The active optical cables market is currently experiencing robust growth, and it is expected to grow further owing to the large-scale adoption of cloud-based services, digitalization, 5G, data centers, and other applications.

Key Highlights

- The active optical cable (AOC) market is mostly driven by the increasing need for high-speed data transmission in a variety of applications, including data centers, telecommunications, and consumer electronics. The growing need for data through various applications is expected to drive the demand for the AOC Market.

- The data center market is growing rapidly owing to the large-scale application of cloud technologies, digitalization, and growing demand for AI/ML. According to Cloudscene, a telecommunication services provider, there are approximately 10,978 data center locations worldwide as of December 2023, with numbers growing rapidly. Data centers require robust and high-speed internet connectivity. Therefore, the growth in the data center market is anticipated to drive the AOC market as well.

- 5G implementation is poised to meet the escalating demand for efficient communication, which is crucial for enhancing digital operations. While 5G's broader wavelength enables rapid data transmission, its signals are limited in range compared to 3G and 4G. Consequently, a robust 5G network necessitates a dense array of cell towers, each reliant on high-speed cables for signal transmission, thereby bolstering the demand for the AOC market.

- GSMA forecasts that 5G connections will account for over half (51%) of all mobile connections by 2029, climbing to 56% by the decade's end, solidifying 5G as the leading connectivity technology. 5G has outpaced all previous mobile generations in its rollout, exceeding 1.6 billion connections by the end of 2023, and it is projected to reach 5.5 billion by 2030. Consequently, as 5G continues its rapid expansion, the global active optical cables market is poised for significant growth in the near future.

- Concerns over the security of optical transmissions and potential vulnerabilities in sensitive data applications may impede the widespread adoption of AOCs. Additionally, AOCs often pose greater maintenance and repair challenges compared to traditional copper cables, particularly in sectors requiring swift service interventions.

Global Active Optical Cables (AOC) Market Trends

Rising Demand for Active Optical Cable in Data Centers to Drive the Market

- The global active optical cable (AOC) market has witnessed significant growth in recent years, propelled by the surging demand for high-speed data transmission across industries. With technological advancements, the emphasis on efficient and dependable connectivity solutions has never been more critical. Active optical cables (AOCs) stand out as high-speed cabling solutions, incorporating active elements like lasers and photodiodes directly into the cable assembly. These components are pivotal, facilitating the transmission of optical signals through fiber optic cables. In the realm of data centers, the term '200G AOC' specifically denotes cables engineered to support data rates of 200 gigabits per second (Gbps).

- Additionally, in high-performance computing (HPC) settings demanding substantial computational power, the 200G AOC facilitates swift data exchange between processors and storage units. Organizations leverage high-performance computing for parallel processing, empowering them to execute advanced programs like AI and data analytics. Data centers, especially those emphasizing AI and machine learning, stand to gain significantly from HPC.

- The rise of cloud computing within organizations significantly drives the data center market. According to the Flexera State of the Cloud Report 2023, 72% of companies have adopted hybrid clouds. Yet, this transition frequently means moving beyond conventional private and public cloud infrastructures.

- Active optical cables (AOCs) are pivotal in connecting data center cabling racks and switches, enabling seamless communication between switches and servers. Typically, data centers first install switches, then implement structured cabling, and finally, select the appropriate interconnect products for network access. Copper cables are the most cost-effective choice for short distances, defined as under 90 meters for 10G and under 10 meters for 40G. For medium distances spanning under 500 meters for 10G and 150 meters for 40G, multimode VCSEL (vertical cavity surface emitting laser) transceivers are favored, often complemented by AOCs.

- India's data center market is set for a significant uptick, with forecasts pointing to a climb to USD 4.6 billion by 2025. This growth is fueled by several factors: a growing domestic internet user base, rising demands for cloud computing, government initiatives driving digitalization, and a shift toward localization by digital service providers. Notably, India's data center sector boasts a significant cost advantage, both in its development and operational phases, compared to more mature markets. Currently, key data center hubs are primarily located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune, with emerging centers in Calcutta, Kerala, and Ahmedabad. As investments in data centers expand, so does the demand for ancillary infrastructure services covering IT, electrical, mechanical, and general construction throughout India.

North America to Hold a Major Share

- North America boasts the world's largest data center market, currently experiencing a notable rise in hyperscale data center construction. This surge is primarily fueled by the escalating demand for cloud services and the ongoing digital transformation. Recent data from Cloudscene, as of March 2024, highlights the United States as the global leader, housing 5,381 reported data centers. Germany and the United Kingdom follow closely, with 521 and 514 centers, respectively. Historically, copper cables have been the go-to for networking links between servers, routers, and switches. With the expanding data center landscape, the demand for active copper cables in the region is set to rise.

- The demand for new data centers in the United States remains strong, with fresh projects unveiled almost weekly. In March 2024, Amazon disclosed its plan to invest a hefty USD 650 million in acquiring a data center adjacent to the Berwick nuclear power plant. This initiative, confirmed by Talen Energy, the operator of the Susquehanna Steam Electric Station in Salem Township, will see Amazon's web services arm spearhead the development of the new data center.

- The development of high-speed internet in the United States is also a major factor driving the global AOC market. The US Department of Agriculture (USDA) has pledged a total of USD 97 million to assist operators in establishing networks. These networks are aimed at areas lacking connectivity or falling below the US government's set target of 100 Mbps download and 20 Mbps upload speeds for all American households by 2027. This initiative is set to enhance services for 22,000 subscribers across 11 states.

- Green City's Northeast Missouri Rural Telephone Company secured a USD 13.7 million loan to transition six exchanges from copper to fiber-to-the-premises technology. This initiative involves laying down approximately 500 route miles of fiber, with the aim of enhancing services for 1,063 subscribers.

- In October 2023, the US Federal Communications Commission (FCC) initiated a significant investment of approximately USD 18.28 billion to strengthen rural broadband infrastructure. This funding, allocated for a 15-year program commencing in January 2024, targets the deployment of 100/20 Mbps broadband to over 700,000 locations. Furthermore, it aims to upgrade existing services for approximately 2 million locations spread across 44 states. This ambitious broadband expansion is set to have a profound impact on the AOC market.

Global Active Optical Cables (AOC) Industry Overview

The active optical cables (AOC) market is fragmented in nature. Some major players in the market studied are ACT, Broadcom Inc., Sumitomo Electric, JPC Connectivity, etc. Players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

- January 2024: OFS, a prominent figure in the fiber optic solutions realm, unveiled its latest innovation: the LaserWave Dual-Band OM4+ Multimode Optical Fiber. This addition to the lineup, alongside the already esteemed OM4 and OM5 offerings, sets new benchmarks in bandwidth, attenuation, and geometry. The LaserWave Dual-Band OM4+ stands out as a premium yet cost-effective fiber, meticulously crafted for bidirectional (BiDi) applications. It is tailored to bolster the upcoming wave of high-density, low-power multimode links. Its capability to deliver performance akin to OM5 at both 850 nm and 910 nm wavelengths is also noteworthy, which is crucial for bidirectional transmissions. This ensures a consistent 100-meter reach, a vital metric for cutting-edge applications like Terabit BiDi Ethernet, including 800G-SR4.2 and 1.6T-SR8.2.

- January 2024: Telstra International teamed up with Trans Pacific Networks (TPN) to introduce the Echo cable system, marking the inaugural subsea cable directly linking the United States and Singapore. The initial segment of the Echo cable, a dedicated fiber-optic line linking Guam and the United States, is set for a mid-2024 debut, with subsequent segments slated for 2025. Upon completion, the cable will seamlessly link California, Jakarta, Singapore, and Guam. Telstra emphasizes that this system will not only forge a new route but also promise a network infrastructure characterized by low latency, high speeds, and robust resilience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Macro-economic Scenarios (Recession, Russia-Ukraine Crisis, etc.)

- 4.3 An Assessment of the Impact of and Recovery from COVID-19 Pandemic

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Change in the Telecom Sector Toward Faster Optical Networks

- 5.1.2 Increased Need for Higher Bandwidth

- 5.1.3 Rising Demand for Active Optical Cable in Data Centers

- 5.1.4 Digitalization and High Adoption of 5G Connectivity

- 5.2 Market Challenges

- 5.2.1 Significant Initial Cost and Optical Network Security Fiber Hacking

- 5.2.2 Significant Power Consumption Concerns

- 5.2.3 Lack of Technical Expertise

- 5.3 Analysis of Pricing and Technical Specifications

- 5.4 Technology Insights on Direct Attach Cables (Active and Passive) vs. Active Optical Cable

- 5.5 Global Trade Analysis

- 5.6 Key Insights into Most Common Form Factor Specifications of AOC

- 5.7 Key Insights into Various Protocol Types of AOC

6 MARKET SEGMENTATION

- 6.1 By Application Area

- 6.1.1 Data Center

- 6.1.2 Telecommunication

- 6.1.3 High-Performance Computing (HPC)

- 6.1.4 Consumer Electronics

- 6.1.5 Industrial Applications

- 6.1.6 Other Applications

- 6.2 By Region

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JPC Connectivity

- 7.1.2 Shenzhen Sopto Technology Co. Ltd

- 7.1.3 Linkreal Co. Ltd

- 7.1.4 Broadcom

- 7.1.5 Sumitomo Electric Lightwave Inc.

- 7.1.6 Black Box

- 7.1.7 ACT

- 7.1.8 IOI Technology Corporation

- 7.1.9 ETU-Link Technology Co. Ltd

- 7.1.10 Amphenol Corporation