|

市场调查报告书

商品编码

1549916

鞋类包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Shoe Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

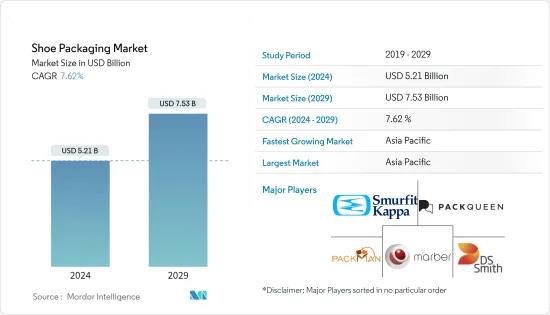

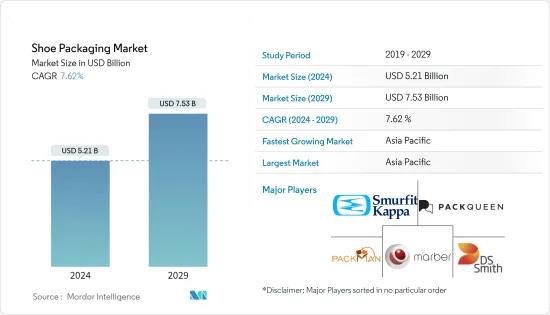

预计2024年鞋类包装市场规模为52.1亿美元,预计到2029年将达到75.3亿美元,在预测期内(2024-2029年)复合年增长率为7.62%。

主要亮点

- 近年来,在时尚潮流不断变化、可支配收入增加和消费者意识不断增强的推动下,鞋类包装市场经历了显着增长。因此,对鞋类包装解决方案的需求显着增加。鞋子包装可以在运输过程中保护鞋子,增强美观性,并为製造商提供独特的品牌推广途径。此外,采用永续包装材料和创新设计解决方案的先进包装正在扩大市场,以满足具有环保意识的消费者不断变化的偏好。

- 透明的鞋子包装受到许多奢侈品牌的青睐,可以让消费者一窥盒子内的鞋子。这种趋势引起了目标消费者的共鸣,从而推动了市场需求。此外,政府倡导环保做法的努力进一步推动鞋类製造商和相关产业采用透明包装。人们对视觉吸引力的包装解决方案的偏好不断提高,以及对永续包装选择的认识不断提高,预计将进一步扩大市场。

- 鞋盒是高度可客製化的,品牌可以根据自己的特定要求进行客製化。印刷和精加工技术进一步增强视觉吸引力。有些采用金色或银色饰面,营造出奢华的外观。这些材料通常由纸板或牛皮纸製成,既环保又经济。

- 此外,现有企业和新参与企业都在全球鞋类包装市场采用创新设计。这样的设计不仅迎合了广泛的人群,而且有助于降低原材料成本。如果这些设计变得流行并证明在储存和运输各种类型的鞋子方面有效,它们可能会支持全球鞋子包装市场的成长。利用鞋类包装透过美学增强来吸引新消费者的能力代表了该行业的一个主要销售机会。

- 此外,在鞋类包装中采用永续材料和环保做法越来越受到关注,进一步推动了市场扩张。公司越来越注重技术创新,这与消费者对独特包装产品不断增长的需求相吻合。这一趋势预计将为鞋类包装市场的成长和创新开闢新的途径。

- 例如,2023 年 12 月,阿迪达斯与 3D 列印公司 WASP 合作,为莱昂内尔·梅西 (Lionel Messi) 製作定製鞋盒,庆祝他第八次获得金球奖。此次合作不仅凸显了3D列印技术的突破,也展现了其根据个人品味客製化产品的潜力。

- 此外,由于对轻质包装的需求不断增长以及消费者对创新包装解决方案的偏好日益增长,全球鞋类包装市场正在见证成长。包装不仅是功能方面,也是产品行销策略的重要组成部分。许多鞋履品牌采用视觉吸引力的设计不仅增加了销量,还增加了对鞋履及其包装的需求。这些趋势预计将在未来几年为鞋类包装市场提供重大成长机会。

- 包括纸张和纸板在内的原材料价格进一步上涨,加上新包装模式和风格的频繁推出,对市场成长构成了重大挑战。对于那些寻求从成本与市场波动直接相关的产品中获利的公司来说,这种动态是一个主要障碍。此外,包装成本的增加可能会阻碍公司的整体盈利和市场竞争。公司必须透过优化供应链、探索具有成本效益的替代方案以及创新包装设计来应对这些挑战,以保持市场地位和盈利。

鞋类包装市场趋势

盒子和纸箱细分市场预计将占据主要市场份额

- 鞋盒和纸箱对于保护您的鞋子免受光线、温度、湿度、刮伤和污垢等各种因素的影响极为重要。鞋盒不仅是储存空间,也是企业强大的广告工具。这些盒子上装饰的标誌、口号和设计巧妙地强化了您在客户心中的品牌。

- 此外,这些盒子有助于整体拆箱体验,提高顾客满意度和忠诚度。鞋盒使用环保材料也符合消费者对永续包装解决方案不断增长的需求,并进一步强化了品牌形象。

- 乘着鞋业不断扩张的顺风,鞋类包装市场可望显着成长。推动这一快速成长的因素包括电子商务的兴起、对永续包装的日益重视、对品牌和美学的关注、奢侈品领域的快速成长以及技术进步。电子商务正在推动对耐用且具有视觉吸引力的包装解决方案(例如瓦楞纸箱和纸箱)的需求,以增强客户体验。

- 此外,人们对环境议题的认识不断增强,促使公司在包装中采用环保材料和做法。奢侈品产业的成长进一步推动了对反映品牌形象和价值的优质包装的需求。自动化和智慧包装等技术进步对于鞋类包装市场的转型至关重要。

- 运动鞋产业预计在未来几年显着成长。这种快速增长背后的驱动力是由于健康意识的提高而引起的世界各地体育活动的活性化。特别是,千禧世代和老年人口都在拥抱健身,刺激了所有年龄层对运动鞋的需求。此外,体育赛事的增加也进一步支持了该细分市场的成长轨迹。结合运动和休閒服装的休閒日益流行,也有助于市场扩张。

- 此外,鞋类技术的进步,例如改进的缓衝和支撑,正在吸引更多的消费者。电子商务平台的兴起使运动鞋更容易购买,进一步促进了销售。最后,运动员和名人的代言持续影响消费者的偏好,提高品牌知名度和市场渗透率。例如,中国运动鞋的市场规模预计将从2022年的376亿美元大幅增长至2023年的426亿美元,并在2026年达到586亿美元,使得鞋包装製造商表明存在潜在市场。

- 此外,鞋业製造商和包装供应商需要顺应这些趋势,共同创造创新且永续的包装解决方案。此次合作不仅将应对不断变化的需求,还将应对不断增长的需求,打开鞋类包装领域新商机之门。透过主动回应市场变化,您可以确保在不断变化的市场环境中实现长期成长和竞争力。

北美市场预计将占据很大份额

- 由于人口增长以及消费者对运动、时尚和日常鞋类的需求不断增加,北美在该行业中占据主导地位。该地区快速的工业化和建立製造单位的积极管治倡议正在推动该市场成为成长最快的细分市场。此外,重要市场参与者的存在和技术进步进一步增加了该地区的市场占有率。

- 可支配收入的增加和消费者生活方式偏好的改变也对北美市场的扩张做出了重大贡献。此外,该地区受益于完善的供应链和强大的分销网络,确保了高效的产品供应和市场渗透。该行业对创新和永续性的关注对于保持其在北美市场的主导地位也发挥关键作用。

- 此外,美国电子商务和数位平台的激增增加了对鞋类的需求。网路购物非常受欢迎,为消费者提供了多种鞋子选择和无缝的购物体验。这项变化使品牌能够接触到更多的消费者,并提供适合不同消费者偏好的产品。此外,随着都市化和现代化席捲该地区许多国家,生活方式和时尚偏好也在不断变化。因此,对满足这些不断变化的消费者需求并无缝融合风格、舒适性和多功能性的鞋类的需求不断增长。可支配收入的增加和时尚潮流的影响也促进了这种需求的增长,因为消费者希望透过鞋类选择来表达自己的个性。

- 此外,名人也大大推动了年轻人对时尚鞋履的需求。他们透过社群媒体和评价产生的影响力使时尚鞋履成为年轻消费者的必备品。此外,该地区的体育和健身文化蓬勃发展,增加了对运动鞋的需求。随着人们对运动、健身和户外活动的热情日益高涨,运动鞋、跑鞋和其他运动鞋市场正在显着成长。这一趋势也得益于体育基础设施投资的增加以及健身赛事和马拉鬆的日益普及。

- 耐吉是领先的运动服装和鞋类品牌,赞助超级杯等重大赛事,并与巴塞隆纳足球俱乐部等着名足球俱乐部合作。此外,透过与拉斐尔纳达尔等顶级运动员的代言合作,我们正在进一步加强我们的全球体育粉丝基础。

- 到 2023 年,该公司拥有由 1,032 家零售店组成的全球网络,主要位于美国。耐吉的收入从2020年的146.25亿美元大幅跃升至2023年的220.7亿美元。这一显着成长凸显了该公司不断成长的市场影响力。随着耐吉等知名品牌的足迹不断扩大,鞋类包装的需求预计在未来几年将会上升。随着公司努力满足零售商和消费者不断变化的需求,这一趋势预计将推动鞋类包装市场的创新和竞争。此外,对永续性和环保包装解决方案的日益关注可能会塑造鞋类包装行业的未来,鼓励品牌采取更环保的做法。

鞋材包装产业概况

鞋类包装市场是半固体的,由 PackQueen 和 Packman Packaging Private Limited 等少数全球性和区域性公司组成。 Smurfit Kappa、MARBER SRL 和 DS Smith 等公司正在这个竞争激烈的领域争夺关注。该市场的特点是产品差异化程度低、产品渗透率不断提高、市场竞争激烈。

- 2023 年 10 月 - DS Smith 宣布成立「R8」中心,以加速创新包装解决方案的研发。该中心旨在解决关键的行业挑战并促进 DS Smith、客户和合作伙伴之间的合作。

- 2023 年 7 月 - 着名鞋履品牌 Ares Gray 与材料创新者 Sway 合作推出环保解决方案。具有可堆肥和生物基成分。这种源自海藻的创新包装完全重新设计了传统的鞋盒。旨在最大限度地减少材料使用和重量。在运输过程中,鞋子受到 100% 生物基薄膜的保护,该薄膜可快速分解,因此无需额外包装。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场动态

- 市场驱动因素

- 包装的快速发展

- 对轻便舒适运动鞋的需求不断增长

- 对永续包装解决方案的需求

- 市场挑战

- 由于新型号、新款式的频繁推出,包装成本增加

- 市场驱动因素

第五章市场区隔

- 依材料类型

- 塑胶

- 纸板

- 依产品类型

- 包包

- 裹

- 盒子/纸箱

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第六章 竞争状况

- 公司简介

- Smurfit Kappa

- PackQueen

- Packman Packaging Private Limited

- Unipack AD

- PakFactory

- Packtek

- MARBER SRL

- DS Smith

第七章 投资分析

第八章市场的未来

The Shoe Packaging Market size is estimated at USD 5.21 billion in 2024, and is expected to reach USD 7.53 billion by 2029, growing at a CAGR of 7.62% during the forecast period (2024-2029).

Key Highlights

- The shoe packaging market has experienced significant growth in recent years, propelled by shifting fashion trends, escalating disposable incomes, and heightened consumer awareness. Consequently, the need for shoe packaging solutions has seen a notable uptick. Shoe packaging safeguards shoes during transit and elevates their aesthetic appeal, offering manufacturers a distinctive branding avenue. Additionally, the market has expanded due to advancements in sustainable packaging materials and innovative design solutions, catering to the evolving preferences of eco-conscious consumers.

- Transparency in shoe packaging, favored by numerous luxury brands, allows consumers a glimpse of their shoes within the box. This trend resonates well with the target audience, consequently driving market demand. Moreover, governmental initiatives advocating for eco-friendly practices have further bolstered the adoption of transparent packaging among shoe providers and related industries. The increasing preference for visually appealing packaging solutions and the rising awareness of sustainable packaging options are expected to expand the market further.

- Shoeboxes are highly customizable, allowing brands to tailor them to their specific requirements. Printing and finishing techniques further enhance their visual appeal. Some are even finished in gold or silver for a touch of luxury. Typically crafted from cardboard or kraft paper, these materials are eco-friendly and cost-efficient

- Moreover, established players and entrants in the global shoe packaging market embrace innovative designs. These designs not only cater to a broader audience but also help cut costs for raw materials. As these designs become more prevalent and prove effective in storing and shipping various types of shoes, they are poised to bolster the global shoe packaging market's growth. Leveraging the ability of shoe packaging to attract new consumers through enhanced aesthetics presents a significant sales opportunity for the industry.

- Additionally, integrating sustainable materials and eco-friendly practices in shoe packaging is gaining traction, further driving market expansion. Companies are increasingly focusing on innovation, which aligns with the growing consumer demand for unique packaging products. This trend is expected to create new avenues for growth and innovation in the shoe packaging market.

- For instance, in December 2023, Adidas partnered with 3D printing company WASP to craft a bespoke shoe box for Lionel Messi, who was celebrating his eighth Ballon d'Or victory. This collaboration not only underscores the strides in 3D printing but also showcases its potential in tailoring products to individual preferences.

- Furthermore, the global shoe packaging market is witnessing growth, propelled by a rising demand for lightweight packaging and a growing consumer preference for innovative packaging solutions. Packaging is not just a functional aspect but a crucial part of a product's marketing strategy. The adoption of visually appealing designs by numerous shoe brands has not only boosted sales but also heightened the demand for both shoes and their packaging. These trends are poised to create significant growth opportunities for the shoe packaging market in the coming years.

- Further rising prices of raw materials, notably paper and paperboard, coupled with frequent introductions of new packaging models and styles, pose a significant challenge to the market's growth. This dynamic presents a major hurdle for companies aiming to profit from products whose costs are directly tied to market fluctuations. Additionally, the increased packaging costs can hinder the overall profitability and competitiveness of businesses in the market. Companies must navigate these challenges by optimizing their supply chains, seeking cost-effective alternatives, and innovating packaging design to maintain their market position and profitability.

Shoe Packaging Market Trends

The Boxes and Cartons Segment is Expected to Hold a Significant Share in the Market

- Shoeboxes and cartons are crucial in safeguarding shoes from various elements like light, temperature, humidity, scratches, and stains. Beyond mere storage, a shoebox is a powerful advertising tool for businesses. Logos, slogans, and designs adorning these boxes subtly reinforce the brand in customers' minds.

- Additionally, these boxes contribute to the overall unboxing experience, enhancing customer satisfaction and loyalty. Using eco-friendly materials in shoeboxes also aligns with the increasing consumer demand for sustainable packaging solutions, further strengthening the brand's image.

- The shoe packaging market is set for substantial growth, riding on the coattails of the expanding footwear industry. Factors driving this surge include the ascent of e-commerce, a heightened emphasis on sustainable packaging, a focus on branding and aesthetics, a burgeoning luxury segment, and technological strides. E-commerce has increased demand for durable and visually appealing packaging solutions like corrugated boxes and cartons to enhance customer experience.

- Additionally, the growing awareness of environmental issues has pushed companies to adopt eco-friendly materials and practices in their packaging. The luxury segment's growth has further fueled the need for premium packaging that reflects the brand's image and value. Technological advancements like automation and smart packaging are crucial in transforming the shoe packaging market.

- The athletic footwear segment is poised for significant growth in the coming years. This surge is fueled by a global uptick in sports activities, driven by heightened health awareness. Notably, both millennials and older demographics are embracing fitness, spurring demand for athletic shoes across all age brackets. Moreover, a rising number of sports events further bolsters the segment's growth trajectory. The increasing popularity of athleisure, which combines athletic and leisurewear, also contributes to the expanding market.

- Additionally, advancements in footwear technology, such as improved cushioning and support, are attracting more consumers. The rise of e-commerce platforms has made athletic footwear more accessible, further driving sales. Lastly, endorsements by athletes and celebrities continue to influence consumer preferences, enhancing brand visibility and market penetration. For instance, the market size of athletic footwear in China grew significantly from USD 37.60 billion in 2022 to USD 42.60 billion in 2023 and is forecasted to reach USD 58.60 billion by 2026, showing a potential market for shoe packaging manufacturers.

- Further, manufacturers and packaging suppliers in the shoe industry need to align with these trends and work together to craft innovative and sustainable packaging solutions. This collaboration not only meets the sector's changing demands but also positions them to leverage rising demand, opening doors to fresh opportunities in the shoe packaging segment. By staying proactive and responsive to market shifts, they can ensure long-term growth and competitiveness in the evolving landscape.

The North America Segment is Expected to Hold a Significant Share in the Market

- North America dominates the industry, driven by a growing population and escalating consumer demand for sports, fashion, and daily shoes. The region's swift industrialization and proactive governance initiatives to establish manufacturing units propel it as the fastest-growing market segment. Additionally, the presence of significant market players and advancements in technology further bolster the region's market share.

- Increasing disposable income and changing consumer lifestyle preferences also contribute significantly to the market's expansion in North America. Furthermore, the region benefits from a well-established supply chain and robust distribution networks, ensuring efficient product availability and market penetration. The industry's strong emphasis on innovation and sustainability also plays a crucial role in maintaining North America's leading position in the market.

- Further, the surge in e-commerce and digital platforms in the United States has heightened the demand for footwear. Online shopping, gaining immense popularity, offers consumers many footwear choices and seamless shopping experiences. This shift has enabled brands to reach a broader audience and tailor their offerings to meet diverse consumer preferences. Moreover, as urbanization and modernization sweep through numerous countries in the region, lifestyles and fashion tastes are evolving. Consequently, there is a growing appetite for footwear that seamlessly marries style, comfort, and versatility, aligning with these shifting consumer needs. The increasing disposable income and the influence of fashion trends also contribute to this rising demand, as consumers seek to express their individuality through footwear choices.

- Further, celebrities are significantly boosting the demand for trendy footwear among the youth. Their influence through social media and endorsements has made stylish footwear a must-have for young consumers. Additionally, the region's burgeoning sports and fitness culture drives the need for athletic footwear. With a rising enthusiasm for sports, fitness, and outdoor activities, the market for sports shoes, running shoes, and other athletic footwear is witnessing substantial growth. This trend is further supported by increasing investments in sports infrastructure and the growing popularity of fitness events and marathons.

- Nike, a leading brand in athletic apparel and footwear, sponsors major events like the Super Bowl and partners with renowned football clubs like FC Barcelona. Moreover, its endorsement collaborations with top-tier athletes, like Rafael Nadal, further solidify its global sports fan base.

- In 2023, the company boasted a global network of 1,032 retail stores, primarily concentrated in the United States. Nike's revenue surged significantly from USD 14,625 million in 2020 to USD 22,007 million by 2023. This substantial growth highlights the company's expanding market presence and influence. With renowned brands like Nike increasing their footprint, the demand for shoe packaging is set to rise in the coming years. This trend is expected to drive innovation and competition within the shoe packaging market as companies strive to meet the evolving needs of both retailers and consumers. Additionally, the growing emphasis on sustainability and eco-friendly packaging solutions is likely to shape the future of the shoe packaging industry, encouraging brands to adopt more environmentally responsible practices.

Shoe Packaging Industry Overview

The shoe packaging market is semi-consolidated and comprises a few global and regional players, such as PackQueen and Packman Packaging Private Limited. Players like Smurfit Kappa, MARBER SRL, and DS Smith are vying for attention in this contested space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- October 2023 - DS Smith unveiled its 'R8' center, designed to expedite the research and development of innovative packaging solutions. The center aims to address the industry's significant challenges and foster collaboration among DS Smith, its customers, and partners.

- July 2023 - Ales Grey, a prominent shoe brand, collaborated with material innovators Sway to introduce an eco-friendly solution. Their creation features compostable and bio-based components. This innovative packaging, derived from seaweed, completely reimagines the traditional shoebox. It is designed to minimize material usage and weight. The shoes are shielded during shipping by a 100% biobased film that rapidly decomposes, eliminating the need for additional packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Dynamics

- 4.4.1 Market Drivers

- 4.4.1.1 Swift Advancement in Packaging

- 4.4.1.2 Demand for Lightweight and Comfortable Athletic Footwear is Increasing

- 4.4.1.3 Demand for Sustainable Packaging Solutions

- 4.4.2 Market Challenge

- 4.4.2.1 Frequently Introducing New Models and Styles Can Lead to an Increase in Packaging Costs

- 4.4.1 Market Drivers

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Paper and Paperboard

- 5.2 By Product Type

- 5.2.1 Bags

- 5.2.2 Wraps

- 5.2.3 Boxes and Cartons

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia and New Zealand

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Argentina

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Smurfit Kappa

- 6.1.2 PackQueen

- 6.1.3 Packman Packaging Private Limited

- 6.1.4 Unipack AD

- 6.1.5 PakFactory

- 6.1.6 Packtek

- 6.1.7 MARBER SRL

- 6.1.8 DS Smith