|

市场调查报告书

商品编码

1549920

日本交流电机市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Japan AC Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

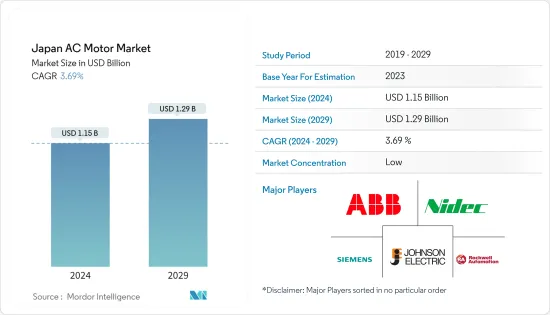

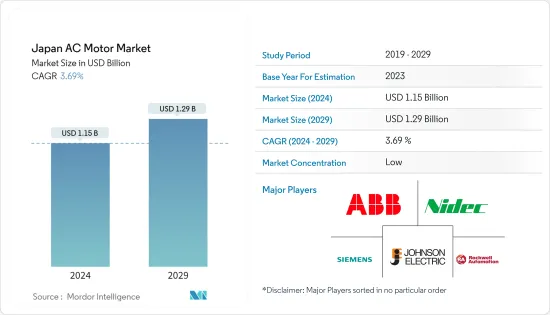

日本AC马达市场规模预计 2024 年为 11.5 亿美元,预计 2029 年将达到 12.9 亿美元,预测期内(2024-2029 年)复合年增长率为 3.69%。

主要亮点

- 日本透过其工业 4.0 策略,在向自动化工业经济转型方面取得了重大进展,并已成为工厂自动化产品和供应亚太其他区域市场的製造中心。

- 例如,根据国际贸易振兴机构的报告,日本政府已拨款16.2亿美元支持日本中小企业,其中包括支持企业升级製造业设备。

- 透过提高能源效率来节省能源和成本的兴趣日益浓厚,推动了日本AC马达的需求,包括工业製造、发电、离散製造业、石油和天然气、航太和国防以及采矿。支援采用

- 此外,日本政府积极努力减少碳排放,并推出了支持性政策,鼓励工业界采用节能解决方案。因此,AC马达越来越多地被应用于交通和工业自动化等各个行业。

- 此外,由于城市人口比例增加和饮食习惯改变等因素,日本的食品和饮料产业正在蓬勃发展。例如,根据《全球有机贸易指南》,日本包装有机食品的消费量预计到 2025 年将达到 4.271 亿美元,而 2018 年为 4.014 亿美元,我们支持在产品产业采用AC马达。有几个问题阻碍了AC马达在日本的引进。马达的重要成本是能源、维护和初始购买成本。

日本AC马达市场趋势

感应马达占较大市场占有率

- 感应电动机又称交流电动机。在感应马达中,产生扭矩所需的转子电流是透过定子绕组旋转磁场的电磁感应获得的。非同步马达的转子是鼠笼式或绕线式转子。

- 交流感应马达高效、灵活且设计相对简单,使其能够满足几乎所有电气应用的负载需求。感应马达广泛应用于各种行业和应用,包括泵浦、风扇、压缩机、输送机、起重机和电梯。

- 此外,感应电动机还有两种:单相感应马达和三相感应马达。单相感应马达比三相繫统更广泛地用于家庭、商业和有时的工业应用。三相感应马达用于商业和工业应用,是高功率应用的理想选择。

- 单相马达有很多优点。首先,单相马达比其他马达製造成本更低。由于传输电压高,流经线路的电流就小。换句话说,导体可以做得更轻、更紧凑,使支撑塔更轻。该装置将是便携式的。较低电流的另一个好处是降低 I2R 损耗、提高传输效率并优化运作。

- 两相马达可用于各种工业应用中的推进,包括工具机、印刷机和输送系统。此外,它还可用于空调和洗衣机等家用电器。然而,由于现代马达广泛使用三相电,两相马达现在不太受欢迎。三相马达由于效率更高且运作平稳,在各种工业应用中越来越受欢迎。

- 在配电系统中,三相感应马达驱动变压器和开关设备。这些设备增加或减少电压,打开和关闭电力传输和配电电路。根据经济产业省统计,截至2023年9月,日本太阳能发电厂数量约4,030座,是发电厂数量最多的再生能源来源。

- 此外,ABB 等领先公司提供各种使用电磁感应作为旋转动力的低压三相马达。 ABB的低压感应马达功率范围为0.06至1000kW。

石油和天然气行业的成长支持市场成长

- 由于基础设施升级和新工厂建设等活动的显着增长,石油和天然气行业对AC马达的需求不断增加。

- 在石油和天然气行业,AC马达驱动帮浦、压缩机和涡轮机。这些设备从油井中提取、加工和运输石油和天然气,透过精製,到达消费者手中。

- AC马达动力来源将原油从油井输送到管道和储存槽的离心式帮浦、为运输和储存天然气加压的压缩机以及在海上平台和偏远地区发电的涡轮机提供动力。

- 政府已采取多项倡议来增加国内石油和天然气产业的产量,预计将进一步刺激AC马达市场的需求。例如,2023年10月,日本政府宣布延长国内石油产品补贴,以缓衝能源价格飙升的影响。

- 同样,2023年1月,日本最大的石油和天然气生产商Inpex公司宣布,由于俄罗斯入侵乌克兰后全球天然气市场发生结构性变化,中期内液化天然气市场面临紧张状况。天然气LNG的生产和销售。

- 另外,根据经济产业省的数据,2023年日本的天然气产量约为20亿立方公尺。这比上年减少了近 22 亿立方公尺。

日本AC马达产业概况

日本AC马达市场由各种大、中、小型公司竞争。日本AC马达产业的公司正在推出创新的新产品,以满足不断增长的消费者需求。该市场的主要参与者包括西门子股份公司、日本电产集团、WEG 德国有限公司、东元电气欧洲有限公司和 ABB 有限公司。医疗保健、能源和基础设施等各行业的技术进步将推动市场成长。

2024年5月,Regal Rexnord宣布将182T高度以下的NEMA交流感应马达加入LEESON产品系列中,显着扩大了LEESON品牌。

2024 年 3 月,ABB 宣布推出更高效率的AC马达,以解决日益增长的问题。据该公司称,ABB BaldorReliance SP4马达是传统交流感应马达的直接替代品,但效率提高了 20%。这些性能改进可以透过直接在线操作来实现,无需变速驱动器。但ABB声称,与引擎结合使用时,可以获得更大的好处。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 影响市场的宏观经济因素分析

第五章市场动态

- 市场驱动因素

- 国内製造业成长是市场成长的驱动力

- 政府法规对能源效率的需求

- 市场挑战

- 初始成本高

第六章 市场细分

- 感应交流AC马达

- 单相

- 多态性

- 同步交流AC马达

- 直流励磁转子

- 永久磁铁

- 磁滞马达

- 马达马达

- 按最终用户产业

- 石油和天然气

- 化工/石化

- 发电

- 用水和污水

- 金属/矿业

- 饮食

- 离散製造业

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Rockwell Automation

- Siemens AG

- Johnson Electric Holdings Limited

- Nidec Corporation

- ABB Ltd

- Franklin Electric Co. Inc.

- WEG Electric Corporation

- Yaskawa Electric Corporation

- Bosch Rexroth AG(ROBERT Bosch GMBH)

- Fuji Electric Co. Ltd

第八章投资分析

第9章市场的未来

The Japan AC Motor Market size is estimated at USD 1.15 billion in 2024, and is expected to reach USD 1.29 billion by 2029, growing at a CAGR of 3.69% during the forecast period (2024-2029).

Key Highlights

- Japan has been significantly transforming into an automated industrial economy through its Industrial version 4.0 strategies, and the country has emerged as a manufacturing hub for factory automation products and supplies to other regional markets in Asia-Pacific.

- For instance, the Government of Japan allocated USD 1.62 billion to support Japanese small and medium-sized enterprises, which includes assisting businesses in upgrading their manufacturing plant equipment, according to the report of the International Trade Administration, which would fuel the adoption of AC motors and accelerate market growth.

- The rising concern about saving energy costs by improving energy efficiency has driven the adoption of AC motors in Japan across various high energy-intensive industries such as industrial manufacturing, power generation, discrete industries, oil and gas, aerospace and defense, and mining.

- Moreover, the Japanese government's proactive approach to reducing carbon emissions has led to supportive policies encouraging industries to embrace energy-efficient solutions. This has further increased the adoption of AC motors in various industries, including transportation and industrial automation.

- Also, Japan's food and beverage industry is prospering, owing to factors such as a higher share of the urban population and changing food consumption habits. For instance, according to the Global Organic Trade Guide, the consumption of packaged organic food in Japan is anticipated to reach a value of USD 427.1 million by 2025, compared to USD 401.4 million in 2018, thus supporting the adoption of AC motors in the food and beverages industry. Several obstacles are impeding the country's implementation of AC motors. The significant costs for the motors are the energy, maintenance, and initial purchase costs.

Japan AC Motor Market Trends

Induction Motors Hold Significant Market Share

- An induction motor is also called an AC electric motor. In an induction motor, the electrical current in the rotor required to generate the torque is obtained through electromagnetic induction from the rotating magnetic field of the stator winding. The rotor of an asynchronous motor can be a squirrel cage or a wound rotor.

- AC induction motors are highly efficient, flexible, and relatively simple in design, which allows them to match the load demand for almost any electrical application. Induction motors are widely used in various industries and applications, such as pumps, fans, compressors, conveyors, cranes, and elevators.

- They are also categorized into two main types: single-phase and three-phase induction motors. Single-phase induction motors are used more widely than the three-phase system for domestic, commercial, and sometimes industrial purposes. Three-phase induction motors are used for commercial and industrial purposes and are ideal for higher-power applications.

- There are many benefits to single-phase motors. For starters, single-phase motors are less expensive to manufacture than other motors. As the transmission voltage is high, the current through the line will be lower. This means the conductor can be lightweight and compact, making the supporting tower lighter. The unit is a portable one. Another benefit of lower current is reduced I2R losses, increased transmission efficiency, and optimized operation.

- Two-phase motors can be used for propulsion in different industrial applications, such as machine tools, printing presses, and conveyor systems. In addition, they might be used in home equipment, such as air conditioners and washing machines. However, due to the widespread use of three-phase electricity in contemporary electric motors, two-phase motors are far less popular now. Due to their increased efficiency and smoother operation, three-phase motors are becoming more popular in various industrial applications.

- In power distribution systems, three-phase induction motors drive transformers and switchgear. These devices increase or decrease the voltage and turn power transmission and distribution circuits on and off. According to METI, as of September 2023, the number of solar power plants in Japan amounted to approximately 4.03 thousand, making up the renewable energy source with the largest number of power stations.

- Moreover, major players such as ABB offer a range of low-voltage, three-phase electric motors whose rotating power is based on electromagnetic induction. ABB's low voltage induction motors cover the power range from 0.06 to 1000 kW.

Growing Oil & Gas Industry will Support the Market Growth

- The demand for AC motors in oil and gas is increasing as the country's oil and gas is witnessing a notable growth in activities such as infrastructure upgrades and the establishment of new plants, which, in turn, is creating a favorable ecosystem for the market's growth as utilities operating in the country continue to increase the adoption of automation solutions.

- AC motors drive pumps, compressors, and turbines in the oil and gas industry. These devices extract, process, and transport oil and gas from wells through refineries to consumers.

- AC motors are used to power a centrifugal pump that moves crude oil from wells to pipelines or storage tanks, drive a compressor that pressurizes natural gas for transportation or storage, and run a turbine that generates electricity for offshore platforms or remote locations.

- The government is taking several initiatives to increase the production of the country's oil and gas sector, which will further fuel the demand in the AC motor market. For instance, in October 2023, the Japanese government announced extending domestic oil product subsidies to mitigate the impact of soaring energy prices.

- Similarly, in January 2023, Inpex Corp, Japan's largest oil and natural gas producer, announced an accelerated expansion of liquefied natural gas LNG production and sales as it expects the LNG market to remain tight in the medium term due to structural changes in the global natural gas market after the Russian invasion of Ukraine.

- Also, according to METI, Japan's natural gas production volume amounted to around two billion cubic meters in 2023. This decreased from the previous year, with almost 2.2 billion cubic meters.

Japan AC Motor Industry Overview

The Japanese AC motor market is competitive with various large, medium, and small players. The Japanese AC motors industry players are introducing new innovative products to cater to growing consumer demands. Major players in the market include Siemens AG, Nidec Corporation, WEG Germany GmbH, TECO Electric Europe Ltd, and ABB Limited. Technological advances in various industries, including healthcare, energy, and infrastructure, will boost the market growth.

In May 2024, Regal Rexnord announced that the LEESON brand would be extended significantly by adding NEMA AC induction motors smaller than 182T in height to the LEESON product family.

In March 2024, ABB announced that a set of AC motors have higher efficiencies to combat growing concerns. According to the company, ABB BaldorReliance SP4 motors are a drop-in replacement of traditional AC induction motors but have increased efficiency by 20%. These performance gains can be achieved via direct online operation without a variable speed drive. However, ABB claims they are even more significant combined with an engine.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Analysis of Macroeconomic Factors Affecting on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Growing Manufacturing Sector in the Country Will Drive the Market Growth

- 5.1.2 Demand for Energy Efficiency Owning to Government Regulations

- 5.2 Market Challenges

- 5.2.1 High Initial Cost

6 MARKET SEGMENTATION

- 6.1 Induction AC Motors

- 6.1.1 Single Phase

- 6.1.2 Poly Phase

- 6.2 Synchronous AC Motors

- 6.2.1 DC Excited Rotor

- 6.2.2 Permanent Magnet

- 6.2.3 Hysteresis Motor

- 6.2.4 Reluctance Motor

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power Generation

- 6.3.4 Water and Wastewater

- 6.3.5 Metal and Mining

- 6.3.6 Food and Beverages

- 6.3.7 Discrete Industries

- 6.3.8 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation

- 7.1.2 Siemens AG

- 7.1.3 Johnson Electric Holdings Limited

- 7.1.4 Nidec Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Franklin Electric Co. Inc.

- 7.1.7 WEG Electric Corporation

- 7.1.8 Yaskawa Electric Corporation

- 7.1.9 Bosch Rexroth AG (ROBERT Bosch GMBH)

- 7.1.10 Fuji Electric Co. Ltd