|

市场调查报告书

商品编码

1549923

Wi-Fi 网路设备的全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Wi-Fi Network Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

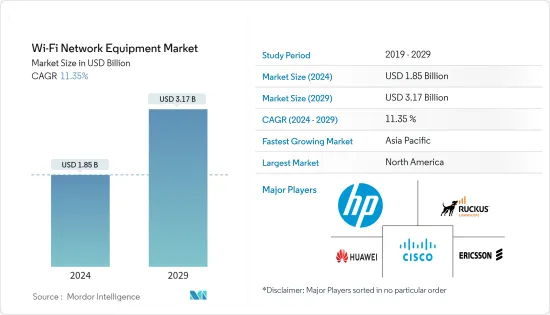

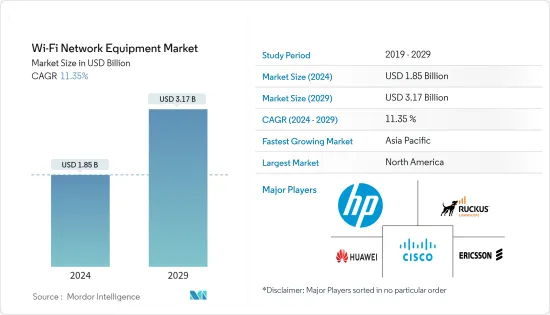

全球Wi-Fi网路设备市场规模预估2024年为18.5亿美元,2029年达31.7亿美元,预测期间(2024-2029年)复合年增长率为11.35%。

主要亮点

- 物联网 (IoT) 设备在消费者、商业和工业环境中的使用不断增加,是设备需求的关键驱动力。随着 5G 技术的兴起,企业准备拥抱更多的连网型设备并增强利用业务资料的能力。智慧连网型设备采用的快速成长将直接支持全球 Wi-Fi 网路设备市场的成长。

- 此外,许多公司正在检修其网路设备,以提高安全性并简化资料交换。采用最新的 Wi-Fi 标准、Wi-Fi 6 和 Wi-Fi 6E 连线有助于提高同时处理多个装置时的速度、容量和效率。这些进步对于支援视讯会议、游戏和物联网设备等频宽密集型应用至关重要。根据 World in Data 的数据,到 2023 年,只有 63% 的人口能够上网。

- 儘管 2023 年重返办公室的要求一直是推动力,但对灵活性的呼声仍然强烈。许多公司认为返回办公室对于加强企业文化至关重要,但返回办公室存在重大障碍。协作提供传统的办公室环境,包括面对面会议、虚拟通话和先进技术。因此,为了满足需求,家庭Wi-Fi设备的需求仍在成长。

- Wi-Fi 网路遇到了无数的安全威胁,这主要是由于支援 Wi-Fi 的装置的激增。儘管安全通讯协定的技术取得了进步,但维护资料的安全性和完整性仍然是一个严峻的挑战。尤其是企业在处理敏感资讯时面临更大的资料外洩风险。攻击者利用这些漏洞,通常会导致诈欺的资料存取。

- COVID-19 大流行后,企业和服务供应商投入大量资金升级其网路基础设施,以应对远端用户增加的负载。我们计划升级现有的 Wi-Fi 网路并引进新技术,以确保安全可靠的连线。

Wi-Fi网路设备市场趋势

企业部门预计将占很大份额

- 企业是重要的组成部分,为组织、教育、医疗保健和大型商业通讯提供必要的基础设施和服务。公司监督支援语音、资料和网际网路服务的网路基础设施的部署和维护。

- 警察、消防和紧急部门等公共机构都严重依赖这些 Wi-Fi 网路设备来实现快速资讯共用、协调和紧急应变。此外,医疗保健产业依靠这些网路来实现安全的患者资料传输、远端医疗、远端监控以及专业人员之间的无缝医疗资料交换。

- 此外,由于 Wi-Fi 6 (802.11ax) 在高密度环境中速度的提高和效能的提高,采用 Wi-Fi 6 (802.11ax) 的需求日益增长。许多企业正在升级到 Wi-Fi 6,以满足频宽大的应用程式不断增长的需求。许多企业正在转向云端管理的 Wi-Fi 解决方案,可实现集中管理、扩充性和轻鬆部署。

- AI 平台和应用程式为企业开发人员提供支持,使他们能够利用 ML 的力量来提高准确性、改善用户体验并提高效率。人工智慧的使用范围将从边缘扩展到核心再到云端。例如,2023 年 12 月,Origin AI 和 AirTees 合作,透过 Wi-Fi 感测技术提高 ISP收益和客户满意度。此次合作代表了智慧 Wi-Fi 解决方案的重大进步。利用这项合作关係,Airtee 的 ISP 客户已在其宽频服务中加入了先进的入侵侦测功能。透过整合 Origin 的先进技术,Airtease 的目标不仅是增加 ISP 的收益来源,还可以防止客户流失并提高净推荐价值 (NPS)。

- 此外,日益增加的网路安全威胁促使企业使用具有更好安全功能的先进 Wi-Fi 解决方案来保护资料并遵守特定国家/地区的法规。 IBM资料显示,到2023年,製造业将是最容易受到网路威胁的产业,达到25.7%,其次是金融和保险业,达到18.2%。

亚太地区预计将占成长的很大份额

- 5G 和 Wi-Fi 通常被认为是互补技术。 5G 主要提供广泛的网路覆盖和高速行动连线,而 Wi-Fi 则提供高容量和局部覆盖(尤其是室内)。在亚太地区,多个已开发市场在 5G 部署方面处于领先地位。韩国于2019年4月推出了世界上第一个国家5G网络,为世界树立了榜样。年终晚些时候,澳洲、菲律宾、中国和纽西兰也很快出现了类似的发展。据 GSMA Intelligence 称,亚太地区目前正在经历第二波 5G 部署,印尼、印度和马来西亚等国家准备在 2025 年使亚太地区成为全球最大的 5G 市场之一。

- 扩大公共Wi-Fi 基础设施的投资不断增加,以便在都市区、大众交通工具和场所提供可靠的网路存取。这一趋势得到了旨在改善所有人连结性的政府措施和私人投资的支持。据思科称,亚太地区在全球公共 Wi-Fi 热点中所占份额最高,预计到 2024 年将超过 48% 左右。

- 人工智慧和机器学习正在日益影响网路管理和自动化。这些技术可自动执行网路配置、简化问题解决并根据使用模式提高效能。人工智慧在优化网路基础设施内的能源消耗方面发挥着至关重要的作用,从而显着减少碳排放和营运成本,特别是在先进的通讯网路中。根据 CompTIA IT 产业展望 2024 调查显示,30% 的通路公司已经将 AI 纳入业务中,另外 26% 的通路公司正在积极考虑 AI 解决方案。

- 随着高清视讯、软体更新和资料集等数位檔案数量的不断增加,快速、高频宽的网路变得至关重要。它提供更快的传输速率,并允许用户快速在线下载和上传檔案。许多公司现在正在转向云端资料库以更好地保护资料。在此背景下,具有扩展频宽的Wi-Fi已成为促进快速有效地存取线上资料的关键参与者。

- 高频宽速度至关重要,尤其是随着消费者云端储存变得越来越流行,下载大型多媒体檔案可以像从本地硬碟传输它们一样快。例如,根据思科的一份报告,超过 25Mbps 的速度在亚太地区已达到令人印象深刻的 97% 的渗透率。

- 一些市场参与者正在增强其 Wi-Fi 技术,以支援扩增实境(AR) 用例的先进解决方案。 2024年2月,华为率先发表了符合最新Wi-Fi标准的企业级AirEngine Wi-Fi 7解决方案。该技术有望提供更强大、更无缝的无线网络,特别是在需要高密度、高频宽和低延迟连接的场景中。此类场景包括访问元宇宙并利用扩增实境/虚拟实境 (AR/VR) 进行教育目的。

Wi-Fi网路设备产业概况

Wi-Fi 网路设备市场较为分散,并且有各种各样的公司。在这个市场上,许多供应商都专注于各种成长策略,例如联盟、合作伙伴关係和新推出。着名公司包括Cisco、Hewlett Packard Enterprise Development LP (Aruba)、康普 (RUCKUS Networks)、Telefonaktivolaget LM Ericsson 和华为技术有限公司。

- 2024 年 1 月,领先的网路连线公司康普宣布 Wi-Fi 联盟选择其 RUCKUS Wi-Fi 7 AP 系列进行严格测试。此选择使 RUCKUS 设备成为认证测试台中唯一的商业网路基地台,确保与 Wi-Fi CERTIFIED 7 设备的无缝互通性。此举凸显了康普致力于提升下一代设备全球网路 Wi-Fi 效能的承诺。

- 2023年11月,华为在Huawei Connect 2023上发表了全场景WLAN解决方案。此次发布进一步聚焦Wi-Fi 7技术在企业领域的采用,以增强教育、医疗、零售和製造等产业客户的网路体验。随着Wi-Fi 7增强频宽能力的引入,园区网路正准备向多Ge园区演进,以适应不断增长的流量。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 宏观经济情境分析(景气衰退、俄罗斯/乌克兰危机等)

- 网路服务相关监管状况

- 报告国家资料保护指南

第五章市场动态

- 市场驱动因素

- 扩大连网型设备和 BYOD 政策的使用

- 企业数位转型不断推动

- Wi-Fi技术的持续技术进步(例如Wi-Fi 6标准的实施)

- 市场限制因素

- 资料安全和隐私问题

- 对室外 Wi-Fi 部署的担忧

- 深入了解 Wi-Fi 连线标准

- 涵盖 802.11b、802.11a、802.11g、802.11n、802.11ac、802.11ax

- 案例研究分析

- 为来宾企业引入Wi-Fi服务的趋势概述

- 成长动力(对客户参与和忠诚度的需求不断增长 | 企业 BYOD 趋势 | 需要透过可靠的 Wi-Fi 存取增强企业资产的网路安全措施)

- 企业Wi-Fi热点管理解决方案概述和主要功能(包括分析)

- 行业使用案例

- 涵盖旅游/饭店、IT/通讯、零售/电子商务、教育、BFSI等。

- 主要供应商及其产品概述

- 覆盖Purple WiFi、Noniussoft、AVSystem、Wanaport等

第六章 市场细分

- 依设备类型

- 网路基地台

- 闸道

- 路由器和扩展器

- 其他(线缆、介面、模组等)

- 按最终用户

- 消费者

- 公司

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 北美洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- Hewlett Packard Enterprise Development LP(Aruba)

- CommScope(RUCKUS Networks)

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd

- Extreme Networks

- Ubiquiti Inc.

- D-Link Corporation

- TP-Link Corporation

- NETGEAR Inc.

第八章 市场机会及未来趋势

The Wi-Fi Network Equipment Market size is estimated at USD 1.85 billion in 2024, and is expected to reach USD 3.17 billion by 2029, growing at a CAGR of 11.35% during the forecast period (2024-2029).

Key Highlights

- The increasing use of Internet of Things (IoT) devices in consumer, commercial, and industrial settings is a key driver for equipment demand. With the rise of 5G technology, organizations are poised to embrace even more connected devices, enhancing their ability to leverage business data. This surge in smart and connected device adoption directly fuels the global Wi-Fi network devices market's growth.

- Furthermore, many enterprises are overhauling their network equipment to bolster security and streamline data exchanges. The adoption of the latest Wi-Fi standards, Wi-Fi 6 and Wi-Fi 6E connectivity, facilitates improved speed, capacity, and efficiency in handling multiple devices simultaneously. These advancements are crucial for supporting bandwidth-intensive applications such as video conferencing, gaming, and IoT devices. As per the 'World in Data,' only 63% of the population had access to the online internet in 2023, which provides immense growth potential.

- While return-to-office mandates gained traction in 2023, the call for flexibility remains strong. Many firms view office returns as pivotal for bolstering their culture, yet the shift back poses significant hurdles. Collaboration provides traditional office setups, including in-person meetings, virtual calls, and advanced technology. Thus, there is still growth in the requirement for home Wi-Fi devices to cater to the demand.

- Wi-Fi networks encounter a myriad of security threats, primarily stemming from the prevalence of Wi-Fi-enabled devices. Despite technological advancements in security protocols, maintaining data safety and integrity remains a significant challenge. Particularly in corporate settings, when handling sensitive information, the risk of data breaches increases. Attackers exploit these vulnerabilities, often resulting in unauthorized data access.

- After the COVID-19 pandemic, enterprise and service providers invested heavily in upgrading the network infrastructure to cater to the increasing load that is coming from the remote user. The company planned for upgrading the existing Wi-Fi networks and implementing new technologies to ensure secure and reliable connectivity.

Wi-Fi Network Equipment Market Trends

The Enterprises Segment is Expected to Hold a Major Share

- Enterprises form a pivotal segment, offering the infrastructure and services crucial for organizational, educational, healthcare, and large-scale business communication. They oversee the deployment and maintenance of network infrastructures, supporting voice, data, and internet services.

- Public safety entities, including police, fire, and emergency services, heavily depend on these Wi-Fi network equipment devices for swift information sharing, coordination, and emergency response. Moreover, the healthcare sector relies on these networks for secure patient data transmission, telemedicine, remote monitoring, and seamless medical data exchange among professionals.

- Moreover, there is a growing need for Wi-Fi 6 (802.11 ax) adoption, which is driven by higher speed and better performance in dense environments. Many enterprises are upgrading to Wi-Fi 6, which caters to the increasing need for bandwidth-intensive applications. Many enterprises are moving toward cloud-managed Wi-Fi solutions, which allow centralized management, scalability, and easier deployment.

- AI platforms and applications empower enterprise developers, enabling them to harness ML's capabilities for heightened accuracy, user experience, and efficiency. The reach of AI is set to span from the edge to the core to the cloud. For instance, in December 2023, Origin AI and Airties joined forces to enhance ISP revenue and customer satisfaction through Wi-Fi Sensing Technology. This collaboration marks a significant advancement in Smart Wi-Fi solutions. By leveraging the partnership, Airties' ISP clients included an advanced intrusion detection feature in their broadband offerings. By integrating Origin's advanced technology, Airties aims to not only boost ISPs' revenue streams but also combat customer churn and elevate their Net Promoter Scores (NPS).

- Moreover, increasing cybersecurity threats encourage enterprises to use advanced Wi-Fi solutions with better security features to protect data and remain compliant with country-specific regulations. As per data by IBM, the manufacturing sector was exposed to maximum cyber threats, which were 25.7%, followed by the finance and insurance sector, with 18.2% threats in 2023.

Asia-Pacific is Expected to Hold a Major Growth Share

- 5G and Wi-Fi are often seen as complementary technologies. While 5G primarily provides broad network coverage and high-speed mobile connectivity, Wi-Fi offers high-capacity and localized coverage, especially indoors. Several advanced markets have taken the lead in rolling out 5G in Asia-Pacific. South Korea set the global pace by launching the world's first nationwide 5G network in April 2019. This was swiftly followed by similar deployments in Australia, the Philippines, China, and New Zealand later that same year. According to GSMA Intelligence, the region is now witnessing a second wave of 5G rollouts, with countries like Indonesia, India, and Malaysia poised to propel Asia-Pacific into one of the world's largest 5G markets by 2025.

- There is growing investment in expanding public Wi-Fi infrastructure to provide reliable internet access in urban areas, public transportation, and venues. This trend is supported by government initiatives and private-sector investments that aim to improve connectivity for all. According to Cisco, Asia-Pacific is expected to have the highest share of global public Wi-Fi hotspots, at around more than 48% in 2024.

- AI and machine learning are increasingly shaping network management and automation. These technologies automate network settings, streamline issue resolution, and enhance performance based on usage patterns. AI plays a pivotal role in optimizing energy consumption within network infrastructures, leading to substantial reductions in both carbon footprints and operational costs, especially in advanced telecommunications networks. According to the CompTIA IT Industry Outlook 2024 survey, 30% of channel firms are already integrating AI into their operations, while an additional 26% are actively exploring AI solutions.

- As digital files, including high-definition videos, software updates, and datasets, continue growing, networks with high speeds and greater bandwidth are crucial. They enable faster transfer rates and empower users to download and upload files swiftly online. Many corporations are now gravitating toward cloud databases for enhanced data protection. In this landscape, Wi-Fi with expanded bandwidth emerges as a key player, facilitating swift and efficient access to online data.

- High-bandwidth speeds are becoming imperative, especially as consumer cloud storage gains traction, ensuring that downloading large multimedia files is as swift as transferring them from a local hard drive. For example, a Cisco report highlights that Asia-Pacific has achieved a remarkable 97% penetration rate in delivering speeds exceeding 25 Mbps.

- Several market players are enhancing Wi-Fi technologies to cater to advanced solutions for augmented reality use cases. In February 2024, Huawei set the tone by introducing its enterprise-grade "AirEngine Wi-Fi 7," a cutting-edge solution that adheres to the latest Wi-Fi standards. This technology promises a more robust and seamless wireless network, especially in scenarios demanding high-density, high-bandwidth, and low-latency connections. These scenarios include accessing the metaverse and leveraging augmented reality/virtual reality (AR/VR) for educational purposes.

Wi-Fi Network Equipment Industry Overview

The Wi-Fi network equipment market is fragmented, with various significant players. In the market, numerous vendors are focused toward diverse growth strategies such as collaborations, partnerships, and new launches. Notable players include Cisco Systems Inc., Hewlett Packard Enterprise Development LP (Aruba), CommScope (RUCKUS Networks), Telefonaktiebolaget LM Ericsson, and Huawei Technologies Co. Ltd.

- In January 2024, CommScope, a prominent player in network connectivity, revealed that the Wi-Fi Alliance had chosen a member of its RUCKUS Wi-Fi 7 AP family for rigorous testing. This selection places the RUCKUS device as the sole commercial access point in the certification test bed, ensuring seamless interoperability with Wi-Fi CERTIFIED 7 devices. This move underscores CommScope's commitment to advancing Wi-Fi performance for the global network of next-gen devices.

- In November 2023, At Huawei Connect 2023, Huawei unveiled its All-Scenario WLAN Solution. This launch further focused on the adoption of Wi-Fi 7 technology in the enterprise sector, enhancing network experiences for customers across industries like education, healthcare, retail, and manufacturing. With the deployment of Wi-Fi 7's enhanced bandwidth capabilities, campus networks are gearing up for a multi-Ge campus evolution to handle the increased traffic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Macro-Economic Scenarios (Recession, Russia-Ukraine crisis, etc.)

- 4.3 Regulatory Landscape Related to Internet Services

- 4.3.1 Coverage on Data protection Guidelines in Various Countries

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the use of connected devices and BYOD policy

- 5.1.2 Rising Digital Transformation in the Enterprises

- 5.1.3 Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation, etc.)

- 5.2 Market Restraints

- 5.2.1 Data securities and Privacy Concerns

- 5.2.2 Concerns Related to Wi-Fi Implementation in Outdoor Areas

- 5.3 Insights on Wi-Fi connectivity standards

- 5.3.1 Coverage on 802.11b, 802.11a, 802.11g, 802.11n, 802.11ac, and 802.11ax

- 5.4 Case Study Analysis

- 5.5 Overview of Adoption Trends of Guest Enterprise Wi-Fi Offerings

- 5.5.1 Growth Drivers (Increasing Need for Customer Engagement and Loyalty| Growing Trends of BYOD in Enterprises | Need for Enhanced Cyber Security Measures for Enterprises Assets with Reliable Wi-Fi Access)

- 5.5.2 Overview of Enterprise Wi-Fi Hotspot Management Solution and Key Features (Including Analytics)

- 5.5.3 Industry-wise use cases

- 5.5.3.1 Coverage on Travel and Hospitality, IT and telecom, Retail and E-commerce, Education, BFSI, etc.

- 5.5.4 Brief About Major Vendors and Their Offerings

- 5.5.4.1 Coverage on Purple WiFi, Noniussoft, AVSystem, Wanaport, etc.

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Access Points

- 6.1.2 Gateways

- 6.1.3 Routers and Extenders

- 6.1.4 Others (Cables, Interface, Modules, etc.)

- 6.2 By End User

- 6.2.1 Consumers

- 6.2.2 Enterprises

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.6 Latin America

- 6.3.6.1 Brazil

- 6.3.6.2 Mexico

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Hewlett Packard Enterprise Development LP (Aruba)

- 7.1.3 CommScope (RUCKUS Networks)

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Huawei Technologies Co. Ltd

- 7.1.6 Extreme Networks

- 7.1.7 Ubiquiti Inc.

- 7.1.8 D-Link Corporation

- 7.1.9 TP-Link Corporation

- 7.1.10 NETGEAR Inc.