|

市场调查报告书

商品编码

1549948

全球云端物流市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Cloud Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

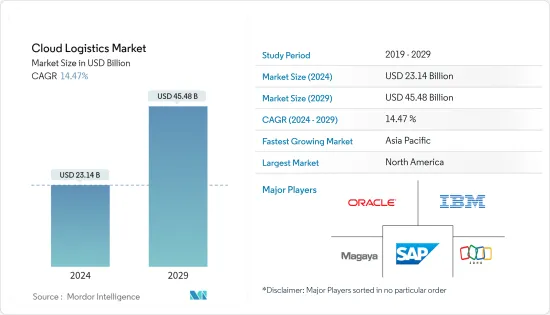

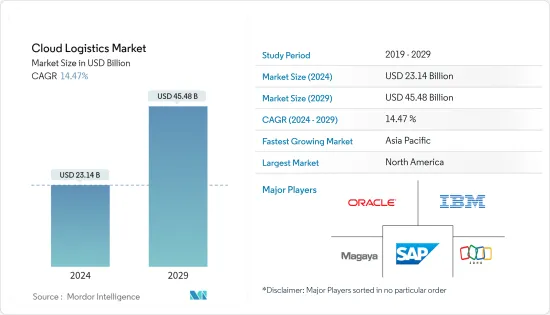

根据预测,2024年全球云端物流市场规模预估为231.4亿美元,2029年达454.8亿美元,预测期间(2024-2029年)复合年增长率为14.47%。

主要亮点

- 云端物流解决方案可协助企业管理库存、追踪出货并规划物流,以满足全球对效率的需求。这些解决方案还支援海关合规、客户服务、申请以及车辆和路线规划的运输管理等专业功能,预计将在未来几年推动市场需求。

- 云端物流软体的采用正在增加,因为其灵活性、易于更新和经济效益支持了市场的成长。在订阅的基础上使用云端基础的物流软体的优点是用户可以预测他们每月的成本。

- 企业越来越多地采用云端基础的物流解决方案,利用软体即服务 (SaaS) 框架中的仓库管理系统 (WMS) 等软体。这种云端化简化了 WMS 安装和部署,从而加快部署速度并显着提高成本效率。因此,许多公司正在采用云端化来管理库存并促进通用资料访问,从而在预测期内推动市场发展。

- 然而,云端物流解决方案使用云端基础设施来储存和处理资料,这增加了业务环境中的资料安全风险。这种资料外洩风险可能会对业务合规性和客户满意度造成毁灭性影响。如果资料库遭到破坏,货物可能会被滞留在港口或被拒绝入境。此外,客户资料外洩可能会损害公司的声誉并带来潜在的法律挑战,从而限制全球最终用户行业采用云端基础的物流解决方案,并有可能对市场成长构成挑战。

- 宏观经济趋势,例如 COVID-19 大流行后最终用户行业采用数位策略、支援工厂自动化趋势的成长以及分析和工业物联网的采用增加,正在支撑市场需求。随着COVID-19大流行后人工智慧和机器学习以及云端运算技术在物流管理中的出现,云端物流软体在供应链和物流自动化中的应用正在推动市场成长。

云端物流市场趋势

消费品和零售领域对市场占有率贡献显着

- 物流解决方案对于维持零售业务中及时且经济高效的产品交付至关重要。这支持了零售业对库存管理、运输、仓储和订单履行等应用的云端物流解决方案的需求,并可能随着全球零售业的发展推动市场成长。

- 消费者线上购物支出增加以及零售供应商全通路销售管道的扩张推动了电子商务的成长,推动了零售业的跨境交易,进而带动了第三方物流提供者的需求增加这刺激了运输公司和其他公司的需求,支持了预测期内对云端物流软体的采用需求。

- 零售供应链中的货运代理主要采用云端基础的解决方案,因为他们需要SaaS 模式的物流软体,该软体可以透过互联网简化供应链活动,而无需内部基础设施或硬体。的成长。此外,线上零售和消费品销售对物流提供者和托运人的依赖也支撑了零售业的市场需求。

- 文具和办公用品零售商越来越多地转向基于云端基础的仓库管理系统来简化网路商店的库存,凸显了该行业在预测期内的成长潜力。电子商务物流中的云端运算等进步将提高高效的交付和具有成本效益的供应链管理,进一步推动市场扩张。

- 云端物流为零售商提供有关发货地点的即时、准确信息,提高他们应对延误和中断的能力。使用云端运算实现供应链自动化可以节省宝贵的时间和资源并提高效率。此外,模组化云端物流平台允许企业透过API将其现有的资料基础设施与物流提供者的平台集成,从而简化并无缝地确保供应链中每个环节的资料流。

亚太地区预计将经历显着的市场成长

- 由于经济成长、消费者需求增加和技术进步推动的变化,亚太地区的运输和物流行业变得充满活力和复杂。此外,亚太地区拥有世界上一些最重要的港口、机场和重要的製造区,正在转型为全球供应链枢纽,这可能会推动未来对云端物流市场的需求。

- 该地区包括印度等东南亚国家等新兴经济体,以及企业发展、韩国和日本等全球重要製造业国家,支撑了该地区製造业、零售业等行业不断增长的外包物流需求。用户产业价值链中运输原料、半成品和成品的供应商正在推动市场成长。

- 政府对中小企业发展和该地区新兴经济体内部製造能力扩张的支持(例如印度製造计划)正在增加该地区的物流参与者和供应链活动的数量,并为未来市场创造了成长机会。

- 随着企业推动数位化策略,该地区的供应链和物流自动化程度不断提高。 2023年12月,富士通在日本宣布推出一项云端基础的服务,专注于物流资料的标准化和视觉化。该服务针对托运人、物流公司和供应商,并利用物流资料来提高永续性。此措施有助于与内部相关人员安全、轻鬆地共用见解,显示亚太地区在预测期内对云端基础的物流解决方案的需求不断增长。

- 云端服务供应商正在扩大其在亚洲的资料中心足迹,以满足不断增长的需求。透过扩展区域基础设施,供应商将能够为其客户提供更快、更安全的云端服务。此外,这将确保遵守严格的当地资料隐私法,并为整个亚太地区更广泛地接受云端物流解决方案铺平道路。

云端物流行业概况

云端物流市场可能会出现适度分散的竞争格局,这主要是由于大量中小型解决方案供应商的崛起。这些提供者正在积极与各行业的公司合作,以加速云端基础的物流解决方案的采用。此外,IBM 公司、SAP SE、Zoho 公司、Magaya 公司和 Oracle 公司等主要行业参与者正在增强其解决方案的功能,以保持竞争力。

- 2024 年 2 月 - Oracle宣布计画增强其供应链和製造 (SCM) 融合云端。此次升级增强了 Oracle 运输管理和 Oracle 全球贸易管理应用程序,并将在未来推出。这些增强功能包括先进的商业情报工具、改进的物流网路模型、新的贸易奖励倡议、增强的运输管理行动应用程式以及现有市场供应商所取得的技术进步。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 监管状况

- 评估宏观经济趋势的影响

- 生态系/价值链分析

第五章市场动态

- 市场驱动因素

- 订阅定价模式提高了中小型企业的采用率

- 物联网和分析技术的集成

- 市场限制因素

- 互通性问题和资料安全挑战

- 关键使用案例和案例研究

- 云端物流解决方案的功能(3PL 和 4PL、托运人、货运代理、承运人等)

- 物流行业趋势

第六章 市场细分

- 按组织规模

- 小型企业

- 大公司

- 按最终用户产业

- 消费品/零售

- 医疗保健/生命科学

- 石油和天然气

- 製造业

- 能源/电力

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- SAP SE

- Oracle Corporation

- Magaya Corporation

- Microsoft Corporation

- Detrack Systems

- Zoho Corporation

- Trimble Inc.

- The Descartes Systems Group Inc

- ShipBob, Inc

第八章投资分析

第9章市场的未来

The Cloud Logistics Market size is estimated at USD 23.14 billion in 2024, and is expected to reach USD 45.48 billion by 2029, growing at a CAGR of 14.47% during the forecast period (2024-2029).

Key Highlights

- Cloud logistic solutions help businesses manage inventory, track shipments, and plan logistics, meeting the global demand for efficiency. These solutions also support customs compliance, customer service, invoicing, and specialized functions, such as transportation management for fleet and route planning, which are expected to drive market demand in the coming years.

- The increasing adoption of cloud logistic software for its flexibility, easy updates, and economic benefits supports the market's growth. The advantage of using cloud-based logistics software on a subscription basis is that users have a predictable monthly cost, which can help their OPEX estimations easily and support the market's growth worldwide.

- Businesses increasingly adopt cloud-based logistics solutions, leveraging software like a warehouse management system (WMS) in a software-as-a-service (SaaS) framework. This cloud iteration streamlines WMS installation and deployment, leading to fast implementation and significant cost efficiencies. Consequently, many enterprises embrace the cloud transformation to manage their inventory and facilitate universal data access, driving the market during the forecast period.

- However, cloud logistic solutions use cloud infrastructure for data storing and processing, increasing the risk of Data security in the business environment. This data breach risk can be critical for operational compliance and customer satisfaction. Compromised databases could lead to shipments being held at ports or refused entry. Additionally, customer data breaches can damage reputation and potential legal challenges for enterprises, restricting the adoption of cloud-based logistic solutions in the end-user industries worldwide, which could be a challenge for market growth.

- The macroeconomic trends, including the digital strategy adoptions among the end-user vertical after the covid-19 pandemic, supporting the growth of factory automation trends, and the increasing adoptions of analytics and IIoTs are supporting the demand for the market. The application of cloud logistic software in automating supply chain and logistics in line with the emergence of AI&ML and Cloud Computing technologies in logistic management in the post-COVID-19 pandemic has fueled the market growth.

Cloud Logistics Market Trends

Consumer Goods and Retail Segment Contributes Significantly to the Market Share

- Logistic solutions are essential for maintaining timely and cost-effective product deliveries in retail management. This supports the demand for cloud logistic solutions due to their application in inventory management, transportation, warehousing, and order fulfillment in the retail sector, which would fuel the market growth in line with the development of the retail industry worldwide.

- The e-commerce growth, in line with the increasing consumer spending for online purchases and the enhancement of omnichannel sales channel expansions by the retail vendors, is fueling the cross-border transactions in the retail landscape, which has been fueling the demand for 3rd party logistic providers, freight providers, and others in the industry, supporting the demand for the cloud logistic software adoptions during the forecast period.

- Freight forwarders in the retail supply chain have started to adopt cloud-based solutions, mainly because they need a SaaS model of logistic software to streamline their supply chain activities over the Internet without needing internal infrastructure or hardware, fueling the market growth in the retail industries. Additionally, the dependency of online retailing and the selling of consumer goods products on logistic providers and shippers support the demand for the market in the retail sectors.

- Stationery and office supplies retailers are increasingly using cloud-based warehouse management systems to streamline their online store inventories, highlighting the sector's growth potential during the forecast period. Advancements like cloud computing in e-commerce logistics bolster efficient deliveries and cost-effective supply chain management, further propelling market expansion.

- Cloud logistics empowers retailers with real-time, accurate information on their shipment locations, enhancing their ability to address delays or disruptions. Automating the supply chain through cloud computing increases efficiency by saving valuable time and resources. Additionally, modular cloud logistics platforms allow a business to integrate its existing data infrastructure with logistics provider platforms via APIs, ensuring a streamlined and seamless flow of data on every link in the supply chain, which supports the growth of cloud logistic solutions in the small scale retailers due to their increasing demand for low-cost logistic management software for business efficiencies.

Asia Pacific Expected to Witness Significant Market Growth

- The transportation and logistics industry in the Asia Pacific has been becoming dynamic and complex, with changes driven by economic growth, increasing consumer demands, and technological advances. Additionally, with some of the world's most important ports, airports, and critical manufacturing zones, the Asia-Pacific region has transformed into a hub for global supply chains, which would raise the demand for the cloud logistics market in the future.

- The region includes developing economies, such as India and other Southeast Asian countries, and significant global manufacturing countries, such as China, South Korea, and Japan, among others, supporting the manufacturing, retail, and other sectors' growth in the region, which would fuel the demand outsourced logistic providers for the transportations of raw materials, semi-finished and finished goods across the value chains of different end-user industries operating in the region, which would fuel the market growth.

- The growth of SMEs and the governmental support for in-house manufacturing capabilities expansions in the emerging economies in the region, such as the Make in India initiatives and others, are increasing the number of logistic providers and supply chain activities in the area, creating an opportunity for market growth in the future.

- Supply chain and logistic automation are gaining traction in the region in line with the growth of digitalization strategy among enterprises. In December 2023, Fujitsu introduced a cloud-based service in Japan, focusing on standardizing and visualizing logistics data. This service caters to shippers, logistics firms, and vendors, increasing sustainability by leveraging logistics data. This initiative would facilitate the safe and easy sharing of insights with internal stakeholders, showing a rising demand for cloud-based logistics solutions in the APAC region during the forecast period.

- Cloud service providers are expanding their data center footprint in Asia to cater to the surging demand. Increasing their regional infrastructure allows these providers to offer their customers faster and more secure cloud services. Additionally, this would ensure compliance with stringent local data privacy laws and pave the way for increasing acceptance of cloud logistics solutions across the Asia-Pacific.

Cloud Logistics Industry Overview

The Cloud Logistics Market is set to witness a moderately fragmented competitive landscape, primarily due to the rise of numerous small and medium-sized solution providers. These providers are actively partnering with companies from various sectors to drive the adoption of their cloud-based logistics solutions. Additionally, key industry players, such as IBM Corporation, SAP SE, Zoho Corporation, Magaya Corporation, and Oracle Corporation, are enhancing the capabilities of their solutions to stay competitive.

- February 2024 - Oracle Corporation announced plans to enhance its Supply Chain and Manufacturing (SCM) Fusion Cloud, aiming to empower enterprises in logistics management. The upgrades, set to roll out, would increase the Oracle Transportation Management and Oracle Global Trade Management applications. These enhancements encompass advanced business intelligence tools, improved logistics network modeling, a fresh trade incentive initiative, and an enhanced Transportation Management Mobile app, which shows the technological advancement by the solution offering from the exhisting market vendors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Regulatory Landscape

- 4.4 Assessment of Impact of macroeconomic trends

- 4.5 Ecosystem/Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising adoption in SMEs due to subscription pricing model

- 5.1.2 Integration of IoT and Analytics Technology

- 5.2 Market Restraints

- 5.2.1 Interoperability issues coupled by data security challenges

- 5.3 Key use cases and case studies

- 5.4 Role of cloud logistics solutions (3PL and 4PL,

Shippers,

Freight Forwarders,

Carriers and others)

- 5.5 Logistics industry trends

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 SMEs

- 6.1.2 Large Enterprises

- 6.2 By End-user Industry

- 6.2.1 Consumer Goods and Retail

- 6.2.2 Healthcare and Life Sciences

- 6.2.3 Oil & Gas

- 6.2.4 Manufacturing

- 6.2.5 Energy & Power

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 SAP SE

- 7.1.3 Oracle Corporation

- 7.1.4 Magaya Corporation

- 7.1.5 Microsoft Corporation

- 7.1.6 Detrack Systems

- 7.1.7 Zoho Corporation

- 7.1.8 Trimble Inc.

- 7.1.9 The Descartes Systems Group Inc

- 7.1.10 ShipBob, Inc