|

市场调查报告书

商品编码

1549972

日本地理空间分析:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

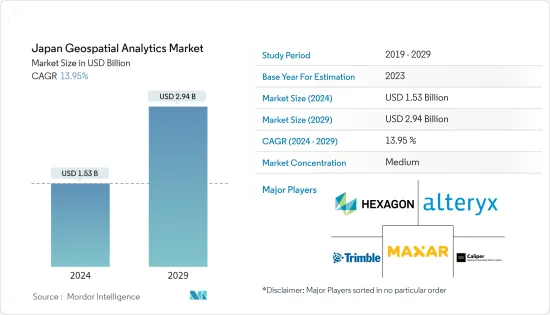

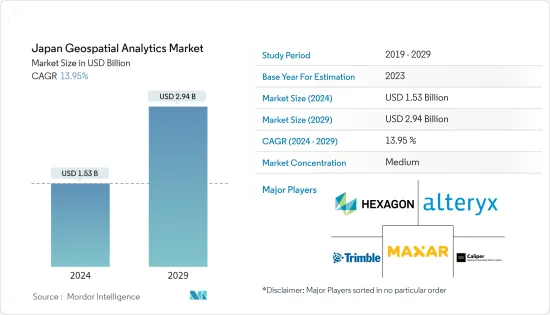

日本地理空间分析市场规模预计到 2024 年为 15.3 亿美元,预计到 2029 年将达到 29.4 亿美元,预测期内(2024-2029 年)复合年增长率为 13.95%。

主要亮点

- 地理空间分析是收集、操作和显示地理资讯系统 (GIS)资料和影像(例如 GPS 和卫星影像)的过程。日本地理空间分析市场上年度的市场规模为14亿美元,预计未来五年将达到28.1亿美元,复合年增长率为12.69%。

- 由于智慧城市开发计划的采用不断增加,日本的地理空间分析市场正在显着成长。这些措施利用先进技术来加强城市基础设施、改善公共服务并优化资源管理。透过将地理空间分析纳入规划和运营,日本城市可以更好地分析空间资料、监测环境变化并做出明智的决策。预计这一趋势将继续推动市场发展,并为创新和投资提供大量机会。

- 例如,东京智慧城市工作室是乔治亚理工学院和东京大学合作的研究项目,旨在东京发展智慧和生态社区。该程式使用地理空间分析和其他技术来分析和视觉化有关城市规划、交通、能源消耗等的资料。

- 此外,5G 技术的部署也显着增强了日本地理空间分析市场的需求和成长。随着 5G 的出现,地理空间分析功能不断扩展,提供更快的资料处理、更高的准确性和即时分析。这项技术进步使地理空间资料能够在交通、城市规划和灾害管理等各个领域得到更有效的使用。因此,在 5G 技术日益普及的推动下,日本地理空间分析市场正经历强劲成长。

- 在日本,儘管有多个因素正在推动地理空间分析市场的发展,但高成本和营运挑战是阻碍其需求和成长的主要限制因素。实施地理空间分析解决方案所需的高成本(包括软体、硬体和技术人员)是许多组织面临的主要障碍。此外,资料隐私问题、整合复杂性以及持续更新和维护的需求等营运问题进一步阻碍了市场扩张。

日本地理空间分析市场的趋势

减少灾害风险和管理

- 日本自然灾害的频率和强度不断增加,需要引进先进的地理空间分析。这些工具有助于预测、准备和减轻此类事件的影响,从而提高日本的抗灾能力。例如,地理空间分析对潜在的灾难场景进行建模,使当局能够制定更有效的疏散计划和资源分配策略。

- 旨在减少灾害风险的政府措施和政策也对地理空间分析市场的成长做出了重大贡献。日本政府正在投资先进技术以改善灾害管理策略,这推动了对地理空间分析的需求。国家抗灾计画和减少灾害风险基本计画等计画强调地理空间资料的整合,以加强备灾和救灾。

- 此外,地理空间分析与人工智慧和巨量资料等其他技术的整合正在为灾害管理创新创造新的机会。这种整合可以实现更准确、更及时的资料分析,这对于有效的灾难应变和復原至关重要。例如,人工智慧演算法正在分析地理空间资料来预测颱风的路径,从而实现更快、更准确的紧急应变。

- 2023年9月,位于日本广岛县的东广岛市推出了先进的网路GIS应用程序,用于洪水灾害和防灾。该平台由 ASP.NET 的 TatukGIS 开发内核 (DK) 提供支持,旨在评估与大量农业水库相关的洪水风险。

对定位服务(LBS) 的需求不断增长

- 定位服务(LBS) 在日本越来越受欢迎,为地理空间分析市场的扩张做出了重大贡献。这些服务利用即时地理资料提供资讯、娱乐和安全,以改善用户体验和业务效率。 LBS 与导航、社交网路和行动行销等各种应用的整合正在迅速增加对地理空间分析解决方案的需求。

- 此外,技术进步在定位服务的广泛使用中发挥着重要作用。智慧型手机的普及和高速网路基础设施的发展使消费者和企业更容易存取和使用LBS。 2023年,日本智慧型手机拥有率将迅速增至约79%,自2010年代中期以来大幅成长。这些技术进步使得能够收集更准确、更可靠的地理空间资料,进一步激发日本地理空间分析市场的活力。

- 此外,日本政府正积极推动将地理空间资讯用于各种公共服务和城市规划措施。改善地理空间资料基础设施的政府政策和投资正在为地理空间分析市场的成长创造有利的环境。这些努力预计将进一步推动各领域的创新和地理空间技术的采用。

- 地理空间分析在运输、物流和零售业中越来越多的使用也促进了市场的成长。这些行业的公司正在利用地理空间资料来优化路线、管理资产并改善客户体验。空间资料分析和视觉化提供了宝贵的见解,可以帮助企业做出明智的决策并提高业务效率。

日本地理空间分析产业概况

由 Hexagon AB 等大型企业主导的日本地理空间分析市场正在见证整合趋势。这些主要企业正在建立策略联盟和收购,以扩大其市场份额。同时,我们专注于创新、新应用部署和研发,以开发先进的地理空间工具。这些工具涉及城市规划、灾害管理和环境监测等不同领域。此类倡议将支持未来几年的市场成长。

2024年1月,AWS宣布计画在2027年在日本投资2.26兆日圆(152.4亿美元),以扩大其在日本的云端运算基础设施。除了扩大在东京和大阪的设施外,AWS 还计划透过 AWS 教育计画、培训和认证解决数位技能差距,帮助日本释放其云端潜力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第 2 章执行摘要

第三章调查方法

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 智慧城市发展的采用率不断提高

- 引入5G推动市场成长

- 市场限制因素

- 高成本和营运问题

- 法律障碍

第六章 市场细分

- 按类型

- 表面分析

- 网路分析

- 地理空间视觉化

- 按最终用户产业

- 农业

- 公共事业和通讯

- 国防/情报

- 政府机构

- 采矿/自然资源

- 汽车/交通

- 卫生保健

- 房地产/建筑业

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Alteryx

- Hexagon AB

- TomTom

- Maxar Technologies

- Trimble

- ESRI

- Caliper Corporation

- General Electric

- Bentley Systems Co.

- Fugro

第八章投资分析

第九章 市场机会及未来趋势

The Japan Geospatial Analytics Market size is estimated at USD 1.53 billion in 2024, and is expected to reach USD 2.94 billion by 2029, growing at a CAGR of 13.95% during the forecast period (2024-2029).

Key Highlights

- Geospatial analytics is the process of gathering, manipulating, and displaying geographic information system (GIS) data and imagery, including GPS and satellite photographs. The Japanese geospatial analytics market was valued at USD 1.40 billion in the previous year, and it is expected to register a CAGR of 12.69%, reaching USD 2.81 billion by the next five years.

- The Japanese geospatial analytics market is experiencing significant growth due to the increasing adoption of smart city development projects. These initiatives leverage advanced technologies to enhance urban infrastructure, improve public services, and optimize resource management. As cities in Japan integrate geospatial analytics into their planning and operations, they better analyze spatial data, monitor environmental changes, and make informed decisions. This trend is expected to continue driving the market forward, offering numerous opportunities for innovation and investment in the coming years.

- For instance, the Tokyo Smart City Studio, a collaboration between the Georgia Institute of Technology and the University of Tokyo, is a research program that aims to develop a smart and ecologically sound community in Tokyo. The program uses geospatial analytics and other technologies to analyze and visualize urban planning, transportation, energy consumption, and more data.

- Also, the deployment of 5G technology is significantly enhancing the demand and growth of the geospatial analytics market in Japan. With the advent of 5G, the capabilities of geospatial analytics are expanding, offering faster data processing, improved accuracy, and real-time analytics. This technological advancement enables various sectors, including transportation, urban planning, and disaster management, to leverage geospatial data more effectively. As a result, the geospatial analytics market in Japan is experiencing robust growth, driven by the increased adoption of 5G technology.

- In Japan, while several factors propel the geospatial analytics market, high costs and operational challenges are significant constraints that impede its demand and growth. The high costs associated with implementing geospatial analytics solutions, including software, hardware, and skilled personnel, pose a substantial barrier for many organizations. Additionally, operational concerns such as data privacy issues, integration complexities, and the need for continuous updates and maintenance further hinder the market's expansion.

Japan Geospatial Analytics Market Trends

Disaster Risk Reduction and Management

- The increasing frequency and intensity of natural disasters in Japan have necessitated the adoption of advanced geospatial analytics. These tools help predict, prepare for, and mitigate the impacts of such events, thereby enhancing the country's disaster resilience. For instance, geospatial analytics can model potential disaster scenarios, allowing authorities to develop more effective evacuation plans and resource allocation strategies.

- Also, government initiatives and policies aimed at disaster risk reduction significantly contribute to the growth of the geospatial analytics market. The Japanese government has been investing in advanced technologies to improve disaster management strategies, which drives the demand for geospatial analytics. Programs such as the National Resilience Program and the Basic Plan for Disaster Risk Reduction emphasize the integration of geospatial data to enhance disaster preparedness and response.

- Also, the integration of geospatial analytics with other technologies, such as artificial intelligence and big data, is creating new opportunities for innovation in disaster management. This integration allows for more accurate and timely data analysis, crucial for effective disaster response and recovery. For example, AI algorithms are used to analyze geospatial data to predict the path of a typhoon, enabling quicker and more precise emergency responses.

- In September 2023, Higashihiroshima City, located in the Hiroshima Prefecture of Japan, launched an advanced web GIS application for flood hazard and disaster prevention. This platform, powered by the TatukGIS developer kernel (DK) for ASP.NET, is engineered to assess flood risks associated with numerous agricultural irrigation reservoirs.

Growing Demand for Location-based Services

- Location-based services (LBS) have become increasingly popular in Japan, contributing significantly to the expansion of the geospatial analytics market. These services utilize real-time geographical data to provide information, entertainment, and security, enhancing user experience and operational efficiency. The integration of LBS in various applications, such as navigation, social networking, and mobile marketing, has led to a surge in demand for geospatial analytics solutions.

- Moreover, technological advancements have played a crucial role in the proliferation of location-based services. The widespread adoption of smartphones and the development of high-speed internet infrastructure have made it easier for consumers and businesses to access and utilize LBS. In 2023, smartphone ownership in Japan surged to nearly 79%, marking a substantial rise from the mid-2010s. This technological progress has enabled more precise and reliable geospatial data collection, further boosting the geospatial analytics market in Japan.

- Additionally, the Japanese government has been actively promoting the use of geospatial information for various public services and urban planning initiatives. Government policies and investments to improve geospatial data infrastructure have created a favorable environment for the growth of the geospatial analytics market. These initiatives are expected to drive further innovation and adoption of geospatial technologies across different sectors.

- Also, the increasing use of geospatial analytics in transportation, logistics, and retail industries contributes to market growth. Companies in these sectors are leveraging geospatial data to optimize routes, manage assets, and enhance customer experiences. Analyzing and visualizing spatial data provides valuable insights that help businesses make informed decisions and improve operational efficiency.

Japan Geospatial Analytics Industry Overview

The Japanese geospatial analytics market, dominated by major players like Hexagon AB, is witnessing a trend toward consolidation. These key players are strategically partnering and acquiring to fortify their market presence. Simultaneously, they innovate, roll out new applications, and focus on R&D to craft advanced geospatial tools. These tools are tailored for diverse sectors, spanning urban planning, disaster management, and environmental monitoring. Such initiatives are poised to propel market growth in the coming years.

In January 2024, AWS announced plans to invest JPY 2.26 trillion (USD 15.24 billion) in Japan by 2027 to expand cloud computing infrastructure in the country. In addition to expanding its facilities in Tokyo and Osaka, AWS planned to help Japan unlock its cloud potential by addressing the digital skills gap through AWS education programs, training, and certification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Factors on Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase In Adoption of Smart City Development

- 5.1.2 Introduction of 5G to Boost Market Growth

- 5.2 Market Restraints

- 5.2.1 High Costs and Operational Concerns

- 5.2.2 Legal Hurdles

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Surface Analysis

- 6.1.2 Network Analysis

- 6.1.3 Geovisualization

- 6.2 By End-user Vertical

- 6.2.1 Agricultural

- 6.2.2 Utility and Communication

- 6.2.3 Defense and Intelligence

- 6.2.4 Government

- 6.2.5 Mining and Natural Resources

- 6.2.6 Automotive and Transportation

- 6.2.7 Healthcare

- 6.2.8 Real Estate and Construction

- 6.2.9 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alteryx

- 7.1.2 Hexagon AB

- 7.1.3 TomTom

- 7.1.4 Maxar Technologies

- 7.1.5 Trimble

- 7.1.6 ESRI

- 7.1.7 Caliper Corporation

- 7.1.8 General Electric

- 7.1.9 Bentley Systems Co.

- 7.1.10 Fugro