|

市场调查报告书

商品编码

1549997

智慧家庭门禁控制:市场占有率分析、产业趋势、成长预测(2024-2029)Smart Home Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

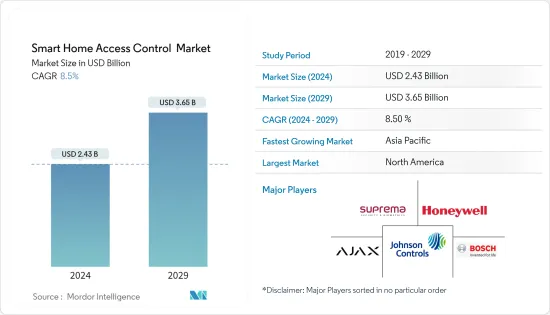

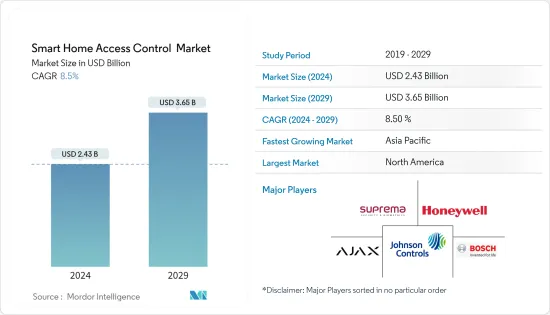

智慧家庭门禁市场规模预计到2024年为24.3亿美元,预计到2029年将达到36.5亿美元,在预测期内(2024-2029年)复合年增长率为8.5%,预计会增长。

虽然有关家庭安全的讨论往往集中在重型钢门和刺耳的警报上,但智慧门禁控制提供了更微妙、更强大的安全解决方案。智慧门禁控制使用门禁码、钥匙圈和门禁卡来管理进入。其主要优势在于其确保空间安全并影响从保险范围到减轻事故损失等各种因素的能力。

推动智慧家庭门禁市场成长的因素有很多。其中包括由于入室盗窃率上升而日益引起的安全担忧,以及核心家庭的普遍存在,特别是涉及工作父母和分居的年长亲戚的情况。

对于住宅来说,智慧存取控制对于确保隐私和安全至关重要。无论是在公共区域、停车场还是私人公寓,设置屏障以防止未授权存取可以提高您的财产的吸引力,并提供有关建筑物入侵的宝贵见解。

此外,精通技术的人口的快速增长和家庭自动化计划的兴起正在推动市场需求。

现代门禁系统利用生物识别、射频、蓝牙和 NFC 等最尖端科技,但最终用户可能会因相关的测试、培训和实施成本而望而却步。此外,公众意识的缺乏和操作上的犹豫,特别是对于云端整合无线锁的好处,正在阻碍市场的扩张。

全球大流行极大地改变了智慧家庭门禁系统的格局,强调对占用资料的监控以确保安全。凭藉现有技术和疫情后復苏计划引入的新技术,市场预计将在未来发现新的机会。

智慧家庭门禁市场趋势

生物辨识读卡机占据主要市场占有率

- 生物识别家庭安全代表了身份验证方法的现代转变,它使用个人的独特特征而不是传统证书进行身份验证。这项技术在家庭安全领域迅速普及。住宅越来越多地利用指纹、视网膜和脸部辨识技术来增强存取控制。

- 生物识别锁改进了安全措施并减少了对传统密钥系统的依赖。它在多因素认证中也极为重要,尤其是在高安全场景下。例如,在安全设施中出示实体徽章后,指纹可以充当附加的身份验证层。

- 根据统计,抢劫往往是一种机会主义犯罪。传统钥匙锁很容易受到这些机会主义者的攻击,但主要依赖蓝牙或 Wi-Fi 的智慧锁却引入了新的漏洞。此外,依赖 PIN 码的数位锁容易受到骇客攻击且容易被遗忘。

- 鑑于这些漏洞,生物辨识读取器在世界各地越来越受欢迎,以增强家庭安全。生物辨识感测器将资料储存在您的装置上,因此即使断电或 Wi-Fi 连线不可靠也不会危及您锁的安全。因此,您可以透过智慧锁安全地存取您的家、汽车、保险箱或手提箱,确保只有授权使用者才能进入。

- 这种安全性增强引起了消费者的共鸣。根据最近的一项调查,近三分之一的消费者有兴趣在未来使用生物识别阅读器进出他们的家。除了安全方面之外,生物识别读取器提供的便利性也进一步推动了该市场的成长。

亚太地区实现显着成长

- 亚洲正迅速成为智慧家居门禁市场。未来五年,该地区的成长轨迹将取决于需求的激增和技术进步的采用,特别是在家用电器和家电领域。

- 智慧型手机的普及、线上业务的成长以及政府针对数位转型的强大倡议等因素正在推动这一势头。根据GSMA的2023年报告《亚太地区移动经济》,多个国家已使5G成为主流技术,包括澳洲、日本、新加坡和韩国。

- 值得注意的是,印度已成为成长最快的 5G 市场之一,预计仅 2023 年将增加数千万个 5G 连线。预计到2030年,该地区5G连线数将达到约14亿,占所有行动连线的41%。

- 此外,该地区强劲的经济成长使中产阶级不断壮大,购买力不断增强,消费群不断扩大。随着亚洲地区收入的增加,更多消费者将进入高所得阶层。消费趋势的这些变化预计将推动特别先进的技术和服务的消费,进一步推动智慧家庭门禁市场的发展。

- 此外,该地区政府对智慧城市计画的投资正在增加,可能会创造新的商机。例如,丰田公司雄心勃勃的「编织城市」计划即将完工,该计画将成为以无人驾驶汽车为特色的创新城市生活的试验场。 「编织城市」点缀着装有感测器的“智慧房屋”,可实现居住者、建筑物和车辆之间的无缝通讯。该市以氢能发电为重点,旨在引领排放气体和氢基技术。

智慧家庭门禁产业概况

智慧家庭门禁市场较为分散,全球和地区厂商都在激烈的竞争中力争获得更大的份额。儘管进入障碍很高,但一些新参与企业还是在市场上取得了成功。其他主要企业包括 Suprema Inc.、Johnson Controls、Ajax Systems、Bosch Security System Inc. 和 Honeywell International Inc.。公司正在做出重要的策略决策,以提高其市场占有率。

2024年4月,Resideo Technologies宣布美国智慧家庭科技公司。作为收购的一部分,Resideo 将把 Snap One 整合到其 ADI 全球分销部门。这项策略性倡议旨在透过将更广泛的第三方产品与我们自己的解决方案相结合来加强我们为整合商提供的产品。增强的产品系列将透过广泛的实体网路和强大的数位工具进行补充。

2023 年 9 月,Guardian Access Solutions 被 CenterOak Partners 收购,进入 CenterOak 旗下 Guardian 的下一阶段成长。随着 Guardian 扩大其在整个东南部和全国门禁行业的领先地位,CenterOak 将透过持续投资于有机和无机成长计划来支持该公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 由于犯罪率和威胁不断上升,门禁系统的采用率增加

- 技术进步

- 市场限制因素

- 对营运和投资回报率的担忧

- 技术简介

- 存取控制解决方案的演变

- RFID与NFC技术比较分析

- 主要技术趋势

第六章 市场细分

- 按类型

- 读卡机及门禁设备

- 卡座

- 接近型

- 智慧卡(接触式/非接触式)

- 生物辨识阅读器

- 电子锁

- 软体

- 其他类型

- 读卡机及门禁设备

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Suprema Inc.

- Tyco International PLC(Johnson Controls)

- Bosch Security Systems

- Ajax Systems

- Honeywell International Inc.

- Nedap NV

- Thales Group(Gemalto NV)

- Allegion PLC

- ASSA ABLOY AB Group

- Schneider Electric SE

- Panasonic Corporation

- Brivo Systems LLC

- Identiv Inc.

- Dormakaba Holding AG

- NEC Corporation

- Idemia Group

- Axis Communication AB

第八章投资分析

第9章 市场的未来

The Smart Home Access Control Market size is estimated at USD 2.43 billion in 2024, and is expected to reach USD 3.65 billion by 2029, growing at a CAGR of 8.5% during the forecast period (2024-2029).

While heavy steel doors and blaring alarms are often the focus of home security discussions, smart access control presents a more nuanced yet potent security solution. Utilizing entry codes, key fobs, and access cards, smart access control governs entries. Its key strength lies in its capacity to secure spaces and impact factors ranging from insurance coverage to mitigating accident losses.

Several factors are fueling the growth of the smart home access control market. These include heightened safety concerns due to rising burglary rates and the prevalence of nuclear families, especially in scenarios involving working parents and separated elderly relatives.

For homeowners, smart access control is pivotal in ensuring the privacy and security they deserve. Whether for communal areas, car parks, or personal flats, implementing barriers against unauthorized access enhances a property's appeal and provides valuable insights into building entries.

Moreover, the surge in tech-savvy populations and the rise of home automation projects bolstered the demand in the market.

While modern access control systems leverage cutting-edge technologies like biometrics, RF, Bluetooth, and NFC, end users are sometimes deterred by the associated testing, training, and implementation costs. Additionally, a lack of public awareness and operational hesitations, especially concerning the benefits of cloud-integrated wireless locks, pose hurdles to market expansion.

The global pandemic has significantly altered the landscape of smart home access control systems, emphasizing the monitoring of occupancy data to ensure safety. With both existing technologies and new additions introduced under the post-pandemic recovery agenda, the market is poised to unveil fresh opportunities in the future.

Smart Home Access Control Market Trends

The Biometric Readers Segment to Hold Major Market Share

- Biometric home security represents a modern shift in authentication methods, utilizing unique individual features for verification rather than traditional credentials. This technology is rapidly gaining traction in the home security sector. Homeowners increasingly use fingerprint, retina, or facial recognition technologies to bolster access control.

- Biometric locks elevate security measures, reducing reliance on conventional key-based systems. They are also crucial in multifactor verification, especially in high-security scenarios. For instance, after presenting a physical badge at a secure facility, a fingerprint can serve as an additional layer of verification.

- Statistically, burglary is often an opportunistic crime. While traditional key locks have long been vulnerable to such opportunists, smart locks, predominantly reliant on Bluetooth or Wi-Fi, introduce new vulnerabilities. Additionally, digital locks, hinging on PIN codes, are susceptible to hacking and prone to being forgotten.

- Considering these vulnerabilities, biometric readers are becoming popular for enhancing home security worldwide. Biometric sensors store data on the device, ensuring that power outages or unreliable Wi-Fi connections do not compromise the lock's security. This results in secure access to homes, cars, safes, and suitcases through smart locks, allowing only authorized users to gain entry.

- This heightened security is resonating with consumers. Recent research indicates that nearly one in three consumers express interest in adopting biometric readers for home access in the future. Beyond the security aspect, the convenience offered by biometric readers is further propelling the growth of this market.

Asia-Pacific to Witness Significant Growth

- Asia is swiftly establishing itself as a dominant smart home access control market. Over the next five years, the region's growth trajectory hinges on the surging demand and adoption of technological advancements, particularly in home appliances and consumer electronics.

- Factors like the widespread adoption of smartphones, an expanding online business landscape, and robust government initiatives focused on digital transformation drive this momentum. According to the GSMA's 2023 report, "The Mobile Economy for Asia Pacific," several countries, including Australia, Japan, Singapore, and South Korea, have made 5G a mainstream technology.

- Notably, India is emerging as one of the fastest-growing 5G markets, with projections indicating the addition of tens of millions of 5G connections in 2023 alone. The region is poised to reach around 1.4 billion 5G connections by 2030, accounting for 41% of all mobile connections.

- Additionally, the region's robust economic growth has swelled the middle class, expanding the consumer base with increased purchasing power. As incomes rise across Asia, a larger consumer segment will move into higher income brackets. This shift within the consumer landscape is set to drive consumption, particularly in advanced technologies and services, further propelling the smart home access control market.

- Moreover, the region's escalating government investments in smart city initiatives are poised to unlock fresh opportunities. For instance, iToyota's ambitious 'Woven City' project, nearing completion, will serve as a testing ground for innovative urban living featuring driverless cars. 'Woven City' will be dotted with 'smart homes' embedded with sensors, enabling seamless communication among residents, buildings, and vehicles. With a primary focus on hydrogen power, the city aims to lead in emissions reduction and hydrogen-based technology.

Smart Home Access Control Industry Overview

The smart home access control market is fragmented and comprises global and regional players striving for a larger share in a fiercely contested space. Despite the high barriers to entry, several new entrants have successfully made a mark in the market. Some of the notable players in the industry include Suprema Inc., Johnson Controls, Ajax Systems, Bosch Security System Inc., Honeywell International Inc., and others. Companies are making significant strategic decisions to increase their market presence.

April 2024: Resideo Technologies announced a USD 1.4 billion acquisition of a US smart home technology company. Resideo will merge Snap One into its ADI Global Distribution arm as part of the deal. This strategic move aims to bolster offerings for integrators, combining a wider array of third-party products with in-house solutions. The enhanced product lineup will be accessible through an expansive physical branch network complemented by robust digital tools.

September 2023: Guardian Access Solutions was acquired by CenterOak Partners, marking a transition into Guardian's next phase of growth under CenterOak, which will support the company through continued investments in organic and inorganic growth initiatives as Guardian expands its leading presence in the access control industry throughout the Southeast and nationally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats

- 5.1.2 Technological Advancements

- 5.2 Market Restraints

- 5.2.1 Operational and ROI Concerns

- 5.3 Technology Snapshot

- 5.3.1 Evolution of Access Control Solutions

- 5.3.2 Comparitive Analysis of RFID and NFC Technology

- 5.3.3 Key Technological Trends

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Card Reader and Access Control Devices

- 6.1.1.1 Card-based

- 6.1.1.2 Proximity

- 6.1.1.3 Smart Card (Contact and Contactless)

- 6.1.2 Biometric Readers

- 6.1.3 Electronic Locks

- 6.1.4 Software

- 6.1.5 Other Types

- 6.1.1 Card Reader and Access Control Devices

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Suprema Inc.

- 7.1.2 Tyco International PLC (Johnson Controls

- 7.1.3 Bosch Security Systems

- 7.1.4 Ajax Systems

- 7.1.5 Honeywell International Inc.

- 7.1.6 Nedap NV

- 7.1.7 Thales Group (Gemalto NV)

- 7.1.8 Allegion PLC

- 7.1.9 ASSA ABLOY AB Group

- 7.1.10 Schneider Electric SE

- 7.1.11 Panasonic Corporation

- 7.1.12 Brivo Systems LLC

- 7.1.13 Identiv Inc.

- 7.1.14 Dormakaba Holding AG

- 7.1.15 NEC Corporation

- 7.1.16 Idemia Group

- 7.1.17 Axis Communication AB