|

市场调查报告书

商品编码

1550006

资料中心处理器:市场占有率分析、产业趋势、成长预测(2024-2029)Data Center Processor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

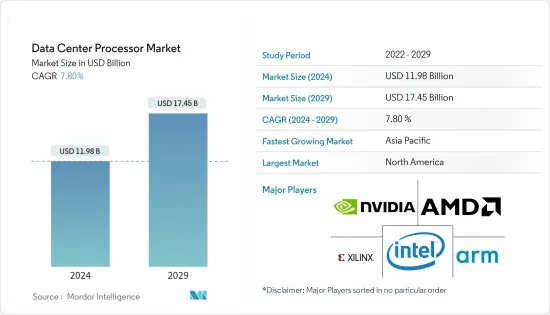

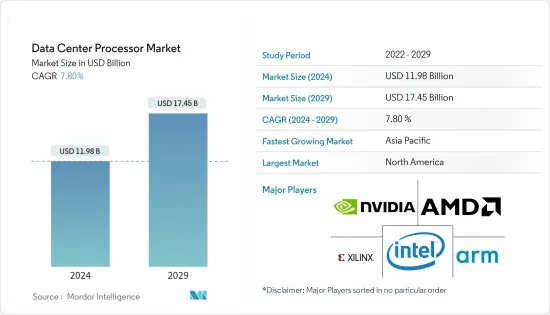

资料中心处理器市场规模预计到 2024 年为 119.8 亿美元,预计到 2029 年将达到 174.5 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.80%。

主要亮点

- 资料中心处理器是资料中心运算基础设施的关键元件。执行算术处理、逻辑处理、输入/输出处理等多种任务的高效能晶片。资料中心依赖伺服器,伺服器是具有大量储存、记忆体、处理能力和输入/输出能力的高效能电脑。这些伺服器使用资料中心处理器来处理计算负载并运行应用程式。资料中心处理器的选择取决于您的特定任务和要求。虽然通用 CPU 可能适合许多应用,但人工智慧 (AI) 和机器学习 (ML) 等专门任务可能更喜欢针对这些工作负载进行最佳化的处理器。

- CPU 处理器是资料中心中最常见的处理器类型。它用途广泛且适应性强,可以处理各种任务和应用。 GPU 处理器最初是为图形密集型应用程式设计的,由于其并行处理能力,它已成为资料中心的必需品。 GPU 执行高度并行运算,使其适用于机器学习、人工智慧和巨量资料分析。配备大量核心,可同时处理大量资料,显着减少处理时间并提高整体效能。

- FPGA 处理器利用可编程硬件,可针对特定应用进行客製化。此电路可以灵活地重新配置,使其适合需要低延迟和高吞吐量的任务。 FPGA 处理器通常用于即时处理很重要的功能,例如加密、视讯处理和网路封包处理。

- 随着连网型设备、云端运算和物联网的激增,产生的资料量正以前所未有的速度成长。资料的激增需要强大的处理器来满足资料中心的处理和分析要求。此外,资料中心还负责处理和分析大量即时资料。随着对资料主导的洞察和复杂运算的越来越依赖,处理器需要提供高效能并有效地处理要求苛刻的工作负载。

- 此外,能源效率是资料中心处理器的关键市场驱动因素。资料中心消耗大量能源,优化电力消耗对于降低营运成本和环境影响至关重要。对具有更高每瓦性能的处理器的需求不断增加,以实现更有效率的资料中心营运。此外,人工智慧 (AI) 和机器学习 (ML) 技术的日益普及正在推动对具有增强处理人工智慧工作负载能力的处理器的需求。人工智慧和机器学习演算法需要强大的处理器来处理和分析复杂的资料模式并做出准确的预测,从而增加了对人工智慧工作负载进行最佳化的专用处理器的需求。

- GDP 成长是影响资料中心处理器市场的主要宏观经济趋势之一。随着经济的扩张,企业往往会增加对资料中心等IT基础设施的投资。随着企业需要更多的运算能力来处理不断增长的资料量,这种投资的增加意味着对资料中心处理器的需求增加。例如,美国是一个重要的资料中心市场。根据经济分析局(BEA)预测,美国GDP将从2022年的25.7兆美元增加到2023年的约27.36兆美元。

- 然而,资料中心处理器市场面临着几个阻碍其成长和潜力的市场限制因素。资料中心处理器的高成本是中小型企业的主要障碍,限制了它们的采用。此外,行业技术的快速进步导致处理器生命週期缩短,使公司难以跟上最新的创新。

资料中心处理器市场趋势

中央处理器(CPU)领域预计将推动市场成长

- CPU资料中心处理器,也称为伺服器处理器,是资料中心运作的关键元件。这些处理器专为处理资料中心环境的严苛工作负载和高效能要求而设计。 CPU资料中心处理器的主要特征之一是其高核心数量。这些处理器通常具有多个核心,从 8 个到 64 个或更多。这实现了任务并行性,允许资料中心同时处理不同的工作负载。此外,高核心数量可实现高效的资源利用,并最大限度地提高资料中心的整体效能。

- 另一个重要特征是CPU资料中心处理器的高时脉速度。时脉速度是处理器执行指令的速度。更快的时脉速度意味着更快的资料处理,这对于需要即时处理大量资料的资料中心至关重要。此外,CPU资料中心处理器通常包含 Turbo Boost 技术,该技术允许它们在需要额外效能时暂时提高时脉速度。

- 此外,CPU资料中心处理器旨在支援虚拟。虚拟可让您在单一实体伺服器上执行多个虚拟机,从而最大限度地提高资源利用率并降低硬体成本。 CPU资料中心处理器包括硬体辅助虚拟等功能,以提高虚拟环境的效能和安全性。

- 市场驱动因素之一是行动装置、社群媒体和物联网等各种资讯来源产生的资料快速增加。即时处理和分析大量资料需要强大的高效能处理器。随着资料处理市场的持续成长,资料中心营运商被迫投资先进的 CPU 处理器,以满足不断增长的运算需求。

- 云端处理服务的快速扩张预计也将显着推动市场成长。云端平台提供扩充性、灵活性和成本效率,这使得它们对许多企业至关重要。为了满足对云端服务不断增长的需求,资料中心需要部署能够处理繁重工作负载并提供最佳效能的处理器。因此,始终需要更强大、更节能的 CPU 处理器来满足云端处理不断变化的需求。

- 据 Cloudscene 称,截至 2024 年 3 月,美国据报道拥有 5,381 个资料中心,比世界上任何其他国家都多。另外 521 个地点位于德国,514 个地点位于英国。几个地区对资料中心的投资增加似乎正在推动市场成长。例如,2023年10月,Vantage Data Centers完成了对欧洲多个资料中心资产的投资交易。该公司宣布已与 DigitalBridge、Infranity 和 MEAG 领导的投资者联盟完成投资合作。该投资合作伙伴由六个稳定的欧洲资料中心组成,价值约27亿美元,其中包括Vantage的股权。

北美占最大市场占有率

- 由于技术进步、资料密集型应用程式的激增以及对高效能运算的需求,美国资料中心处理器市场正在经历显着增长。随着企业转向云端基础的解决方案,北美对强大资料中心的需求不断增加。这增加了对能够处理不断增长的资料量并提供无缝性能的强大处理器的需求。

- 美国越来越多地采用互联网、人工智慧、5G、物联网和高效能运算等先进技术,需要高资料传输速度,这正在推动市场成长。根据软体即服务解决方案公司和线上媒体监控公司 Meltwater 的数据,截至 2023 年 10 月,美国的网路普及率为 91.8%。

- 资料中心消耗大量能源,增加了营运成本和环境问题。因此,人们关注的是能够在不影响效能的情况下优化功耗的节能处理器。

- 资料中心采用异质运算架构来满足人工智慧和机器学习等新兴技术的区域需求。这一趋势整合了 CPU、GPU 和专用加速器,以提供卓越的效能和灵活性。

- 资料流量的爆炸性增长对开发多个资料中心以支援企业和消费者产生的资料的需求不断增长。云端处理服务和应用程式的使用将在美国继续扩大,从而导致大规模超大规模云端为基础的资料中心的发展。

- 多家公司正在该地区投资资料中心扩容,以支持光收发器市场的扩张。例如,亚马逊在2023年9月宣布将投资35亿美元在美国俄亥俄州新奥尔巴尼新建五个资料中心。据悉,这些将于2030年完成。五个资料中心和配套建筑的建设计划于 2025 年开始。这项投资是亚马逊承诺斥资 78 亿美元扩建该州资料中心的第一部分。该协议是在 Google 最近宣布斥资 17 亿美元扩建新奥尔巴尼三个资料中心的计划之后达成的。

资料中心处理器产业概述

在资料中心处理器市场,英特尔公司、NVIDIA公司、Advanced Micro Devices Inc.、Xilinx Inc.和Arm Holdings PLC等主要企业正向半固体过渡。研究市场中的参与者不断努力创新先进产品,以满足消费者不断变化的需求。

2024 年 2 月:Nvidia 宣布提高 GPU 产量,以推动 AI资料中心革命。该公司已开始针对 Google 新发布的 Gemma 系列轻量级模型进行最佳化。两家公司开发了架构提高在 Nvidia资料中心、云端和 GPU 支援的 PC 上运行的模型的效能。 Nvidia H200 处理器的首批库存预计将于 2024 年末出货。

2023 年 12 月:英特尔在纽约举行的 AI Everywhere 活动上宣布推出第五代 Xeon 可扩充处理器。英特尔于 2023 年 1 月发布了第四代英特尔至强处理器,但为了跟上竞争对手的步伐,它发布了第五代晶片,代号为“Emerald Rapids”。与上一代Xeon 处理器Sapphire Rapids 相比,这些新处理器的运算效能平均提高了21%,记忆体速度平均提高了16%,从而降低了各种客户工作负载的平均每瓦效能,英特尔声称可以提高这些性能。英特尔表示,这使其成为最具永续的资料中心处理器,能够执行处理器密集任务,同时消耗更少的电力。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 技术简介

- 深度学习、公共云端介面和企业介面如何影响资料中心加速器

- 各厂商的技术更新/开发状况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 和其他宏观经济因素对市场的影响

- 基于设定的市场场景 - 内部部署与云

第五章市场动态

- 市场驱动因素

- HPC资料中心更常采用人工智慧

- 资料中心设施和云端基础服务部署的增加

- 市场限制因素

- 有限的人工智慧硬体专业知识和基础设施问题

第六章 市场细分

- 按处理器

- CPU(中央处理单元)

- GPU(图形处理单元)

- FPGA(现场可程式化闸阵列)

- ASIC(专用积体电路)- 仅 AI专用加速器

- 网路加速器(SmartNIC、DPU)

- 按用途

- 人工智慧(深度学习、机器学习)

- 资料分析/图形

- 高效能运算 (HPC)/科学运算

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- NVIDIA Corporation

- Advanced Micro Devices Inc.

- Xilinx Inc.

- Arm Holdings PLC

- Super Micro Computer Inc.

- Samsung Electronics Co. Ltd

- Qualcomm Technologies Inc.

- Imagination Technologies Limited

- Advantech Co. Ltd

第八章投资分析

第9章 市场的未来

The Data Center Processor Market size is estimated at USD 11.98 billion in 2024, and is expected to reach USD 17.45 billion by 2029, growing at a CAGR of 7.80% during the forecast period (2024-2029).

Key Highlights

- A data center processor is a critical component of a data center's computing infrastructure. It is a high-performance chip that performs various tasks, including arithmetic, logic, and input/output operations. Data centers rely on servers, which are high-performance computers with large storage space, memory, processing power, and input/output capabilities. These servers use data center processors to handle the computational workload and run applications. The choice of processors in a data center depends on the specific tasks and requirements. General-purpose CPUs may be suitable for many applications, but processors optimized for these workloads may be preferred for specialized tasks like artificial intelligence (AI) and machine learning (ML).

- CPU processors are the most common type of processors found in data centers. They provide the capability to handle various tasks and applications, making them versatile and adaptable. Initially designed for graphics-intensive applications, GPU processors have become indispensable in data centers due to their parallel processing capabilities. GPUs perform highly parallel computations, making them suitable for machine learning, artificial intelligence, and big data analytics. Their massive number of cores enables them to process vast amounts of data simultaneously, significantly reducing processing time and improving overall performance.

- FPGA processors offer the advantage of programmable hardware, allowing customization to specific applications. They provide the flexibility to reconfigure their circuitry, making them suitable for tasks that require low latency and high throughput. FPGA processors are often used for functions such as encryption, video processing, and network packet processing, where real-time processing is crucial.

- With the proliferation of connected devices, cloud computing, and the Internet of Things, the amount of data being generated is increasing at an unprecedented rate. This surge in data necessitates powerful processors that can handle data centers' processing and analysis requirements. Further, data centers are responsible for processing and analyzing vast real-time data. As industries increasingly rely on data-driven insights and complex computations, processors must deliver high performance and efficiently handle demanding workloads.

- Moreover, energy efficiency is a significant market driver for data center processors. Data centers consume enormous amounts of energy, and optimizing power consumption is crucial for reducing operational costs and environmental impact. Processors that offer higher performance per watt are in high demand as they allow for more efficient data center operations. Moreover, the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies is driving the demand for processors with enhanced capabilities in handling AI workloads. AI and ML algorithms require powerful processors to process and analyze complex data patterns and make accurate predictions, driving the need for specialized processors optimized for AI workloads.

- One of the key macroeconomic trends that can affect the data center processors market is GDP growth. As the economy expands, companies are inclined to increase their investments in IT infrastructure, such as data centers. This increased investment leads to a higher demand for data center processors, as businesses require more computing power to handle the growing volume of data. For instance, the United States is a prominent data center market. According to the Bureau of Economic Analysis (BEA), the US GDP increased from USD 25.7 trillion in 2022 to about USD 27.36 trillion in 2023.

- However, the data center processor market faces several market restraints that can hinder its growth and potential. The high cost of data center processors is a significant barrier for small and medium-sized businesses, limiting their adoption. Additionally, the rapid technological advancements in the industry lead to a shorter lifecycle of processors, making it challenging for businesses to keep up with the latest innovations.

Data Center Processor Market Trends

The Central Processing Unit (CPU) Segment is Expected to Drive the Growth of the Market

- CPU data center processors, also known as server processors, are a crucial component in the functioning of data centers. These processors are specifically devised to handle the demanding workload and high-performance requirements of data center environments. One of the primary features of CPU data center processors is their high core count. These processors often have multiple cores, ranging from 8 to 64 or more. This allows for parallel processing of tasks, enabling data centers to handle various workloads simultaneously. The high core count also ensures efficient resource utilization, maximizing the data center's overall performance.

- Another essential feature is the high clock speed of CPU data center processors. Clock speed refers to how fast a processor can execute instructions. Higher clock speeds result in faster data processing, which is crucial for data centers that need to handle large amounts of data in real time. Additionally, CPU data center processors often have turbo boost technology, temporarily increasing the clock speed when additional performance is required.

- Also, CPU data center processors are designed to support virtualization. Virtualization facilitates multiple virtual machines to run on a single physical server, maximizing resource utilization and reducing hardware costs. CPU data center processors include features like hardware-assisted virtualization, improving virtualized environments' performance and security.

- One of the primary market drivers is the exponential growth of data generated by various sources like mobile devices, social media, and the Internet of Things. This vast amount of data must be processed and analyzed in real time, requiring powerful, high-performance processors. As the market for data processing continues to grow, data center operators are compelled to invest in advanced CPU processors to meet the increasing computational requirements.

- The rapid expansion of cloud computing services is also anticipated to drive market growth significantly. Cloud platforms have become essential to many businesses, offering scalability, flexibility, and cost-efficiency. To support the growing demand for cloud services, data centers must deploy processors that can handle the heavy workloads and provide optimal performance. As a result, there is a constant need for more robust and energy-efficient CPU processors to cater to the evolving requirements of cloud computing.

- According to Cloudscene, as of March 2024, there were a reported 5,381 data centers in the United States, the most of any country worldwide. A further 521 were in Germany, while 514 were in the United Kingdom. The increasing investments in data centers in several regions are likely to aid the growth of the market. For instance, in October 2023, Vantage Data Centers closed an investment deal for several European data center assets. The company announced it had completed an investment partnership with DigitalBridge and a consortium of investors led by Infranity and MEAG. The investment partnership initially comprises six stabilized European data centers and is valued at approximately USD 2.7 billion, including Vantage's stake.

North America Holds the Largest Market Share

- The American data center processor market has experienced substantial growth due to technological advancements, the proliferation of data-intensive applications, and the need for high-performance computing. The migration of businesses to cloud-based solutions has fueled the demand for robust data centers in North America. This has driven the need for powerful processors that can handle the increasing volume of data and provide seamless performance.

- The high adoption of the Internet and advanced technologies like AI, 5G, IoT, and high-performance computing in the United States is driving the need for a high data transmission rate, which drives the market's growth. According to Meltwater, a software-as-a-service solution company and an online media monitoring company, as of October 2023, the internet penetration rate in the United States was 91.8%.

- Data centers consume large amounts of energy, resulting in heightened operational costs and environmental concerns. As a result, there is a rising emphasis on energy-efficient processors that can optimize power consumption without compromising performance.

- Data centers are embracing heterogeneous computing architectures to meet the region's requirements of emerging technologies like AI and machine learning. This trend has led to the integration of CPUs, GPUs, and specialized accelerators, offering superior performance and flexibility.

- The upsurge in data traffic has created elevated demand for developing several data centers that support data generated by businesses and consumers. The use of cloud-computing services and applications will continue to grow in the US, leading to the development of large hyperscale cloud-based data centers.

- Several companies are investing in data center capacity expansions in the region, thereby driving the expansion of the optical transceiver market. For instance, in September 2023, Amazon announced it would invest USD 3.5 billion in five new data centers in New Albany, Ohio, United States. It is reported that they will be finished by 2030. The construction is set to commence in 2025 on the five data centers and supporting buildings. The investment is claimed to be an initial part of Amazon's USD 7.8 billion commitment to expand data centers in the state. The agreement follows Google's recent announcement of a planned USD 1.7 billion expansion of its three data centers in New Albany.

Data Center Processor Industry Overview

The data center processor market is semi-consolidated with significant players like Intel Corporation, NVIDIA Corporation, Advanced Micro Devices Inc., Xilinx Inc., and Arm Holdings PLC. The players in the studied market are striving to constantly innovate advanced products to cater to the evolving needs of consumers.

February 2024: Nvidia announced that it ramped up GPU production to fuel the AI data center revolution. The company launched optimizations for Google's newly released Gemma family of lightweight models. The two companies developed architecture to accelerate the model's performance running in Nvidia data centers, in the cloud, and on GPU-enhanced PCs. The initial stock of Nvidia's H200 processors is set to ship in the second half of 2024.

December 2023: Intel launched its 5th-generation Xeon Scalable processors at the AI Everywhere event in New York. Intel released the fourth generation of its Intel Xeon processors in January 2023, but to keep pace with its competitors, it has unveiled the fifth generation of the chips, also known by its code name Emerald Rapids. These new processors offer a 21% average compute performance gain and 16% better memory speeds than the previous generation of Xeon processors, Sapphire Rapids, enabling 36% higher average performance per watt across a diverse range of customer workloads - Intel claims. This would facilitate users' undertaking processor-intensive tasks while utilizing less overall power, with Intel describing them as their most sustainable data center processors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.2.1 Impact of Deep Learning, Public Cloud Interface, and Enterprise Interface on Data Center Accelerators

- 4.2.2 Technological Updates/Developments by Various Vendors

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.6 Market Scenario Based on the Setup - On-premise vs Cloud

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Deployment of AI in HPC Data Centers

- 5.1.2 Increasing Deployment of Data Center Facilities and Cloud-based Services

- 5.2 Market Restraints

- 5.2.1 Limited AI Hardware Experts and Infrastructural Concerns

6 MARKET SEGMENTATION

- 6.1 By Processor

- 6.1.1 CPU (Central Processing Unit)

- 6.1.2 GPU (Graphics Processing Unit)

- 6.1.3 FPGA (Field-programmable Gate Array)

- 6.1.4 ASIC (Application-specific Integrated Circuit) - Only AI-dedicated Accelerators

- 6.1.5 Networking Accelerators (SmartNIC and DPUs)

- 6.2 By Application

- 6.2.1 Artificial Intelligence (Deep Learning and Machine Learning)

- 6.2.2 Data Analytics/Graphics

- 6.2.3 High-performance Computing (HPC)/Scientific Computing

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 NVIDIA Corporation

- 7.1.3 Advanced Micro Devices Inc.

- 7.1.4 Xilinx Inc.

- 7.1.5 Arm Holdings PLC

- 7.1.6 Super Micro Computer Inc.

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 Qualcomm Technologies Inc.

- 7.1.9 Imagination Technologies Limited

- 7.1.10 Advantech Co. Ltd