|

市场调查报告书

商品编码

1550033

高电压薄膜电容器:市场占有率分析、产业趋势、成长预测(2024-2029)High Voltage Film Capacitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

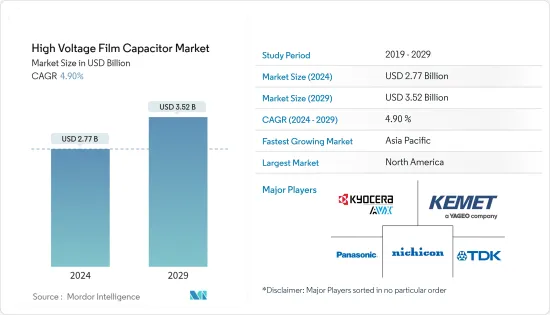

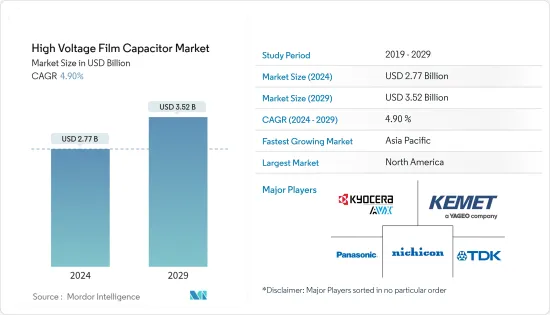

预计2024年高电压薄膜电容器市场规模为27.7亿美元,2029年将达35.2亿美元,在预测期间(2024-2029年)复合年增长率为4.90%。

由于风能和太阳能等再生能源来源的采用日益增多,高电压薄膜电容器市场正在见证成长,这需要高效的能源储存和转换系统。高电压薄膜电容器因其稳定性、长寿命和高电压耐受性而在这些系统中极为重要。此外,电动车、输配电需求以及电容器技术的持续改进也是推动市场成长的因素。

主要亮点

- 高电压薄膜电容器是在高电压等级下储存和释放电能的电气元件。它使用薄塑胶薄膜作为介电材料,并夹在金属电极之间。高电压薄膜电容器以其在高电压应用中的高绝缘电阻、优异的稳定性和低性能劣化而闻名。

- 由于其高性能、耐用性和承受恶劣条件的能力,高电压薄膜电容器是各种高压和高功率应用的必备电容器。

- 高电压薄膜电容器以其自癒特性而闻名,可以从部分击穿中恢復。在金属化薄膜电容器中,当发生击穿时,击穿周围的一层薄金属会蒸发,从而隔离故障并允许电容器继续运作。

- 随着电网现代化和高电压直流 (HVDC) 输电系统的扩展,对这些有助于提高远距输电效率和可靠性的电容器的需求不断增加。根据IEA(国际能源总署)预测,2012年至2040年间,全球电力需求预计将成长近80%。电力基础设施的扩建、现代化、数位化和分散化,以提高弹性,世界经济论坛 (WEF) 等组织的计画投资(未来 25 年为智慧电网拨款 7.6 兆美元)预计将改变全球各种市场动态设想。

- 此外,世界各地的公用事业公司越来越多地采用人工智慧和数位孪生等技术,再加上政府不断加大的支持和倡议,正在吸引对智慧电网计划的进一步投资。例如,2024 年 1 月,美国能源局宣布拨款 3,400 万美元用于技术开发,以实现电网现代化、将电线埋入地下并更换老化的基础设施。该计划旨在透过最大限度地减少极端天气造成的干扰、降低成本和加速可再生能源的采用,推进现代化和加强国家电网基础设施的解决方案。

- 除了供应链中断、能源价格、制裁、贸易限制、通膨上升等宏观经济因素的影响外,俄乌战争也为高电压薄膜电容器市场带来了充满挑战的环境。儘管中断和成本上升仍然是主要挑战,但对可再生能源和电动车的推动继续推动需求,抵消了一些负面因素。

高电压薄膜电容器市场趋势

汽车领域预计将显着成长

- 高电压薄膜电容器在汽车工业中发挥重要作用,特别是在电动车、混合电动车和先进内燃机汽车中。这些电容器对于管理汽车电能流动和转换的电力电子系统至关重要。

- 在电动车和混合动力车中,电池管理系统使用高电压薄膜电容器来稳定电压并管理电池充电和放电週期。这确保了电池组的最佳性能和使用寿命。

- 此外,ABS 和 ADAS 的持续采用也进一步推动了该细分市场的成长。随着具有 ADAS 功能的车辆变得越来越复杂,它们的功率需求也会增加。高电压薄膜电容器有助于管理这些电力需求,并为支援 ADAS 功能的感测器和处理器提供稳定、可靠的电力。

- 印度政府正在透过各种法规和政策积极推动ADAS的采用。为了反映全球趋势,我们预计将努力在新车中强制要求特定的 ADAS 功能。这种监管推动可能会加速这些技术的采用。

- 此外,汽车行业标准 145 要求在印度销售的所有车辆必须安装安全气囊、SBR、ABS 和 SWS。最近推出的AIS 197:BNCAP(巴拉特新车评估计画)制定了更严格的撞击测试标准,将为ADAS成为强制性要求铺平道路,预计将促进被动和主动式安全的采用。

亚太地区市场预计将显着成长

- 工业扩张、可再生能源计划、交通电气化、消费性电子产品成长、智慧电网发展、技术进步、政府支持政策以及不断增长的能源需求正在推动亚太地区高电压薄膜电容器的成长。

- 过去几年,中国已成为全球最大的汽车市场之一,并正在成为汽车技术强国。该国对技术进步持开放态度,这可能在未来几年对汽车产业产生重大影响。此外,随着工业4.0的到来,中国预计将在「中国製造2025」等计画中实现自动化和工业领域的大规模成长。

- 此外,今年1月,中国比亚迪超越特斯拉,成为全球最大的纯电动车製造商。这一激增是由中国对电动车的需求不断增长推动的,中国销售的汽车中有 40% 是电动车。亚太地区向电动车的转变以及电动大众交通工具系统的发展正在推动对高电压薄膜电容器的需求。

- 印度的消费电子和通讯产业也正在经历显着成长。这些产业预计将为该国高电压薄膜电容器市场的开拓创造有利的市场前景。 ICEA 预计,到 2025 年,印度笔记型电脑和平板电脑製造业的产值将达到 1,000 亿美元。此外,据 IBEF 称,印度的家用电器和消费电子产业预计将成长一倍以上,达到 211.8 亿美元。

- 此外,印度通讯塔产业在过去七年中显着成长了65%。 2022-2023 年通讯业的直接投资为 6.94 亿美元,而 2021-2022 年为 6.68 亿美元。

高电压薄膜电容器产业概况

高电压薄膜电容器市场竞争激烈,供应商规模各异。随着企业继续进行策略性投资以抵消当前的经济放缓,预计市场将出现大量联盟、併购和收购。该市场的一些主要企业包括 TDK Corporation、KYOCERA AVX、Kemet Corporation 和 Vishay Intertechnology。

- 2024 年 4 月 Kyocera AVX 推出两款全新卡扣式电解电容器系列。 SNA系列和SNL系列在长寿命内实现了高可靠性、高耐压和高CV性能。此外,这两个系列均无铅且符合 RoHS 标准,可在 -25℃ 至 +105℃ 的温度范围内使用,非常适合工业应用。

- 2024年4月,KEMET公司宣布发表R41P。 R41P 是一款 Y2/X1 薄膜电容器,其尺寸小(比 R41T 小 40%),使其在空间要求和成本优先的应用中特别有吸引力。因此,其THB值较低,高温下使用寿命较短。此电容器系列适用于需要安全等级 Y2/X1 的「线对地」和「线上」应用中的电磁干扰 (EMI) 抑制滤波器。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 电动车需求不断成长

- 智慧电网需求不断成长

- 对节能技术的需求不断增加

- 市场限制因素

- 原料取得困难

- 生产成本高

第六章 绕线式和迭片式分析

第七章 市场区隔

- 按最终用户产业

- 车

- 航太/国防

- 石油和天然气

- 驱动器和逆变器(非汽车)

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第八章 竞争格局

- 公司简介

- TDK Corporation

- KYOCERA AVX Components Corporation

- Nichicon Corporation

- Kemet Corporation

- Panasonic Industry Co. Ltd

- Vishay Intertechnology nc.

- WIMA GmbH & Co. KG

第九章市场展望

The High Voltage Film Capacitor Market size is estimated at USD 2.77 billion in 2024, and is expected to reach USD 3.52 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

The market for high-voltage film capacitors is witnessing growth due to the increasing adoption of renewable energy sources, such as wind and solar power, which require efficient energy storage and conversion systems. High-voltage film capacitors are crucial in these systems for their stability, long lifespan, and high voltage tolerance. Additionally, the demand for electric vehicles, power transmission and distribution, and the continuous improvements in capacitor technology are some of the factors that are driving market growth.

Key Highlights

- High-voltage film capacitors are electrical components that store and release electrical energy at high voltage levels. They are constructed using thin plastic films as the dielectric material sandwiched between metal electrodes. These capacitors are known for their high insulation resistance, stability, and ability to handle high-voltage applications without significant performance degradation.

- High-voltage film capacitors are favored for their high performance, durability, and ability to withstand harsh conditions, making them indispensable in a wide range of high-voltage and high-power applications.

- High-voltage film capacitors are known for their self-healing properties, which allow them to recover from partial dielectric breakdown. In metalized film capacitors, when a dielectric breakdown occurs, the thin metal layer around the breakdown evaporates, isolating the fault and allowing the capacitor to continue functioning.

- The increasing modernization of power grids and the expansion of high-voltage direct current (HVDC) transmission systems are driving the demand for these capacitors, as they help improve the efficiency and reliability of power transmission over long distances. According to the IEA (International Energy Agency), the world electricity demand is anticipated to increase by nearly 80% between 2012 and 2040. Expansion, modernization, digitization, and decentralization of the electricity infrastructure for improved resiliency and a planned investment from organizations such as the World Economic Forum (USD 7.6 trillion allocated for smart grids for the next 25 years) are expected to change various market dynamics in the global scenario.

- Further, utilities worldwide are increasingly adopting technologies like artificial intelligence and digital twinning, coupled with increased government support and initiatives, which are further attracting investments in smart grid projects. For instance, in January 2024, the US Department of Energy announced the development of technologies aimed at modernizing the electric grid, undergrounding power lines, and replacing aging infrastructure with USD 34 million in grants. The program is aimed at advancing solutions to modernize and boost the country's power grid infrastructure by minimizing extreme weather-related disruptions, lowering costs, and accelerating the adoption of renewable energy.

- The impact of macroeconomic factors such as supply chain disruptions, energy prices, sanctions, trade restrictions, and rising inflation, along with the Russia-Ukraine War, has created a challenging environment for the high-voltage film capacitor market. While disruptions and cost increases pose significant challenges, the ongoing push for renewable energy and electric vehicles continues to drive demand, providing some counterbalance to the negative factors.

High Voltage Film Capacitor Market Trends

Automotive Segment is Expected to Witness a Significant Growth Rate

- High-voltage film capacitors play a crucial role in the automotive industry, particularly in electric vehicles, hybrid electric vehicles, and advanced internal combustion engine vehicles. These capacitors are integral in power electronics systems that manage vehicles' flow and conversion of electrical energy.

- In EVs and HEVs, battery management systems use high-voltage film capacitors to stabilize voltage and manage the battery's charging and discharging cycles. This ensures the battery pack's optimal performance and longevity.

- Further, the increasing initiatives for adopting ABS and ADAS are further boosting the segment's growth. As vehicles become more advanced with ADAS features, the power requirements increase. High-voltage film capacitors help manage these power needs, providing stable and reliable power to sensors and processors that enable ADAS functionalities.

- The Indian government has been actively promoting the adoption of ADAS through various regulations and policies. Initiatives to mandate certain ADAS features in new cars are anticipated, mirroring global trends. This regulatory push is likely to accelerate the widespread adoption of these technologies.

- Further, Automotive Industry Standard 145 requires every vehicle sold in India to have airbags, SBR, ABS, and SWS. The recently introduced AIS 197: BNCAP (Bharat New Car Assessment Program), with its stricter crash testing norms, is expected to catalyze the uptake of passive and active safety, laying the groundwork for ADAS becoming a mandatory requirement.

Asia-Pacific is Expected to Witness Significant Market Growth

- Industrial expansion, renewable energy projects, transportation electrification, consumer electronics growth, smart grid development, technological advancements, supportive government policies, and increasing energy demand propel the growth of high-voltage film capacitors in Asia-Pacific.

- China has been one of the world's largest automotive markets for the past years and is becoming a powerhouse for automotive technology. The country may considerably impact the automotive industry in the coming years as it is open to technological progress. Moreover, with the arrival of Industry 4.0, China is expected to see massive growth in the automation and industry sector, owing to schemes like "Made in China 2025."

- Further, in January of this year, China's BYD outpaced Tesla in becoming the world's largest producer of pure-electric vehicles. The surge is fuelled by rising EV demand in China, where 40% of vehicles sold are electric. This shift toward electric vehicles and the development of electric public transportation systems in Asia-Pacific are driving the demand for high-voltage film capacitors.

- The consumer electronics and telecommunication industries in India are also witnessing significant growth. These industries are expected to create a favorable market scenario for the development of the country's high-voltage film capacitor market. According to ICEA, India can achieve a value of USD 100 billion in the manufacturing of laptops and tablets by 2025. Furthermore, according to IBEF, the Indian appliances and consumer electronics industry is expected to more than double to reach USD 21.18 billion.

- Further, the Indian telecom tower industry has grown significantly by 65% over the past seven years. FDI in the telecommunication sector during 2022-2023 was USD 694 million compared to USD 668 million during 2021-2022.

High Voltage Film Capacitor Industry Overview

The high-voltage film capacitor market is highly competitive, with several vendors of different sizes. As organizations continue to invest strategically in offsetting the present slowdowns, the market is anticipated to encounter a number of partnerships, mergers, and acquisitions. The key companies operating in the market include TDK Corporation, KYOCERA AVX, Kemet Corporation, and Vishay Intertechnology.

- April 2024: Kyocera AVX released two new snap-in aluminum electrolytic capacitors series. The SNA and SNL Series deliver high reliability, high voltage, and high CV performance over long lifetimes. In addition, both series are lead-free compatible and RoHS compliant, rated for temperatures extending from -25°C to +105°C, and ideal for use in commercial and industrial applications, including frequency converters, solar inverters, power inverters, energy storage systems, and power supplies.

- April 2024: KEMET Corporation announced launching the R41P, a Y2/X1 film capacitor whose smaller size (40% smaller than the R41T) is particularly impressive in applications where space requirements and costs are prioritized. Accordingly, the component has a lower THB value and a shorter service life at high temperatures. This capacitor series is suitable for use in filters for suppressing electromagnetic interference (EMI) in "line-to-ground" and "across-the-line" applications that require safety classification Y2/X1.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Electric Vehicles

- 5.1.2 Rising Demand for Smart Grids

- 5.1.3 Increasing Demand for Energy Efficient Technologies

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Raw Materials

- 5.2.2 High Production Cost

6 ANALYSIS OF WOUND TYPE AND LAMINATE TYPE

7 MARKET SEGMENTATION

- 7.1 By End-user Industry

- 7.1.1 Automotive

- 7.1.2 Aerospace and Defense

- 7.1.3 Oil and Gas

- 7.1.4 Drives and Inverters (Non-automotive)

- 7.1.5 Other End-user Industries

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 TDK Corporation

- 8.1.2 KYOCERA AVX Components Corporation

- 8.1.3 Nichicon Corporation

- 8.1.4 Kemet Corporation

- 8.1.5 Panasonic Industry Co. Ltd

- 8.1.6 Vishay Intertechnology nc.

- 8.1.7 WIMA GmbH & Co. KG