|

市场调查报告书

商品编码

1550204

纸杯及容器成型设备:市场占有率分析、产业趋势、成长预测(2024-2029)Paper Cups & Container Forming Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

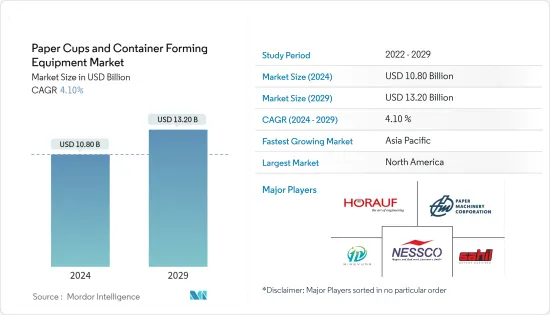

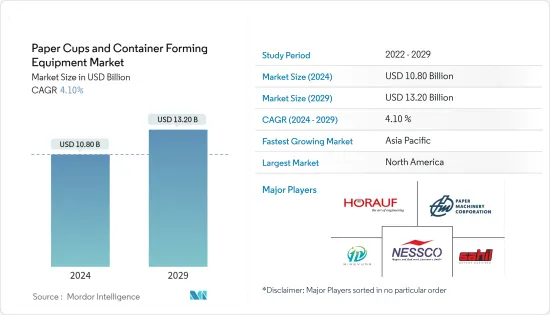

预计2024年纸杯和容器成型设备市场规模为108亿美元,预计到2029年将达到132亿美元,在预测期内(2024-2029年)复合年增长率为4.10%。

纸杯和容器内衬或涂有塑胶以防止洩漏,并且是一次性产品。对于严重依赖纸杯的产业来说,成型纸杯的机器极为重要。纸杯和容器作为食品包装的永续选择越来越受欢迎,这有助于纸杯和容器成型设备市场的成长。

主要亮点

- 各种环境(包括快餐店、办公室和机构)对纸杯的日益偏好,正在推动对纸杯和容器成型设备的需求。此外,消费者越来越多地选择纸杯用于体育场馆、学校、医院等场所,进一步增加了对纸杯及其成型设备的需求。

- 像造纸机械公司这样的企业生产多种型号的杯子和容器成型设备。这些机器满足冷冻甜点和零食包装的快速生产需求。此外,製造商越来越注重整合先进功能,以提高生产力和营运效率。

- 对环保解决方案的需求激增导致可堆肥纸杯和容器的增加,这些纸杯和容器通常内衬聚乳酸 (PLA),以确保热饮和冷饮的耐用性。全自动成型设备主要用于製造这些永续产品,应用于咖啡馆、速食店和餐厅。

- 对纸杯和容器的需求正在上升,但获得低成本的塑胶原料是一个问题。此外,一些餐厅和咖啡馆使用可重复使用杯子的趋势不断增长,可能会减少全球对一次性纸杯的需求。

纸杯及容器成型设备市场趋势

全自动设备可望推动成长

- 全自动杯子及容器成型设备,顾名思义,就是自动化设备。纸杯的一面贴有PE(聚乙烯)薄膜,经过一系列工序加工而成各种容量、尺寸、形状的纸杯。造纸机械公司等公司正在扩展其机器型号,以满足全球食品和饮料供应商和包装公司不断增长的需求,此举将推动市场成长。

- 对纸杯的需求激增,特别是来自食品饮料和酒店等行业的需求,凸显了设备製造商需要抓住这一机会。此外,不同品牌订製纸杯的趋势进一步增加了自动纸杯及容器成型设备的需求。

- 製造商还投资于这些机器的技术改进以推动成长。像 Labo Machinery 这样的公司部署的机器结构坚固、噪音最小、效率高。这些机器利用专为製造纸杯和纸盒而设计的光电系统控制。这些自动化机器具有多种功能和规格,可满足多样化的纸杯生产需求。

- 用于冰淇淋和速食的纸杯和容器主要由纸或纸板製成。用于形成这些杯子和容器的设备基本上是自动化的,简化了操作,从而赢得了製造商的青睐。根据美国(FAO)的数据,美国的纸和纸板产能为74,728,000吨,巩固了其作为市场主要企业的地位。

预计亚太地区将占据最大的市场占有率

- 亚太地区不断增长的人口、不断增长的可支配收入、日益都市化以及对咖啡和茶等饮料日益增长的偏好正在显着推动纸杯的需求。根据国际咖啡组织的资料,亚洲国家以及纽西兰和澳洲将在2023年总合消费4,450万袋咖啡,预计未来几年呈现成长趋势,可能会推动纸杯的需求。

- 该地区快速成长的食品和饮料行业正在推动纸杯和纸盒的需求,直接推动市场成长。根据美国食品农业组织 (FAO) 的资料,亚洲地区的牛奶产量预计将扩大,导致咖啡、奶昔和冰沙等食品和饮料对一次性纸杯的需求不断增长。

- 线上食品配送服务的普及,加上消费者对随身携带咖啡的日益偏好,进一步推动了对纸杯和纸盒的需求。特别是印度电商平台开放数位商务网路(ONDC)的餐厅参与度大幅上升,其食品订购服务从同年2月的仅500家增加到8月的5万家商店参与。

- Nesco India 等该地区的主要企业处于领先地位,提供各种纸杯和最先进的容器成型设备。这些机器的生产速度高达每分钟 90 至 160 杯,为亚洲製造商提供了利润丰厚的出口机会,并支持了市场的成长轨迹。

纸杯及容器成型设备产业概况

纸杯和容器成型设备市场较为分散,Paper Machinery Corporation、Nessco India、Horauf America LLC等主要公司专注于推出新产品、参展市场占有率和展览会、拓展业务以及进行策略併购。

- 2024年4月,美国造纸机械公司宣布参展2024年5月在德国杜塞尔多夫举行的德鲁巴贸易展。该公司将展示纸杯成型设备和纸盖机的尖端技术。

- 2024 年 1 月,Michael Horauf Maschinenfabrik GmbH and Co.KG(德国)推出了 BMP 300 Super Extended,这是一款纸杯成型机,用于高通量生产超大包装杯和容器。这台机器每分钟最多可生产 230 杯咖啡。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 装备技术创新不断提升带动市场成长

- 食品和饮料业对环保包装解决方案的需求不断增长

- 市场限制因素

- 提供更低成本的替代品,例如塑胶杯和发泡聚苯乙烯

第六章 市场细分

- 依设备类型

- 全自动

- 半自动

- 手动的

- 按用途

- 饮食

- 包装

- 其他应用(饭店、零售连锁店)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Zhejiang SEE Machinery Co. Ltd

- Paper Machinery Corporation

- ACE PACK Co. Ltd

- Wenzhou New Smart Machinery Co. Ltd

- Zhejiang New Debao Machinery Co. Ltd

- Sahil Graphics

- Nessco India

- Ruian Mingyuan Machinery Co. Ltd

- Ruian Daqiao Packaging Machinery Co. Ltd(DAKIOU)

- Michael Horauf Maschinenfabrik GmbH and Co. KG

第八章投资分析

第9章市场的未来

The Paper Cups & Container Forming Equipment Market size is estimated at USD 10.80 billion in 2024, and is expected to reach USD 13.20 billion by 2029, growing at a CAGR of 4.10% during the forecast period (2024-2029).

Paper cups and containers, lined or coated with plastic to prevent leaks, are disposable products. Machinery for forming these cups is crucial for industries relying heavily on paper cups. The rising popularity of paper cups and containers as a sustainable option for food packaging is catering to the growth of the paper cup and container-forming machinery market.

Key Highlights

- The increasing preference for paper cups in various settings, including quick-service restaurants, offices, and institutions, is fueling the demand for cup and container-forming equipment. Moreover, as consumers increasingly opt for paper cups in venues like sports stadiums, schools, and hospitals, the need for paper cups and their forming equipment is further amplified.

- Players like Paper Machinery Corporation craft diverse models of cup and container-forming equipment. These machines cater to the swift production needs of frozen dessert and snack packaging. Moreover, manufacturers are increasingly focusing on integrating advanced features to boost productivity and operational efficiency.

- The surge in demand for eco-friendly solutions has led to a rise in compostable paper cups and containers, often lined with polylactic acid (PLA) for durability with both hot and cold beverages. Fully automatic forming machines are predominantly used to create these sustainable products, finding applications in cafes, fast-food outlets, and restaurants.

- While the demand for paper cups and containers is on the rise, the availability of low-cost plastic raw materials poses a challenge. Furthermore, the rising trend of reusable cups in select restaurants and cafes could potentially dampen the global demand for disposable paper cups.

Paper Cups & Container Forming Equipment Market Trends

Fully Automatic Equipment is Expected to Witness Growth

- Fully automatic cup and container-forming machines, as their name implies, are automated devices. They guide paper, coated with PE (polyethylene) film on one side, through a series of processes to create paper cups of diverse capacities, sizes, and shapes. Companies like Paper Machinery Corporation are expanding their machine models to meet the escalating demand from global foodservice and beverage suppliers and packagers, a move set to propel market growth.

- The surging demand for paper cups, especially from industries like food and beverage and hospitality, underscores the need for equipment manufacturers to seize this opportunity. Moreover, the trend for customized paper cups by various brands is further fueling the demand for automatic paper cups and container-forming equipment.

- Manufacturers are also channeling investments into enhancing the technology of these machines to drive growth. Companies such as Labo Machinery are rolling out machines with robust structures, minimal noise, and high efficiency. These machines leverage photoelectric system controls designed to produce paper cups and containers. With various features and specifications, these automatic machines are tailored to meet diverse paper cup production needs.

- Manufacturers craft paper cups and containers for ice creams and fast food primarily from paper and paperboard. The equipment used to form these cups and containers is predominantly automated, simplifying operations and, hence, garnering favor among manufacturers. As per the US Food and Agriculture Organization of the United States (FAO), the United States boasts a substantial production capacity of 74,728 thousand tonnes for paper and paperboard, solidifying its position as a key player in the market.

Asia-Pacific Expected to Hold the Largest Market Share

- The region's increasing population, rise in disposable incomes, and growing urbanization, paired with a rising preference for beverages like coffee and tea, have significantly boosted the demand for paper cups. Data from the International Coffee Organization reveals that in 2023, Asian nations, alongside New Zealand and Australia, collectively consumed 44.5 million bags of coffee, with a projected uptrend in the years ahead, which is likely to propel the demand for paper cup-forming equipment in the region.

- The burgeoning food and beverage industry in the region is set to drive the demand for paper cups and containers, directly fueling market growth. Data from the Food and Agriculture Organization of the United States (FAO) highlights an anticipated expansion in milk production across Asia, a trend that is poised to elevate the need for disposable paper cups, especially for beverages like coffee, milkshakes, and smoothies.

- The rising popularity of online food delivery services, coupled with a growing consumer preference for on-the-go coffee, is further amplifying the demand for paper cups and containers. Notably, the Open Network for Digital Commerce (ONDC), an Indian e-commerce platform, reported a significant surge in restaurant participation, with 50,000 establishments joining its food ordering service in August 2023, up from a mere 500 in February of the same year.

- Key players in the region, like Nessco India, are at the forefront, offering a diverse array of paper cups and cutting-edge container-forming machines. These machines boast impressive production speeds, ranging from 90 to 160 cups per minute, presenting a lucrative export opportunity for Asian manufacturers, thereby bolstering the market's growth trajectory.

Paper Cups & Container Forming Equipment Industry Overview

The paper cups and container forming market is fragmented, with major players such as Paper Machinery Corporation, Nessco India, and Horauf America LLC, among others, vying to increase their market share by introducing new products, showcasing their equipment in expos and trade shows, expanding their operations, and entering strategic mergers and acquisitions.

- In April 2024, Paper Machinery Corporation, a US-based company, announced its participation in the Drupa Trade Show in Dusseldorf, Germany, in May 2024. The company planned to showcase its cutting-edge advancements in paper cup-forming equipment and paper lid machines.

- In January 2024, Michael Horauf Maschinenfabrik GmbH and Co. KG, a German brand, announced the launch of the BMP 300 Super Extended paper cup forming machine to produce extra-large packaging cups and containers with high output. The machine can produce up to 230 cups per minute.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Innovation in Equipment Technologies to Propel Market Growth

- 5.1.2 Increasing Demand for Eco-friendly Packaging Solutions in the Food and Beverage Industry

- 5.2 Market Restraints

- 5.2.1 Availability of Low-cost Alternatives Such as Plastic Cups and Styrofoam

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Fully Automatic

- 6.1.2 Semi-automatic

- 6.1.3 Manual

- 6.2 By Application

- 6.2.1 Food and Beverage

- 6.2.2 Packaging

- 6.2.3 Other Applications (Hospitality, Retail Chains)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zhejiang SEE Machinery Co. Ltd

- 7.1.2 Paper Machinery Corporation

- 7.1.3 ACE PACK Co. Ltd

- 7.1.4 Wenzhou New Smart Machinery Co. Ltd

- 7.1.5 Zhejiang New Debao Machinery Co. Ltd

- 7.1.6 Sahil Graphics

- 7.1.7 Nessco India

- 7.1.8 Ruian Mingyuan Machinery Co. Ltd

- 7.1.9 Ruian Daqiao Packaging Machinery Co. Ltd (DAKIOU)

- 7.1.10 Michael Horauf Maschinenfabrik GmbH and Co. KG