|

市场调查报告书

商品编码

1550323

日本塑胶包装薄膜:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan Plastic Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

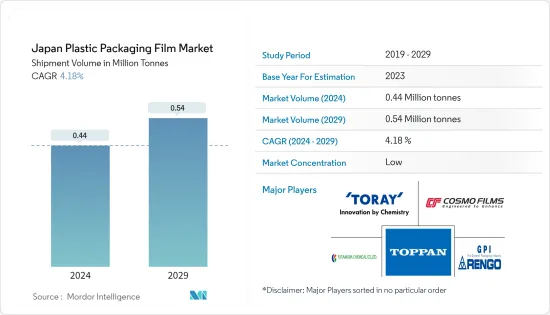

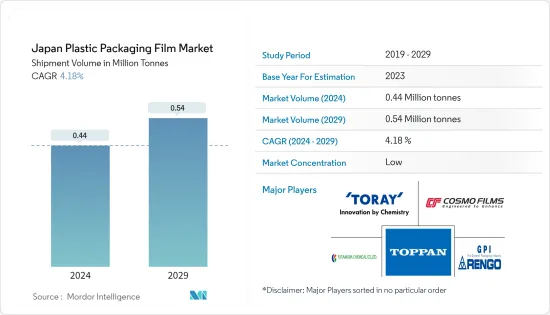

日本塑胶包装薄膜市场规模(以出货量为准)预计将从2024年的44万吨成长到2029年的54万吨,预测期间(2024-2029年)复合年增长率为4.18%。

主要亮点

- 在日本,食品工业的成长有望促进塑胶薄膜的销售。这种快速成长主要归功于薄膜优异的防潮和隔氧性能。聚丙烯包装薄膜的化学和物理性能很有吸引力,食品和饮料行业越来越受到聚丙烯包装薄膜的吸引。

- 日本工业经常需要客製化包装解决方案。专为电子、个人护理和製药行业设计的客製化拉伸膜有助于满足这些多样化的需求。

主要亮点

- 根据 Nipro Corporation 统计,过去几年日本药品包装销售额从 2019 年的 355.3 亿日圆(2.2 亿美元)增至 2023 年的 517.5 亿日圆(3.2 亿美元)。预计未来药品包装的持续成长将持续下去,从而推动对包装薄膜和拉伸薄膜的需求。

- 此外,主要商业中心电子商务和零售活动的激增增加了对安全包装解决方案(尤其是拉伸膜)的需求,以在运输过程中保护货物。拉伸薄膜的持续技术进步带来了高性能变化,以满足广泛的行业需求。

- 日本包装产业长期以来依赖大量塑料,导致对永续和可回收包装薄膜的需求增加。由于塑胶包装的成本效益,领先製造商继续支持塑胶包装。环保且可回收的包装材料(例如拉伸膜)的日益普及是消费者选择和监管要求的结果。

- 日本政府推出了新的塑胶回收策略,目标是到2030年将塑胶包装的回收率降低60%,一次性塑胶的回收率降低25%。这项倡议将影响一次性购物袋、袋子、小袋和小袋的需求,特别是那些由聚丙烯薄膜製成的产品,并抑制市场成长。

日本塑胶包装薄膜市场趋势

对聚丙烯 (PP) 薄膜的强劲需求支撑了营收

- 聚丙烯薄膜越来越受欢迎作为包装材料。由于其密度低,因此具有成本效益,被定位为多种包装应用的替代材料,包括聚乙烯、聚氯乙烯、聚酯和赛珞玢。该薄膜可应用于多种行业,从食品和饮料、製药、个人护理到工业产品、文具、烟草和纺织品。

- 日本快速成长的食品工业预计将提振聚丙烯薄膜的销售。聚丙烯薄膜因其卓越的防潮和氧气阻隔能力而脱颖而出,使其成为食品和饮料公司的首选。公司之所以被该产品所吸引,是因为它能够延长保质期并防止水分和空气等外部因素的影响。

- 随着卫生意识的增强,日本消费者对抗病毒和抗菌产品越来越感兴趣,特别是在住宅、医疗和商业环境中。采用聚合物除生物剂配製的聚丙烯包装薄膜走在了这一趋势的前沿,可有效抑制多种微生物的生长,包括真菌和细菌。这些薄膜采用活性抗菌剂配製,以增强其抗真菌功能。

- 该市场的成长主要是由于软包装薄膜在各行业的日益普及。此外,随着人们对 PP 包装薄膜优势的认识不断增强,尤其是与其他塑胶食品包装薄膜相比,销售量预计将大幅增长。特别是日本食品饮料、电子产品、化妆品和个人护理市场的扩张在推动聚丙烯包装薄膜的需求方面发挥着至关重要的作用。

- 根据2024年4月日本财务省报告,过去几年日本电子设备出口额持续成长,从2019年的585.9亿美元增加至768.7亿美元。随着出口贸易的增加,预计整个市场对高阻隔PP薄膜的需求也将增加。

对糖果和糖果零食的需求促进了销售

- 日本拥有亚洲最大的糖果零食市场之一。日本消费者喜欢外国糖果零食,经常吃糖果零食。特别是,日本糖果零食市场充满活力,巧克力和糖果零食趋势在季节期间多次变化,为新参与企业创造了巨大的机会。

- 随着消费者的健康意识和养生意识日益增强,他们更喜欢口味和营养均衡的偏好食品,并倾向于选择无罪恶感的选择。这一趋势不仅刺激了糖果零食的创新,消费者现在也要求糖果零食采用永续、环保和可回收的包装薄膜。

- 在国内糖果零食业,对轻质、高防护、美观和阻隔性包装的需求不断增长,预计将促进糖果零食包装行业的销售。这种包装的感性吸引力不仅吸引了购买者,而且大大提升了市场前景。

- 根据全日本糖果零食协会2024年4月的公告,2023年日本糖果零食产量约2,000吨。日式糖果零食以传统的日式点心为主,此外还有零嘴零食、饼干、巧克力等。

- 日本糖果零食业的主要企业早已在该行业占据了一席之地,包括明治控股、江崎格力高和森永公司。值得注意的是,像朝日这样以前与糖果零食没有联繫的公司正在向糖果零食生产多元化发展,扩大竞争领域。这种多样化可能会增加日本对包装薄膜的需求。

日本塑胶包装薄膜产业概况

日本塑胶包装薄膜碎片化,碎片化程度中等,如东丽先进薄膜、科斯莫薄膜有限公司、二村化学、凸版等。该市场由提供原材料和包装服务的主要和本地参与者组成。包装和薄膜材料的最新开拓正在塑造市场。

2024 年 3 月 知名印刷包装解决方案供应商凸版(总部:日本)宣布推出 GL-SP,一款针对永续包装的尖端阻隔薄膜。此开创性产品是与印度凸版特种薄膜 (TSF) 合作开发的,采用双轴延伸聚丙烯(BOPP) 作为基材。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 全行业对轻量、永续包装的需求不断增长

- 食品、饮料和製药业的强劲需求推动成长

- 市场限制因素

- 政府对塑胶使用采取严格政策

第六章 市场细分

- 按类型

- 聚丙烯(双轴延伸聚丙烯(BOPP)、流延聚丙烯(CPP))

- 聚乙烯(低密度聚乙烯(LDPE)、线型低密度聚乙烯(LLDPE))

- 聚对苯二甲酸乙二醇酯(双向拉伸聚对苯二甲酸乙二醇酯(BOPET))

- 聚苯乙烯

- 生物基

- PVC、EVOH、PETG等薄膜类型

- 按最终用户

- 食品

- 糖果零食

- 冷冻食品

- 生鲜食品

- 乳製品

- 干粮

- 肉类、家禽、鱼贝类

- 宠物食品

- 其他食品

- 卫生保健

- 个人护理和家庭护理

- 工业包装

- 其他最终用户

- 食品

第七章 竞争格局

- 公司简介

- Toray Advanced Film Co. Ltd

- Futamura Chemical Co., Ltd.

- Cosmo Films Limited

- Toppan Packaging Product Co. Ltd.

- Rengo Co., Ltd

- Kingchuan Packaging

- KISCO LTD

- Gunze Limited

- GSI Creos Corporation

- Unitika LTD.

第 8 章回收与永续性观点

第九章 市场机会及未来趋势

The Japan Plastic Packaging Film Market size in terms of shipment volume is expected to grow from 0.44 Million tonnes in 2024 to 0.54 Million tonnes by 2029, at a CAGR of 4.18% during the forecast period (2024-2029).

Key Highlights

- The food industry's growth in Japan is poised to boost plastic film sales. This surge is primarily due to the films' exceptional moisture and oxygen barrier capabilities. The food and beverage sectors are increasingly drawn to polypropylene packaging films, enticed by their appealing chemical and physical attributes.

- Japanese industries frequently demand bespoke packaging solutions for their distinct products. Tailored stretch films, designed for the electronics, personal care, and pharmaceutical sectors, are instrumental in addressing these varied requirements.

- According to Nipro Corporation, its pharmaceutical packaging-related sales in Japan increased in the past years from JPY 35.53 billion (USD 0.22 billion) in 2019 to JPY 51.75 billion (USD 0.32 billion) in 2023. This constant increase in pharmaceutical packaging is expected to continue in the future, consequently driving the demand for packaging films and stretch films.

- Moreover, the surge in e-commerce and retail activities in major commercial hubs has heightened the need for secure packaging solutions, particularly stretch films, to safeguard goods during transit. Ongoing technological advancements in stretch films have resulted in the creation of high-performance variants tailored to meet a wide array of industry requirements.

- Japan's packaging industry has long relied on significant amounts of plastic, prompting a growing demand for sustainable and recyclable packaging films. Major manufacturers continue to favor plastic packaging due to its cost-effectiveness. The increasing popularity of environmentally friendly and recyclable packaging materials, such as stretch films, is a result of consumer choices and regulatory requirements.

- Japan's government has rolled out a fresh plastic circulation strategy, targeting a 60% recycling rate for plastic packaging and a 25% cut in single-use plastics by 2030. This initiative is poised to temper market growth, particularly impacting the demand for single-use shopping bags, sacks, pouches, and sachets crafted from polypropylene films.

Key Highlights

Japan Plastic Packaging Film Market Trends

Strong Demand For Polypropylene (PP) Films Aids the Top-Line

- Polypropylene film, an increasingly favored packaging material, is versatile. Its low density makes it cost-effective and positions it as a substitute for a range of materials, such as polyethylene, polyvinyl chloride, polyester, and cellophane, in numerous packaging applications. This film finds applications across various industries, from food and beverages, pharmaceuticals, and personal care to industrial goods, stationery, cigarettes, and textiles.

- The burgeoning food industry in Japan is poised to bolster the sales of polypropylene films. These films stand out for their exceptional moisture and oxygen barrier capabilities, making them a prime choice for food and beverage companies. Businesses have been drawn to their products for their capacity to prolong shelf life and shield against external elements like moisture and air.

- With a heightened focus on hygiene, Japanese consumers increasingly turn to antiviral and antibacterial products, especially in residential, medical, and commercial settings. Polypropylene packaging films infused with polymeric biocides are at the forefront of this trend, effectively inhibiting the growth of various microorganisms, including fungi and bacteria. These films are engineered with an active antimicrobial agent, bolstering their antifungal capabilities.

- The market is witnessing growth primarily due to the rising adoption of flexible packaging films across diverse industries. Moreover, as awareness regarding the advantages of PP packaging films, especially in comparison to other plastic food packaging films, increases, sales are expected to surge. Notably, the expanding food & beverage, electronics, and cosmetics & personal care markets in Japan are playing a pivotal role in driving the demand for polypropylene packaging films.

- According to Ministry of Finance Japan report in April 2024, the export value of electronics from Japan have been consistently increasing in the past few years from USD 58.59 billion in 2019 to USD 76.87 billion. With the increasing export trade the demand for hight-barrier PP films are also expected to increase across the market.

Demand From Candy & Confectionery Segments To Boost Sales

- Japan boasts one of the largest confectionery markets in Asia. Japanese consumers exhibit a penchant for foreign confectionery, often indulging in sweet treats. Notably, chocolate and sweet confectionery trends shift multiple times within a season, rendering the Japanese confectionery market dynamic and a very significant opportunity for new players.

- Amid a surge in health consciousness and a quest for wellness, consumers favor indulgences that strike a balance between taste and nutrition, leaning towards guilt-free options. This trend isn't just fueling innovation in the confectionery sector and driving consumers to seek sustainable, eco-friendly, and recyclable packaging films for their treats.

- The country's confectionery sector's growing demand for lightweight, protective, visually appealing, and high-barrier packaging is set to drive up sales in the confectionery packaging segment. The sensory appeal of these packages not only entices purchases but also significantly boosts the market's prospects.

- In 2023, Japan produced approximately two thousand metric tons of confectioneries, as reported by the All Nippon Kashi Association in April 2024. The nation's confectionery landscape is dominated by traditional Japanese confectioneries (wagashi), alongside snack foods, biscuits, and chocolates.

- Key players in Japan's confectionery sector, such as Meiji Holdings, Ezaki Glico, and Morinaga & Company, have long been established in the industry. Notably, companies like Asahi, traditionally outside the confectionery realm, have diversified into sweet treat production, broadening the competitive field. This diversification is also poised to drive up the demand for packaging films in Japan.

Japan Plastic Packaging Film Industry Overview

Japan plastic film packaging is fragmented, displaying moderate fragmentation with Toray Advanced Film Co. Ltd, Cosmo Films Limited, Futamura Chemical Co., Ltd., TOPPAN Inc, and more. The market comprises major and local players supplying raw materials and packaging services. The latest developments in packaging and film materials are shaping the market.

March 2024: Toppan, a prominent printing and packaging solutions provider headquartered in Japan, has unveiled its latest offering, GL-SP, a cutting-edge barrier film designed for sustainable packaging. Developed in partnership with India's TOPPAN Speciality Films (TSF), this pioneering product uses biaxially oriented polypropylene (BOPP) as its base material.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For Light-Weight and Sustainable Packaging Across Industries

- 5.1.2 Robust Demand From the Food, Beverage and Pharmaceutical Sector Aids Growth

- 5.2 Market Restraints

- 5.2.1 Stringent Government Policies Against the Use of Plastic

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Polypropylene (Biaxially Oriented Polypropylene (BOPP), Cast polypropylene (CPP))

- 6.1.2 Polyethylene (Low-Density Polyethylene (LDPE), Linear low-density polyethylene (LLDPE))

- 6.1.3 Polyethylene Terephthalate (Biaxially Oriented Polyethylene Terephthalate (BOPET))

- 6.1.4 Polystyrene

- 6.1.5 Bio-Based

- 6.1.6 PVC, EVOH, PETG, and Other Film Types

- 6.2 By End User

- 6.2.1 Food

- 6.2.1.1 Candy & Confectionery

- 6.2.1.2 Frozen Foods

- 6.2.1.3 Fresh Produce

- 6.2.1.4 Dairy Products

- 6.2.1.5 Dry Foods

- 6.2.1.6 Meat, Poultry, And Seafood

- 6.2.1.7 Pet Food

- 6.2.1.8 Other Food Products

- 6.2.2 Healthcare

- 6.2.3 Personal Care & Home Care

- 6.2.4 Industrial Packaging

- 6.2.5 Other End-use Industry

- 6.2.1 Food

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toray Advanced Film Co. Ltd

- 7.1.2 Futamura Chemical Co., Ltd.

- 7.1.3 Cosmo Films Limited

- 7.1.4 Toppan Packaging Product Co. Ltd.

- 7.1.5 Rengo Co., Ltd

- 7.1.6 Kingchuan Packaging

- 7.1.7 KISCO LTD

- 7.1.8 Gunze Limited

- 7.1.9 GSI Creos Corporation

- 7.1.10 Unitika LTD.