|

市场调查报告书

商品编码

1550478

SEA(东南亚)的数位转型:市场占有率分析、产业趋势、成长预测(2024-2029)SEA Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

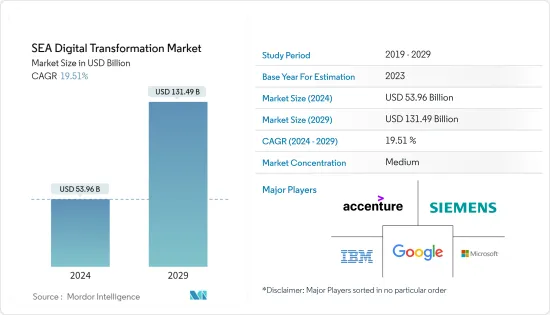

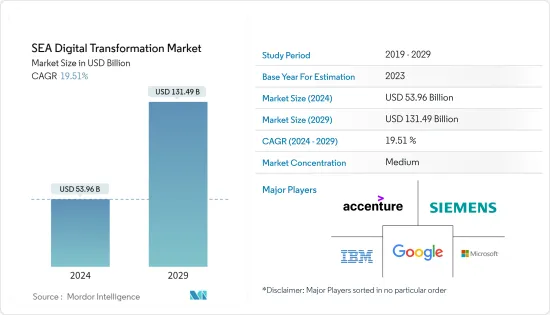

SEA(东南亚)数位转型市场规模预计到 2024 年为 539.6 亿美元,预计到 2029 年将达到 1314.9 亿美元,预测期内(2024-2029 年)复合年增长率为 19.51,预计将增长%。

在科技快速采用、网路普及率不断上升以及政府支持政策的推动下,东南亚(东南亚)的数位转型市场正在经历强劲成长。

主要亮点

- 人工智慧、机器学习、物联网和云端运算等技术的进步正在推动各个领域的数位转型。这些创新使公司能够简化业务、增强客户互动并创新经营模式。

- 东南亚(SEA)拥有强大的网路和行动普及率,推动了数位参与和数位服务的使用。连接性的增强推动了电子商务、数位付款和线上服务的成长,加速了该地区的数位化发展。

- 东南亚各国政府正在製定政策和倡议,以促进数位化和培育智慧城市。泰国 4.0、马来西亚数位经济蓝图和新加坡智慧倡议等着名计画正在帮助培育数位友善景观。

- 在银行和金融服务领域,我们正在利用数位工具透过数位银行、金融科技解决方案、区块链等来改变客户体验。这个数位化支点正在简化业务、增强客户服务并引入创新的金融服务。

- 然而,随着数位化的发展,网路安全和资料外洩的威胁也随之增加。这些风险不仅损害对数位服务的信任,也为企业全面拥抱数位转型设置障碍。

中东和非洲地区数位转型市场趋势

巨量资料分析和其他技术的更多采用将推动市场

- 人工智慧和机器学习透过自动化工作、提高效率和降低营运成本正在彻底改变产业。这项转变释放了人力资源,使其能够专注于策略性倡议。人工智慧预测维护和品管对于减少製造中的停机时间和缺陷至关重要。

- 企业正在利用人工智慧和机器学习来提供个人化的客户体验,从而提高忠诚度和满意度。例如,在电子商务中,根据浏览历史和偏好来提案产品。

- 例如,在马来西亚,从房地产到银行业,AI的热潮让投资者的兴趣显着增加。该国资料中心计划的激增凸显了其科技主导的经济繁荣,并暗示了相关产业的溢出效应。儘管2024年净流出1.5亿美元,但外国投资者正稳步重拾信心,为马来西亚股市的长期前景描绘出乐观的景象。

- 将人工智慧和巨量资料分析纳入智慧城市计划将加强城市管理并提高生活品质。这些技术有助于有效的资源配置、优化交通流量并增强公共服务。新加坡的智慧国家计划利用物联网和人工智慧来实现更有效的城市基础设施和服务管理。

- 互联网在这些技术的发展和应用中发挥着重要作用。新加坡提供世界上最好的网路连线。例如,截至 2023 年 11 月,Singtel 在新加坡提供最佳的 5G 覆盖体验,得分为 8.3,其次是 StarHub 和 M1。消息资讯来源透露,Simba 的 5G 覆盖体验评分最低,得分为 6.2。 2023年初,新加坡5G网路平均峰值下载速度超过700Mbps。新加坡电信不仅提供高品质的 5G 连接,还证明自己是 2023 年 5G 游戏体验的领先供应商之一。

分析、人工智慧和机器学习可望推动市场发展

- 企业正在利用进阶分析来筛选大量资料,以做出明智的决策。其结果是提高了业务效率、完善了策略规划并加深了对客户的了解。特别是在零售业,预测分析对于预测需求、优化库存和客製化行销技术至关重要。

- 例如,2024年5月,新加坡宣布了一项新倡议——数位企业蓝图(DEB),旨在透过引入人工智慧技术来加强中小企业(SME)的数位转型。 DEB 是由通讯和资讯部 (MCI)、通讯和媒体发展局 (IMDA) 以及新加坡网路安全局与主要行业相关人员合作推动的。

- 人工智慧和机器学习透过自动化任务和提高效率正在彻底改变产业。人工智慧和机器学习的整合可以最大限度地减少错误,降低人事费用,并释放人力资本来承担更高层级的职责。在製造业中,人工智慧驱动的机器人和自动品质检查正在优化生产,而在客户服务中,人工智慧聊天机器人正在管理日常查询,以提高回应时间和满意度。

- 新加坡等国家正快速投资以人工智慧技术为基础的企业。例如,截至 2024 年 6 月,Trax Technology Solutions Pte. Ltd 在新加坡人工智慧企业中名列前茅,资本投资超过 10.7 亿美元。值得注意的是,新加坡的创业投资创投在 2021 年达到顶峰,跃升至 25 亿美元。

- 人工智慧、机器学习和物联网技术越来越多地被纳入智慧城市计画中,以提高城市的生活水准。这些解决方案简化了交通、能源使用和公共服务,最终提高了居民的生活品质。例如,在新加坡的智慧国家计画中,人工智慧和物联网对于有效监督城市基础设施至关重要,从而显着增强交通和安全服务。

SEA(东南亚)数位转型产业概览

SEA(东南亚)的数位转型产业市场较为分散,参与者规模庞大且区域参与者数量众多。市场上的主要企业正在采取合作伙伴关係、协议、创新和收购等策略来增强其服务产品并获得永续的竞争优势。

- 2024 年 6 月 TikTok 背后的中国科技巨头位元组跳动累计约 100 亿元人民币(21.3 亿美元)在马来西亚建立人工智慧中心。此举符合各大科技公司向东南亚扩张的趋势。此外,马来西亚投资、贸易和工业部证实,位元组跳动正在加强其在马来西亚柔佛州的资料中心业务,并将额外投资 15 亿元人民币(约 1,000 亿日元)来扩大业务。

- 2024 年 4 月 缅甸大型私人银行 KBZ Bank 将与新加坡人工智慧信用评分公司 FinbotsAI 建立策略伙伴关係。此次合作旨在加强 KBZ 银行的信用风险管理。根据此次合作,KBZ 银行将整合 FinbotsAI 最先进的信用建模平台 CreditX,以更高的准确性和速度评估零售和小型企业申请人的信用度。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章产业生态系分析

第五章市场动态

- 市场驱动因素

- 巨量资料分析和其他技术的更多采用将推动市场

- 行动装置和应用程式的快速采用

- 市场限制因素

- 对资讯隐私和安全的担忧

第六章当前市场场景和数位转型的演变

第七章 关键指标

- 科技支出趋势

- 物联网设备数量

- 网路攻击总数

- 技术人员动向

- 网路在每个国家的发展与传播

- 数位竞争力排名

- 固定和行动宽频

- 云端渗透率

- 人工智慧渗透率

- 电商渗透率

第八章市场区隔

- 按类型

- 分析、人工智慧、机器学习

- 扩增实境(XR)

- IoT

- 工业机器人

- 区块链

- 积层製造/3D列印

- 网路安全

- 云端运算和边缘运算

- 其他(数位双胞胎、移动性、连结性)

- 按最终用户产业

- 製造业

- 石油、天然气和公共产业

- 零售/电子商务

- 运输/物流

- 卫生保健

- BFSI

- 通讯/IT

- 政府/公共机构

- 其他最终用户产业(教育、媒体与娱乐、环境等)

第9章 竞争格局

- 公司简介

- Accenture PLC

- Google LLC(Alphabet Inc.)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- EMC Corporation(Dell EMC)

- Oracle Corporation

- Adobe Inc.

- Amazon Web Services Inc.(Amazon.com Inc.)

- Apple Inc.

- Salesforce.com Inc.

- Cisco Systems Inc.

第10章 关键改造技术

- 量子计算

- 製造即服务 (MaaS)

- 认知过程自动化

- 奈米科技

第十一章 市场机会及未来趋势

The SEA Digital Transformation Market size is estimated at USD 53.96 billion in 2024, and is expected to reach USD 131.49 billion by 2029, growing at a CAGR of 19.51% during the forecast period (2024-2029).

The Southeast Asia (SEA) digital transformation market is experiencing robust growth driven by rapid technological adoption, increasing internet penetration, and supportive government policies.

Key Highlights

- Technological advancements, notably in AI, ML, IoT, and cloud computing, are driving digital transformations across diverse sectors. These innovations empower businesses to streamline operations, elevate customer interactions, and innovate business models.

- In Southeast Asia (SEA), robust internet and mobile penetration rates are catalyzing digital engagement and the uptake of digital services. This heightened connectivity is fueling the growth of e-commerce, digital payments, and online services, thereby expediting the region's digital evolution.

- SEA governments are rolling out policies and initiatives to champion digitalization and foster smart cities. Notable programs like Thailand 4.0, Malaysia's Digital Economy Blueprint, and Singapore's Smart Nation initiative are instrumental in cultivating a digital-friendly landscape.

- The banking and financial services realm is harnessing digital tools to revamp customer experiences through digital banking, fintech solutions, or blockchain. This digital pivot is streamlining operations, enhancing customer service, and introducing novel financial offerings.

- However, as digitalization intensifies, the specter of cybersecurity threats and data breaches looms larger. These risks not only jeopardize trust in digital services but also pose a hindrance to businesses fully embracing the digital shift.

SEA Digital Transformation Market Trends

Increase in the Adoption of Big Data Analytics and Other Technologies to Drive the Market

- AI and ML are revolutionizing industries by automating tasks, boosting efficiency, and cutting operational costs. This shift allows human resources to concentrate on strategic endeavors. AI's predictive maintenance and quality control are pivotal in reducing downtime and defects in manufacturing.

- Companies are leveraging AI and ML for personalized customer experiences, fostering loyalty and satisfaction. E-commerce, for instance, tailors product suggestions based on browsing history and preferences.

- For instance, Malaysia is experiencing a significant uptick in investor interest, spanning sectors from real estate to banking, all thanks to the AI boom. The country's surge of data center projects underscores a tech-driven economic surge and hints at a ripple effect across related industries. Although 2024 saw a net outflow of USD 150 million, foreign investors are showing a steady return of confidence, painting an optimistic picture for Malaysian equities in the long run.

- Integrating AI and Big Data Analytics into smart city projects enhances urban management and elevates the quality of life. These technologies facilitate efficient resource allocation, optimize traffic flow, and bolster public services. Singapore's Smart Nation initiative exemplifies this, leveraging IoT and AI for more effective urban infrastructure and service management.

- The internet plays an important role in developing and applying these technologies. Singapore has one of the world's best and most connected internet services. For instance, as of November 2023, Singtel provided the best 5G coverage experience across Singapore, with a score of 8.3, followed by StarHub and M1. According to the source, Simba had the lowest 5G coverage experience rating, with a score of 6.2. At the beginning of 2023, Singapore had an average peak download speed of over 700 Mbps on its 5G networks. In addition to providing quality 5G connectivity, Singtel has proven itself in 2023 to be one of the leading providers of 5G gaming experiences.

Analytics, Artificial Intelligence, and Machine Learning is Expected to Drive the Market

- Organizations are harnessing advanced analytics to sift through extensive data, empowering them to make well-informed decisions. This, in turn, boosts operational efficiency, refines strategic planning, and deepens customer understanding. Notably, in retail, predictive analytics are pivotal, aiding in demand projections, inventory optimization, and tailored marketing approaches.

- For instance, in May 2024 - Singapore unveiled the Digital Enterprise Blueprint (DEB), a fresh initiative aimed at bolstering the digital transformation of small and medium-sized enterprises (SMEs) through the adoption of AI technologies. The DEB is a collaborative effort between the Ministry of Communications and Information (MCI), the Infocomm Media Development Authority (IMDA), and the Cyber Security Agency of Singapore in partnership with key industry players.

- AI and ML are revolutionizing industries by automating tasks and boosting efficiency. Their integration minimizes errors, slashes labor expenses, and liberates human capital for higher-level responsibilities. In manufacturing, AI-driven robots and automated quality checks are optimizing production, and in customer service, AI chatbots are enhancing response times and satisfaction by managing routine queries.

- Countries like Singapore are witnessing rapid investment in AI technology-based businesses. For instance, by June 2024, Trax Technology Solutions Pte. Ltd held the top spot among Singapore's AI startups, boasting a capital investment exceeding USD 1.07 billion. Notably, Singapore's AI venture capital investment hit its zenith in 2021, surging to USD 2.5 billion.

- AI, ML, and IoT technologies are increasingly being integrated into smart city initiatives, elevating urban living standards. These solutions streamline traffic, energy use, and public services, ultimately enriching residents' quality of life. Take Singapore's Smart Nation initiative, for example, where AI and IoT are pivotal in efficiently overseeing urban infrastructure, leading to notable enhancements in transportation and public safety services.

SEA Digital Transformation Industry Overview

The SEA Digital Transformation Industry market is fragmented, with the presence of major players and numerous regional companies. Key players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain a sustainable competitive advantage.

- June 2024: ByteDance, the Chinese tech giant behind TikTok, earmarked approximately CNY 10 billion (USD 2.13 billion) to establish an artificial intelligence hub in Malaysia. This move is in line with a trend of major tech players venturing into Southeast Asia. Additionally, ByteDance is bolstering its data center presence in Malaysia's Johor state, injecting an extra CNY 1.5 billion into the expansion, as confirmed by Malaysia's Ministry of Investment, Trade, and Industry.

- April 2024: Myanmar's premier privately-owned bank, KBZ Bank, forged a strategic alliance with FinbotsAI, a Singaporean AI credit scoring company. This collaboration aims to enhance KBZ Bank's credit risk management. Under this partnership, KBZ Bank will integrate FinbotsAI's cutting-edge credit modeling platform, CreditX, to evaluate the creditworthiness of its retail and SME applicants with heightened precision and speed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Adoption of Big Data Analytics and Other Technologies to Drive the Market

- 5.1.2 The Rapid Proliferation of Mobile Devices and Apps

- 5.2 Market Restraints

- 5.2.1 Concerns About the Privacy and Security of Information

6 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

7 KEY METRICS

- 7.1 Technology Spending Trends

- 7.2 Number of IoT Devices

- 7.3 Total Cyberattacks

- 7.4 Technology Staffing Trends

- 7.5 Internet growth and penetration in individual countries

- 7.6 Digital Competitiveness Ranking

- 7.7 Fixed and mobile broadband coverage

- 7.8 Cloud adoption

- 7.9 AI adoption

- 7.10 E-commerce Penetration

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.1.3 Use Case Analysis

- 8.1.1.4 Market Outlook

- 8.1.2 Extended Reality (XR)

- 8.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.2.3 Use Case Analysis

- 8.1.2.4 Market Outlook

- 8.1.3 IoT

- 8.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.3.3 Use Case Analysis

- 8.1.3.4 Market Outlook

- 8.1.4 Industrial Robotics

- 8.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.4.3 Use Case Analysis

- 8.1.4.4 Market Outlook

- 8.1.5 Blockchain

- 8.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.5.3 Market Outlook

- 8.1.6 Additive Manufacturing/3D Printing

- 8.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.6.3 Use Case Analysis

- 8.1.6.4 Market Outlook

- 8.1.7 Cybersecurity

- 8.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.7.3 Use Case Analysis

- 8.1.7.4 Market Outlook

- 8.1.8 Cloud and Edge Computing

- 8.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.8.3 Use Case Analysis

- 8.1.8.4 Market Outlook

- 8.1.9 Others (Digital Twin, Mobility, and Connectivity)

- 8.1.9.1 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.9.2 Market Breakdown by Type (Digital Twin, Mobility and Connectivity)

- 8.1.9.3 Use Case Analysis

- 8.1.9.4 Market Outlook

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.2 By End-user Industry

- 8.2.1 Manufacturing

- 8.2.2 Oil, Gas, and Utilities

- 8.2.3 Retail & e-commerce

- 8.2.4 Transportation and Logistics

- 8.2.5 Healthcare

- 8.2.6 BFSI

- 8.2.7 Telecom and IT

- 8.2.8 Government and Public Sector

- 8.2.9 Other End-user Industries (Education, Media & Entertainment, Environment etc)

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Accenture PLC

- 9.1.2 Google LLC (Alphabet Inc.)

- 9.1.3 Siemens AG

- 9.1.4 IBM Corporation

- 9.1.5 Microsoft Corporation

- 9.1.6 Cognex Corporation

- 9.1.7 Hewlett Packard Enterprise

- 9.1.8 SAP SE

- 9.1.9 EMC Corporation (Dell EMC)

- 9.1.10 Oracle Corporation

- 9.1.11 Adobe Inc.

- 9.1.12 Amazon Web Services Inc. (Amazon.com Inc.)

- 9.1.13 Apple Inc.

- 9.1.14 Salesforce.com Inc.

- 9.1.15 Cisco Systems Inc.

10 KEY TRANSFORMATIVE TECHNOLOGIES

- 10.1 Quantum Computing

- 10.2 Manufacturing as a Service (MaaS)

- 10.3 Cognitive Process Automation

- 10.4 Nanotechnology