|

市场调查报告书

商品编码

1624573

北美自动储存与搜寻系统:市场占有率分析、产业趋势/统计、成长预测(2025-2030)North America Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

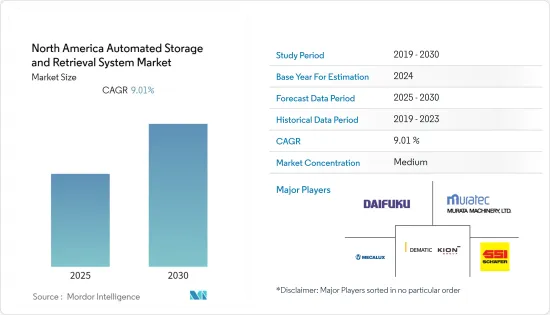

北美自动化储存和搜寻系统市场预计在预测期内复合年增长率为 9.01%

主要亮点

- 北美是全球最大的自动储存和搜寻系统(ASRS)市场之一,以美国主导。该地区的製造业是 ASRS 解决方案的巨大需求来源,依赖美国经济的主导地位,美国经济占该地区经济产出的 82%。

- 此外,库存单位 (SKU) 的快速成长使得批发商和经销商难以就业务做出明智的决策。这一因素推动了对劳动力、设备和技术的更创新使用的需求。推动自动化物料输送系统的关键因素是降低成本、提高劳动效率和空间限制。

- 目前的市场环境提高了产品可用性,并增加了对更频繁和更小交付的需求。自动化物流作业可以立即将组织的订单准确性提高一半到几个百分点。

- 其他值得注意的因素,例如该国工人工资的稳定增长,促使仓库运营商寻求替代仓储解决方案,而製造业和零售业等行业的劳动力扩张预计将推动对自动化的需求。使用者产业

- 此外,在美国,由于政府旨在增加国内产量而不是进口成品的政策,预计一些国内机器人解决方案将在预测期内呈现稳健成长。

- 此外,公司越来越注重在业务营运中采用多种技术,以降低整体成本并获得相对于竞争对手的竞争优势。物料输送解决方案供应商製造灵活的系统,可以与其他系统无缝集成,作为整体物料输送计划的一部分,使最终用户能够专注业务中的空间和时间的效用。方法。

北美自动化储存和搜寻系统市场趋势

零售业预计将占据主要市场占有率

- 北美的零售市场是世界上最大的零售市场之一。该国拥有强大的全通路供应商,使其成为 ASRS 等物料输送解决方案的最大消费者之一。电子商务企业对 ASRS 的需求特别高,因为它们的履约中心需要高吞吐量。

- 美国是该地区的主要零售市场之一。据估计,每年全国三分之二以上的GDP是由零售消费所产生的。该国的电子商务部门的销售额持续超过实体店。由于自动化是一个关键的差异化因素,线上零售商和全通路零售商之间的竞争正在加剧。

- 此外,该地区大量的线上消费者和较高的网路普及率预计将成为该国零售业的主要推动要素。该地区的网路普及率全球最高,达89.4%。

- 此外,该地区的零售商已经认识到 ASRS 的需求,并正在为消费者提供更多有形的好处,例如忠诚度福利。该技术越来越多地与多个商业网站集成,以提供无缝体验。

- 随着冠状病毒大流行期间需求激增,一些公司正在投资 ASRS 的开发。例如,2020 年 7 月,加拿大下一代製造 (Ngen) 向计划将开发和生产自动化而非手动储存和搜寻系统技术,以阻止冠状病毒的传播。

美国占最大市场占有率

- 根据交通统计局的数据,美国,包括私人和公立机场。美国最大的机场是丹佛国际机场,每年服务超过 3,100 万名乘客。我国机场使用的储存搜寻系统数量在全球占有很大份额。

- 此外,在美国,由于政府旨在增加国内产量而不是进口成品的政策,预计一些国内机器人解决方案将在预测期内呈现稳健成长。

- 根据RIA估计,截至2020年9月,美国约有29.3万台机器人在使用。随着该国製造业更多地转向国内生产机器人,预计未来四年该国製造业将对包括 ASRS 在内的物料输送方案产生巨大需求。

- 此外,电子商务是 ASRS 等自动化物流仓库需求的主要驱动力,因为消费者要求比以往更快的交货时间。与电子商务相关的网路购物的增加导致2020年电子商务销售额额外增加1,748.7亿美元(资料来源:美国商务部)。该系统透过准确追踪来维护库存记录的能力对产业来说很有价值。同时,网路零售流程主要由电脑自动系统控制驱动,ASRS可以轻鬆集成,同时实现高效率。这些综合因素正在推动零售业对 ASRS 的需求。

- 此外,其他显着因素,例如支付给工人的工资的稳定增长,也促使仓库营运商寻求替代的仓库管理解决方案。预计这些因素将推动几个高度依赖劳动力的最终用户产业对自动化的需求。

北美自动化储存和搜寻系统产业概述

北美自动化储存和搜寻系统市场竞争激烈,许多大公司进入该市场。供应商根据该地区客户的需求提供广泛的产品系列。主要企业包括Daifuku、Schaefer Holding International Gmbh、Dematic Group-KION Group AG、Murata Machinery Ltd、Mecalux SA等。近期市场趋势如下。

- 2021 年 2 月 - 罗克韦尔自动化和FANUC America 宣布成立学徒计画联盟,以教育和支援储存和配送领域的机器人和自动化工人技能的发展。

- 2020 年 2 月 - ABB Limited 和 Covariant 宣布建立伙伴关係,将人工智慧储存解决方案推向市场,首先是完全自主的仓库履约履行解决方案。此次伙伴关係将两家对人工智慧驱动的机器人有着通用愿景的公司聚集在一起。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 日益重视职业安全

- 人们对人事费用的担忧日益加剧

- 市场限制因素

- 对熟练劳动力的需求以及对人工替代的担忧

- COVID-19 对市场的影响

第六章 市场细分

- 依产品类型

- 固定通道法

- 轮播(水平轮播+垂直轮播)

- 垂直升降模组

- 按最终用户产业

- 飞机场

- 车

- 饮食

- 一般製造业

- 小包裹

- 零售业

- 其他最终用户产业

- 国家名称

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Daifuku Co. Ltd

- Schaefer Systems International Pvt Ltd

- Dematic Group(KION Group AG)

- Murata Machinery Ltd

- Mecalux SA

- Honeywell Intelligrated

- Swisslog Holding AG

- Knapp AG

- Kardex Remster

- Bastian Solutions Inc.

- Toyota Industries Corporation

- Viastore Systems Inc.

第八章投资分析

第9章 市场的未来

The North America Automated Storage and Retrieval System Market is expected to register a CAGR of 9.01% during the forecast period.

Key Highlights

- North America is one of the largest markets for automated storage and retrieval systems (ASRS) globally, led by the United States. The region's manufacturing sector, which is a vast source of demand for the ASRS solutions, hinges on the dominant US economy, accounting for 82% of the region's economic output.

- Moreover, with the rapid growth in stock-keeping units (SKUs), wholesalers and distributors find it difficult to make informed decisions about the operations. This factor is driving the need for more innovative usage of labor, equipment, and technology. The significant factors driving automated material-handling systems are cost savings, labor efficiency, and space constraints.

- In the current market landscape, there is an increase in available products and demand for more frequent and smaller deliveries. The automated distribution operations can immediately increase an organization's order accuracy, from half a percent up to several percentage points.

- Other prominent factors, such as steady growth in wages paid to workers in the country, have made warehouse operators look forward to alternate solutions for warehouse management and are expected to drive the demand for automation in several end-user industries that are highly dependent on the workforce, such as manufacturing and retail, among others.

- Furthermore, the United States, over the forecast period, is expected to witness robust growth in several domestic robotic solutions, owing to government policies that aim at increasing domestic production rather than importing finished goods.

- Moreover, enterprises are focusing more on adopting diverse technologies for their business operations to reduce their overall costs and gain a competitive advantage over their rivals. Vendors of material handling solutions have gradually veered toward the modern approach of helping end-users focus on the space and time utility of their operations by manufacturing flexible systems that can seamlessly integrate with other systems as a part of the overall material handling plan.

North America Automated Storage and Retrieval System Market Trends

Retail Industry is Expected to Hold Significant Market Share

- North America's retail market is one of the largest in the world. The country has a high presence of omnichannel vendors that stand to be one of the largest consumers of material handling solutions, such as ASRS. The demand for ASRS is especially high from the e-commerce establishments that require high throughput operations in their fulfillment centers.

- The United States stands to be one of the major retail markets in the region. It is estimated that more than two-thirds of the country's GDP is generated from retail consumption every year. In the country's e-commerce sector, the sales growth continues to increase more than the physical stores. With automation being the key differentiating factor, there is increasing competition between online and omnichannel retailers.

- Moreover, high number of online shoppers and extreme internet penetration in the region are expected to be the primary driving factors of the retail industry in the country. Internet penetration in the region was the highest in the world and stood at 89.4%.

- Further, the retailers in the region have recognized the need for ASRS, thus offering more tangible benefits in the consumer's mind, such as loyalty benefits. The technology has been better integrated with several commerce sites to create a seamless experience.

- Some players are investing in developing ASRS due to the sudden increase in demand during the coronavirus pandemic. For instance, in July 2020, Next Generation Manufacturing Canada (Ngen) invested USD 5 million in projects leading to the development and production of Automated storage and retrieval systems technologies instead of manually to help stop coronavirus spread.

United States Accounts For Largest Market Share

- According to the Bureau of Transportation Statistics, the US is home to 19,919 airports, including private and public. The largest airport in the United States is the Denver International Airport and sees over 31,000,000 passengers every year. The number of storage retrieval systems used in airports in the country holds a significant global share.

- Furthermore, the United States, over the forecast period, is expected to witness robust growth in several domestic robotic solutions, owing to the government policies that aim at increasing domestic production rather than importing finished goods.

- According to RIA estimates, as of September 2020, approximately 293,000 robots were in use in the United States. With the increasing trends toward locally produced robots in the next four years, the country's manufacturing sector is anticipated to create a considerable demand for material handling solutions, including ASRS, in the country.

- Moreover, e-commerce is a significant driving factor for the demand from automated distribution warehouses, such as ASRS, as consumers seek ever-shorter delivery times. COVID-19-related boosts in online shopping resulted in an additional USD 174.87 billion in e-commerce revenue in 2020 (source: US Commerce Department). The system's ability to maintain an inventory record with accurate tracking has made it valuable to this industry. Along with this, the process of online retail is primarily driven by automated system control by computers, where ASRS can be integrated with simplicity while attaining a high rate of efficiency. These factors combined have led to a massive demand for these systems in the retail industry.

- Further, other prominent factors, such as steady growth in the wages paid to workers, have made warehouse operators look forward to alternative warehouse management solutions. These factors are anticipated to drive the demand for automation in several end-user industries that are highly dependent on the workforce.

North America Automated Storage and Retrieval System Industry Overview

The North American automated storage and retrieval system market is competitive and covered by many significant players. Vendors provide a deep product portfolio catering to the customer's needs in the region. Key players include Daifuku Co. Ltd, Schaefer Holding International Gmbh, Dematic Group - KION Group AG, Murata Machinery Ltd, Mecalux SA, etc. Some of the recent developments in the market are -

- February 2021 - Rockwell Automation and Fanuc America announced forming a coalition for an apprenticeship program to educate and help develop workers' skills for robotics and automation in storage and distribution.

- February 2020 - ABB Limited and Covariant announced a partnership to bring AI-enabled storage solutions to market, starting with a fully autonomous warehouse order fulfillment solution. The partnership brings together the two companies with a common vision for robotics enabled by AI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industries

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and beverages

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Schaefer Systems International Pvt Ltd

- 7.1.3 Dematic Group (KION Group AG)

- 7.1.4 Murata Machinery Ltd

- 7.1.5 Mecalux S.A.

- 7.1.6 Honeywell Intelligrated

- 7.1.7 Swisslog Holding AG

- 7.1.8 Knapp AG

- 7.1.9 Kardex Remster

- 7.1.10 Bastian Solutions Inc.

- 7.1.11 Toyota Industries Corporation

- 7.1.12 Viastore Systems Inc.