|

市场调查报告书

商品编码

1624574

3D 列印材料和服务 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)3D Printing Materials and Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

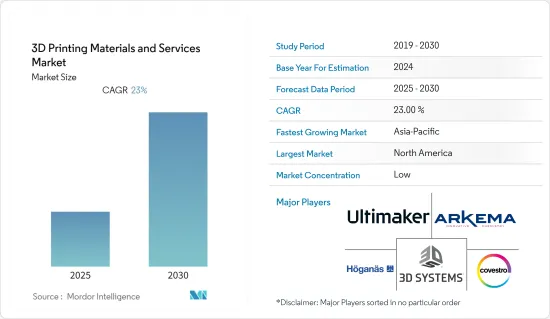

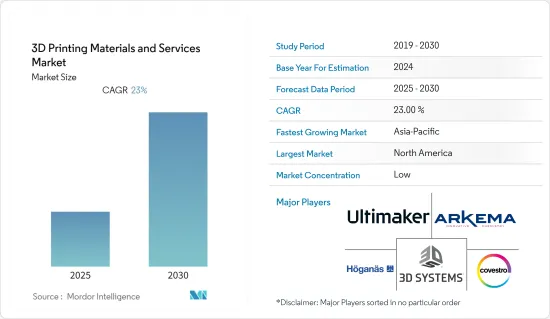

3D列印材料和服务市场预计在预测期内复合年增长率为23%。

主要亮点

- 3D 列印技术的早期采用者之一是飞机工业,该技术为设计人员提供了创建最佳零件的优势,同时节省成本和生产可行性,从而更容易製造有用的复杂零件。该行业主要使用钛金属和合金,它们在製造过程中提供优异的机械性能和高尺寸精度。

- 教育部门不断增长的需求也推动了市场的成长。许多教育机构都建立了 3D 列印实验室,例如,允许工程学生列印原型,允许生物学学生研究器官的截面,允许图形设计学生研究 3D 版本的作品。

- 医疗保健产业的推动预计也将对市场成长产生正面影响。例如,透过3D列印技术製造手术器械、义肢和植入、组织工程产品等各种医疗产品,并应用于整形外科、牙科、颅颚颜面等其他领域。

- 由于高纯度和成分标准而导致的高材料成本是市场面临的主要限制因素。

- 疫情对3D融资材料市场产生了负面影响,航太和国防、汽车和建筑等行业的产能为零或处于部分产能状态。

3D列印材料和服务市场趋势

增加在汽车产业的应用

- 3D列印材料广泛应用于汽车产业来生产用于测试的比例模型。它也用于波纹管、前保险桿、空调管道、悬吊叉骨、仪表板介面、交流发电机安装支架和电池盖等零件。汽车OEM正在使用 3D 列印材料进行快速原型製作。

- 3D 列印製程的优势,例如成本更低、製造时间更快和材料浪费更少,正在推动汽车製造商使用这种製程。一些世界上最大的汽车製造商,包括奥迪、劳斯莱斯、保时捷和 Hackrod,都使用这些材料来製造零件和金属原型。

- 目前全球汽车生产放缓正在影响聚酯短纤维市场,因为汽车纤维的需求正在减少。此外,中国等国家汽车销售放缓预计将进一步抑制对3D列印材料的需求。

- 疫情严重影响了全球汽车产业,根据OICA(国际工业协会)的数据,2020年第三季全球汽车产量约为5,000万辆,较去年同期的约6,500万辆大幅下降。 。

预计中国将主导市场

- 就新技术和建筑创新材料的使用而言,中国是成长最快的市场之一。随着中国作为世界建筑中心的主导地位,3D混凝土列印领域的加速发展很可能会彻底改变中国的传统建设产业,其应用范围从住宅到纪念碑。

- 在该国,建筑物、办公室和桥樑正在使用 3D 列印技术建造。上海还拥有世界上最长的 3D 列印桥樑,长 86 英尺,由 176 个混凝土单元组成。

- 建筑领域的 3D 列印存在一些局限性,包括缺乏建筑开发人员的信任以及缺乏有关该技术使用的适当法规。然而,随着对新技术及其优势的认识不断增强,组织和个人越来越希望降低成本。这正在推动中国3D混凝土列印市场的需求。

- 中国是世界上最大的汽车生产国。儘管该国的产量近年来有所下降,但电动车产业预计将成长。 2020年4月,中华人民共和国财政部发布瞭如何推动新型电动车财政辅助的通知。据此,2021年1月1日至2022年12月31日期间购买的新电动车免征车辆购置税。

- 此外,3D 列印的逐层沉积过程允许将感测器、天线和其他功能性电子产品直接列印到塑胶零件、金属表面,甚至玻璃面板和陶瓷材料上。

3D列印材料和服务业概况

从事3D列印材料和服务市场的公司专注于材料研发,以实现产品差异化以及可应用于新应用领域的材料创新。主要市场供应商包括3D Systems, Inc.、阿科玛集团、CRP Technology Srl、EnvisionTEC Inc.、EOS GmbH Electro Optical Systems、通用电气公司、Hoganas AB、LPW Technology Ltd、Royal DSM NV、Sandvik AB、Solvay、 Stratasys Ltd、 Ultimaker BV 等

- 2021 年 9 月 - 3D Systems 推出 VisiJet Wax Jewel Red,这是其材料组合的最新成员,彻底改变了珠宝製造。这种材料使珠宝製造商能够设计和製造更复杂、更耐用的图案,从而提高生产效率并减少废弃物。

- 2020 年9 月-帝斯曼宣布,已同意以总计16.1 亿欧元的价格向科思创股份公司出售帝斯曼增材製造,作为出售帝斯曼树脂和功能材料及(其他)相关业务的一部分。帝斯曼增材製造提供高性能材料和深厚的 3D 列印应用专业知识,帮助製造商重新思考他们设计产品的方式。截至同一日期,帝斯曼将这些业务重新归类为已终止业务。交易的完成须获得监管部门的核准,包括反垄断许可。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 扩大在製造应用上的使用

- 与 3D 列印相关的大规模定制

- 政府对研发的支持

- 市场限制因素

- 资金投入要求高

第四章市场区隔

- 按材质

- 塑胶(包括聚丙烯等塑胶)

- 陶瓷

- 金属

- 其他材料

- 按最终用户产业

- 车

- 航太/国防

- 卫生保健

- 建筑/建筑

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第五章竞争状况

- 公司简介

- 3D Systems, Inc.

- Arkema Group

- CRP Technology Srl

- EnvisionTEC Inc.

- EOS GmbH Electro Optical Systems

- General Electric Company

- Hoganas AB

- LPW Technology, Ltd

- Royal DSM NV

- Sandvik AB

- Solvay

- Stratasys Ltd

- Ultimaker BV

第六章 投资分析

第七章投资分析市场的未来

The 3D Printing Materials and Services Market is expected to register a CAGR of 23% during the forecast period.

Key Highlights

- One of the early adopters of 3D Printing Technology is the aircraft industry, where the technology is useful for producing complex parts by providing designers the advantage of creating the best parts with reduced cost and production feasibility. The industry mainly uses titanium metal and alloys as it offers good mechanical properties and high dimensional accuracy during production.

- The growing demand from the educational sector is also driving the growth of the market. With labs being set up at many educational institutions for 3D printing, such as for engineering students to enable them to print prototypes, for biology students to allow them to study cross-sections of organs, and graphic design students to work on 3D versions of their work.

- The push from the healthcare sector is also expected to impact the growth of the market positively. For instance, various medical products, such as surgical equipment, prosthetics & implants, and tissue engineering products, are manufactured through 3D printing technology and in other sector applications such as orthopedic, dental, and craniomaxillofacial, and more.

- The high material cost is the major restraint the market is facing due to high material costs owing to its higher standards of purity and composition required.

- The pandemic has negatively impacted the 3D Printing Materials market with the supply chain disruptions resulting in delays or non-delivery of raw materials, financial flows getting affected, and decrease of the workforce in the production line have resulted in industries such as aerospace & defense, automotive, construction, and others to operate at zero or partial capacities.

3D Printing Materials and Services Market Trends

Increasing Applications in the Automotive Industry

- 3D printing materials are extensively used in the automotive industry to manufacture scaled models for testing. They are also used for components, such as bellows, front bumper, air conditioning ducting, suspension wishbone, dashboard interface, alternator mounting bracket, battery cover, etc. Automotive OEM manufacturers are using 3D printing materials for rapid prototyping.

- Owing to the advantages of the 3D printing process, such as low cost, less manufacturing time, reduced material wastage, etc., automotive manufacturers are moving toward the usage of this process. Some of the largest automotive manufacturers in the world, such as AUDI, Rolls Royce, Porsche, Hackrod, and many others, are using these materials for manufacturing spare parts and metal prototypes.

- The current slowdown in global automotive production has affected the market for polyester staple fiber because of the decreased demand for automotive fibers. Additionally, the current slowdown in automotive sales in countries such as China is further expected to hinder the demand for 3D printing materials.

- The pandemic has severely impacted the automotive sector globally; according to OICA (International Organization of Motor Vehicle Manufacturers), global production of vehicles in the third quarter of 2020 was around 50 million, a significant decrease compared to the production in the third quarter of 2019, which was around 65 million.

China is Expected to Dominate the Market

- China is among the fastest-growing markets in terms of new technologies and the usage of innovative materials for construction purposes. With China's dominating role as a global construction center, the accelerated development in the 3D concrete printing sector is likely to revolutionize the traditional construction industry in the country, with applications ranging from residential buildings to monuments.

- The country is involved in the construction of buildings, offices, and bridges using 3D printing technology. Additionally, Shanghai is the home for the longest 3D-printed bridge, which is 86 feet in length in the world, consisting of 176 concrete units.

- There are a few limitations for 3D printing in the construction sector, such as lack of confidence from building developers and absence of proper regulations for the usage of this technology. However, with the increasing awareness regarding new technologies and their advantages, organizations and individuals are increasingly tending toward cost-saving alternatives. This, in turn, is driving the demand in the 3D concrete printing market in the country.

- China has the world's largest automotive market in terms of production. Although the production in the country declined in the past few years, the electric vehicles segment is expected to grow. In April 2020, the Ministry of Finance of the People's Republic of China issued a notice on ways to promote financial subsidies for new electric vehicles. It stated that new EVs purchased between January 1, 2021, and December 31, 2022 would be exempted from vehicle purchase tax.

- Furthermore, the layer-by-layer deposition process in 3D printing allows sensors, antennas, and other functional electronics to be printed directly onto plastic components, metal surfaces, and even glass panels and ceramic materials.

3D Printing Materials and Services Industry Overview

Companies operating in 3D Printing Materials and Services Market focus on the research and development of its materials for product differentiation and innovation in materials that could be applied for newer applications areas. The key market vendors include 3D Systems, Inc., Arkema Group, CRP Technology S.r.l., EnvisionTEC Inc., EOS GmbH Electro Optical Systems, General Electric Company, Hoganas AB, LPW Technology Ltd, Royal DSM N.V., Sandvik AB, Solvay, Stratasys Ltd, and Ultimaker B.V.

- September 2021 - 3D Systems introduced VisiJet Wax Jewel Red, an addition to the materials portfolio that is transforming jewelry production. The material enables jewelry manufacturers to design and produce more intricate, durable patterns as well as deliver improved production efficiency and reduced waste.

- September 2020 - DSM announced an agreement to sell DSM additive manufacturing to Covestro AG at the total purchase price of EUR 1.61 billion, as part of the sale of DSM Resins & Functional Materials and (other) related businesses. DSM Additive Manufacturing provides performance materials and deep application expertise in 3D printing to help manufacturers rethink the way they design products. As of that date, DSM reclassified these businesses as discontinued operations. The closing of the transaction is subject to regulatory approvals, including antitrust clearance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET DYNAMICS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Threat of New Entrants

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Bargaining Power of Suppliers

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 Assessment of Impact of COVID-19 on the Industry

- 3.5 Market Drivers

- 3.5.1 Growing Usage in Manufacturing Applications

- 3.5.2 Mass Customization Associated with 3D Printing

- 3.5.3 Government Support for Research and Development

- 3.6 Market Restraints

- 3.6.1 High Capital Investment Requirement

4 MARKET SEGMENTATION

- 4.1 By Material

- 4.1.1 Plastics (including Polypropylene and other plastics)

- 4.1.2 Ceramics

- 4.1.3 Metals

- 4.1.4 Other Material Types

- 4.2 By End-user Industry

- 4.2.1 Automotive

- 4.2.2 Aerospace and Defense

- 4.2.3 Healthcare

- 4.2.4 Construction and Architecture

- 4.2.5 Other End-user Industries

- 4.3 By Geography

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 Latin America

- 4.3.5 Middle East and Africa

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 3D Systems, Inc.

- 5.1.2 Arkema Group

- 5.1.3 CRP Technology S.r.l.

- 5.1.4 EnvisionTEC Inc.

- 5.1.5 EOS GmbH Electro Optical Systems

- 5.1.6 General Electric Company

- 5.1.7 Hoganas AB

- 5.1.8 LPW Technology, Ltd

- 5.1.9 Royal DSM N.V.

- 5.1.10 Sandvik AB

- 5.1.11 Solvay

- 5.1.12 Stratasys Ltd

- 5.1.13 Ultimaker B.V.