|

市场调查报告书

商品编码

1624575

欧洲雷射雷达:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

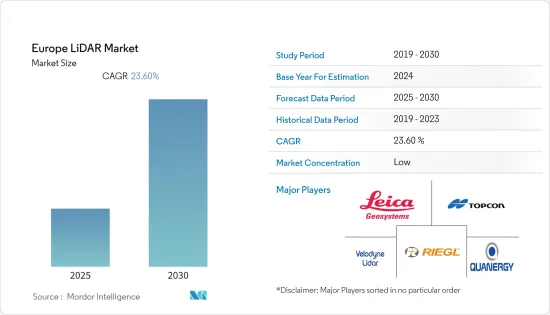

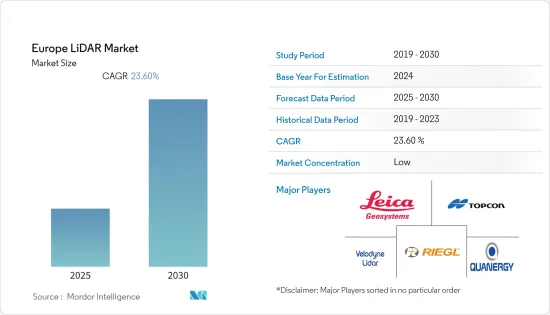

欧洲 LiDAR 市场预计在预测期内复合年增长率为 23.6%

主要亮点

- 基于雷射雷达的测绘解决方案非常灵活,可用于固定或移动车辆。因此,它已在许多行业中被采用,特别是在工程、建筑、环境和探勘应用中,证明了该技术的有效性和需求。该技术是为军事用途而发明的,但在 2010 年代初首次被研究云的气象学家广泛采用。

- 非洲大陆各国政府都在积极投资航空光达开发技术。过去 17 年来,英国政府一直在收集 LiDAR资料并向公众提供。政府负责人声称这些资料可能有助于考古学家可视化古代景观。

- 此外,法国政府正在支持自动驾驶汽车的发展,目标是在2020年至2022年期间让「高度自动化」的车辆出现在公共道路上。政府的目标是製定立法,使自动公共交通的使用和第三级自动驾驶车辆的分配成为可能。

- 然而,市场面临着设备和测量应用成本相对较高以及缺乏对该技术的教育和认识的挑战,这阻碍了市场的成长。然而,受访的交易厂商在创新方面的进步预计将压低价格并进一步扩大该技术的商业性范围。

- COVID-19 的疫情正在影响世界各地的各行各业。汽车业是光达的主要采用者之一。疫情爆发迫使多家生产工厂关闭。根据欧洲汽车工业协会 (ACEA) 的数据,由于工厂停工,全部区域汽车行业的生产损失至少达到 2,446,344 辆汽车、卡车、货车、巴士和客车。

欧洲光达市场趋势

工程行业占主要市场占有率

- 测量和土木工程发现雷射雷达技术在空中和地面扫描方面具有重要意义,可以为现有结构和斜坡稳定性的细节和其他因素提供有价值的见解。

- UAV(无人驾驶飞行器)也用于测量应用,以克服技术人员在危险区域使用固定解决方案所面临的挑战。此外,考虑到与配备光达技术的直升机相比具有节省成本的优势,我们预计整合光达的无人机将被广泛使用。

- 地面雷射雷达的远端操作进一步确保当局安全勘探岩体特征并监测边坡稳定性的岩石动态位置。地质力学细节对于建立铺设道路和其他地面交通的安全位置非常重要。

- 雷射雷达广泛应用于铁路行业,用于监控资产健康报告,以实现高效的资产管理,并供政府当局评估因客流量增加而导致的路线状况。光达经常用于了解河床深度和水流强度,以便正确设计水坝和其他控制流量的结构。它还在雨水和洪水管理系统的设计中发挥重要作用,因为它有助于分析环境灾害可能引起的问题。

- 随着人们对光达安全、简便操作的认识在各地区广泛传播,预计在预测期内,光达产品和技术在建筑和维修应用中的使用将会增加。此外,在建筑应用中使用航空 LiDAR 优于其他方法,例如摄影测量(从高解析度相机收集资料以建立区域的 2D 或 3D 测量)。

- 此外,该地区建筑数量的增加正在推动光达市场的成长。例如,根据 OECD(经济合作暨发展组织)和欧盟统计局的数据,欧洲建筑/工程行业产生的收益预计将从 2021 年的 20,262 亿欧元增加到 2024 年的 21,328 亿欧元。增长。

汽车产业越来越多地采用光达推动市场成长

- 汽车行业自动驾驶和电动车的成长趋势预计将成为光达新应用的关键驱动力。自动驾驶汽车越来越多地使用 LiDAR 感测器来产生 360° 视觉的巨大 3D 地图,并提供准确的资讯来帮助自动导航和物体侦测。

- 由于消费者对电动车的兴趣不断增加、对 ADAS 的偏好以及自动驾驶技术在该行业的日益普及,预计雷射雷达市场将吸引该地区的大量投资。例如,Ouster 是一家为自动驾驶汽车、测绘和机器人技术提供 LiDAR 感测器的公司,该公司宣布进军欧洲,在巴黎开设了新办公室。

- 为了满足对光达感测器不断增长的需求,各种汽车OEM正在开发新型电动车并在车展上展示它们。此外,这些OEM已开始在该全部区域设立多个工厂,以获得市场先发优势的竞争优势。

- 此外,自动驾驶和自动驾驶汽车很快就会成为现实,Google、特斯拉、宝马等主要汽车製造商已经展示了原型车款。加拿大汽车零件供应商麦格纳与以色列光达技术开发商Innoviz合作,正在为BMW提供创新的感测器和系统。预计它将提供高解析度雷射雷达技术,并在所有天气条件下即时产生车辆周围的 3D 点云。

- 随着最新技术的进步减少了感测器尺寸和成本,LiDAR 感测器有望用于自动驾驶汽车技术。光达感测器以及摄影机、雷达和其他低成本安全技术在大众市场车辆中已变得司空见惯。

- 例如,自动驾驶汽车(AV) 行业感测系统供应商Velodyne Lidar Inc. 正在推出一款新型LiDAR 装置,其尺寸比一副扑克牌还要小,售价为100 美元,可整合到各种解决方案中。

- 根据ACEA的数据,2021年德国在欧洲主要市场的乘用车销售量将达到2,622,132辆,其次是法国。这些销售量预计将继续增加,并推动光达市场的成长。

欧洲光达产业概况

由于众多参与者的存在,欧洲光达市场竞争非常激烈。参与者专注于新产品发布、伙伴关係、併购和收购等策略活动,以获取最高的市场占有率。市场的主要发展包括:

- 2021 年 11 月 - Velodyne Lidar 宣布达成一项多年期协议,为瑞士公司 Topodrone 提供雷射雷达感测器,该公司为航空测量开发经济实惠的高精度解决方案。透过此感测器,Topodrone 将在农场、森林和基础设施等严苛环境中提供高精度测绘和 3D 建模,以支持推动经济和永续性目标的发展。

- 2021 年 9 月 - 法国无人机光达解决方案设计公司 YellowScan 宣布推出 YellowScan Explorer。这种新型光达测绘系统专为载人轻型飞机和无人机平台而设计。这使得最终用户能够从事广泛的计划。

- 2021 年 7 月 - XenomatiX 是用于 ADAS、自动驾驶汽车和其他道路应用(包括施工和维护)的真正固态 LiDAR 的先驱,宣布推出下一代 XenoLidar-X。新型 XenoLidar-X 旨在满足现代OEM所需的性能要求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 无人机应用的快速发展与扩展

- 汽车业的采用率提高

- 市场挑战

- LiDAR系统高成本

第六章 市场细分

- 副产品

- 航空光达

- 地基光达

- 按成分

- GPS

- 雷射扫描仪

- 惯性测量单元

- 其他组件

- 按最终用户产业

- 工程

- 车

- 工业

- 航太/国防

- 按国家/地区

- 英国

- 德国

- 西班牙

- 荷兰

- 法国

- 比利时

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Leica Geosystems Ag

- Topcon Corporation

- Riegl Laser Measurement Systems GmbH

- Velodyne Lidar Inc.

- Quanergy Systems Inc.

- Phantom Intelligence Inc.

- Neptec Technologies Corp.

- Innoviz Technologies Ltd

- Geoslam

- Sick Ag

- Trimble Inc.

- TELEDYNE Optech

- Denso Corporation

- Faro Technologies Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 46167

The Europe LiDAR Market is expected to register a CAGR of 23.6% during the forecast period.

Key Highlights

- LiDAR-based mapping solutions are agile and can be used on a stationary or moving vehicle. Due to this, they are being adopted by many industries, especially for application in engineering, construction, environment, and exploration, proving the effectiveness and demand for this technology. The technology was invented for military use but was first adopted widely by meteorologists to study clouds in the early 2010s.

- Governments across the continent are investing in aerial LiDAR development technologies aggressively. The UK government has been collecting LiDAR data for the past 17 years and has made it available to the public. A spokesperson for the government claimed that the data may be beneficial for archeologists to visualize ancient landscapes.

- Further, the French government is supporting the development of self-driving cars, aiming to deploy 'highly automated' vehicles on public roads between 2020 and 2022. The government had aimed to establish a legislative regulation that is likely to allow the use of autonomous public transport and the circulation of third-level autonomous cars.

- However, the market is challenged by a relatively high cost of equipment and surveying applications, along with a lack of education and awareness about the technology, which impedes the market's growth. However, increasing innovation by the studied vendors is expected to bring down the prices and further expand the commercial scope of the technology.

- The COVID-19 outbreak has affected industries across the globe. The automotive industry is one of the significant adopters of LiDAR. The outbreak has led to the shutdown of various production plants. According to the European Automobile Manufacturers Association (ACEA), the region-wide production losses in the automotive industry due to factory shutdowns amounted to at least 2,446,344 motor vehicles, including passenger cars, trucks, vans, buses, and coaches.

Europe LiDAR Market Trends

Engineering Industry to Hold Considerable Market Share

- Surveying and civil engineering find crucial importance in the LiDAR technology for the aerial and terrestrial scanning to provide valuable insights as to the existing architecture or details regarding the stability of the inclinations and other factors, which could play a vital role in the development of the plans for construction and other operations.

- UAVs (unmanned aerial vehicles) are also being used for surveying applications as they eliminate the challenges faced by technicians who use fixed solutions in hazardous areas. Also, considering cost reduction advantages compared to helicopters with LiDAR technologies, UAVs integrated with LiDAR are expected to gain traction.

- The remote operation of the ground-based LiDARs has further ensured a safe investigation of the locations by the authorities for monitoring the rock mechanics for the rock mass characterization and slope stability. Geomechanical details hold critical importance in establishing safe locations for laying the roadways and other modes of ground transport.

- LiDAR is widely used in the railroad industry to monitor the asset health reports for efficient asset management and the responsible government authorities to assess the pathway conditions due to increasing passenger traffic. LiDAR is frequently used to understand the riverbed's depth and flow strength to create appropriate designs for dams and other flow control constructions. They also play a vital role in designing stormwater or flood management systems as they help analyze the possible complications resulting from an environmental disaster.

- The LiDAR products and technology usage in construction and restoration applications are expected to increase during the forecast period as awareness about their safe and easy operation spread through the regions. In addition, using aerial LiDAR for construction applications is also preferred over other methods, like photogrammetry (data collected from high-resolution cameras to create either a 2D or 3D survey of an area), considering the technical limitations, i.e., the technology cannot be used to get past brush or ground cover.

- Moreover, the growing number of constructions in this region drives the growth of the LiDAR market. For instance, according to OECD (Organisation for Economic Co-operation and Development) and Eurostat, the revenues generated from the European construction/engineering industry are predicted to increase by EUR 2,132.8 billion in 2024 from EUR 2,026.2 billion in 2021, which is expected to drive the growth of the LiDAR market in Europe.

Increasing Adoption of LiDAR in the Automotive Industry to Drive the Market Growth

- The growing trends in the automotive industry toward self-driving cars and electric vehicles are expected to be the critical drivers for newer applications of LiDAR. Self-driving cars increasingly use LiDAR sensors for generating huge 3D maps for 360° vision and for accurate information to assist in self-navigation and object detection.

- With the growing consumer propensity toward electric vehicles, preference for ADAS, and the growing adoption of autonomous technology in the industry, the LiDAR market is expected to attract significant investments in the region. For instance, Ouster, a provider of LiDAR sensors for autonomous vehicles, mapping, and robotics, announced its expansion into Europe with a new office in Paris.

- To meet the growing demand for LiDAR sensors, various automobile OEMs have started working on new electric cars and presenting them at auto expos. Additionally, these OEMs have started setting up multiple factories across the region to gain a competitive advantage in terms of first-mover advantage in the marketplace.

- Moreover, self-driving and autonomous cars are becoming a reality soon, with major giants, such as Google, Tesla, and BMW, already releasing their prototype models. The Canadian car components supplier, Magna, and an Israeli LiDAR technology developer, Innoviz Cooperated, will provide BMW with its innovative sensor and system. It is expected to offer high-resolution LiDAR technology, which generates a 3D point cloud in real-time of the vehicle's surroundings under all weather conditions.

- With the recent technological advancements in reducing both size and cost of the sensor, LiDAR sensors are expected to be used in autonomous vehicle technology. They have become commonplace in mass-market vehicles such as cameras, radars, and other low-cost safety technology.

- For instance, Velodyne Lidar Inc., a supplier of sensing systems for the autonomous vehicle (AV) industry, launched a new LiDAR unit which costs USD 100 and comes in a compact size smaller than a deck of cards to be embedded in a range of various solutions in the industry.

- According to ACEA, With the increasing sales of passenger cars in key European markets in 2021, the sales in Germany were 26,22,132 million, followed by France in the European region. These sales numbers will also continue to rise in the future, which is expected to drive the growth of the LiDAR market.

Europe LiDAR Industry Overview

The European LiDAR market is competitive owing to the presence of various players in the market. Players focus on strategic activities such as new product launches, partnerships, mergers, and acquisitions to capture the highest market share. Some of the key developments in the market are:

- November 2021 - Velodyne Lidar announced a multi-year agreement to provide its Lidar sensors to Topodrone, a Swiss-based company that develops affordable, high-precision solutions for aerial surveys. The sensors will enable Topodrone to bring high-precision mapping and 3D modeling to demanding environments, including farms, forests, infrastructure, and more, to support development that advances economic and sustainability goals.

- September 2021 - YellowScan, a France-based UAV LiDAR solutions designer, announced the launch of YellowScan Explorer. The new lidar mapping system is designed to be used on light human-crewed aircraft or UAV (unmanned aerial vehicles) platforms. It allowed end-users to tackle a broad range of projects.

- July 2021 - XenomatiX, a pioneer of true-solid-state LiDARs for ADAS, autonomous vehicles, and other road applications, including construction and maintenance, launched the next generation of XenoLidar-X. The new XenoLidar-X had been designed to meet the performance requirements needed by modern OEMs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Fast Paced Developments and Increasing Applications of Drones

- 5.1.2 Increasing Adoption in the Automotive Industry

- 5.2 Market Challenges

- 5.2.1 High Cost of the LiDAR Systems

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Aerial LiDAR

- 6.1.2 Ground-based LiDAR

- 6.2 By Component

- 6.2.1 GPS

- 6.2.2 Laser Scanners

- 6.2.3 Inertial Measurement Unit

- 6.2.4 Other Components

- 6.3 By End-user Industry

- 6.3.1 Engineering

- 6.3.2 Automotive

- 6.3.3 Industrial

- 6.3.4 Aerospace and Defense

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 Spain

- 6.4.4 Netherlands

- 6.4.5 France

- 6.4.6 Belgium

- 6.4.7 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Leica Geosystems Ag

- 7.1.2 Topcon Corporation

- 7.1.3 Riegl Laser Measurement Systems GmbH

- 7.1.4 Velodyne Lidar Inc.

- 7.1.5 Quanergy Systems Inc.

- 7.1.6 Phantom Intelligence Inc.

- 7.1.7 Neptec Technologies Corp.

- 7.1.8 Innoviz Technologies Ltd

- 7.1.9 Geoslam

- 7.1.10 Sick Ag

- 7.1.11 Trimble Inc.

- 7.1.12 TELEDYNE Optech

- 7.1.13 Denso Corporation

- 7.1.14 Faro Technologies Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219