|

市场调查报告书

商品编码

1624590

White Spirit:市场占有率分析、产业趋势/统计、成长预测(2025-2030)White Spirit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

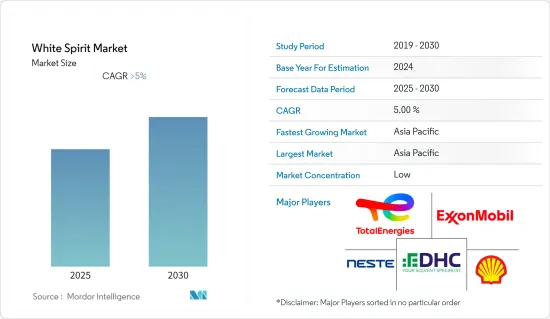

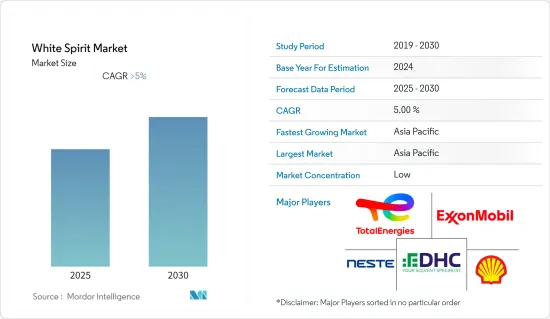

预计白酒市场在预测期内复合年增长率将超过 5%

主要亮点

- 油漆和涂料行业不断增长的需求以及活性化的基础设施开发正在推动市场成长。

- 另一方面,有毒和危险的性质预计将严重阻碍市场的成长。

- 未来的机会包括针对特定应用的产品客製化以及对松节油替代品日益增长的需求。

- 预计亚太地区将在预测期内主导全球市场。

白酒市场趋势

对涂料稀释剂应用的需求不断增长

- 石油溶剂油是一种从石油中提取的透明液体,是一种有效的有机溶剂,广泛用作油漆稀释剂。

- 白油常用于使用油漆的建设产业。全球建设产业的成长推动了油漆和被覆剂的需求,并刺激了白油市场。

- 根据美国人口普查局的数据,2021 年 12 月美国建筑支出经季节已调整的后的年率估计为 16,399 亿美元,比 11 月修正值 16,365 亿美元增长 0.2%。

- 中国的成长主要是由住宅和商业建筑的快速扩张所推动的。中国正鼓励并持续推动都市化进程,预计2030年都市化率将达到70%。

- 此外,2021年中国建筑业产值达到高峰约4.44兆美元。因此,这些因素可能会增加预测期内对白酒的需求。

- 此外,白油可用于家具行业,因为它用于木製家具和地板。由于世界各地有大量建设计划处于规划或开发阶段,对白酒的需求预计也将在未来几年实现,并且对家具的需求预计将增加。

- 所有上述因素预计将在预测期内推动涂料稀释剂应用的白油需求。

亚太地区主导市场

- 由于印度和中国等国家的需求不断增加,预计亚太地区将在预测期内主导白酒市场。

- 根据中国2022年1月公布的五年计划,预计2022年中国建设产业将成长6%左右。中国计划增加组装式建筑,以减少建筑工地的污染和废弃物。

- 预计中国油漆和涂料行业在预测期内将出现高需求,这主要是由于装饰涂料的需求不断增加。

- 2021年5月,PPG宣布投资1,300万美元对其位于中国嘉定的油漆和涂料工厂进行扩建,完成8条粉末涂料生产线和一个粉末涂料技术中心的扩建。此次扩建将使该工厂的产能每年增加 8,000 多吨,对市场成长产生正面影响。

- 此外,印度预计未来七年将在住宅领域投资约 1.3 兆美元。预计将建造6000万套新住宅。预计 2024 年经济适用住宅将成长 70% 左右,支撑市场成长。

- 所有上述因素预计将在预测期内推动该地区的白酒市场。

白酒产业概况

白酒市场较为分散。该市场的主要企业包括(排名不分先后)Neste、埃克森美孚、壳牌、DHC Solvent Chemie GmbH 和 TotalEnergies。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 油漆和涂料行业的需求增加

- 加强基础建设

- 抑制因素

- 白油的毒性和危险

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按年级

- 低闪光等级

- 普通闪光等级

- 高闪光等级

- 按用途

- 油漆稀释剂

- 清洗剂

- 除油剂

- 燃料

- 消毒剂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Al Sanea

- Cepsa

- DHC Solvent Chemie GmbH

- Exxon Mobil Corporation

- HCS Group GmbH

- KAPCO PETROLEUM INDUSTRIES FZC

- KH Chemicals

- Kuwaitintlfactory

- Mehta Petro Refineries Limited

- Neste

- Shell Plc

- STOCKMEIER Group

- TotalEnergies

第七章 市场机会及未来趋势

- 针对特定应用客製化产品

- 作为松节油替代品的需求不断增加

简介目录

Product Code: 46557

The White Spirit Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The increasing demand from the paints and coatings industry and augmenting infrastructure development are driving the market's growth.

- On the flip side, toxic and hazardous nature is expected to significantly hinder the market's growth.

- Customization of products more specific to an application and the increasing demand as a substitute for turpentine will likely act as opportunities in the future.

- Asia-Pacific is expected to dominate the global market during the forecast period.

White Spirit Market Trends

Growing Demand from Paint Thinner Application

- White spirit is a petroleum-derived, transparent liquid that stands to be an effective organic solvent widely used as a paint thinner.

- White spirit is commonly used in the construction industry, wherever paints are used. The growth of the global construction industry is boosting the demand for paints and coatings, stimulating the white spirit market.

- According to the US Census Bureau, during December 2021, the construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,639.9 billion, 0.2% more than the revised November estimate of USD 1,636.5 billion.

- China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030.

- Also, China's construction output peaked in 2021 at about USD 4.44 trillion. As a result, these factors tend to increase the demand for the white spirit during the forecast period.

- In addition, white spirit is used for wooden furniture or floors, making it useful for application in the furniture industry. With numerous construction projects under planning or development phases worldwide, the expected growth in demand for furniture is also expected to create apparent demand for white spirit over the years to come.

- All the factors above are expected to drive the demand for white spirit for paint thinner applications over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for the white spirit during the forecast period due to increased demand from countries like India and China.

- According to China's five-year plan unveiled in January 2022, the construction industry in the country is estimated to register a growth rate of approximately 6% in 2022. China is planning to increase prefabricated building construction to reduce pollution and waste from construction sites.

- China's paints and coatings industry is expected to experience high demand during the forecast period, primarily due to increased demand for decorative coating.

- In May 2021, PPG announced the completion of a USD 13 million investment in its Jiading, Chinese paint and coatings facility, including eight new powder coating production lines and an expanded Powder Coatings Technology Center. The expansion will increase the plant's capacity by more than 8,000 metric tons annually, positively impacting the market growth.

- Furthermore, India will likely invest around USD 1.3 trillion in housing over the next seven years. It is expected to see the construction of 60 million new homes. The availability of affordable housing is likely to rise by around 70% in 2024, thus, supporting the market growth.

- All the factors mentioned above are expected to drive the white spirit market in the region over the forecast period.

White Spirit Industry Overview

The white spirit market is fragmented in nature. Some of the major players in the market include Neste, Exxon Mobil Corporation, Shell plc, DHC Solvent Chemie GmbH, and TotalEnergies, among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Paints and Coatings Industry

- 4.1.2 Augmenting Infrastructure Development

- 4.2 Restraints

- 4.2.1 Toxic and Hazardous Nature of White Spirit

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Grade

- 5.1.1 Low-flash Grade

- 5.1.2 Regular-flash Grade

- 5.1.3 High-flash Grade

- 5.2 Application

- 5.2.1 Paint Thinner

- 5.2.2 Cleansing Agent

- 5.2.3 Degreasing Agent

- 5.2.4 Fuel

- 5.2.5 Disinfectant

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Al Sanea

- 6.4.2 Cepsa

- 6.4.3 DHC Solvent Chemie GmbH

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 HCS Group GmbH

- 6.4.6 KAPCO PETROLEUM INDUSTRIES FZC

- 6.4.7 KH Chemicals

- 6.4.8 Kuwaitintlfactory

- 6.4.9 Mehta Petro Refineries Limited

- 6.4.10 Neste

- 6.4.11 Shell Plc

- 6.4.12 STOCKMEIER Group

- 6.4.13 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Customization of Products More Specific to Application

- 7.2 Increasing Demand as a Substitute for Turpentine

02-2729-4219

+886-2-2729-4219