|

市场调查报告书

商品编码

1624592

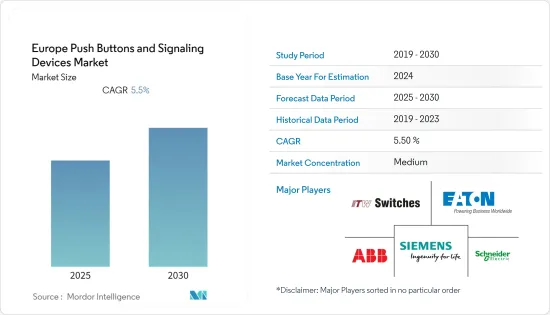

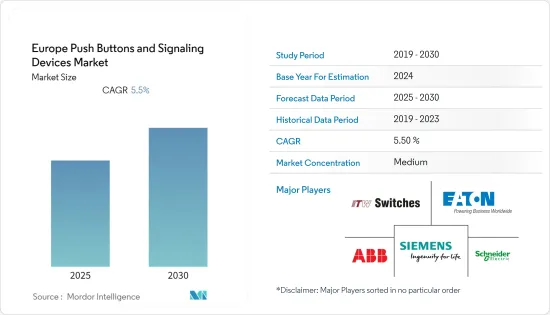

欧洲按钮与讯号设备:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Push Buttons and Signaling Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

欧洲按钮和讯号设备市场预计在预测期内复合年增长率为 5.5%

主要亮点

- 按钮和信号装置等先导装置控制和监控工业设备和机械。这些设备包括多种类型的按钮、指示灯以及声音和视觉信号设备。这些设备可用作发现设备范围内的故障和材料短缺的指示器,提醒操作员设备内的任何危险或死亡,并减少製程停机时间。由于食品和饮料、化学、製药以及石油和天然气等行业的安全标准更加严格,按钮和讯号设备的市场正在不断扩大。

- 此外,2021 年 12 月,APS Industrial 的新型西门子 SIRIUS ACT 按钮和信号设备满足所有这些标准,形成了完整的食品和饮料按钮和信号设备产品线。食品和饮料行业对清洁度、韧性和品质有很高的标准。不符合这些要求的设备会因可避免的故障和停机而浪费时间。此类产品的开发可能会增加该地区对按钮的需求。

- 信号装置和系统用于传达有关机器、生产线或单一工业设备操作的简单讯息。如果没有适当的低阶光学和声音讯号设备,很难想像一个正常运作的工业工厂。

- 号誌设备已在 STARS计划下广泛应用,以开发一种通用方法来预测铁路环境中安全关键应用中可实现的 GNSS 性能,特别是在 ERTMS(欧洲铁路交通管理系统)中使用。

欧洲按钮讯号装置市场趋势

汽车预计将获得显着的市场占有率

- 为了减少碳足迹,欧洲汽车市场正在经历重大变革时期。随着汽车中按钮、自动启动功能和其他自动化机制的引入,电动车市场获得了巨大的投资。

- 过去五年,欧洲的联网汽车出货量快速成长。大众汽车、标緻雪铁龙和雷诺日产联盟这三大汽车集团几乎占据了欧洲联网汽车出货量的一半。

- 联网汽车系统仅在具有内建连线功能的乘用车中实作。到 2025 年,欧洲大多数联网汽车将继续配备支援 4G 的远端资讯处理控制单元 (TCU)。然而,随着5G网路部署的成熟,4G的份额将从2022年开始下降。

- 在整个全部区域,Covid-19危机的影响是巨大的,许多汽车零售商关闭了一个多月,导致汽车製造商的利润与过去两年相比出现了前所未有的下降。可能需要几年的时间才能从盈利的急剧下降中恢復过来。

英国预计将获得显着的市场占有率

- 按钮已用于在汽车中提供无钥匙存取。许多汽车製造商都使用按钮式点火器,因其舒适性和可靠性而受到好评。

- 面板灯和喇叭是汽车中最常使用的信号装置。汽车製造商也专注于提供视讯监控和闪光灯等附加功能。此外,所有新製造的汽车现在都配备了紧急照明。预计这也将推动该国预测期内的市场成长。

- 大型工业偏好并选择按钮和讯号装置的自动化,主要是为了避免人为错误因素。 SCADA、PLC 和 IT 控制等工业控制系统的出现正在推动市场成长。推动国内需求的主要因素是设备为工业空间提供的控制灵活性和功能性以及工业现场安全工作环境的增强。

- 从长远来看,受疫情影响,英国各地的可再生能源需求也预计将推动市场成长。然而,由于疫情影响了所有终端用户产业,供应链和需求的不确定性带来的短期影响预计将阻碍市场成长。

欧洲按钮和信号设备产业概述

欧洲按钮和信号设备市场竞争适中。越来越多的企业透过策略併购以及与规模较小的企业结盟来扩大市场份额。该市场的主要企业包括罗克韦尔自动化公司、ABB 有限公司、施耐德电气公司、西门子公司和联邦信号公司。

- 2022 年 2 月 - 西门子股份公司同意将合资企业法雷奥西门子电动车 (VSeA) 50% 的股权出售给法雷奥。 3亿欧元的效益效应将在2022年第二季确认,交易将于2022年7月完成。

- 2022 年 2 月 - 伊顿汽车集团宣布为商用车和非公路应用提供低压电气元件,包括转换、保护和配电,以满足不断增长的电力和控制要求。这些技术适用于各种应用,包括商用车辆、军事、建筑和农业。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对市场的影响

- 市场驱动因素

- 增加火灾警报管理和安全系统的使用

- 用于改善欧洲轨道运输管理系统的号誌设备

- 市场限制因素

- 缺乏技术纯熟劳工和资本密集型计划

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 副产品

- 圆形/方形体型

- 不亮的按钮

- 其他产品

- 按类型

- 可听见的

- 可见的

- 其他类型

- 按最终用户产业

- 车

- 能源/电力

- 製造业

- 饮食

- 运输

- 其他最终用户产业

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

第六章 竞争状况

- 公司简介

- ITW Switches

- Siemens AG

- ABB Ltd

- Schneider Electric

- Carling Technologies

- Omron Industrial Automation(Omron Corporation)

- Eaton Corporation

- NKK Switches

- Panasonic

- Littelfuse

- Wurth Electronics

- Nihon Kaiheiki

- Marquardt Mechatronik

- Kaihua Electronics

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 46642

The Europe Push Buttons and Signaling Devices Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- Pilot devices such as push buttons and signaling devices control and monitor industrial equipment and machinery. These devices include several types of pushbuttons, indicating lights, and audible-visual signaling devices. These devices can be used as indicators to spot malfunctions and material shortages across facilities and alert operators to any hazard or fatality in the facility, reducing process downtime. The market for push buttons and signaling devices has expanded, as industrial safety standards for food and beverages, chemicals, and pharmaceuticals and the oil and gas industries have become more stringent.

- Further, In December 2021, the new Siemens SIRIUS ACT push buttons and signaling devices offered from APS Industrial matched all of these criteria, forming the perfect product line of food and beverage push buttons and signaling devices. The food and beverage business has high cleanliness, toughness, and quality standards. Equipment that does not fulfill these requirements wastes time due to avoidable breakdowns and downtimes. Such product developments may increase the demand for push buttons in this region.

- Signaling Devices and systems are used to convey simple messages concerning the operation of machinery, manufacturing lines, or individual industrial equipment. It is difficult to imagine a properly functioning industrial plant without appropriate low-level optical and audible signaling devices.

- The signaling devices are extensively used under STARS Project to develop a universal approach to predict the achievable GNSS performance in a railway environment, especially for safety-critical applications within ERTMS (The European Railway Traffic Management System).

Europe Push Buttons Signaling Devices Market Trends

Automotive Expected to Witness Significant Market Share

- The European automotive market is going through a huge transformation to curb the Carbon footprint. EV market has seen huge investment along with it the implementation of push buttons and have also increased for auto-start functions and other automated mechanisms in vehicles.

- Europe-connected car shipments have been increasing rapidly during the last five years. The top three automotive groups - Volkswagen, PSA, and Renault Nissan Alliance - account for almost half of the connected car shipments in Europe, primarily because they have been leading the passenger car sales in the region.

- The connected car system is only implemented on passenger cars with embedded connectivity. The vast majority of connected cars will continue to have a 4G-enabled Telematics Control Unit (TCU) by 2025 in Europe. But with 5G network deployment maturing, the share of 4G will start declining after 2022.

- Across the region, the repercussions of the COVID-19 crisis are immense and unprecedented, as many auto-retail stores have remained closed for a month or more, resulting in the decline in profit by the automotive manufacturer compared to the last two years. It may take years to recover from this plunge in profitability.

United Kingdom Expected to Witness Significant Market Share

- Push buttons have been used for implementing keyless access in vehicles. Many automobile companies widely adopt Push-button ignition due to its comfort and reliability in the country.

- The panel lights and horns are the most commonly used signaling devices in vehicles. Automotive manufacturers also focus on providing additional features, such as video surveillance and strobes. The emergency lighting is also being included in all the newly manufactured vehicles. This is also anticipated to drive the market's growth during the forecast period in the country.

- Large-scale industries prefer and opt for automation of push-button and signaling devices, primarily to avoid the human error factor. The emergence of industrial control systems, such as SCADA, PLC, and IT control, aided the market growth. The primary factor that drives the demand in the country is the flexibility in control and functionality that devices offer in the industrial space and the enhancement in the safe work environment on the industry floors.

- In the long run, the demand for renewable energy across the United Kingdom accelerated by the pandemic is also expected to boost the market's growth. However, the uncertainty in the supply chain and demand brought by the short-term repercussions is expected to stall the market's growth as the pandemic impacted all end-user industries.

Europe Push Buttons Signaling Devices Industry Overview

The Europe Push Button and Signaling Device Market are moderately competitive. An increasing number of players are boosting their share through strategic mergers and acquisitions and partnerships with several small players. Some of the key players in the market include Rockwell Automation Inc., ABB Ltd, Schneider Electric SE, Siemens AG, and Federal Signal Corporation.

- February 2022 - Siemens AG has agreed to sell Valeo its 50% ownership in the joint venture Valeo Siemens e-Automotive (VSeA). In the second quarter of fiscal 2022, a profit effect of EUR 300 million will be recognized, with the transaction set to close in July 2022.

- February 2022 - Eaton's Vehicle Group announced that it now offers a range of low-voltage electrical components, including conversion, protection, and distribution for commercial vehicles and off-highway applications, to meet expanding power and control requirements. The technologies are intended for various uses, including commercial vehicles, military, construction, and agriculture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Increasing use of fire alarm management systems and safety systems

- 4.3.2 Signaling devices used to improve The European Railway Traffic Management System

- 4.4 Market Restraints

- 4.4.1 Lack of skilled lobor and capital intensive projects.

- 4.5 Value Chain Analysis

- 4.6 Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Round or Square Body Type

- 5.1.2 Non-lighted Push Button

- 5.1.3 Other Products

- 5.2 By Type

- 5.2.1 Audible

- 5.2.2 Visible

- 5.2.3 Other Types

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Energy and Power

- 5.3.3 Manufacturing

- 5.3.4 Food and Beverage

- 5.3.5 Transportation

- 5.3.6 Other End-user Industries

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Russia

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ITW Switches

- 6.1.2 Siemens AG

- 6.1.3 ABB Ltd

- 6.1.4 Schneider Electric

- 6.1.5 Carling Technologies

- 6.1.6 Omron Industrial Automation (Omron Corporation)

- 6.1.7 Eaton Corporation

- 6.1.8 NKK Switches

- 6.1.9 Panasonic

- 6.1.10 Littelfuse

- 6.1.11 Wurth Electronics

- 6.1.12 Nihon Kaiheiki

- 6.1.13 Marquardt Mechatronik

- 6.1.14 Kaihua Electronics

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219