|

市场调查报告书

商品编码

1624593

亚太地区非破坏性检测设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030)APAC NDT Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

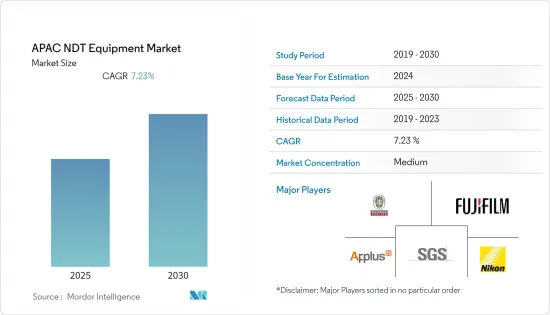

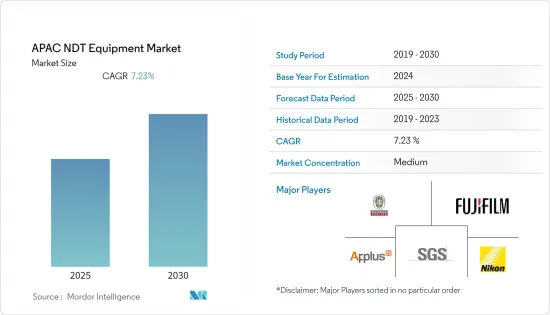

亚太地区非破坏性检测设备市场预计在预测期间内复合年增长率为7.23%

主要亮点

- 大众柴油引擎排放丑闻和中国牛奶丑闻(婴儿奶粉中发现三聚氰胺)等安全违规行为导致新兴经济体加强了监管。这些违规行为显示了独立检验和认证服务的重要性。因此,法规和标准变得更加严格和复杂,导致对第三方的依赖增加,主要是在评估方面。

- NDT(无损检测)设备无需拆卸和拆卸,可以节省大量时间。例如,涉及剥离(和更换)蒙皮的飞机维护和内部结构部件(例如翼肋)的检查可以使用萤光检查设备来执行。

- 当前无损检测设备的市场趋势是强大的即时资料撷取和需要即时即时回馈的全面撷取。 NDT 设备采用了新型感测器以及其他智慧、嵌入式的智慧多功能组件。

- 此外,电力和能源部门使用无损检测设备来测试发电厂的多个组件。随着世界各地发电厂和发电机组的增加,对无损检测设备的需求预计将增加。例如,根据世界核能协会统计,截至2020年4月,中国已有47座运作核能发电厂,并计画兴建更多核电厂,并提供线上检查和电站运作检查服务。

- 此外,市场上的供应商正在透过併购策略扩大其足迹。例如,2020 年 2 月,Eddyfi/NDT 收购了 NDT Global。 Eddyfi Technologies 与 NDT Global 合併而成,是一家专注于 NDT 的创新商业测试和测量技术集团。该集团由高端技术业务部门组成,分为两个不同的部门,包括非破坏性检测设备和特定应用整合测试。

亚太地区无损检测设备市场趋势

严格的法规要求安全

- 世界各地的多个政府机构和区域机构已製定严格的措施,主要是为了确保建筑物的安全。这些措施要求使用无损检测和其他评估技术来执行一致性检查。

- 这对于从有关当局获得基础设施计划的建筑许可证非常重要。这些检查包括结构强度评估、消防安全和紧急通讯协定合规性测试。

- 制定安全措施的国际建筑规范委员会(ICC)推出了一系列被称为「国际规范」的示范建筑规范。儘管这些代码是为在美国使用而设计的,但它们已在其他地区广泛采用。

- ICC1704标准要求焊接部门需要获得NDT认证,以确保结构完整性。然而,在美国,区域组织被赋予制定自己的技术和工业标准的自主权。

- 无损检测在国防和航太等先进应用中最为重要。在这些领域,出错的可能性接近零,这就是为什么政府机构采用 ASTM 和 ISO 标准来强制在基础设施开发和维护中使用无损检测技术。

- 在能源、材料科学和太空等关键领域,无损检测被广泛应用于确保零件的结构完整性。 ASTM、ISO、NAS等世界知名民间组织的角色不容忽视。这些组织制定无损检测产业级政策,以定义一套无损检测服务和设备製造商应遵循的实务和程序。

超音波测试

- 超音波测试是一种体积测试方法,利用高频声波来测量材料的几何和物理性能。将高频声波引入材料中以检测表面和表面下缺陷。

- 超音波检测可以检测缺陷的存在和位置,并提供有关缺陷类型的信息。透过金属-气体界面/金属-液体界面的能量、声波穿过样品所需的时间以及声束的衰减来检测缺陷。

- 该检验用于所有主要行业的品管和材料检验,包括铸件、锻件、挤压件、焊接接头、钢铁製造和生产以及压力容器、桥樑、汽车、机械和喷气发动机等结构的製造它用于。

- 超音波检测的主要优点是它只需要接触被测材料的一侧,主要用于测试压力设备、储存槽和管道系统。超音波检查是检测裂缝和不完全熔合等严重平面故障的最佳方法。

- 此检测技术具有深度渗透能力。超音波测试是一种检测线性不连续性的高灵敏度方法。超音波检测比 X 光检测更快、更经济。应用包括壁厚测量、腐蚀测绘、层压检查、缺陷检测、密度测量和硬度测量。

- 超音波测试也可用于在製造和维护检查过程中测量金属零件的厚度。超音波测试用于测量壁厚、检测隐藏的裂缝以及其他检测影响结构完整性的异常情况。超音波检测在建筑构件中的广泛使用增加了超音波检测在工业品管中的重要性。

亚太地区非破坏性检测设备产业概况

由于国内外众多厂商的存在,亚太地区非破坏性检测设备市场竞争非常激烈。市场是分散的,每个参与者都在价格、产品设计和产品创新等因素上竞争。

- 2021 年 3 月 - Intertek 宣布将其建筑业务线扩展到加勒比海地区,并在波多黎各陶巴哈开设 Intertek-PSI。该设施将在整个加勒比地区提供岩土工程服务、环境咨询和建筑材料测试,提供以前仅在美国当地和加拿大提供的服务。

- 2021 年 4 月 - 尼康公司 (Nikon) 收购了 Morf3D Inc.,Morf3D Inc. 是金属增材製造 (AM) 领域公认的先驱,专门从事航太、航太和国防工业的增材製造和工程,收购金额。

- 2021 年 5 月 - 尼康公司(Nikon)透过新的偏移 CT 重建演算法增强了其计量工业微焦点 X 光 CT 检测解决方案,提供无与伦比的扫描速度和影像解析度。使用 X 光 CT 对铝铸件和电动车电池模组等大型零件进行无损品管,可在不牺牲解析度的情况下缩短检查週期时间。这需要高X射线强度或X射线助焊剂。

- 2021 年 4 月 - 必维国际检验集团正在参与以科学为基础的目标计划。作为该组织的成员,必维国际检验集团的目标是将全球气温上升限制在比工业化前水准高 1.5°C 的范围内。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 严格的安全法规和检验服务业的成长预计将推动招聘

- 建设产业的需求不断增加

- 市场限制因素

- 高更换率仍然是关键问题,新兴地区不愿采用新技术

- 市场机会

第 6 章 技术概览

- 无损检测设备产业的演变

- 产业价值链分析

第七章 市场区隔

- 技术类型

- X光检查

- 超音波检查

- 磁粉探伤

- 液体渗透检测

- 目视检查

- 涡流探伤

- 其他技术

- 最终用户

- 石油和天然气

- 电力/能源

- 建造

- 汽车/交通

- 航太/国防

- 其他最终用户

- 国家名称

- 中国

- 日本

- 印度

- 韩国

- 新加坡

- 印尼

- 其他(泰国、马来西亚等)

第八章 竞争格局

- 公司简介

- MISTRAS Group

- SGS Group

- Fujifilm Corporation

- Olympus Corporation

- Bureau Veritas SA

- GE Measurement and Control

- Nikon Metrology NV

- Intertek Group Plc.

- Applus Services, SA

- Acuren Inspection, Inc.(Rockwood Service Corporation)

- TEAM Inc.

- YXLON International Gmbh(COMET Group)

- TUV Rhineland AG

- Magnaflux Corp.

- NCS Testing Technology Co., Limited

- Zetec, Inc.

第九章投资分析

第十章投资分析市场的未来

简介目录

Product Code: 46732

The APAC NDT Equipment Market is expected to register a CAGR of 7.23% during the forecast period.

Key Highlights

- Safety breaches, such as Volkswagen's diesel emission scandal and the Chinese milk scandal (melamine found in infant milk formula), led to more stringent regulations in developing economies. Such breaches demonstrate the significance of independent inspection and certification services. It resulted in tougher and more complex regulations and standards and increased the dependability on third parties, primarily for assessment, thus, providing scope for independent TIC companies.

- NDT devices can save substantial time by eliminating the need for disassembly or dismantling. For instance, the maintenance of aircraft and the examination of internal structural components (like wing ribs), carried out by removing (and replacing) the outer skin, may be accomplished by radiographic inspection equipment.

- The current market trends in NDT equipment are robust live data capture and comprehensive capture, requiring instant real-time feedback. New sensors are being incorporated in NDT devices, along with other smart and multifunctional components that are intelligent and embedded.

- Furthermore, the power and energy sector uses NDT equipment to test several components of plants. The increasing number of plants and power units across the world is expected to drive the demand for NDT instruments. For instance, according to the World Nuclear Association, as of April 2020, China had 47 operable nuclear plants, and the country is planning to establish additional plants, along with in-line inspection and plant operation inspection services.

- Further, vendors in the market are expanding their foothold through the merger and acquisition strategy. For instance, in February 2020, Eddyfi/NDT acquired NDT Global. The combination of Eddyfi Technologies and NDT Global is an innovative and private test and measurement technology group that focuses on NDT. The group is composed of high-end technology business units operating in two different segments, such as NDT equipment and application-specific integrated inspections.

APAC Non-Destructive Testing Equipment Market Trends

Stringent Regulations Mandating Safety

- Several governmental agencies and regional bodies across the world formulated stringent measures, primarily for assuring the safety of buildings. These measures have mandated the use of NDT and other evaluation techniques for conducting fitness checks.

- This is important for gaining building clearances from concerned authorities for infrastructural projects. These checks include structural strength evaluation, fire safety, and emergency protocol compliance tests.

- The International Code Council (ICC), which engages in the formulation of safety measures, introduced a set of model building codes known as international codes. These codes were devised for use in the United States, but they are also widely employed in other regions.

- The ICC 1704 standard mandates the need for gaining NDT certification in the welding category to ensure structural integrity. However, in the United States, regional bodies are given autonomy for framing their own technical and industrial standards.

- NDT is of paramount importance in high-grade applications, such as defense and aerospace. In these sectors, the scope for error is close to zero, so governmental agencies adopted ASTM and ISO standards to mandate NDT techniques during the development and maintenance of infrastructure.

- Key areas, like energy, material science, and space, widely use NDT for ensuring the structural integrity of components. The role played by world-renowned private organizations, like ASTM, ISO, and NAS, cannot be overlooked, and these bodies have framed NDT industry-level policies for stipulating the set of practices and procedures to be followed by NDT service and equipment firms.

Ultrasonic testing

- Ultrasonic testing is a volumetric testing method that uses high-frequency sound waves to measure geometric and physical properties in materials. The high-frequency sound waves are introduced into the material to detect surface and sub-surface flaws.

- Using ultrasonic testing, the presence and location of flaws can be detected, and information about the type of flaw can be obtained. The flaws are detected from energy by the metal gas interfaces/metal liquid interfaces, the time of transit of the sound wave through the test piece, and attenuation of the beam of sound waves.

- This testing is used for quality control and materials testing in all major industries for the testing of castings, forgings, extruded components, weld joints, manufacturing and production of steel, fabrication of structures such as pressure vessels, bridges, motor vehicles, machinery, and jet engines.

- The major advantage of ultrasonic testing is that it only requires access to one side of the material being tested and is mainly used for the inspection of pressure equipment, tanks, and piping systems. Ultrasonic testing is the best method to detect critical planar breaks, such as cracking and incomplete fusion.

- This testing technology has deep penetration ability. Ultrasonic testing is a sensitive method for the detection of linear discontinuities. Ultrasonic testing is faster and economical compared to radiographic examination. It has applications such as wall thickness measurement, corrosion mapping, lamination testing, flaw detection, density measurement, and hardness measurement.

- Ultrasonic testing can also be used to measure the thickness of metal sections during manufacturing and maintenance inspections. Ultrasonic testing is used to measure wall thickness, detect hidden cracks and other abnormalities affecting structural integrity. The widespread use of ultrasonic testing in construction components has augmented the importance of ultrasonic testing for industrial quality control.

APAC Non-Destructive Testing Equipment Industry Overview

The Asia Pacific NDT Equipment Market is highly competitive due to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc.

- March 2021- Intertek announced the expansion of its Building and Construction business line to the Caribbean with Intertek-PSI opening in Tao Baja, Puerto Rico. From this facility, the Company will provide geotechnical services, environmental consulting, and construction materials testing throughout the Caribbean, bringing services to the region that have previously only been available through offices on the U.S. mainland and in Canada.

- April 2021- Nikon Corporation (Nikon) has acquired Morf3D Inc., a valued pioneer in metal additive manufacturing (AM) specializing in AM and engineering for the aerospace, space, and defense industries, for an undisclosed amount.

- May 2021- Nikon enhanced Metrology's industrial microfocus X-ray CT inspection solutions with a new offset CT reconstruction algorithm to deliver unrivaled scan speed and image resolution. Using X-ray CT for non-destructive quality control of larger components like aluminium castings or battery modules for electric vehicles will shorten the inspection cycle times without compromising resolution. One prerequisite for achieving this is high X-ray intensity or flux.

- April 2021- Bureau Veritas joined the Science-Based Targets project, a coalition of major companies committed to achieving the highest degree of climate commitment and paving the way to a net-zero future. Bureau Veritas commits to aligning climate goals to restrict global temperature rise to 1.5°C above pre-industrial levels as a member of this organization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent safety regulations and growth in inspection services industry expected to drive adoption

- 5.1.2 Growing demand from the construction industry

- 5.2 Market Restraints

- 5.2.1 High replacement rate remains a key concern followed by reluctance to adopt new technologies in emerging regions

- 5.3 Market Opportunities

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of the NDT equipment industry

- 6.2 Industry Value Chain Analysis

7 MARKET SEGMENTATION

- 7.1 Technology Type

- 7.1.1 Radiography Testing

- 7.1.2 Ultrasonic Testing

- 7.1.3 Magnetic Particle Testing*

- 7.1.4 Liquid Penetrant Testing

- 7.1.5 Visual Inspection

- 7.1.6 Eddy Current Testing*

- 7.1.7 Other Technologies

- 7.2 End-user

- 7.2.1 Oil & Gas

- 7.2.2 Power & Energy

- 7.2.3 Construction

- 7.2.4 Automotive & Transportation

- 7.2.5 Aerospace & Defense

- 7.2.6 Other End-users

- 7.3 Country

- 7.3.1 China

- 7.3.2 Japan

- 7.3.3 India

- 7.3.4 South Korea

- 7.3.5 Singapore

- 7.3.6 Indonesia

- 7.3.7 Others (Thailand, Malaysia, others)

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 MISTRAS Group

- 8.1.2 SGS Group

- 8.1.3 Fujifilm Corporation

- 8.1.4 Olympus Corporation

- 8.1.5 Bureau Veritas S.A.

- 8.1.6 GE Measurement and Control

- 8.1.7 Nikon Metrology NV

- 8.1.8 Intertek Group Plc.

- 8.1.9 Applus Services, S.A.

- 8.1.10 Acuren Inspection, Inc.(Rockwood Service Corporation)

- 8.1.11 TEAM Inc.

- 8.1.12 YXLON International Gmbh ( COMET Group)

- 8.1.13 TUV Rhineland AG

- 8.1.14 Magnaflux Corp.

- 8.1.15 NCS Testing Technology Co., Limited

- 8.1.16 Zetec, Inc.

9 Investment Analysis

10 Future of the market

02-2729-4219

+886-2-2729-4219