|

市场调查报告书

商品编码

1624595

冷冻食品包装:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

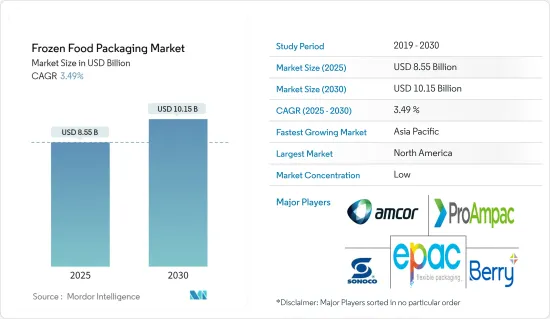

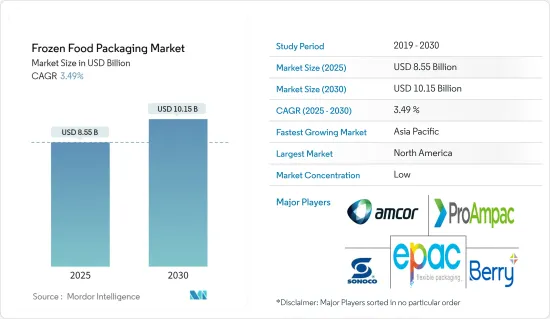

冷冻食品包装市场规模预计到2025年为85.5亿美元,预计到2030年将达到101.5亿美元,预测期内(2025-2030年)复合年增长率为3.49%。

冷冻食品包装具有轻量、不易破损和可重新密封的特点,可以减少石化燃料的使用,减少温室气体排放和水的使用,从而创造一个更绿色的环境。

主要亮点

- 市场消费者更喜欢零售店、超级市场和大卖场。有组织的零售商店在全球范围内占有重要地位,并占据了市场的很大一部分。有组织的零售连锁店的兴起与冷冻食品行业对食品包装解决方案的需求直接相关。

- 肉类、家禽和鱼贝类等冷冻食品包装在其他食品应用中成长最快。全球许多领先的食品包装公司都推出了极具创造性和装饰性的包装。

- 例如,2023 年 8 月,纤维产品製造商 Ahlstrom 与永续包装供应商 The Paper People 合作,推出了冷冻食品的永续包装解决方案。这种完整的纤维包装由两家公司共同开发,旨在替代传统的化石塑胶和薄膜,主要用于冷冻食品包装。这种可回收包装可与现有包装设备一起使用,包括垂直成形充填密封、立式袋和 SOS 型系统。

- 此外,2023 年 5 月,Sabic 与 Estiko Packaging Solutions 和挪威品牌所有者 Coldwater Prawns 合作,设计和製造了一种用于冷冻虾的新型永续包装袋。该袋由循环认证的随机聚合物级 Sabic PP(聚丙烯)晶体(Estico Packaging Solutions 提供的多层薄膜)製成,含有约 60% 的海洋塑胶。

- 然而,政府包装法律和法规可能会限制市场成长。在美国,食品药物管理局(FDA) 负责监管食品中添加物质的安全性。整体而言,冷冻食品包装需要以下基本特性:耐低温和高温,一定的机械强度,耐酸、油和食品中存在的其他降解化学物质,以及一定的卫生水平和相似性。

冷冻食品包装市场趋势

肉类和海鲜食品占据主要市场份额

- 冷冻肉类市场预计在未来几年将显着增长,这主要是由于食品偏好的变化。 COVID-19 爆发后,对冷冻肉类和包装已调理食品的需求激增。随着时间的推移,肉类产业已经多元化,现在许多加工公司提供冷冻肉类和已调理食品。值得注意的是,该行业几乎在世界每个地区都在扩张。

- 消费者越来越愿意为更高的品质支付溢价。消费者始终更喜欢优先生产不含防腐剂或最少防腐剂的冷冻肉类产品的品牌。因此,消费者对健康饮食的偏好不断增加,将推动以「有机」且不含防腐剂的方式销售的冷冻肉和鱼产品的需求。现在,许多人对购买冷冻肉品充满信心,因为它们具有比生鲜肉更长的保质期等优点。

- 据纽西兰统计局称,2023 年纽西兰冷冻鸡肉产量将略高于 68,000 吨,高于前一年的约 63,000 吨。这种成长趋势预计将持续下去,进一步推动冷冻食品包装的需求。

- 根据挪威风险管理和保证公司挪威船级社(DNV)的水产品预测,到2050年,全球人均水产品需求将稳定成长。随着市场的扩大,维持水产品的品质已成为最重要的议题。这需要包装解决方案能够减少微生物生长,防止冷冻,促进快速冷冻,并透过最大限度地减少滴水损失来延长保质期。因此,包装水产品产品的消费不断增加,推动了对冷冻水产品包装的需求。

- 市场主要企业不断推出新的冷冻水产品产品,从而扩大了包装供应商的机会。例如,2024 年 5 月,Scott & Jon's 扩大了其冷冻虾系列,新增了一款可微波炉加热的鲑鱼碗。这些最新产品是 Scott &Jon 于 2023 年推出注重健康的虾碗系列后推出的。

亚太地区将经历最快的成长

- 在亚太地区,人口成长正在推动食品需求的扩大。都市化以及人们对食物中毒、浪费和腐败的认识不断提高,推动了对更高品质产品的需求。中国在亚太冷冻食品包装市场中占有主要份额。该国庞大的人口和都市化刺激了人们对冷冻食品日益增长的需求。当今的消费者优先考虑便利性和品质。

- 印度的冷冻食品产业正在迅速扩张。每个品牌的冷冻食品都成功地从偶尔聚会上提供的轻食转变为各个年龄层的人都喜欢的必备品。对已调理食品(RTE) 和方便食品的需求正在迅速增加,尤其是随着劳动力的增长。这种趋势在现代夫妇中更为明显,他们生活忙碌,为家人寻求快速、营养的膳食。

- 随着健康和健身趋势在整个全部区域蓬勃发展,冷冻食品产业也不甘落后。包装在这个行业中起着至关重要的作用。食品製造商优先考虑确保其产品从生产到消费的整个过程都是安全且不受污染的,而强大的冷冻食品包装解决方案有效地应对了这一挑战。

- 由于高品质和易于准备的流行趋势,冷冻食品包装受到日本消费者的青睐。此外,日本跨国食品和生物技术公司味之素预测,日本家庭冷冻食品消费将从上一年的486亿日元(3.3亿美元)增至2023年的603亿日元(4.1亿美元)。 ,这将增加到 10,000,000 美元。这一激增将推动该地区冷冻食品包装市场的发展。

- 此外,由于冷冻肉类和已烹调肉类的需求不断增加,中国、日本、印度和其他亚洲国家的冷冻食品包装市场规模正在扩大。根据中国国家统计局统计,近年来冷冻食品包装产业成长近30%。

冷冻食品包装产业概况

冷冻食品包装市场较为分散,由几家主要参与者组成,例如 Sonoco Products Company.ProAmpac LLC、Cascades Inc.从市场占有率来看,目前只有少数大公司占据市场主导地位。然而,具有创意和装饰性包装图案的中小企业正在透过赢得新契约和开发新市场来增加其市场份额。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 新兴国家对冷冻食品的需求不断扩大

- 有组织的零售店增加

- 市场限制因素

- 政府监管和干预

第六章 市场细分

- 依食品类型

- 水果和蔬菜

- 肉类/海鲜

- 冷冻甜点和冰淇淋

- 烘焙点心

- 按包装类型

- 包包

- 盒子

- 管杯

- 托盘

- 饶舌歌手

- 小袋

- 其他包装

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ProAmpac LLC

- Sonoco Products Company

- Amcor PLC

- Berry Plastics Group Inc.

- ePac Holdings, LLC

- Cascades Inc.

- Duropack Limited

- Smurfit Westrock plc

- Mondi Group

- American Packaging Corporation

- ThinkInk Packaging

第八章投资分析

第九章 市场机会及未来趋势

The Frozen Food Packaging Market size is estimated at USD 8.55 billion in 2025, and is expected to reach USD 10.15 billion by 2030, at a CAGR of 3.49% during the forecast period (2025-2030).

Frozen food packaging delivers lightweight, unbreakable, and resealable features, lowers fossil fuel usage, and can reduce greenhouse gas emissions and water usage to create an eco-friendly environment.

Key Highlights

- The market's consumers prefer retail stores, supermarkets, and hypermarkets. Organized retail stores are a substantial part of the market with a significant global presence. The increase in the organized retail chain is translating directly into the need for food packaging solutions in the frozen food industry.

- Packaging for frozen foods like meat, poultry, and seafood witnessed the fastest growth among other food applications. Many large food packaging companies across the globe are launching hugely creative and decorative packaging.

- For instance, in August 2023, fiber-based products manufacturer Ahlstrom teamed up with sustainable packaging provider The Paper People to launch a sustainable packaging solution for frozen food. Co-developed by the two companies, this fully fiber-based packaging is mainly designed to substitute traditional fossil-based plastic and films for frozen food packaging. The recyclable packaging can be utilized on existing packaging equipment, including vertical form-fill-seal, stand-up pouches, and SOS-style systems.

- Also, in May 2023, Sabic joined forces with Estiko Packaging Solutions and brand owner Coldwater Prawns of Norway to design and execute a sustainable new packaging pouch for frozen prawns. The pouch is made from a multilayer film offered by Estiko Packaging Solutions utilizing a circular-certified random polymer grade of Sabic PP (polypropylene) Qrystal with an ocean-bound plastic content of around 60%.

- However, the government packaging laws and regulations could limit the market growth. In the United States, the Food and Drug Administration (FDA) regulates the safety of substances added to food. Overall, frozen food packaging should have the following essential characteristics: Resistance to low and high temperatures, a particular mechanical strength, resistance to acid, oil, and other degrading chemicals in the food product, and a specific level of hygiene and similar.

Frozen Food Packaging Market Trends

Meat and Sea Food to Account for a Major Share in the Market

- The frozen meat market is poised for substantial growth in the coming years, primarily driven by shifting food preferences. Following the COVID-19 outbreak, demand surged for frozen meats and packaged, ready-to-eat foods. Over time, the meat industry has diversified, with numerous processing firms now offering frozen meat products and ready-to-eat items. Notably, this sector is witnessing expansion in nearly every region worldwide.

- Consumers are increasingly willing to pay a premium for higher quality. They consistently prefer brands that prioritize producing frozen meat items with minimal or no preservatives. As a result, the growing consumer preference for healthy eating is set to boost the demand for frozen meat and fish products marketed as "organic" and preservative-free.Many individuals now purchase frozen meat products with confidence, drawn by advantages like extended shelf life compared to fresh meat.

- Statistics New Zealand reported that New Zealand produced just over 68 thousand metric tons of frozen chicken meat in 2023, up from approximately 63 thousand metric tons the year before. This upward trend is anticipated to continue, further driving the demand for frozen food packaging.

- According to the "Seafood Forecast" by Det Norske Veritas (DNV), a Norwegian risk management and assurance firm, global per capita seafood demand is set to rise steadily until 2050. As markets expand, maintaining seafood quality becomes paramount. This necessitates packaging solutions that extend shelf life by curbing microbial growth, preventing freezer burn, facilitating rapid freezing, and minimizing drip loss. Consequently, the rising consumption of packaged seafood products is driving up the demand for frozen seafood packaging.

- Major players in the market are consistently launching new frozen seafood products, thereby expanding opportunities for packaging vendors. For example, in May 2024, Scott & Jon's expanded its frozen shrimp entree line to include new microwavable salmon bowls. These latest offerings come on the heels of Scott & Jon's 2023 debut of its health-focused shrimp bowl line.

Asia-Pacific to Witness the Fastest Growth

- In the Asia-Pacific region, a growing population is driving an increasing demand for food products. Urbanization and heightened awareness of foodborne illnesses, wastage, and spoilage are fueling demand for higher-quality offerings. China holds a significant share of the Asia-Pacific frozen food packaging market. The country's vast population and urbanization have spurred a rising appetite for frozen food items. Today's consumers prioritize both convenience and quality.

- India's frozen food segment is witnessing rapid expansion. Brands have successfully transitioned their offerings from being occasional party snacks to regular meal items enjoyed by all age groups. The surge in demand for ready-to-eat (RTE) and convenience foods is particularly pronounced among the growing working population. This trend is even more evident among modern couples, both of whom lead busy lives and seek quick, nutritious meals for their families.

- As the health and fitness trend gains momentum across the region, the frozen foods sector is not left behind. Packaging plays a pivotal role in this industry. Food manufacturers prioritize ensuring their products remain safe and contamination-free from production to consumption, a challenge effectively addressed by robust frozen food packaging solutions.

- Due to its high quality and popular easy-to-cook trends, frozen food packaging is preferred by Japanese consumers. Moreover, Ajinomoto, a Japanese multinational food and biotechnology corporation, reported that the consumption of home-use frozen meals in Japan rose to JPY 60.3 billion (USD 0.41 billion) in 2023, up from JPY 48.6 billion (USD 0.33 billion) the previous year. This surge is poised to boost the market for frozen food packaging options in the region.

- Additionally, the size of China, Japan, India and other Asian countries frozen food packaging market is expanding due to the rise in demand for frozen meat and ready-to-eat meal products. The National Bureau of Statistics of China states that the industry saw an increase in frozen food packaging of almost 30% in the last few years.

Frozen Food Packaging Industry Overview

The frozen food packaging market is fragmented and consists of several major players, such as Sonoco Products Company. ProAmpac LLC, Cascades Inc., and more. In terms of market share, few of the major players currently dominate the market. However, with creative and decorative packaging patterns, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Frozen Food Demand in Emerging Countries

- 5.1.2 Rising Number of Organized Retail Stores

- 5.2 Market Restraint

- 5.2.1 Government Regulations and Interventions

6 MARKET SEGMENTATION

- 6.1 By Type of Food

- 6.1.1 Fruits and Vegetables

- 6.1.2 Meat and Sea Food

- 6.1.3 Frozen Desserts and Ice Creams

- 6.1.4 Baked Foods

- 6.2 By Type of Packaging

- 6.2.1 Bags

- 6.2.2 Boxes

- 6.2.3 Tubs and Cups

- 6.2.4 Trays

- 6.2.5 Wrappers

- 6.2.6 Pouches

- 6.2.7 Other Types of Packaging

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ProAmpac LLC

- 7.1.2 Sonoco Products Company

- 7.1.3 Amcor PLC

- 7.1.4 Berry Plastics Group Inc.

- 7.1.5 ePac Holdings, LLC

- 7.1.6 Cascades Inc.

- 7.1.7 Duropack Limited

- 7.1.8 Smurfit Westrock plc

- 7.1.9 Mondi Group

- 7.1.10 American Packaging Corporation

- 7.1.11 ThinkInk Packaging