|

市场调查报告书

商品编码

1626297

非洲钻井和完井液:市场占有率分析、产业趋势和成长预测(2025-2030)Africa Drilling and Completion Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

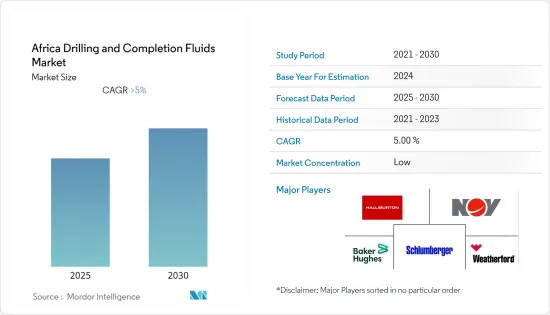

预计非洲钻井完井液市场在预测期内的复合年增长率将超过 5%。

COVID-19大流行严重影响了2020年的市场。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,非洲国家钻井作业数量的增加以及页岩、深水和超深水油田的市场开发预计将推动市场成长。

- 同时,由于供需缺口、地缘政治紧张局势和其他几个因素,近期油价波动预计将阻碍预测期内非洲钻井和完井液市场的成长。

- 我们相信,钻井正在从陆地转向海洋,并且比以前更严格的钻井,例如深水和超深水计划,将为非洲钻井和完井液市场在预测期内提供利润丰厚的成长机会。

- 尼日利亚在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长归因于石油和天然气行业投资的增加。

非洲钻井完井液市场趋势

海工业务实现显着成长

- 非洲海上石油和天然气产业持续扩张,非洲海上探勘和生产活动的成长主要得益于政府提供重大奖励以释放投资机会并进一步促进市场发展。

- 截至2021年6月,非洲安装了60多个石油和天然气钻井平台。其中,56座为陆域钻机,9座为海上钻机。石油钻机(石油平台)是用来钻探石油和天然气的结构。

- 此外,非洲近海深水和超深水空间继续吸引石油勘探商和生产商的扩张,特别是在非洲南部和西部。随着非洲上游业务不断增加,对油田服务的需求也不断成长。因此,预计服务公司将在预测期内在该市场取得长足发展。

- 然而,非洲海上钻机数量从2019年的23座下降到2021年的11座,主要是由于疫情的出现以及承包商老旧自升式钻井平台的退役,最终导致供应减少。

- 2022年12月,尼日利亚上游石油监管委员会(NUPRC)宣布了2022年海上油田新原油探勘和钻探活动的迷你竞标。今年的小型竞标中,提案7个海上区块,水深1,150m至3,100m,面积约6,700km2。

- 然而,中国海洋石油总公司和埃尼集团等公司正在该地区投资勘探活动,预计将在预测期内推动钻井和完井液市场的发展。

尼日利亚主导市场

- 尼日利亚是该地区最大的原油生产国,生产的原油硫含量较低,全球精製加工产品的硫含量需求很高。因此,奈及利亚在勘探与生产领域占据主导地位,并推动了钻井和完井液市场。

- 此外,自2017年以来,尼日利亚的许多上游计划一直在不同阶段等待核准。随着油价回升,营运商重拾信心并启动了多个计划。因此,即将推出的陆上和海上计划预计将在预测期内推动市场。

- 2021年,尼日利亚运作的石油和天然气钻机数量限制为8个。尼日利亚是非洲大陆活跃钻机数量最多的国家。

- 2019年至2021年,石油钻机数量、完井数量及净生产量均下降。儘管如此,如果油价上涨,上游活动的增加将对该国的原油产量和健康的完工量产生积极影响。

- 深水、水平钻井和水力压裂的最新趋势导致该国对钻井和完井液的需求显着增加。因此,预计该地区海上石油和天然气投资以及探勘和生产活动增加等因素将扩大预测期内钻井和完井液市场的需求。

非洲钻完井液产业概况

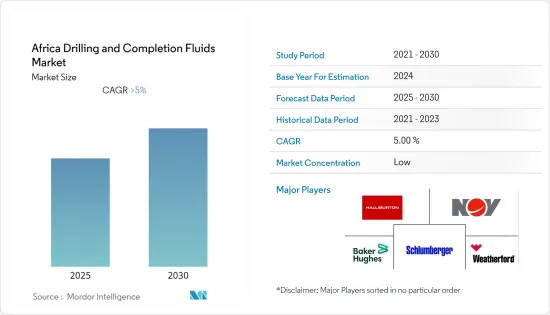

非洲钻井和完井液市场因其性质而适度细分。市场主要企业包括(排名不分先后)斯伦贝谢有限公司、哈里伯顿公司、贝克休斯公司、威德福国际有限公司和国民油井华高公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 流体类型

- 水性的

- 油腻的

- 其他的

- 地方

- 陆上

- 离岸

- 井型

- 传统的

- 高压高温(HPHT)

- 地区

- 奈及利亚

- 阿尔及利亚

- 迦纳

- 其他非洲地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited

- Weatherford International Plc

- National Oilwell Varco, Inc.

- Superior Energy Services Inc.

- CES Energy Solutions Corp.

- Newpark Resources Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 47054

The Africa Drilling and Completion Fluids Market is expected to register a CAGR of greater than 5% during the forecast period.

The COVID-19 pandemic affected the market severely in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increase in the number of drilling operations in African countries and the development of shale, deep-water, and ultra-deepwater fields are expected to drive the market's growth.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitical tensions, and several other factors, are expected to hamper the growth of Africa's drilling and completion fluids market during the forecast period.

- Nevertheless, wells are being drilled away from land into the sea, and more profound than before, such as deepwater and ultra-deepwater projects, are likely to create lucrative growth opportunities for Africa's drilling and completion fluids market in the forecast period.

- Nigeria dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments in the oil and gas industry.

Africa Drilling & Completion Fluids Market Trends

Offshore Segment to Witness Significant Growth

- Africa's offshore oil and gas industry continues to expand, and the growth of Africa's offshore exploration and production activities has been mainly driven by the efforts of governments in their region to provide critical incentives and supporting policies to unlock the investment opportunity, further promulgating the market.

- More than 60 oil and gas rigs were located in Africa as of June 2021. Of the total, 56 were land rigs, while nine were offshore. Oil rigs, or oil platforms, are structures used for oil and natural gas drilling.

- Moreover, Africa's offshore deep and ultra-deep space has continued to attract oil explorers and producers to increase their operations, especially in Southern and Western Africa. As the upstream activities continue to rise in Africa, the demand for oil field services is also growing. This, in turn, is expected to help the services companies to progress in this market over the forecast period.

- However, the number of offshore rigs in Africa decreased from 23 in 2019 to 11 in 2021, primarily due to the advent of the pandemic and retiring of older jackups by contractors, which eventually declined the supply.

- In December 2022, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) announced the Mini-Bid Round 2022 for new crude oil exploration and drilling activities in the offshore blocs. In this year's Mini-Bid Round, seven offshore blocks covering an area of approximately 6,700 km2 in water depths of 1,150m to 3,100m are put on offer.

- But companies such as China National Offshore Oil Corporation and Eni have invested in exploration activities in the region, which is expected to drive the drilling and completion fluids market during the forecast period.

Nigeria to Dominate the Market

- Nigeria, the largest crude oil producer in the region, produces low-sulfur content crude oil, which has a high global demand about the need for a reduction in sulfur content in the products processed by the global refiners. Therefore, Nigeria has dominated the E&P sector, driving the drilling and completion fluid market.

- Moreover, many upstream projects were awaiting approval post-2017 at different stages in Nigeria. With the advent of oil price recovery, the operators started gaining confidence and kick-started a few projects. Hence, upcoming projects onshore and offshore are expected to drive the market during the forecast period.

- In 2021, the number of active oil and gas rigs in Nigeria was restricted to 8 active rigs. Nigeria was the country with significant active rigs in the continent.

- The oil rigs, well-completed count, and net crude oil production decreased during 2019-2021. Still, once the oil price improves, the increase in upstream activities will positively impact crude oil production and the number of healthy completion activities in the country.

- The recent development of deepwater, horizontal drilling and fracking have resulted in a massive increase in demand for drilling and completion fluids in the country. Therefore, factors such as rising offshore oil and gas investments, and exploration and production activities in the region are expected to grow the need for the drilling and completion fluids market over the forecast period.

Africa Drilling & Completion Fluids Industry Overview

The Africa drilling and completion fluids market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International PLC, and National-Oilwell Varco Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fluid Type

- 5.1.1 Water-Based

- 5.1.2 Oil-Based

- 5.1.3 Others

- 5.2 Location

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Well Type

- 5.3.1 Conventional

- 5.3.2 High Pressure High Temperature (HPHT)

- 5.4 Geography

- 5.4.1 Nigeria

- 5.4.2 Algeria

- 5.4.3 Ghana

- 5.4.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 Halliburton Company

- 6.3.3 Schlumberger Limited

- 6.3.4 Weatherford International Plc

- 6.3.5 National Oilwell Varco, Inc.

- 6.3.6 Superior Energy Services Inc.

- 6.3.7 CES Energy Solutions Corp.

- 6.3.8 Newpark Resources Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219