|

市场调查报告书

商品编码

1626300

亚太地区石油和天然气自动化:市场占有率分析、产业趋势、统计和成长预测(2025-2030)APAC Oil & Gas Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

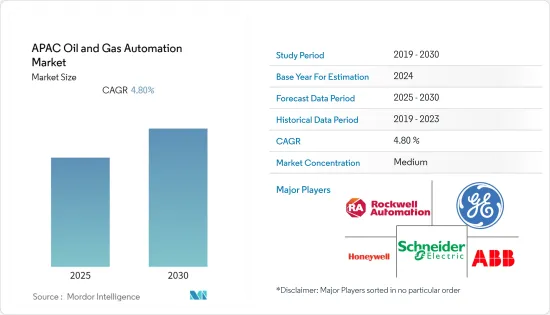

亚太地区石油和天然气自动化市场预计在预测期内复合年增长率为4.8%

主要亮点

- 自动化正在被多个行业采用,以带来即时和持久的变化,特别是在石油和天然气行业等大型行业。石油和天然气产业正开始走向数位化,更多的感测器从世界各地的钻机上累积资料。然而,在日益多元化的市场中,仍有一些尚未探索的领域可供公司改进。采用数位技术使工程团队能够与石油和天然气公司合作,更有效地管理资料和计划要求、改善内部沟通并简化规划。

- 此外,印度等国家面临着 2040 年将精製能力增加一倍的压力,以满足乘用车数量不断增长而不断增长的燃料需求。然而,儘管石油产量增加,像英国石油公司(印度)这样的下游公司却没有计划建造新的炼油厂。该公司将专注于对现有工厂进行现代化改造,同时扩大其加油站网络,预计将产生 30 亿美元的额外现金。

- 感测器成本的下降还可能提供多种成本节约措施,以在石油和天然气行业引入自动化技术,以提高生产率并消除经营模式中的潜在瓶颈。

- 然而,根据去年发布的 Digital-Re-Definery 报告,报告指出数位技术使精製业务利润率提高 10% 或更多的精製数量从 11% 下降到 3%。此外,此后的利润率改善幅度均有所下降。这突显了这样一个事实:由于石油和气体纯化行业最终并未利用数位投资,因此存在巨大的改进潜力。

- 此外,石油和天然气产业也面临技术纯熟劳工短缺的问题。人才库薄弱使得石油和天然气公司僱用具有解决新能源来源所需技术技能的新员工的能力变得复杂。此外,自 2020 年起,由于 COVID-19 以及沙乌地阿拉伯和俄罗斯之间的价格战,油价下跌的压力预计将鼓励石油生产商提高生产效率并刺激该行业的需求。

亚太地区石油和天然气自动化市场趋势

利用数位技术提高生产效率

- 随着工业 4.0 技术在石油和天然气领域的出现,解决方案供应商正在引入额外的感测器和控制器,在实现即将到来的数位技术的优势之前,这些感测器和控制器需要替换现有的控制器。

- 例如,公司正在开发和部署额外的感测器来测量地下和井口附近的压力、温度、振动和流速。该解决方案透过物联网网关或集线器将大型资料集传送到云端。在云端,资料科学家建构基于人工智慧的机器学习模型。这需要大量的资金投入,但如上所述,目前存在很大的限制。

- 过去几十年甚至更早的时候,很大一部分人工抽油井已经安装了感测器和自动化设备。但问题是控制器只执行基本的控制功能。这提供了足够的运算能力来执行操作人工水泵的简单功能,其预设操作设定由操作员或生产工程师使用 SCADA 软体指定。

石油消费量上升推动自动化

- 为了满足这种不断增长的需求,公司越来越多地转向自动化策略,以保持生产环境的高效率。因此,与油气三大领域相比,下游产业的自动化渗透率相对较高。

- 2020年天然气需求预计将下降2.3%,与金融危机后的2009年市场非常相似。大多数地区的消费量均下降,但中国除外,其天然气需求增加了近7%。

- 在下游领域,资产效率推动投资收益(ROI)。炼油厂週转计画可能至少持续三到五週,这表明维护这些资产的重要性。

- 在预测期内,预计产业内物联网解决方案以及与 SCADA、PLC 和 HMI 系统结合的预测维修系统的数量将大幅增加。

- 自动化技术有潜力显着提高生产力和效率,同时帮助产业保持高产出。例如,考虑像英国,该国在石油和天然气领域的技术渗透率相当高。

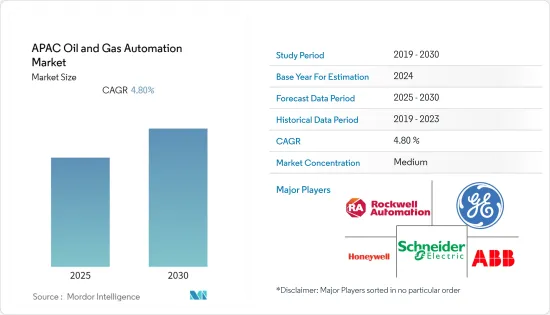

亚太地区石油和天然气自动化产业概况

石油和天然气自动化市场竞争激烈,由多家大公司组成。从市场占有率来看,目前少数大公司占据市场主导地位。这些拥有高市场份额的大公司正专注于扩大海外基本客群。这些公司利用策略合作措施来扩大市场占有率并提高盈利。我们也收购新兴企业,以增强我们的产品能力。

- 2020 年 3 月 - 艾默生和 Quantum Reservoir Impact 宣布建立合作伙伴关係,开发和行销专为石油和天然气探勘和生产而设计的基于人工智慧的分析和决策工具的次世代应用程式。

- 2021 年 9 月 - Automation Anywhere 宣布与印度石油公司 (IOCL) 合作。在其五年计画的第一阶段,IOCL 将使用 Automation 360(一个由人工智慧驱动的机器人流程自动化 (RPA) 平台)来自动化财务、人力资源和库存等部门的关键流程选择。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场动态与趋势

- 市场概况

- 推动市场的因素

- 生产优化

- 增强安全保障

- 高效率、便捷的维护

- 老储存探勘

- 市场限制因素

- 初期投资高

- 政治不稳定

- 当前的市场机会

- 技术简介

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 产业政策

第五章市场区隔

- 透过自动化技术

- 集散控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 人机介面 (HMI)

- 监控/资料采集 (SCADA)

- 即时最佳化和模拟(RTOS)

- 其他的

- 按行业分类

- 上游

- 中产阶级

- 下游

- 按石油衍生产品

- 液化石油气

- 汽油

- 柴油引擎

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他的

- 亚太地区

第六章 竞争状况

- 公司简介

- ABB

- Honeywell

- General Electric

- Rockwell Automation

- Schneider Electric

- Siemens

- Yokogawa Electric Corporation

- Metso Corporation

- Mitsubishi Electric Corporation

第七章 投资分析

- 最近的併购

- 投资者展望

第八章亚太油气自动化市场未来

The APAC Oil & Gas Automation Market is expected to register a CAGR of 4.8% during the forecast period.

Key Highlights

- Automation is being adopted across several industries to make an immediate and lasting difference, particularly in a large industry like the oil and gas sector. The oil & gas industry has begun the move toward digitization with more sensors accumulating data from rigs worldwide. However, there are still some untapped areas where companies can improve within an increasingly diverse market. Employing digital technologies can help engineering teams work more efficiently with oil and gas companies to manage data and project requirements better, improving internal communications and simplifying planning.

- Furthermore, in countries like India, there is a severe need to double the country's refining potential by 2040 to suffice growing fuel demand as passenger vehicles increase. However, downstream companies such as BP (India) have no plans to build new refineries despite growing oil production. They are expected to focus on modernizing existing plants while expanding their network of filling stations to generate USD 3 billion in additional cash.

- Declining sensor costs could also offer several cost-cutting measures to implement automation technologies in the oil & gas industry to improve productivity and eliminate any possible hindrances in the business model.

- However, according to the Digital-Re-Definery report released in the past year, the number of refiners that reported digital technologies delivering a margin improvement of more than 10% in refining operations dropped from 11% to 3%. The numbers also dropped for all subsequent margin improvement ranges. This underscores the fact that there is considerable potential for improvement as Oil and Gas Refineries are yet to capitalize ultimately on digital investments.

- Additionally, the oil & gas industry is suffering from a skilled labor shortage. The shallow talent pool has made it complicated for oil & gas companies to hire new employees with the technical skills required to work on new energy sources. Moreover, stress with the oil prices declining over 2020, in the wake of COVID-19 & price war between Saudi Arabi and Russia, is expected to drive the oil-producing companies to improve their production efficiency and dive the demand in the sector.

APAC Oil Gas Automation Market Trends

Digital Technologies to increase the production efficiency

- As Industry 4.0 technology emerges in the oil and gas sector, solution providers are introducing additional sensors or controllers that need to replace existing controllers before realizing the benefits of the upcoming digital technologies.

- For example, companies are developing and deploying additional sensors to measure pressure, temperature, vibration, and flow in the underground area or at or near the wellhead. This solution involves sending large datasets to the cloud over IoT gateways and hubs. In the cloud, data scientists build AI-based machine learning models. This requires a significant capital investment, but as mentioned above, it is currently severely restricted.

- A significant proportion of artificially lifted wells already have sensors and automation equipment installed in the last few decades or earlier. However, the problem is that the controller performs only essential control functions. This provides sufficient computational power to perform the simple functions of operating an artificial lift device with the preset operating settings specified by the operator or production engineer using SCADA software.

Increase in the consumption of Oil is pushing for automation

- To keep up with such increasing demand, companies are often turning toward automation strategies to maintain high efficiencies of their production environments. Hence, compared to all three streams of oil and gas, the penetration of automation is comparatively high in the downstream sector.

- Gas demand is estimated to have declined by 2.3% in 2020, much like what the market saw in 2009 after the financial crisis. Consumption declined in most regions except China, where gas demand increased by almost 7%.

- In the downstream sector, the efficiency of the assets determines the return on investment (ROI) factors. The turnaround schedules of the refineries that last for at least three to five weeks in some cases demonstrate the importance of maintaining these assets.

- Over the forecast period, the industry is expected to witness a considerable increase in the number of IoT solutions and predictive maintenance systems combined with SCADA, PLC, and HMI systems.

- Automation technologies may dramatically enhance productivity and efficiency while also helping the industry maintain high production output. For example, consider countries like the United Kingdom, where technology penetration is considerably high in the oil and gas sector.

APAC Oil Gas Automation Industry Overview

The oil and gas automation market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability. The companies operating in the market are also acquiring start-ups working on oil and gas automation to strengthen their product capabilities.

- March 2020 - Emerson and Quantum Reservoir Impact announced a partnership to develop and market next-generation applications for artificial intelligence-based analytics and decision-making tools designed for oil and gas exploration and production.

- September 2021 - Automation Anywhere announced a collaboration with Indian Oil Corporation Limited (IOCL) to speed and scale automation to drive innovation across the organization of 30,000 employees. In the first phase of the five-year plan, IOCL will use Automation 360, AI-powered robotic process automation (RPA) platform, to automate critical process choices across departments such as finance, human resources, and inventory.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND TRENDS

- 4.1 Market Overview

- 4.2 Factors Driving the Market

- 4.2.1 Optimizing Production

- 4.2.2 Enhancing Safety and Security

- 4.2.3 Effective and Easy Maintenance

- 4.2.4 Exploration from Aging Reservoirs

- 4.3 Factors Restraining the Market

- 4.3.1 Initial Investment is high

- 4.3.2 Political Instability

- 4.4 Current Opportunities in the Market

- 4.5 Technology Snapshot

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Competitive Rivalry within the Industry

- 4.7 Industry Value-Chain Analysis

- 4.8 Industry Policies

5 MARKET SEGMENTATION

- 5.1 By Automation Technologies

- 5.1.1 Distributed Control Systems (DCS)

- 5.1.2 Programmable Logic Controller (PLC)

- 5.1.3 Human Machine Interface (HMI)

- 5.1.4 Supervisory Control and Data Acquisition (SCADA)

- 5.1.5 Real Time Optimization & Simulation (RTOS)

- 5.1.6 Others

- 5.2 By Sectors

- 5.2.1 Upstream

- 5.2.2 Midstream

- 5.2.3 Downstream

- 5.3 By Petroleum Derivative Products

- 5.3.1 Liquefied Petroleum Gas

- 5.3.2 Petrol

- 5.3.3 Diesel

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 Others

- 5.4.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB

- 6.1.2 Honeywell

- 6.1.3 General Electric

- 6.1.4 Rockwell Automation

- 6.1.5 Schneider Electric

- 6.1.6 Siemens

- 6.1.7 Yokogawa Electric Corporation

- 6.1.8 Metso Corporation

- 6.1.9 Mitsubishi Electric Corporation

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers and Acquisitions

- 7.2 Investor Outlook