|

市场调查报告书

商品编码

1626308

欧洲温度感测器:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

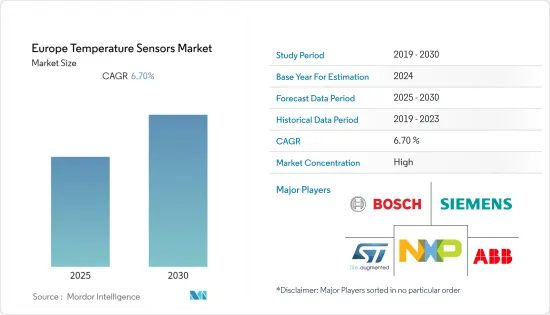

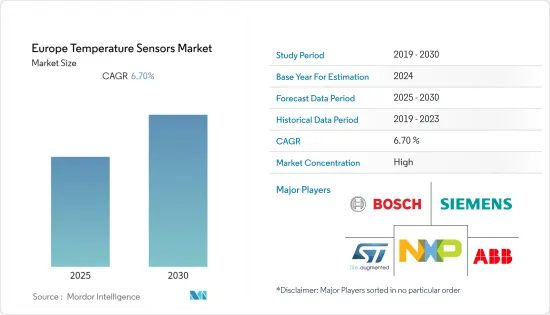

欧洲温度感测器市场预计在预测期内复合年增长率为 6.7%

主要亮点

- 医疗、汽车以及石油和天然气领域温度感测器的采用正在推动该地区的市场成长。预计该国汽车行业的成长将受到电动和混合动力汽车汽车的推动,其中一些公司专注于电动车技术。联邦政府也支持在该地区引入插电式电动车。

- 英国汽车工业协会 (SMMT) 表示,英国汽车工业对国家经济至关重要,累计超过 820 亿欧元,为英国经济增加了 186 亿欧元的附加价值。英国有 30 多家製造商生产 70 多种车型,并得到 2,500 家零件製造商和熟练工程师的支持。

- 超级大国增加军费开支正在推动法国在军事领域的支出。法国政府承诺2025年将国防预算提高到国内生产总值)的2%,这意味着2019年至2023年公共支出将达到1,980亿欧元,2019年至2025年总计2.95兆欧元。亿欧元的计划。此类投资可望增加温度感测器在该国军事领域的使用。

- 最近宣布的 1300 亿欧元的后 COVID-19奖励策略将分配大量资金用于基础设施发展、税收减免和进一步补贴,以提振德国电动车市场。

欧洲温度感测器市场趋势

石油和天然气成长显着

- 该地区出现了温度感测器领域的重要新兴企业。例如,总部位于英国的 Silixa 专注于为石油和天然气产业开发分散式光纤监控解决方案。该公司采用分散式温度感测技术进行资料采集。此解决方案只需一次安装和重新进入即可应用于多种井下应用和管道监测。

- 在法国可以看到多种伙伴关係活动。例如,两家法国工业公司 MIOS 和 CA PYROCONTROLE 正在利用技术,透过为火炬烟囱配备 LoRa 温度感测器,将连网感测器引入法国一家大型精製的复杂流程中。 MIOS 开发了嵌入每个 CA PYROCONTROLE ATex 温度感测器中的电子电路基板,并在炼油厂现场部署了整个 LoRa 无线通讯基础设施。

- 此外,总部位于西班牙的 Kintech Engineering 还获得了一份提供全套 15 个太阳能监测站的合约。太阳能监测站将安装在五个不同的太阳能发电厂,总合容量为240MW。监测站包括两台助焊剂製造的 SR30 A 级日射强度计,配备加热、通风和温度感测器。

汽车占据较高的市场占有率

- 根据《2030 年气候行动计画》,政府的目标是到 2030 年在德国道路上拥有多达 1,000 万辆电动车和 100 万个充电站。为了实现这一目标,延长或增加了多项电动车激励措施。因此,汽车产业是德国温度感测器最重要的用户之一。

- 法国也举办重要活动,多家公司展示和展示其产品。例如,2022年将在法国举办温度感测器国际会议。此次会议旨在汇集学者、科学家和研究人员,交流和共用温度感测器各方面的经验和研究成果。这是一场跨学科的活动,从业者、研究人员和教育工作者将展示可在未来汽车行业积极实施的温度感测器领域的最新创新、趋势、关注点、实际挑战和解决方案,预计将提供一个平台。

- 2020 年 5 月,法国政府宣布计划投资 80 亿欧元,以振兴受到 COVID-19 影响的当地汽车产业。该计划包括大力推动电动车的发展。预计这一因素将显着促进温度感测器在该国汽车产业的采用。

欧洲温度感测器产业概况

欧洲温度感测器市场竞争激烈,由多家大型厂商组成。从市场占有率来看,目前该市场由几家大型企业主导。然而,凭藉创新和永续的包装,许多公司正在透过赢得新契约和开拓新市场来扩大其市场份额。

- 2020 年 7 月 - Sensirion 宣布 TDK 为其智慧多感测器行动通讯模组SmartBug 选择湿度和温度感测器 SHTC3。此模组专为多个 IoT(物联网)而设计,可快速轻鬆地存取智慧且可靠的感测器资料。 TDK 的 SmartBug 是一款多感测器行动通讯模组,利用 TDK 的 MEMS 感测器和演算法,支援广泛的物联网应用。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 工业 4.0 和高速工厂自动化的发展

- 消费性电子产品对穿戴式装置的需求不断增加

- 市场限制因素

- 原物料价格波动

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 有线

- 无线的

- 科技

- 红外线的

- 热电偶

- 电阻温度检测器

- 热敏电阻器

- 温度变送器

- 光纤

- 其他的

- 最终用户产业

- 化学/石化

- 石油和天然气

- 金属/矿业

- 发电

- 饮食

- 车

- 医疗保健

- 航太/军事

- 消费性电子产品

- 其他的

- 国家名称

- 英国

- 德国

- 法国

- 欧洲其他地区

第六章 竞争状况

- 公司简介

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporatio

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 47180

The Europe Temperature Sensors Market is expected to register a CAGR of 6.7% during the forecast period.

Key Highlights

- The adoption of temperature sensors in the healthcare, automotive, oil, and gas sectors is boosting the market's growth in the region. Electric vehicles and hybrid vehicles are expected to lead the growth of the country's automotive industry, with companies focusing on electric vehicle technologies. The federal government is also supporting the adoption of plug-in electric vehicles in the region.

- According to the Society of Motor Manufacturers and Traders (SMMT), the UK automotive industry is an essential part of the country's economy, worth more than EUR 82 billion turnovers and adding EUR 18.6 billion value to the UK economy. More than 30 manufacturers build more than 70 models of vehicles in the United Kingdom, which are supported by 2,500 component providers and skilled engineers.

- The increasing military spending of super-powerful countries is driving France's expenditure in the military sector. The French government's commitment to increasing the defense budget to 2% of the country's GDP by 2025 is indicated by the financial outlay of EUR 198 billion for 2019-2023 and its plans for a total of EUR 295 billion during 2019-2025. Such investments are poised to increase the usage of temperature sensors in the military segment of the country.

- The recently announced post-COVID-19 stimulus package of EUR 130 billion is set to allocate significant funding for infrastructure development, tax cuts, and further subsidies to invigorate Germany's electric vehicle market.

Europe Temperature Sensors Market Trends

Oil and Gas to Show Significant Growth

- The region is witnessing significant start-ups in the temperature sensors landscape. For instance, the UK-based Silixa focuses on developing distributed fiber optic monitoring solutions for the oil and gas industry. The company uses distributed temperature sensing technologies for data acquisition. Solutions are poised to find applications in multiple in-well applications through a single installation/re-entry and pipeline surveillance.

- France is witnessing multiple partnership activities. For instance, MIOS and CA PYROCONTROLE, two French industrial companies, combined their skills to bring connected sensors to a complex process on the pilot site of one of the major French players in refining by equipping LoRa temperature sensors on the flare stacks. MIOS developed an electronic circuit board incorporated in each CA PYROCONTROLE ATex Temperature Sensor and rolled out the entire LoRa radio communication infrastructure at the refinery site.

- Also, Spain-based Kintech Engineering was awarded a contract for supplying 15 complete solar monitoring stations. The solar monitoring stations are installed on five different photovoltaic solar plants, with a combined capacity of 240 MW. The monitoring stations include two SR30 class-A pyranometers from Hukseflux, equipped with both heating and ventilation and temperature sensors.

Automotive to Hold the Highest Market Share

- In the 2030 Climate Action Program, the government aims to have up to 10 Million EVs and 1 Million charging stations on German roads by 2030. In order to achieve this objective, several electric vehicle incentives have been extended or added. This factor is poised to make the automotive sector one of the significant users of temperature sensors in Germany.

- Also, France hosts significant events where several companies launch or showcase their respective products. For instance, the International Conference on Temperature Sensors is expected to happen in 2022 in France. It aims to bring together academic researchers, scientists, and research scholars to exchange and share their experiences and research results on various aspects of temperature sensors. It is expected to provide an interdisciplinary platform for practitioners, researchers, and educators to present the most recent innovations, trends, concerns, practical challenges encountered, and solutions adopted in the field of temperature sensors that can be actively implemented in the future Automotive Industry.

- In May 2020, the French government announced its plans to seek to jump-start the local auto industry that was affected by COVID-19 with a EUR 8 billion plan. The plan includes a significant boost to electric vehicles. This factor is expected to significantly drive the adoption of temperature sensors in the country's automotive sector.

Europe Temperature Sensors Industry Overview

The Europe Temperature Sensor Market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- July 2020 - Sensirion announced that TDK used its humidity and temperature sensor SHTC3 in its smart multi-sensor wireless module SmartBug. The module is designed for several IoT (Internet of Things) applications and enables quick and easy access to smart and reliable sensor data. TDK's SmartBug is a multi-sensor wireless module that leverages TDK's MEMS sensors and algorithms for a wide range of IoT applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 & Rapid Factory Automation

- 4.3.2 Increasing Demand for Wearable in Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Fluctuation in Raw Material Prices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 End-user Industry

- 5.3.1 Chemical & Petrochemical

- 5.3.2 Oil & Gas

- 5.3.3 Metal & Mining

- 5.3.4 Power Generation

- 5.3.5 Food & Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace & Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Panasonic Corporation

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Honeywell International Inc.

- 6.1.5 ABB Ltd

- 6.1.6 Analog Devices Inc.

- 6.1.7 Fluke Process Instruments

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 Microchip Technology Incorporated

- 6.1.11 NXP Semiconductors NV

- 6.1.12 GE Sensing & Inspection Technologies GmbH

- 6.1.13 Robert Bosch GmbH

- 6.1.14 Gunther GmbH Temperaturmesstechnik

- 6.1.15 TE Connectivity Ltd

- 6.1.16 Denso Corporation

- 6.1.17 Omron Corporatio

- 6.1.18 FLIR Systems

- 6.1.19 Thermometris

- 6.1.20 Maxim Integrated Products

- 6.1.21 Kongsberg Gruppen

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219