|

市场调查报告书

商品编码

1626314

中东和非洲的安全运动控制:市场占有率分析、产业趋势和成长预测(2025-2030)MEA Safety Motion Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

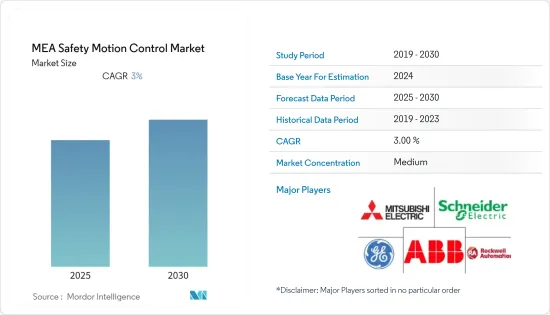

中东和非洲安全运动控制市场预计在预测期内复合年增长率为 3%

主要亮点

- 自动化解决方案的主要运动控制产品是运动控制器、驱动器、马达和机器人。运动控制系统用于实现流程自动化,越来越多的公司开始采用机器人和输送机系统,以在组装和生产中实现更高的效率。因此,在这些应用中使用各种马达来控制製程。

- 工业自动化和储能法规的持续发展趋势需要更安全的运动控制产品。供应商透过推出多种产品、收购基于工业物联网软体的公司以及建立合作伙伴关係,增加了对该领域的投资。

- 工业IoT(IIoT)的日益普及和智慧工厂数量的增加进一步推动了市场的成长。由于安全产品是智慧工厂的关键架构师,智慧工厂正成为安全运动控制产品的重要采用者。工业IoT也进一步增加了工业中对连网机器的需求和需求。仅这些连接的机器不足以实现纯粹的数位转型,因此组织正在开发一个无缝的人机生态系统来运行最佳化的端到端流程。

- 此外,仓库自动化的成长趋势以及数位双胞胎运算、边缘运算和预测製造等趋势的成长也为先进安全运动控制设备开闢了空间。机器人已成为全球重要的自动化趋势。机器人已成为先进汽车製造的关键组成部分。亚马逊等公司也崛起,协作机器人、AGV等机器人也在製造业受到关注。

- COVID-19 大流行对世界各地的小型、中型和大型产业造成了经济干扰。此外,各国的封锁对许多製造业的打击更加严重。因此,安全运动控制设备的需求在几个细分领域中波动。然而,COVID-19 危机的影响迫使公司遵守严格的要求,以确保员工和机器的持续安全。结果,对自动化的需求激增。

中东和非洲安全运动控制市场趋势

汽车产业需求庞大

- 随着HCV和高端汽车製造和组装流程的发展,汽车产业对安全运动控制系统的需求显着增加。

- 在汽车产业,高端运动控制器用于控制生产过程中机械零件的运动。安全运动控制系统广泛应用于引擎和驾驶员辅助系统等关键零件的製造。

- 汽车行业的所有重要供应商都依靠运动控制系统透过致动器和机械臂来优化其生产链。此外,在组装和维护过程中越来越多地采用安全运动控制系统。

- 例如,安全控制系统广泛应用于车辆组装中,这是一个需要高精度和吞吐量的密集过程,以最少的资源执行重复性任务。

- 波湾合作理事会(GCC)汽车市场是该地区的主要市场之一。多年来我们实现了持续成长。该地区的主要市场是沙乌地阿拉伯,拥有最大的新车销售和汽车零件行业。儘管该地区严重依赖日韩汽车製造商,但对于豪华汽车品牌来说,它也是一个充满前景的市场。由于消费者可支配收入的增加,梅赛德斯、路虎探测车和保时捷等豪华汽车品牌开始在阿联酋受到欢迎。同时,二手车市场和售后市场也不断扩大。特别是,Covid-19大流行增加了全球经济的不确定性,并导致人们重新考虑他们的支出。

- 2020年初,阿联酋探索了进口豪华跑车的可能性,并很快考虑将自己建立为豪华跑车的生产基地。与波湾合作理事会其他次区域一样,阿拉伯联合大公国正在寻求企业实现经济多元化并减少石油和天然气收入。

工业自动化的采用不断增加,促进了市场需求。

- 由于各种最终用户产业越来越多地采用自动化,中东和非洲已成为安全运动控制设备最重要的市场之一。该地区的能源挑战也增加了先进工具的采用,促使许多公司投资机械安全设备,进一步推动市场成长。

- 为因应COVID-19导致的全球景气衰退,中东和非洲工厂自动化和工业控制系统市场在2020年上半年见证了需求方的正面影响和供应方的混合影响。智慧工厂计画将帮助製造商克服COVID-19 带来的挑战,包括减少劳动力、某些产品销量减少、保持社交距离以及许多从事最终用户行业(主要是製造业、汽车业)的公司因停工而关闭生产基地。

- 沙乌地阿拉伯于2018年启动了一项价值70亿美元的可再生能源计划,以太阳能发电厂为主导。这是到 2023 年安装 9.5 吉瓦太阳能和风能计画的一部分。此类基础设施的发展可能会提供工业控制和工厂自动化解决方案。

中东和非洲安全运动控制产业概况

安全运动控制市场高度分散。越来越参与企业正在透过策略併购以及与较小的参与企业结盟来扩大其在运动控制驱动市场的份额。近期趋势如下。

- 2020 年 1 月 - 罗克韦尔公司宣布推出新型马达保护断路器,可节省空间、时间和成本。此断路器经过 UL 认证,可用于集体安装。这种安装方式无需在每个马达电路上安装单独的分支短路保护装置,从而减少了面板空间、安装和接线时间以及整体成本。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 工业安全标准

- 安全设备的需求

- 轻鬆设定和维护

- 灵活的自动化能力

- 市场限制因素

- 市场竞争加剧

- 产品成本增加

- 高资本要求

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 元件类型

- 伺服驱动器

- 伺服马达

- 致动器

- 其他的

- 最终用户产业

- 车

- 能源/电力

- 石油和天然气

- 航太/国防

- 饮食

- 药品

- 其他的

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

第六章 竞争状况

- 公司简介

- Rockwell Automation

- ABB Ltd

- SIGMATEK Safety System

- ASTRE Engineering Tunisie

- Demero Automation Systems

- Schneider Electric SE

- General Electric Co.

- More Control

- SICK Group

- Siemens AG

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 47259

The MEA Safety Motion Control Market is expected to register a CAGR of 3% during the forecast period.

Key Highlights

- Major motion control products for automation solutions are motion controllers, drives, motors, and robotics. Motion control systems are being used to automate processes, and more companies are turning to robotics and conveyor systems to achieve higher efficiency margins in assembly and production. Therefore, various motors are used in these applications to control the process.

- The ongoing trend in industrial automation and rules and regulations regarding energy reserves demands more safety motion control products. Vendors witnessed increasing investments in this arena via multiple product launches, acquiring IIoT software-based companies, and collaborations.

- The increasing adoption of Industrial IoT(IIoT) and the growing number of smart factories further expand the market's growth. Smart factories are becoming a significant adopter of safety motion control products, as safety products are the principal architect of smart factories. Besides, the industrial IoT further increased the need and demand for connected machines in the industries. These connected machines alone are not enough to accomplish pure digital transformation; hence, organizations are developing a seamless ecosystem of humans and machines, performing optimized, end-to-end processes.

- Additionally, The increasing trend of warehouse automation and growth in trends, such as digital twin, edge computing, and predictive manufacturing, is also developing space for advanced safety motion control devices. Robots have become a significant automation trend across the world. In advanced automotive manufacturing, robots have become a significant component. Companies like Amazon are also heavily increasing, and robots, like collaborative robots and AGVs, are also becoming the center of attraction in the manufacturing industry.

- COVID-19 pandemic has created economic turmoil for small, medium, and large-scale industries worldwide. Additionally, the country-wise lockdown has further hit many manufacturing industries. This has fluctuated the demand for safety motion control devices across some sectors. However, the impact of the COVID-19 crisis forced businesses to adhere to strict requirements to ensure the ongoing safety of their employees and their machines. As a result, the need for automation witnessed a sudden spike.

MEA Safety Motion Control Market Trends

Automotive Industry to Witness Huge Demand

- The demand for safety motion control systems in the automotive industry has seen a marked increase due to the developments in the manufacturing and assembly processes of HCV's and high-end motor vehicles.

- High-end motion controllers are used in the automotive industry to control mechanical parts' movements in the production process. Safety motion control systems are extensively used to manufacture significant components, like engines and driver assistance systems.

- All the essential automotive suppliers rely on motion control systems to optimize their production chains through actuators and robotic arms. Furthermore, assembling and maintenance processes are also witnessing increased adoption of safety motion control systems.

- For instance, vehicle assembly (an exhaustive process requiring high precision and throughput) has been using safety control systems widely for performing repetitive tasks using minimal resources.

- The Gulf Cooperation Council (GCC) automotive market is one of the primary sectors of the region. It has achieved sustainable growth over the years. The region's primary market is Saudi Arabia, with the most significant new car sales and auto parts segment. The region is heavily dependent on Japanese and Korean automakers, but it is also a promising market for luxury car brands. Luxury car brands such as Mercedes, Range Rover, and Porsche have begun to gain popularity in the United Arab Emirates (UAE) due to rising consumer disposable income. Meanwhile, the market for used and aftermarket vehicles is also expanding, especially with the COVID-19 pandemic, which has led people to rethink their spending due to increased uncertainty in the global economy.

- In early 2020, the United Arab Emirates explored the possibility of importing luxury sports cars and considered establishing itself as a production base for luxury sports cars shortly. Like the other subregions of the Gulf Cooperation Council, the United Arab Emirates is considering ventures to diversify its economy and reduce its oil and gas revenues.

Increasing adoption of industrial automation to contribute to market demand.

- Due to the growing adoption of automation across the various end-user industries in the region, the Middle East and Africa is emerging as one of the most significant safety motion control devices. The energy concern in the region is also increasing the adoption of advanced tools and motivating many companies to invest in machine safety devices, further driving the growth market.

- Following the global economic recession led by COVID-19, the Middle Eastern and African factory automation and industrial control system market have witnessed positive impact from the demand side and mixed impact from the supply side in the first half of 2020. Smart factory initiatives have helped manufacturers overcome COVID-19 challenges and address issues such as workforce reductions, drops in sales for some specific products, social distancing, and extreme pressure to cut operational costs since most enterprises operating in the end-user industries (majorly manufacturing, automotive) had shuttered down their production sites due to lockdown restrictions.

- Saudi Arabia initiated USD 7 billion of renewable energy projects in 2018, with solar plants being the frontrunner. It is part of its plan to install 9.5 gigawatts of solar and wind capacity by 2023. such infrastructural developments are likely to provide for industrial controls and factory automation solutions.

MEA Safety Motion Control Industry Overview

The safety motion control market is highly fragmented. The increasing number of players are boosting their share of the motion control drive market through strategic mergers and acquisitions and partnerships with several small players. Some of the recent developments include:

- Jan 2020 - Rockwell Inc announced the launch of new motor protection circuit breakers that offer space, time, and cost savings. The circuit breakers are enabled by UL approval for use in group installation. This type of installation can reduce panel space, installation and wiring time, and overall costs, by eliminating the need for individual branch shortcircuit protective devices for each motor circuit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry Safety Standards

- 4.2.2 Demand for Safe Equipment

- 4.2.3 Easy Set-up and Maintenance

- 4.2.4 Flexible Automation Functions

- 4.3 Market Restraints

- 4.3.1 High Market Competition

- 4.3.2 Rising Product Costs

- 4.3.3 High Capital Requirements

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component Type

- 5.1.1 Servo Drives

- 5.1.2 Servo Motors

- 5.1.3 Actuators

- 5.1.4 Others

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Energy and Power

- 5.2.3 Oil and Gas

- 5.2.4 Aerospace and Defense

- 5.2.5 Food and Beverage

- 5.2.6 Pharmaceuticals

- 5.2.7 Other End-User Industries

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation

- 6.1.2 ABB Ltd

- 6.1.3 SIGMATEK Safety System

- 6.1.4 ASTRE Engineering Tunisie

- 6.1.5 Demero Automation Systems

- 6.1.6 Schneider Electric SE

- 6.1.7 General Electric Co.

- 6.1.8 More Control

- 6.1.9 SICK Group

- 6.1.10 Siemens AG

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219