|

市场调查报告书

商品编码

1626320

CCD影像感测器:市场占有率分析、产业趋势、统计、成长预测(2025-2030)CCD Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

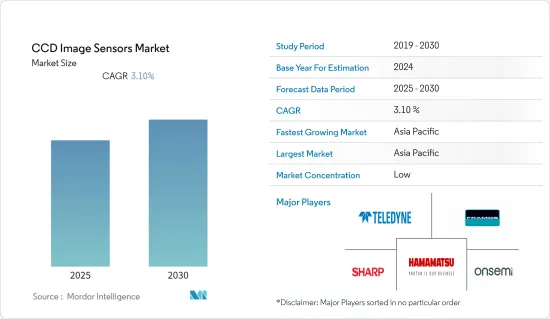

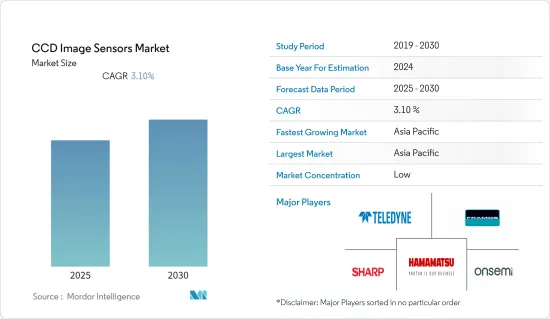

CCD影像感测器市场预计在预测期内复合年增长率为3.1%

主要亮点

- 自动光学侦测 (AOI) 中采用 CCD 影像感测器以及智慧型手机产业相机功能的改进是推动市场发展的主要因素。与 CMOS 影像感测器相比,CCD 影像感测器在长波长下具有更高的 QE、更宽的动态范围和更高的均匀性。

- 在消费性电子产业的智慧型手机领域,行动装置拍摄更好照片的各种解决方案包括基于新技术的创新,以实现更好的相机设备功能。此外,帧传输CCD 感测器和行间传输CCD 感测器在汽车行业中广泛采用,以实现更安全的驾驶。在工业中,对改进性能的需求日益增长,特别是对于在近红外线波长下运行的应用,并且广泛使用 CCD 影像感测器来避免影像清晰度的损失。

- CCD影像感测器在高阶专业消费性电子产品中更为常见且性价比更高。 CCD 影像感测器价格昂贵,因为它们是使用更专业的製造流程製造的。独特的製造流程使 CCD 装置能够在晶片上传输电荷而不会失真,从而产生保真度和光灵敏度方面灵敏且高品质的感测器。 CMOS 晶片使用更常见(且更便宜)的製造流程。

- 配备 CCD 感测器的相机广泛应用于大多数工业应用。 CCD感测器量产时间较长,也较成熟。 CCD 感测器往往具有高品质并具有大量像素。对 CCD 感光元件的需求不断增加,因为它们往往用于强调高影像品质、具有大量像素和出色感光度的相机。另一方面,互补型金属氧化物半导体 (CMOS) 感测器传统上品质、解析度和灵敏度较低。

- 儘管 CMOS 影像感测器在影像检测器市场占据主导地位,但工业和科学成像应用仍需要 CCD 影像感测器,这使得 CCD 感测器从技术和商业性角度成为首选,继续提供重要的影像处理能力。

- 然而,由于 COVID-19 大流行,该行业的几家公司认为他们将因智慧型手机製造商的供应链问题而受到打击。然而,对于每家公司来说,对 CCD 影像感测器生产的影响(包括对材料采购的影响)很小。这对于依赖 CCD 影像感测器的最终用户来说是个好消息,因为用于最新产品的影像感测器的采购不会受到干扰。

CCD影像感测器市场趋势

高品质影像检查预计将占据较大市场占有率

- 在终端用户应用产业中,CCD影像感测器的使用存在于现代製造、品管和产量比率最大化、自动化机器视觉系统、追踪消除人为因素的工业检测中,需要更高的性能。

- 中国和印度等国家的工业生产需要提高测试能力和自动化程度,预计这将在预测期内支持市场需求。 3D视觉系统是影像感测器的关键创新应用领域之一,目前用于工业自动化和机器视觉。高速摄影机和雷射的 3D 视觉可以有效地检测深度并查看物体的形状。

- 对先进工业生产不断增长的需求正在促进美国和中国公司之间的伙伴关係关係,并帮助中国推进影像感测器技术。然而,两国之间的贸易战预计将对价值链流动产生负面影响。预计这将带动亚太地区 CCD 影像感测器的进一步发展。

- 这个市场是技术推动者之间的伙伴关係和合作的合资企业。例如,在中国,先进的类比积体电路製造商TowerJazz正在与长春长光元辰微电子科技有限公司合作,在长春进行背面照明(BSI)製造。为了服务中国的 BSI 製程领域,TowerJazz 使用 CMOS 影像感测器。

亚太地区实现显着成长

- 由于中国和印度的需求,尤其是消费性电子领域的需求,预计亚太地区将主导 CCD 影像感测器市场。中国是世界製造地,对影像品质要求较高的消费性产品对CCD影像感测器的需求量很大。强大的半导体供应链也在市场需求中发挥作用。

- 中国和印度计划部署CCTV摄影设备来发展智慧城市并改善执法基础设施。在需要高影像品质的战略地点,CCD 影像感测器的需求可能会增加。

- 该市场的高速成长主要是由于消费者购买力的增强、政府在监控相关基础设施上的支出以及技术进步的增加。

- 在活跃于该区域市场的公司中,中国的CZ工业技术公司(CZIT)为气体分析仪OEM模组中使用的光谱仪模组提供Tcd1304dg UV涂层CCD线性影像感测器。对于这些供应商在区域市场运作而言,成本至关重要。

CCD影像感测器产业概况

CCD影像感测器市场的竞争非常激烈。市场高度集中,各种规模的公司林立。所有主要企业都占有重要的市场占有率,并致力于扩大全球的消费群。主要公司包括 On Semiconductor Components Industries, LLC、Hamamatsu Photonics KK、Teledyne e2v (Teledyne Imaging)、Sharp Corporation、Stemmer Imaging AG、Oxford Instruments 等。

2021 年 4 月,欧洲太空总署 (ESA) 与 Teledyne Technologies, Inc. 和 Teledyne Imaging Group 旗下的 Teledyne e2v 签订合同,开发先前提供的 CCD69检测器或感测器的改进版本。 Teledyne e2v 正在利用 ESA Aeolus 任务(该任务在太空中进行了首个多普勒测风雷射雷达)的经验和资料,正在开发一种紫外线检测器,该探测器最终可以安装在下一代天基多在普勒测风雷射雷达仪器上,进一步提高性能和灵敏度。

2021 年 2 月,Teledyne 对 NASA 集团火星探勘「毅力号」的成功着陆表示讚扬。该公司的感测器将在 2020 年火星任务期间感知、供电并协助分析矿物和表面化学成分。 Teledyne 正在开发一种 CCD 影像感测器,用于驱动 Supercam 并扫描宜居环境,并提供有机物和化学品的拉曼和发光 (SHERLOC)。这些仪器将寻找矿物质和有机化合物,确定它们是否已被水环境改变,以及地球上先前微生物生命的证据征兆。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对 CCD 影像感测器市场的影响

第五章市场动态

- 市场驱动因素

- 对高品质影像的需求不断增加

- 安全法规的收紧和 ADAS 的普及

- 医疗领域专业影像需求

- 市场挑战

- CCD影像感测器功耗高、製造流程复杂、高成本

- 扩大竞争 CMOS 的采用范围

第六章 市场细分

- 按类型

- 有线

- 无线的

- 按最终用户使用情况

- 家用电子产品

- 卫生保健

- 安全/监控

- 汽车/交通

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- On Semiconductor Components Industries, LLC

- Hamamatsu Photonics KK

- Teledyne e2v(Teledyne Imaging)

- Sharp Corporation

- Stemmer Imaging AG

- Oxford Instruments

- Toshiba Electronic Devices & Storage Corporation

- Framos Gmbh

- Baumer Ltd

- Ames Photonics

第八章投资分析

第9章市场的未来

The CCD Image Sensors Market is expected to register a CAGR of 3.1% during the forecast period.

Key Highlights

- The adoption of CCD image sensors for automatic optical inspection (AOI) and the better camera facility in the smartphone industry is among the significant factor driving the market. CCD image sensors offer better QE at the longest wavelengths, higher dynamic range, and better uniformity than CMOS imagers, which are crucial for space science and hyperspectral applications

- In the smartphone section of the consumer electronics industry, the new technologies-based innovations for better camera facility features to diverse solutions for mobile devices to take better photographs. Additionally, for the automotive industry, to enable safer driving experiences, frame transfer CCD sensors and interline transfer CCD sensors are being widely adopted. The growing demand in the industrial sector for improved performance, particularly for applications operating in near-infrared wavelengths, has extensive usage of CCD image sensors to avoid reducing image sharpness.

- CCD image sensors are more popular and cost-effective in high-end, professional consumer electronic products. CCD image sensors are more expensive because they are manufactured using a more specialized manufacturing process. A unique manufacturing process allows CCD devices to transport charges across the chip without distortion, leading to sensitive, high-quality sensors in terms of fidelity and light sensitivity. CMOS chips use more conventional (and cheaper) manufacturing processes.

- In most industrial applications, cameras with CCD sensors are widely used. CCD sensors have been mass-produced for longer, making them more mature. They tend to have higher quality and more pixels. The demand for CCD sensors is constantly increasing as these sensors tend to be used in cameras that focus on high-quality images with lots of pixels and excellent light sensitivity. In contrast, complementary metal-oxide-semiconductor (CMOS) sensors traditionally have lower quality, resolution, and sensitivity.

- Even though the CMOS image sensors dominate the imaging detector market, there are industrial and scientific imaging applications where CCD imager sensors are still in demand, and the preferred choice from both technical and commercial perspectives, the CCD sensors continue to provide the crucial imaging capability in sciences.

- However, due to the COVID-19 pandemic, several companies in this sphere thought it would take a hit regarding supply chain issues for smartphone manufacturers. However, companies only had minimal effect on the production of CCD image sensors, including the impact on the procurement of materials. This has been positive news for the end-users who rely on the chips, as they need not face any problem procuring image sensors for their latest products.

CCD Image Sensors Market Trends

High Quality Image Cased Inspection Expected to Hold Significant Market Share

- In the end-user application industry, the usage of CCD image sensors is required for obtaining better quality images for industrial inspection to keep track of quality control and maximizing the yield in modern manufacturing, machine vision systems for automation, and removing the human element.

- Industrial production in nations such as China and India requires improved and automated inspection capabilities, and this is expected to support the market demand over the forecast period. 3D vision systems are among the innovative vital application areas for image sensors, which are currently used for industrial automation and machine vision. 3D vision with high-speed cameras and laser light can detect depth and effectively see objects' shapes.

- The growing demand for advanced industrial production has been driving partnerships between the US and Chinese companies, which helps China advance in image sensor technology. However, the trade war between the two nations is expected to impact the value chain flow negatively. This will further develop the Asia-Pacific CCD image sensors.

- Partnerships and collaboration among the technology enablers are joint in this market. For instance, in China, TowerJazz, a manufacturer of advanced analog integrated circuits, has a partnership with Changchun Changguang Yuanchen Microelectronics Technology Inc. for backside illumination (BSI) manufacturing in Changchun. To provide the BSI process segment in China, TowerJazz uses CMOS image sensors.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific is expected to dominate the CCD image sensors market due to the demand generated from China and India, especially in the consumer electronics segment. China is considered the world's manufacturing hub, and the demand for CCD image sensors is high in consumer products requiring high image quality. A better semiconductor supply chain presence has further helped in market demand.

- China and India further plan to install CCTV camera devices to develop smart cities and improve law enforcement infrastructure. CCD image sensors may experience increased demand for strategic places requiring high-quality images.

- The high market growth is mainly attributed to the rising purchasing power of consumers, government expenditure on surveillance-related infrastructure, and increasing exposure to technological advancements.

- Players active in the regional market, such as the CZ industry and technology co., Ltd. (CZIT), a China-based company is delivering Tcd1304dg UV coated CCD linear image sensor for spectrometer module, which is being used for original equipment manufacturer (OEM) modular of the gas analyzer. Cost is essential for these vendors to operate in the regional market.

CCD Image Sensors Industry Overview

The CCD Image Sensors Market is very competitive in nature. The market is highly concentrated due to various small and large players. All the major players account for a significant market share and focus on expanding their consumer base worldwide. Some of the significant players in the market are On Semiconductor Components Industries, LLC, Hamamatsu Photonics K.K., Teledyne e2v (Teledyne Imaging), Sharp Corporation, Stemmer Imaging AG, Oxford Instruments, and many more.

In April 2021, Teledyne e2v, a part of the Teledyne Technologies company and Teledyne Imaging Group, was contracted by the ESA (European Space Agency) to develop an improvised version of the previously supplied CCD69 detector or sensor. Utilizing the experience and data from the ESA Aeolus mission, hosting the first Doppler Wind Lidar in space, Teledyne e2v will further enhance the performance and sensitivity of the ultraviolet detector that could ultimately be deployed in the next-generation space-based Doppler Wind Lidar instruments.

In February 2021, Teledyne commended the NASA group on the successful landing of the mars rover perseverance. The company sensors will sense, power, and help analyze the chemical composition of the minerals and surface during the Mars 2020 mission. Teledyne provided CCD image sensors to drive the SuperCam and Scanning Habitable Environments with the Raman and Luminescence for Organics & Chemicals (SHERLOC). These instruments search for the minerals and organic compounds, determining if they have been altered by the watery environments and prove signs of previous microbial life on the planet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the CCD Image Sensors Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for High-quality Images

- 5.1.2 Increasing Safety Regulations and Adoption of ADAS

- 5.1.3 Demand from the Professional Imaging in Medical Segments

- 5.2 Market Challenges

- 5.2.1 High Power Consumption, Complex Manufacturing, Higher Cost in CCD Image Sensor

- 5.2.2 Growing Adoption of Competitive substitute CMOS

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By End-user Application

- 6.2.1 Consumer Electronics

- 6.2.2 Healthcare

- 6.2.3 Security and Surveillance

- 6.2.4 Automotive & Transportation

- 6.2.5 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 On Semiconductor Components Industries, LLC

- 7.1.2 Hamamatsu Photonics K.K.

- 7.1.3 Teledyne e2v (Teledyne Imaging)

- 7.1.4 Sharp Corporation

- 7.1.5 Stemmer Imaging AG

- 7.1.6 Oxford Instruments

- 7.1.7 Toshiba Electronic Devices & Storage Corporation

- 7.1.8 Framos Gmbh

- 7.1.9 Baumer Ltd

- 7.1.10 Ames Photonics