|

市场调查报告书

商品编码

1626328

北美工业控制系统 (ICS):市场占有率分析、行业趋势、统计和成长预测(2025-2030 年)NA ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

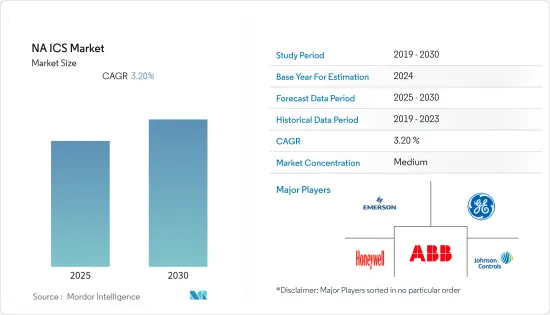

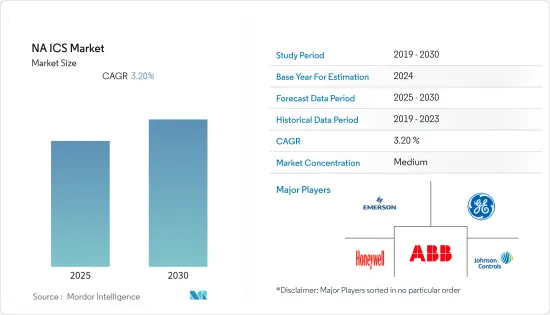

北美工业控制系统 (ICS) 市场预计在预测期内复合年增长率为 3.2%

主要亮点

- 工业应用对自动化和客製化服务解决方案的需求不断增长。过去几年的技术进步使得将机械设备与基于计算机的系统相结合来操作和控制生产成为可能。其结果是自动化设备比传统机器能够显着提高生产力、更轻鬆地监控并减少浪费。

- 不断上升的人事费用,加上製造商在按期交货方面面临的巨大压力,正在推动工厂越来越多地采用自动化。此外,与传统製造流程相比,效率的提高和生产成本的降低正在推动自动化的采用,这是工业控制设备背后的驱动力。

- 製造过程中的网路连接以及透过自动化提高生产效率预计将改变传统的业务运营,并在未来创造充足的机会。

- 製造业是该地区GDP的重要方面,也是经济健康状况的指标。在北美,工业控制设备市场正经历重大变革时期。

- 根据国防安全保障部 (DHS) 的数据,美国85% 的关键基础设施,包括石油和天然气、银行和金融、交通、公共产业、电网和国防,由私营部门拥有,其余的则由政府监管我是公共部门。例如,在该地区的能源和电网领域,需要国土安全部、能源部 (DOE) 和国防部 (DOD) 之间的公私合作和监管合作,以保护操作技术(OT) 和ICS 系统免受网路威胁。此外,云端基础的ICS安全解决方案和服务在该地区已被广泛采用。

北美工业控制系统(ICS)市场趋势

美国和加拿大智慧电网部署的增加预计将推动市场发展

- 北美地区是全球最大的汽车市场之一,拥有超过13家主要汽车製造商。汽车製造是该地区製造业最大的收益来源之一。由于汽车产业在工业控制系统和自动化技术的广泛采用中占据了很大一部分,因此该地区提供了巨大的市场成长机会。

- 北美地区正在加速采用智慧电网,旨在提高公共产业的可靠性和效率,包括引入系统和方法,以更好地让公共产业客户参与能源管理。

- 监控和资料采集系统 (SCADA) 是智慧电网决策的核心,连接到智慧电网的线路感测器和其他设备向中央控制室提供资料流,并在中央控制室自动分析资讯并做出决策。优化效率、路由和发电。因此,智慧电网的部署预计将推动北美的研究市场需求。

- 纽约州能源研究与发展局 (NYSERDA) 是支持和资助智慧技术开发和采用的领导者的典范。根据「改革愿景」计划,纽约州政府正在投资智慧型能源技术创新,以提高电网可靠性、扩大清洁能源技术、减少碳排放并降低能源价格。所有这些措施可望引领国家走向高效率、先进、干净的系统。

- 此外,加拿大政府还计划在四年内斥资 1 亿美元实施智慧电网计画。预计这将推动该地区工业控制系统(ICS)市场的成长。

美国石油和天然气产业投资增加预计将推动市场

由于石油和天然气行业有许多关于安全、工厂可靠性和效率的政府法规,因此工业控制系统(ICS)应用于远端终端装置(RTU)以及泵浦和压缩站以确保安全性。

- 根据BP资料,美国是全球主要石油生产国之一,预计2020财年产量将大幅增加至170万桶/日。美国有多种法规,包括《矿产资源租赁法》、 《大陆棚外土地法》和《国家环境政策法》。

- EIA表示,由于生产效率提高和资源基础扩大,美国产量预计将与前一年同期比较增加。儘管油价下跌,但到 2030 年美国原油产量预计仍将成长 20%。

- 包括阿布拉克萨斯石油公司和雪佛龙在内的各种石油和天然气供应商已经在实施网路数位化计划,并在其网路中采用物联网。例如,艾默生推出了 DeltaV PK 控制器,使 DeltaV 分散式控制系统的先进自动化功能可供较不依赖大规模自动化的高成长产业使用。

北美工业控制系统(ICS)产业概况

由于初始投资较高,北美工业控制系统(ICS)市场适度集中。一些大公司主导市场,包括罗克韦尔自动化、艾默生电气、通用电气、Honeywell国际和德克萨斯。这些拥有大量市场份额的大公司正致力于扩大海外基本客群。这些公司利用策略合作措施来扩大市场占有率并提高盈利。然而,随着技术进步和产品创新,中小企业正在透过赢得新契约和开拓新市场来增加其市场份额。

- 2021 年 6 月 -Honeywell宣布推出进阶监控和事件回应 (AMIR) 服务。该服务提供 24x7操作技术(OT) 网路安全侦测以及对当前和新兴网路威胁的快速回应,帮助工业组织识别和减轻新兴网路威胁并提高其整体水平。

- 2021 年 7 月 - MITRE Engenuity 公布了针对工业控制系统 (ICS) 的第一轮独立 MITRE Engenuity ATT&CK 评估结果。该评估研究了五家 ICS 供应商的网路安全产品如何侦测来自俄罗斯相关恶意软体 Triton 的威胁。该评估使用 ATT&CK for ICS,这是 MITRE 基于已知工业控制系统威胁的对手战术、技术和程序的知识库。

- Check Point Software Technologies 总部美国马萨诸塞州,提供强大的安全解决方案,可保护关键基础设施、工业控制系统(ICS) 和SCADA 系统的网路免受各种先进的第五代网路威胁。 1570R」。 1570R 为发电厂、自动化工厂和海上船队等最严苛的工业环境提供无与伦比的性能、威胁防御安全技术、易于部署和控制以及可靠性。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 降低製造和设计成本

- 电子工业快速成长

- 市场限制因素

- 晶片不断变化

第六章 市场细分

- 依系统类型

- SCADA(监控和资料收集)

- DCS(集散控制系统)

- PLC(可程式逻辑控制器)

- MES(机器执行系统)

- PLM(产品生命週期管理)

- ERP(企业资源规划)

- HMI(人机介面)

- 其他(操作员训练模拟器、机器安全系统)

- 按最终用户产业

- 汽车工业

- 化工/石化

- 公共产业

- 製药

- 饮食

- 石油和天然气

- 其他的

- 国家名称

- 美国

- 加拿大

- 其他北美地区

第七章 竞争格局

- 公司简介

- ABB Group

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Johnson Controls International PLC

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

第八章投资分析

第9章市场的未来

The NA ICS Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- There is a growing demand for automation and customized service solutions in industrial applications. The advent of technology over the past few years has enabled the coupling of mechanical devices with computer-based systems to operate and control production; this has resulted in the development of automated equipment capable of significantly higher production rates, effortless monitoring, and reduced wastage over traditional machines.

- The rising cost of labor, coupled with the immense pressure on manufacturers to meet deadlines, has resulted in the increased adoption of automation in factories. Additionally, improved efficiency and reduction in production costs compared to the conventional manufacturing process are boosting the adoption of automation, which is acting as a driver for industrial controls.

- The connectivity of networks in the manufacturing process and efficiency in production by automation are expected to change the traditional business operations and create ample opportunities in the future.

- The manufacturing sector is a crucial aspect of the region's GDP, indicating economic health. The market for industrial controls is undergoing significant transformations in North America.

- According to the Department of Homeland Security (DHS), 85% of the critical infrastructure in the US, such as oil & gas, banking and finance, transportation, utilities, electric power grids, and defense, are owned by the private sector, and the public sector regulates the rest. For example, the energy and power grid sector in the region requires public, private, and regulatory cooperation among DHS, the Department of Energy (DOE), and the Department of Defense (DOD) for protecting their Operational Technology (OT) and ICS systems from cyber threats. Moreover, this region is witnessing the widespread adoption of cloud-based ICS security solutions and services.

North America Industrial Control Systems Market Trends

Increasing Smart Grid Installation in United States and Canada is Expected to Drive the Market

- The North American region is one of the largest automotive markets in the world and is home to over 13 major auto manufacturers. Automotive manufacturing has been one of the largest revenue generators, in the region, in the manufacturing sector. As the automotive industry accounts for the significant adoption of industrial control systems and automation technologies, the region offers a huge opportunity for market growth.

- The North American region has witnessed the accelerated deployment of smart grids meant to improve the reliability and efficiency of utility operations, including the deployment of systems and practices to better engage utility customers in the management of energy.

- The Supervisory Control and Data Acquisition System (SCADA) lies at the core of smart grid decision-making and line sensors, and other connected equipment on a smart grid provides a stream of data back to a central control room, where information is analyzed, and decisions are automatically made, thereby, regulating voltage levels and optimizing efficiency, routing, and generation. Thus, the deployment of Smart Grid is expected to fuel the demand for the studied market in North America.

- The New York State Energy Research and Development Authority (NYSERDA) is an example of a leader in supporting and financing the development and adoption of smart technologies. The New York State government has invested in the innovation of smart energy technologies as the region pursues to improve grid reliability, expand clean energy technologies, reduce carbon emissions and keep energy bills low under its Reforming the Vision program. All these steps are expected to drive the country towards efficient, advanced, and cleaner systems.

- Furthermore, under its smart grid program, the Govt. of Canada is planning to spend USD 100 million over four years. This is expected to drive the growth of the ICS market in this region.

Increasing Investment in Oil and Gas sector in United States is Expected to Drive the Market

The oil and gas industry is home to a number of government regulations for safety, reliability in plants, and efficiency, owing to which the ICS finds applications in Remote Terminal Units (RTU) and pumping and compression stations for ensuring safety.

- United States is the leading oil-producing country in the world, with its output rising by a massive 1.7 million b/d, during fiscal 2020, according to BP data. The country has various regulations, such as The Mineral Leasing Act, the Outer Continental Shelf Lands Act, the National Environmental Policy Act, etc.

- According to EIA, US production is expected to increase Y-o-Y, owing to the growing production efficiencies and growing resource base. The US crude oil output is expected to increase to 20% by 2030, despite the lower oil prices.

- Various oil and gas vendors, such as Abraxas Petroleum and Chevron, are already driving their network to digitalization projects and adopting IoTs in their network. ICS vendors are increasingly offering industry-specific products; for example, Emerson has launched the DeltaV PK Controller, which helps in making the advanced automation of its DeltaV distributed control system available to fast-growth industries, which are less reliant on large-scale automation.

North America Industrial Control Systems Industry Overview

The North American industrial control systems market is moderately concentrated due to higher initial investments. It is dominated by a few major players like Rockwell Automation Inc., Emerson Electric Co., General Electric Co., Honeywell International Inc., and Texas Instruments Inc. These significant players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- Jun 2021 - Honeywell introduced Advanced Monitoring and Incident Response (AMIR) service. The service provides 24/7 operational technology (OT) cybersecurity detection and rapid response for current and emerging cyber threats to help industrial organizations identify and mitigate emerging cyber threats, manage overall risk and demonstrate compliance.

- Jul 2021- MITRE Engenuity released results from its first round of independent MITRE Engenuity ATT&CK Evaluations for Industrial Control Systems (ICS). The evaluations examined how cybersecurity products from five ICS vendors detected the threat of Russian-linked Triton malware. The evaluations use ATT&CK for ICS, a MITRE-curated knowledge base of adversary tactics, techniques, and procedures based on known threats to industrial control systems.

- Jun 2020- Check Point Software Technologies Ltd., a leading provider of cybersecurity solutions globally, announced the new 1570R rugged security gateway to protect networks in critical infrastructure, Industrial Control Systems (ICS), and SCADA systems against all types of advanced Gen V cyber-threats. The 1570R delivers unrivaled performance, threat prevention security technology, ease of deployment and control, and reliability to the most demanding industrial settings such as power plants, automated factories, and maritime fleets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reducing Manufacturing and Design Costs

- 5.1.2 Intense growth in elctronics industry

- 5.2 Market Restraints

- 5.2.1 Continous changes in the chips

6 MARKET SEGMENTATION

- 6.1 By Type of System

- 6.1.1 SCADA (Supervisory Control and Data Acquisition)

- 6.1.2 DCS ( Distributed Control Systems)

- 6.1.3 PLC (Programmable logic controller)

- 6.1.4 MES (Machine Execution Systems)

- 6.1.5 PLM (Product Lifecycle Management )

- 6.1.6 ERP (Enterprise Resource Planning)

- 6.1.7 HMI (Human Machine Interface)

- 6.1.8 Others (Operator Training Simulators, Machine Safety Systems)

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Utilities

- 6.2.4 Pharmaceutical

- 6.2.5 Food & Beverage

- 6.2.6 Oil & Gas

- 6.2.7 Others

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 Emerson Electric Co.

- 7.1.3 General Electric Company

- 7.1.4 Honeywell International Inc.

- 7.1.5 Johnson Controls International PLC

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Omron Corporation

- 7.1.8 Rockwell Automation, Inc.

- 7.1.9 Schneider Electric SE

- 7.1.10 Siemens AG

- 7.1.11 Yokogawa Electric Corporation