|

市场调查报告书

商品编码

1626877

纸浆和造纸化学品:市场占有率分析、产业趋势、成长预测(2025-2030)Pulp & Paper Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

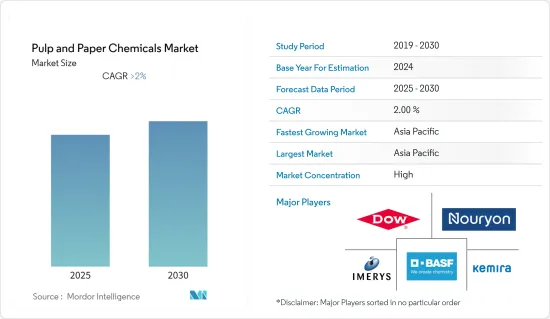

纸浆和造纸化学品市场预计在预测期内复合年增长率将超过 2%

主要亮点

- 新兴国家纸浆和造纸工业的成长以及纸张回收的增加正在推动市场的成长。

- 製浆造纸业造成的环境破坏以及严格的水处理法规可能会阻碍市场成长。

- 对纸张品质改进的广泛研究预计将成为未来市场的机会。

製浆造纸化学品市场趋势

包装和工业用纸的需求增加

- 纸包装包括硬质和软包装形式,如纸袋和袋子、瓦楞纸箱、包装纸、纸箱、展示包装、杯子和托盘、插入物和分隔物、胶带和标籤以及翻盖。纸包装在重量、配送效率和原料投入方面具有显着优势。

- 包装具有保护商品从製造到最终消费者的整个过程中免受损坏的重要功能。防止货物和能源的浪费。包装符合严格的安全、技术和卫生要求。

- 由于消费者对塑胶对环境的有害影响的认识不断提高,以及纸包装的环保性和经济形式,对软纸包装的需求不断增加,正在推动纸浆和造纸化学品市场的增长。

- 使用再生纸包装的一大优点是可以降低高达40%的包装材料成本。政府对环境问题的严格监管和减少碳排放也是预计推动最终用户产业再生纸包装消费的重要因素。

- 美国是北美最大的包装市场之一。美国包装产量将增加,2022年达到6.762亿吨,而2021年为6.461亿吨。该国的包装工业由纸和纸板包装驱动,约占包装市场的40%。

- 随着环保意识的增强,对永续、环保包装的需求也不断增加,进一步拉动了纸包装的需求。同样,随着世界对环境问题的日益关注以及减少有毒排放的需求不断增长,再生纸包装正在医疗保健、个人护理以及食品和饮料行业中使用。

- 因此,随着包装和工业用纸需求的增加,纸浆和造纸化学品市场预计在预测期内也将出现显着的需求成长。

中国主导亚太地区

- 在亚太地区,中国预计将引领纸包装市场,其应用遍及医疗保健、个人护理、家庭护理、零售等行业。因此,它将在未来几年推动纸浆和造纸化学品市场的需求。

- 中国的纸和纸板包装工业是世界第二大工业,预计将继续成长,以满足大众消费者的高需求。然而,永续和环保包装可能会增加,从而推动全国纸浆和造纸化学品市场的发展。

- COVID-19 的影响增加了零售电子商务销售的需求。 2020年中国电子商务销售额成长44%。此外,2021年,它以15,426亿美元的营业额成为最大的电子商务市场,从而增加了该国对纸和纸板包装的需求。

- 2022年中国纸及纸板製造业市场规模将成长5%,达到2,180亿美元。 2017年至2022年,中国纸及纸板製造市场年均成长5.4%。预计将在预测期内推动纸浆和造纸化学品市场的需求。

- 食品和饮料行业对食品安全的日益关注推动了对高品质食品服务板材和液体包装板材的需求。除此之外,中国电子商务的发展促进了快递的增加,进一步增加了对包装纸的需求,并在预测期内带动了製浆造纸化学品市场的需求。

- 上述因素可能导致预测期内中国对製浆造纸化学品的需求增加。

製浆造纸化学品产业概述

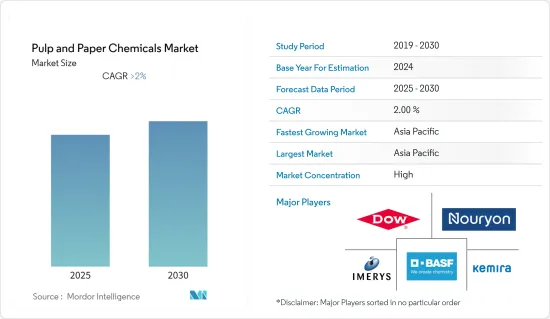

製浆造纸化学品市场本质上是部分一体化的。该市场的主要企业(排名不分先后)包括 Nouryon、 BASF SE、DowDuPont、Imerys 和 Kemira。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 新兴国家製浆造纸工业的成长

- 增加纸张回收利用

- 抑制因素

- 製浆造纸工业造成的环境破坏

- 严格的水处理法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 粘合剂

- 漂白

- 填料

- 製浆

- 浆纱

- 其他的

- 按用途

- 报纸纸张

- 包装/工业用纸

- 列印/书写纸

- 纸浆厂/饮料厂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Ashland Inc.

- BASF SE

- Buckman

- Cargill Incorporated

- Clariant

- DowDuPont

- Ecolab

- ERCO Worldwide

- FMC Corporation

- GE Corporation

- Georgia-Pacific

- Kemira

- Nouryon

- Solvay

- Sonoco Products Company

- Stora Enso

第七章 市场机会及未来趋势

- 纸张品质改进的广泛研究

简介目录

Product Code: 48186

The Pulp & Paper Chemicals Market is expected to register a CAGR of greater than 2% during the forecast period.

Key Highlights

- The growing pulp & paper industry in emerging economies and increasing paper recycling are augmenting the market's growth.

- Environmental hazards from the pulp and paper industry and stringent water treatment regulations will likely hinder the market's growth.

- Extensive research on paper quality improvements is projected to act as an opportunity for the market in the future.

Pulp and Paper Chemicals Market Trends

Increasing Demand from the Packaging and Industrial Papers

- Paper packaging includes rigid and flexible paper packaging formats, such as paper sacks and bags, corrugated boxes, wrapping paper, cartons, display packaging, cups and trays, inserts and dividers, tapes and labels, and clamshells. Significant weight advantages of paper packaging ensure benefits in terms of distribution efficiencies and raw material inputs.

- Packaging performs an essential function by protecting goods from damage, from the point of manufacture to the final consumer. It prevents the wastage of goods and energy. Packaging meets stringent safety, technical, and hygienic requirements.

- A rise in the demand for flexible paper packaging, owing to growing consumer awareness regarding the harmful effects of plastic on the environment, along with the eco-friendly nature and economical form of paper packaging, is expected to propel pulp and paper chemicals market growth.

- The significant advantage of using recycled paper packaging is the associated reduction in the cost of packaging material by up to 40%. Stringent government regulations about environmental concerns and reduction in carbon emissions are also significant factors expected to fuel the consumption of recycled paper packaging across the end-user industries.

- The United States is one of the largest packaging markets in North America. Packaging production in the United States increased, reaching 676.2 million tons in 2022 compared to 646.1 million tons in 2021. The packaging industry is driven by the country's paper and paperboard packaging, which nearly accounts for around 40% of the packaging market.

- With the increasing environmental awareness, the demand for sustainable and eco-friendly packaging is also increasing, further boosting the demand for paper packaging. Similarly, owing to increasing global environmental concerns and the rising need to reduce toxic emissions, recycled paper packaging is used by the healthcare, personal care, and food and beverages industries.

- Hence, with the increasing demand for packaging and industrial papers, the pulp & paper chemicals market is also expected to register a noticeable growth in demand during the forecast period.

China to Dominate the Asia-Pacific Region

- In the Asia-Pacific region, China is expected to drive the market for the paper packaging segment, with applications across industries like healthcare, personal care, home care, retail, and others. It, in turn, is driving the demand for the pulp and paper chemicals market in the coming years.

- The Chinese paper and paperboard packaging industry is the second-largest in the world and will showcase continuous growth owing to meet the higher demand from mass consumers. However, sustainable and eco-friendly packaging is likely to increase, thereby driving the market for Pulp & Paper Chemicals across the country.

- Due to the COVID-19 impact, the demand for retail e-commerce sales increased. E-commerce sales rose by 44% in China in 2020. It further registered as the largest e-commerce market in 2021, with a revenue of USD 1,542.6 billion, thereby increasing the demand for paper and board packaging across the country.

- The market size for the Chinese paper and paperboard manufacturing industry grew by 5% in 2022 to USD 218 billion. China's paper and paperboard manufacturing market increased by an average of 5.4% per year between 2017 and 2022. It is expected to drive the pulp and paper chemicals market demand during the forecast period.

- Increasing concern over food safety in the food and beverages sector propelled the need for high-quality food service boards and liquid packaging boards. Besides this, the development of e-commerce in China promoted the increase in express delivery, further driving the demand for packaging paper, thereby driving the demand for the pulp and paper chemicals market during the forecast period.

- The factors above may contribute to the increasing demand for pulp and paper chemicals in china during the forecast period.

Pulp and Paper Chemicals Industry Overview

The pulp & paper chemicals market is partially consolidated in nature. The major players in this market (not in a particular order) include Nouryon, BASF SE, DowDuPont, Imerys, and Kemira.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Pulp and Paper Industry in Emerging Economies

- 4.1.2 Increasing Paper Recycling

- 4.2 Restraints

- 4.2.1 Environmental Hazards from the Pulp and Paper Industry

- 4.2.2 Stringent Water Treatment Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Binders

- 5.1.2 Bleaching Agents

- 5.1.3 Fillers

- 5.1.4 Pulping

- 5.1.5 Sizing

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Newsprint

- 5.2.2 Packaging and Industrial Papers

- 5.2.3 Printing and Writing Papers

- 5.2.4 Pulp Mills and Drinking Plants

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Ashland Inc.

- 6.4.3 BASF SE

- 6.4.4 Buckman

- 6.4.5 Cargill Incorporated

- 6.4.6 Clariant

- 6.4.7 DowDuPont

- 6.4.8 Ecolab

- 6.4.9 ERCO Worldwide

- 6.4.10 FMC Corporation

- 6.4.11 GE Corporation

- 6.4.12 Georgia-Pacific

- 6.4.13 Kemira

- 6.4.14 Nouryon

- 6.4.15 Solvay

- 6.4.16 Sonoco Products Company

- 6.4.17 Stora Enso

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Extensive Research on Paper Quality Improvements

02-2729-4219

+886-2-2729-4219