|

市场调查报告书

商品编码

1626878

北美炭黑 -市场占有率分析、产业趋势、成长预测(2025-2030)North America Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

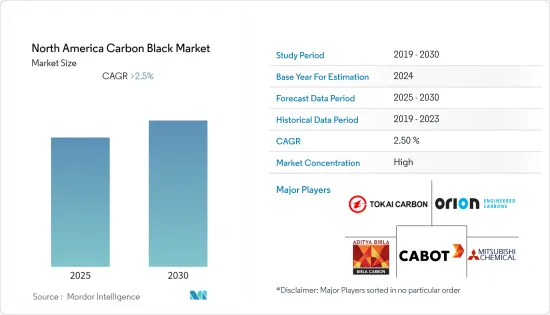

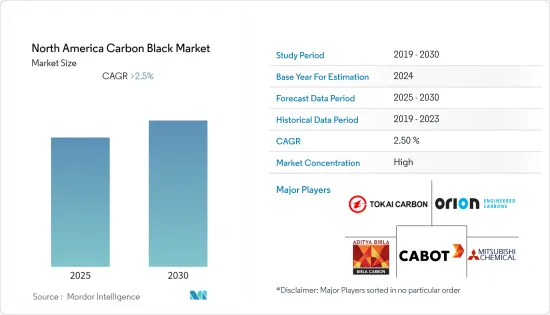

预计北美炭黑市场在预测期内的复合年增长率将超过 2.5%。

由于轮胎和橡胶行业的生产设施关闭和供应链中断,COVID-19 对 2020 年北美炭黑市场产生了负面影响。然而,自从限制解除以来,该行业一直在良好復苏。 2021 年起汽车产量的增加预计将对所研究的市场产生正面影响。

主要亮点

- 短期内,轮胎产业的成长和专门食品炭黑的日益普及正在推动北美市场的需求。

- 与炭黑生产相关的环境问题、原材料价格波动以及二氧化硅替代品的供应可能会阻碍市场成长。

- 电动车的日益普及以及油漆和涂料行业日益增长的需求和使用将在未来几年创造市场机会。

- 美国在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

北美炭黑市场趋势

增加在轮胎行业的使用

- 炭黑是轮胎工业中常用的补强材料之一,因为它影响轮胎的动态性质。炭黑与各种橡胶类型一起用于配方中,以定制轮胎的性能特征。

- 炭黑主要用作轮胎填料,以改善胎面磨损、燃油经济性和使用寿命等各种性能。

- 炭黑主要用在气密层、胎侧和汽车胎体。添加到橡胶化合物中还具有散热作用。它还提高了操控性、胎面磨损、燃油经济性,并列出了耐磨性。

- 轮胎中的炭黑还具有提高橡胶组合物的导电性的优点。据化学工程师称,不含炭黑的轮胎使用寿命可能为 5,000 英里或更短。结果,大多数驾驶员每年必须更换轮胎一到两次,这对大多数消费者来说是不受欢迎的。

- 美国是世界上最大、最先进的轮胎市场之一。美国是一些世界上最大的轮胎製造商的所在地,包括固特异轮胎和橡胶公司、库柏轮胎和橡胶公司、米其林和普利司通美洲轮胎业务。这四家公司占了70%以上的市场占有率。

- 根据美国人口普查局统计,2021年加州轮胎製造业销售额为3,537万美元,2022年为3,551万美元,较上年略有成长。这对所研究市场的需求产生正面影响。

- 加拿大的轮胎市场依赖多个国家的进口。由于过去几年日本汽车持有量迅速增加,预计更换业对轮胎的需求将会增加。

- 此外,卡车和巴士对子午线轮胎(TBR)的需求也在增加。这可能会进一步提振炭黑市场。例如,ZC橡胶最近扩大了生产设施,并已成为全球最大的TBR轮胎製造商。

- 在墨西哥设有生产设施的轮胎公司包括普利司通公司(2 个工厂)、大陆集团、库柏轮胎橡胶公司、固特异、米其林、JK Tire、Industries Ltd(3 个工厂)和倍耐力轮胎公司。美国-墨西哥-加拿大协议(USMCA)的签署使墨西哥汽车生产恢復了稳定。预计这将为国内轮胎生产带来令人兴奋的市场前景。墨西哥的轮胎工业预计将受益于世界领先轮胎製造商的重大投资。

- 此外,该地区对轻型和电动车的需求正在增加,预计在预测期内对炭黑的需求将进一步增加。

- 由于这些因素,预计北美地区炭黑市场在预测期内将稳定成长。

美国主导市场

- 在北美地区,美国是GDP领先的经济强国。美国是仅次于中国的最大炭黑市场生产国和消费国。美国拥有卡博特公司、博拉炭黑、大陆炭素公司(中国合成橡胶公司)、东海炭素公司(西德理查森炭素与能源有限公司)和 Orion Engineered Carbons 等市场巨头的 15 家运作工厂的支援。其炭黑产量超过160 万吨。

- 在美国,炭黑用于多种行业,包括轮胎、塑胶、油漆和涂料以及纺织品。

- 根据美国轮胎工业协会(USTMA)的资料,2022年美国轮胎总出货量约为3.402亿条,而2021年为3.352亿条,2019年为3.327亿条。

- 多年来,美国橡胶工业突飞猛进。该国仍然是橡胶消费的主要力量。它是合成橡胶 (SR) 的主要生产国和消费国,生产多种特殊橡胶化学品,并拥有快速成长的 1,300 亿美元医疗设备市场。到预测期结束时,该国的橡胶需求预计将达到 100 亿美元。

- 根据美国涂料协会(Coatings Tech)统计,2020年美国油漆及涂料产业产值达252.1亿美元,2022年将达280.6亿美元。同样,就数量而言,油漆和涂料行业2020年为13.37亿加仑,2022年将达到14.16亿加仑。该国油漆和涂料领域对炭黑的需求可能会增加。

- 在美国,家用涂料的需求约占油漆和涂料行业总收益的 40%,其次是通用整理加工剂,占 25%,特种涂料占 20%,清漆去除剂和油漆稀释剂占 5%。因此,在预测期内,涂料需求和产量的增加正在推动炭黑的需求。

- 美国是世界第二大纺织相关产品出口国。该国的纺织和服装製造业正在不断变化。服装以外的纺织品,如产业用纺织品和家用纺织品,在工业中发挥越来越重要的作用。由于国内市场资金和劳动成本高昂,政府也从其他国家进口纺织品和服装产品。

- 国内软包装市场是由食品和饮料、药品和医疗产品、零售袋以及其他非食品相关产品的高需求所推动的。消费行为趋势的变化和製造商便利性的提高正在加速国内软包装市场的成长,并为印刷油墨市场带来进一步的利润。

- 此外,由于当前政府的支持措施,预计该国的包装产业将经历适度的高速成长。然而,包装行业印刷油墨的成长将被商业和出版业的下滑所抵消,因为该国大多数人已转向电子书等。

- 因此,所有上述因素预计将在预测期内提振该国炭黑市场的需求。

北美炭黑产业概况

北美炭黑市场已部分整合。市场的主要参与企业包括(排名不分先后)Birla Carbon、Cabot Corporation、Tokai Carbon、Mitsubishi Chemical Corporation 和 Orion Engineered Carbons。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 司机

- 轮胎工业的成长

- 特种炭黑的拓展

- 抑制因素

- 与炭黑生产相关的环境问题

- 原物料价格波动

- 二氧化硅替代炭黑

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(金额/数量))

- 工艺类型

- 炉黑

- 气黑

- 灯黑

- 热感黑

- 目的

- 轮胎及工业橡胶製品

- 塑胶

- 墨粉和印刷油墨

- 涂层

- 纤维

- 其他的

- 地区

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Birla Carbon

- Cabot Corporation

- Continental Carbon Company

- Imerys SA

- Koppers Inc.

- Mitsubishi Chemical Corporation

- OMSK Carbon Group

- Orion Engineered Carbons

- Phillips Carbon Black Limited

- Pyrolyx AG

- Tokai Carbon Co. Ltd.

第七章 市场机会及未来趋势

- 电动车的扩张

- 油漆和涂料行业的需求和应用不断增加

The North America Carbon Black Market is expected to register a CAGR of greater than 2.5% during the forecast period.

COVID-19 negatively impacted the North American carbon black market in 2020 due to the shutting down of production units and disruptions in the supply chain of the tire and rubber industry. However, the sector is recovering well since restrictions were lifted. The rise in automotive production from 2021 is expected to impact the studied market positively.

Key Highlights

- Over the short term, the growing tire industry and increasing penetration of specialty carbon black are some factors driving the market demand in North America.

- Environmental concerns associated with the manufacturing of carbon black, volatility of raw material prices, and availability of silica substitutes may hinder the market's growth.

- The growing adoption of electric cars and increasing demand and usage in the paints and coating industry will likely create opportunities for the market in the coming years.

- The United States is expected to dominate the market and will also witness the highest CAGR during the forecast period.

North America Carbon Black Market Trends

Increasing Usage in the Tire Industry

- Carbon black is one of the reinforcements frequently used in the tire industry, owing to its effect on tires' mechanical and dynamic properties. It is used in various formulations with different rubber types to customize the performance properties of tires.

- Carbon black is used in tires primarily as a filler to enhance its various characteristics, such as tread wear, fuel economy, longevity, etc.

- Carbon black is mainly required in the inner liners, sidewalls, and carcasses. It includes heat-dissipation capabilities when added to rubber compounds. It also improves handling, tread wear, and fuel mileage and provides abrasion resistance.

- Carbon black in tires includes the benefit of making rubber compositions more electrically conductive. According to chemical engineers, a tire built without carbon black would likely last 5000 miles or less. As a result, most drivers would have to replace their tires one to two times per year, which would be undesirable to most consumers.

- The United States represents one of the world's largest and most advanced tire markets. It is home to some of the largest tire manufacturers in the world, such as Goodyear Tire and Rubber Co., Cooper Tire and Rubber Co., Michelin, and Bridgestone Americas Tire Operations. These four companies hold over 70% of the market share.

- As per the US Census Bureau, the industry revenue of tire manufacturing in California was USD 35.37 million in 2021 and USD 35.51 million in 2022, registering a slight increase from the previous years. Thereby positively impacting the demand for the market studied.

- The tire market in Canada relies on tire imports from several countries. The tire demand is anticipated to increase from the replacement sector, as the domestic automotive fleet is growing briskly over the last several years.

- In addition, the demand for truck and bus radial (TBR) tires is also increasing in the country. It can provide a further boost for the carbon black market. For instance, ZC Rubber increased its production facilities recently to become the biggest TBR tire manufacturer in the world.

- There have various tire companies with production facilities in Mexico, including Bridgestone Corp. (two plants), Continental AG, Cooper Tire and Rubber Co., Goodyear, Michelin, JK Tyre and Industries Ltd (three plants), and Pirelli Tyre SpA. With the signing of the United States-Mexico-Canada Agreement (USMCA), stability returned to Mexican automotive production. It will result in an exciting market scenario for domestic tire production. The tire industry in Mexico is expected to receive a massive boost owing to huge investments from leading global tire manufacturers.

- Additionally, with the increasing demand for lightweight and electronic vehicles in the region, the demand for carbon black is expected to increase further during the forecast period.

- Due to all such factors, the market for carbon black in the North American region is expected to have steady growth during the forecast period.

United States to Dominate the Market

- In the North American region, the United States is one of the leading economies in terms of GDP. The United States is the largest producer and consumer of the carbon black market after China. The country produces more than 1.6 million metric tons of carbon black, with the support of 15 operating plants by market giants, like Cabot Corporation, Birla Carbon, Continental Carbon Co. (China Synthetic Rubber Corp.), Tokai Carbon (Sid Richardson Carbon and Energy Co.), and Orion Engineered Carbons.

- Carbon black is used in different industries in the United States, such as tires, plastics, paints and coatings, textile fibers, etc.

- As per the US Tire Manufacturers Association (USTMA) data, in 2022, the total tire shipments in the United States amounted to around 340.2 million units, compared to 335.2 million units in 2021 and 332.7 million in 2019.

- Over the years, the US rubber industry grew by leaps and bounds. The country continues to be a significant force in terms of rubber consumption. Apart from being a major producer and consumer of synthetic rubber (SR), the industry produces a host of specialty rubber chemicals and is home to a booming USD 130 billion medical devices market. The demand for rubber in the country is projected to reach USD 10 billion by the end of the forecast period.

- According to the American Coatings Association (Coatings Tech), the paints and coatings industry in the United States accounted for USD 25.21 billion in 2020 and reached USD 28.06 billion in 2022. Similarly, in terms of volume, the paints and coatings industry stood at 1,337 million gallons in 2020 and reached 1,416 million gallons in 2022. It is likely to enhance the demand for carbon black from the paints and coatings sector in the country.

- In the United States, the demand for home paints accounts for about 40% of the total paints and coatings industry revenue; commodity finishes for 25%; special-purpose coatings for 20%; and varnish removers and paint thinners own 5%. Therefore, increasing demand and production of paints have boosted the demand for carbon black during the forecasted period.

- The United States is the world'sworld's second-largest individual country exporter of textile-related products. The textile and apparel manufacturing in the country is fluctuating. Non-apparel textile products, such as industrial and home textiles, are becoming a more critical part of the industry. The government also imports textile and apparel products from other foreign countries due to the high cost of capital and labor in the domestic market.

- The flexible packaging market in the country is driven by high demand for food and beverage, pharmaceuticals and medicals, retail bags, and other non-food-related products. The changing trends in consumer behavior and manufacturers' more accessible convenience have benefitted the flexible packaging market to grow faster in the country, further benefiting the printing ink market.

- Moreover, the packaging industry is expected to grow at a moderately high rate in the country, owing to the current government'sgovernment's supportive policies. However, the growth of printing ink from the packaging industry is compensated by the decline in the commercial and publications industry as most people in the country are shifting to e-books and other sources.

- Therefore, all the above factors will likely boost the demand for the carbon black market in the country during the forecasted period.

North America Carbon Black Industry Overview

The North American carbon black market is partially consolidated in nature. Some of the major players in the market include Birla Carbon, Cabot Corporation, Tokai Carbon Co. Ltd., Mitsubishi Chemical Corporation, and Orion Engineered Carbons, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Tire Industry

- 4.1.2 Increasing Penetration of Specialty Carbon Black

- 4.2 Restraints

- 4.2.1 Environmental Concerns Associated With the Manufacturing of Carbon Black

- 4.2.2 Volatility in Raw Material Prices

- 4.2.3 Silica Substituting Carbon Black

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Process Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 Application

- 5.2.1 Tires and Industrial Rubber Products

- 5.2.2 Plastics

- 5.2.3 Toners and Printing Inks

- 5.2.4 Coatings

- 5.2.5 Textile Fibers

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Colaborations and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Birla Carbon

- 6.4.2 Cabot Corporation

- 6.4.3 Continental Carbon Company

- 6.4.4 Imerys S.A.

- 6.4.5 Koppers Inc.

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 OMSK Carbon Group

- 6.4.8 Orion Engineered Carbons

- 6.4.9 Phillips Carbon Black Limited

- 6.4.10 Pyrolyx AG

- 6.4.11 Tokai Carbon Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Adoption of Electric Cars

- 7.2 Increasing Demand and Usage in the Paints and Coating Industry