|

市场调查报告书

商品编码

1626886

亚太半导体(硅)智慧财产权 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Asia-Pacific Semiconductor (Silicon) Intellectual Property - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

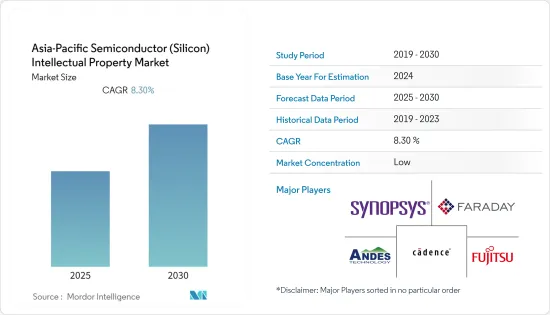

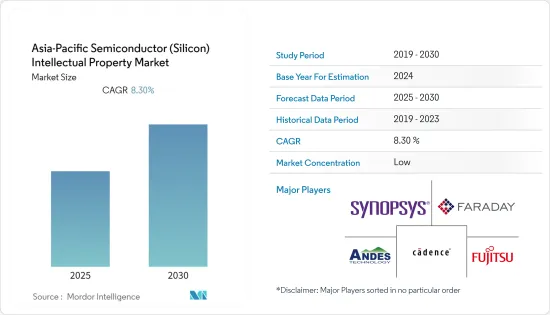

亚太半导体智慧财产权市场预计在预测期内复合年增长率为8.3%

主要亮点

- 政府在塑造中国市场方面也扮演着重要角色。自2020年8月以来,中国政府宣布了多项新的相关措施,以促进半导体产业的发展。一是2020年8月,国务院印发《关于促进积体电路产业及软体产业发展多项措施的通知》。

- 此外,2021 年 3 月,政府宣布了多项实施措施,包括企业必须满足的标准才能获得政府奖励措施、税收和海关法规。此外,中国的新措施将鼓励美国和外国半导体公司将某些技术、智慧财产权、研发转移到中国境内运营,从而促进国内市场的成长。此外,这些措施也为愿意在中国建立生产设施等能力的企业提供了未来10年的优惠条件,包括智慧财产权保护、税收和融资。

- 台湾是世界领先的半导体生产国之一。台湾拥有台积电、联华等主要企业,在台湾半导体产业中领先。该国半导体市场的成长在一定程度上要归功于政府的支持。最近,国家发展基金宣布,台湾企业计划在 2021 年至 2025 年间投资 1,070 亿美元来发展半导体产业。政府也透过资金和人才招聘计划支持新半导体技术的开发。因此,半导体市场的成长也会带来智慧财产权的成长。

- 然而,系统单晶片 (SoC) 设计的复杂性已经超出了系统工程能力。设计复杂性的增加导致资料量的增加,使半导体开发比以前更加困难,并限制了所研究市场的成长。此外,儘管受到 COVID-19 大流行的影响,与 2019 年相比,2020 年整体半导体市场仍显示出强劲增长,并且由于终端用户的巨大需求,预计未来几年将进一步增长。这也支持了市场供应商的成长。

- 例如,2020 年 10 月,Cadence Inc. 报告收益2019 年同期报告的营收为 5.8 亿美元。此外,由于下半年中国硬体和IP销售活动的增加以及我们的系统设计和分析业务的持续进展,我们上调了2020年的收益和业绩预测。 2020年第四季度,我们预期企业收益在7.2亿美元至7.4亿美元之间。

亚太半导体(硅)知识产权市场趋势

消费性电子产品占据主要市场占有率

- 消费性电子产业正在呈指数级发展,来自消费者的压力迫使供应商提供差异化产品并保持市场领先地位。现今的智慧产品由复杂的电子系统组成,需要无错误操作。更快的资料速度、更小的设备尺寸、对多种无线技术的支援以及更长的电池寿命都需要严格的分析。此外,将各种功能整合到单一设备中的愿望导致了复杂的电路基板设计。

- 半导体体内置于行动电话等通讯设备以及游戏机、电视和家用电子电器产品等消费家用电子电器。积体电路 (IC) 的发明一直是消费性电子产业(包括宽频和日益增长的行动应用)发展的主要推动力之一。

- 受平板设备销售成长推动的资料处理市场和智慧型手机销售成长所推动的通讯市场的推动,市场依然强劲。此外,消费性电子产品也受惠于销售量的成长,尤其是数位机上盒。

- 供应商正在为消费性电子市场开发和整合新技术。例如,2021 年 5 月,Synopsys Inc. 宣布为基于 Arm Mali G710 GPU、Armv9 和 Arm DynamIQ 的下一代 Arm Cortex-X2、Cortex-A510 和 Cortex-A710 CPU 的早期采用者推出多个 SoC。这些下一代 SoC 专为高阶消费性设备而开发,并利用 Arm 的全新架构创新来提供更高的效能和能源效率。此外,两家公司还共同开发了针对 5nm、4nm 和 3nm 先进製程技术的流程和方法。

- 此外,Imagination Technologies 也为智慧型手机、数位电视、平板电脑和机上盒提供半导体 IP 解决方案。该公司将把半导体设计能力与PowerVR多媒体和人工智慧核心结合,打造先进的SoC,推动智慧型手机的进一步革命。

汽车领域预计将保持高成长

- 汽车产业技术创新的快节奏直接影响了汽车电子在汽车设计和製造总成本的成本。因此,人们的注意力集中在完成汽车领域技术整合所需的智慧财产权价值上。自动驾驶汽车已成为半导体晶片的最大消费者之一。 ADAS(高级驾驶辅助系统)、自动驾驶系统和车载资讯娱乐系统正在推动对 LiDAR 和 RADAR 等感测器、互连摄影机、显示器和车载处理器的需求。

- 预计每辆自动驾驶汽车每小时能够创建和消耗高达 4 Terabyte的资料。高速有线连接对于将这些资料从感测器移动到处理节点并以低延迟连接车辆组件至关重要。此外,严格的安全要求意味着车载连接必须高度可靠,并且能够在恶劣环境下抵抗干扰和噪音。 2020 年,以行动为导向的全球商业联盟 MIPI 宣布了首个汽车长距离 SerDes 介面规范,可实现高达每秒 16Gigabit的资料传输,并计划实现每秒 48Gigabit及以上的资料传输。

- 许多公司透过提供车载半导体 IP 来利用自动驾驶汽车的趋势。例如,Achronix Semiconductor Corporation 的 Speedcore eFPGA IP 允许汽车半导体供应商在其设备中包含客自订数量的可程式逻辑,从而比典型的 CPU 或 GPU 实现更多客製化。

- 此外,在汽车领域,机器越来越多地与机器学习 (ML) 和人工智慧 (AI) 集成,主要是为了实现自动驾驶功能。此外,5G网路的结合预计将增加V2X(车辆到一切)技术在大都会圈的可行性。通用汽车在中国推出了搭载V2X技术的商用车别克GL8。是国内首个搭载此技术的品牌。通用汽车还宣布,将从 2022 年开始为新款凯迪拉克汽车以及大多数雪佛兰和别克汽车配备 5G 技术。

- 将此类先进技术融入汽车领域将增加对半导体的需求,从而产生对特定应用半导体IP的需求。因此,公司正在进行投资以满足市场需求。

亚太半导体(硅)智慧财产权产业概况

亚太半导体(硅)智慧财产权市场是一个竞争激烈的市场,由智原科技公司(Faraday Technology Corporation)、Cadence Design Systems Inc.、富士通有限公司(Fujitsu Ltd)和 eMemory Technology Inc. 等重要参与企业组成。从市场占有率来看,目前该市场由几家大型企业主导。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。

- 2021 年 6 月 - 智原科技公司宣布,高达 4.2Gbps 的 LPDDR4 和 LPDDR4X 组合 PHY IP 现已在三星 14 奈米 LPC 製程上推出。高度紧凑的设计透过两种硬化配置提供了额外的灵活性,支援内联矩形和角落边缘放置。

- 2021 年 6 月 - Synopsys Inc. 与 Samsung Foundry 合作提供 Synopsys Fusion 设计平台,让 Samsung Foundry 成功交付多系统晶片(SoC) 首轮晶片。该平台增强了下一代 3nm 环栅 (GAA) 製程技术的功耗、效能和麵积扩展优势。

- 2021 年 4 月 - eMemory Technology Inc. 与 Achronix Semiconductor Corporation 合作,Achronix Semiconductor Corporation 是一家基于 FPGA 的资料加速器设备的着名供应商,可提高半导体晶片等级的安全性。 eMemory 在 Achronix 产品组合中列出了其 NeoFuse 和 NeoPUF IP。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第四章市场动态

- 市场驱动因素

- 对连网型设备的需求不断增长

- 对现代 SoC 设计的需求不断增长

- 市场限制因素

- IP经营模式与规模经济

第五章市场区隔

- 按收益类型

- 执照

- 版税

- 服务

- 按IP类型

- 处理器IP

- 有线/无线介面IP

- 其他的

- 按行业分类

- 消费性电子产品

- 电脑、网路、通讯

- 车

- 工业的

- 其他行业

- 按国家/地区

- 中国

- 台湾

- 日本

- 韩国

- 印度

- 其他亚太地区

第六章 竞争状况

- 公司简介

- Faraday Technology Corporation

- Fujitsu Ltd

- ARM Limited

- Synopsys Inc.

- Cadence Design Systems Inc.

- CEVA Inc.

- Andes Technology Corporation

- MediaTek Inc.

- Digital Media Professionals Inc.

- VeriSilicon Holdings Co. Ltd

- Rambus Incoporated

- eMemory Technology Inc.

第七章 投资分析

第八章市场的未来

The Asia-Pacific Semiconductor Intellectual Property Market is expected to register a CAGR of 8.3% during the forecast period.

Key Highlights

- The government has also played a significant role in molding the market in China. Since August 2020, the government of China has issued several new related policy measures to boost the development of its semiconductor industry. To begin with, in August 2020, China's State Council issued a Notice on different policies to promote the development of the IC industry and software industry.

- Also, in March 2021, the government issued several implementing measures that include criteria companies must meet to qualify for government preferences, tax, and tariff provisions. In addition, China's new policies encourage the United States and foreign semiconductor companies to transfer specific technology, intellectual property, research, and development to operations in China, driving growth in the domestic market. Furthermore, such policies offer preferential terms over the next ten years, including IP protection, tax, and financing for companies willing to establish capabilities, including production facilities in China.

- Taiwan is one of the largest producers of semiconductors in the world. The country is home to Taiwan Semiconductor Manufacturing Limited (TSMC), United Microelectronics Corporation, and other prominent players, driving the country's semiconductor industry. The semiconductor market in the country is also growing due to support from the government. Recently, the National development fund announced that between 2021 and 2025, the Taiwan companies have planned USD 107 billion investment for the semiconductor industry's growth. The government is also helping develop new semiconductor technologies with funding support and talent recruitment programs. Therefore, the increase in the semiconductor market leads to a rise in intellectual properties as well.

- However, The complexity of system on chip (SoC) designs is outpacing systems engineering capabilities. Increasing design complexity has given rise to increasing data size and thus, making semiconductor development more challenging than before, and is restraining the growth of the studied market. Further, the overall semiconductor market witnessed significant growth in 2020 compared to 2019, despite the COVID-19 pandemic, and it is further expected to grow in the coming years, owing to massive end-user demand. This has also supported the growth of the market vendors.

- For instance, in October 2020, Cadence reported a revenue of USD 667 million in the third quarter of 2020, compared to the revenue of USD 580 million reported for the same period in 2019. The company also raised its 2020 revenue and earnings forecast due to higher second-half hardware and IP sales activity in China and continuing progress in the system design and analysis business. For the fourth quarter of 2020, the company expected the total revenue in the range of USD 720 million-USD 740 million.

APAC Semiconductor (Silicon) Intellectual Property Market Trends

Consumer Electronics to Hold a Major Market Share

- The consumer electronics industry is evolving exponentially, and the pressure of demands from the consumer side has been compelling suppliers to provide differentiated products and be the first movers in the market. Currently, smart products are comprised of complex electronic systems that require an error-less operation. Faster data rates, device miniaturization, support for multiple wireless technologies, and longer battery life demand rigorous analysis. Furthermore, demand for various feature integrations onto a single device has led to intricate circuit board designs.

- Semiconductors are integrated into communication devices such as mobile phones and consumer electronics like gaming consoles, TV sets, and household appliances. The invention of integrated circuits (ICs) was one of the major drivers behind the development of the consumer electronics industry, including broadband and increasingly mobile applications.

- The market is continued in a strong position due to the data processing application market, driven by increased tablet sales and the communications market by smartphone sales. Moreover, consumer electronics also benefitted from a growth in units sold, particularly in digital set-top boxes.

- Vendors in the market are developing and integrating new technologies for applications in the consumer electronics market. For instance, in May 2021, Synopsys Inc. announced multiple SoC tape-outs at early adopters of the next-generation Arm Cortex-X2, Cortex-A510, and Cortex-A710 CPUs based on Arm Mali G710 GPUs, Armv9, and Arm DynamIQ. These next-generation SoCs were developed for high-end consumer devices to deliver improved performance and power efficiency through Arm's new architectural innovations. Furthermore, the company jointly developed flows and methodologies aiming at 5nm, 4nm, and 3nm advanced-process technologies.

- Moreover, Imagination Technologies provides Semiconductor IP solutions targeting smartphones, digital television, tablet, and set-top box. The company integrates semiconductor design capability with PowerVR multimedia and AI cores to create advanced SoCs for further smartphone revolution.

The Automobile Segment is Anticipated to Register High Growth Rate

- The fast pace of innovation in the automobile industry has directly impacted the cost of automobile electronics in the total cost of vehicle design and build. As a result, this has led to an increased focus on the value of the IP needed to complete technology integration in the automotive space. Autonomous vehicles have become one of the largest consumers of semiconductor chips. Advanced driver assistance systems, autonomous driving systems, and in-vehicle infotainment drive the need for sensors such as LiDARs and RADARs, interconnected cameras, displays, and onboard processors.

- It is anticipated that each autonomous car will be able to create and consume up to 4 terabytes of data per hour. High-speed wired connectivity is crucial to moving this data from sensors to processing nodes and connecting the automotive components with low latency. Moreover, due to stringent safety requirements, automotive connectivity has to be resilient and reliable to interference and noise under harsh environments. In 2020, MIPI, a mobility-oriented global business alliance, released the first automotive long-reach SerDes interface specification, allowing data rates as high as 16 gigabits per second with a plan to 48 gigabits per second and beyond.

- Many companies are utilizing the autonomous vehicles trend by providing automotive semiconductor IPs. For instance, Achronix Semiconductor Corporation's Speedcore eFPGA IP enables automotive semiconductor suppliers to include a custom amount of programmable logic in their devices which permits more customization than a typical CPU or GPU.

- Further, the automobile sector is witnessing the integration of Machine Learning (ML) and Artificial Intelligence (AI) in vehicles, primarily for enabling autonomous driving functionalities. Additionally, combining 5G networks is expected to make vehicle-to-everything (V2X) technology more viable in major metropolitan areas. General Motors has launched a production vehicle equipped with V2X technology, the Buick GL8, in China. It is the first such brand with this technology in China. General Motors also announced that 5G technology would be available on new Cadillac and most Chevrolet and Buick vehicles starting in 2022.

- Incorporating such advanced technologies in the automobile sector drives the need for semiconductors, resulting in driving application-specific semiconductor IPs. As a result, companies are investing to fulfill the market demands.

APAC Semiconductor (Silicon) Intellectual Property Industry Overview

The Asia Pacific Semiconductor (Silicon) Intellectual Property Market is a highly competitive market and consists of several significant players like Faraday Technology Corporation, Cadence Design Systems Inc., Fujitsu Ltd, eMemory Technology Inc., etc. In terms of market share, few of the major players currently dominate the market. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability.

- June 2021 - Faraday Technology Corporation announced its LPDDR4 and LPDDR4X combo PHY IP up to 4.2Gbps, which is currently available in Samsung's 14nm LPC process. The highly compact design provides additional flexibility with two hardened configurations supporting both in-line rectangular and corner-edge placement.

- June 2021 - Synopsys Inc. partnered with Samsung Foundry to provide Synopsys Fusion Design Platform to enable Samsung Foundry to achieve first-pass silicon success for multi-subsystem system-on-chip (SoC). It augments the extended power, performance, and area benefits of its next-generation, 3nm gate-all-around (GAA) process technology.

- April 2021 - eMemory Technology Inc. partnered with Achronix Semiconductor Corporation, a prominent provider of FPGA-based data accelerator devices for improving security at the semiconductor chip level. eMemory will contribute its NeoFuse and NeoPUF IP to the Achronix portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 Assessment of Impact of COVID-19 on the Market

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Connected Devices

- 4.1.2 Growing Demand for Modern SoC Designs

- 4.2 Market Restraints

- 4.2.1 IP Business Model and Economies of Scale

5 MARKET SEGMENTATION

- 5.1 By Revenue Type

- 5.1.1 License

- 5.1.2 Royalty

- 5.1.3 Services

- 5.2 By IP Type

- 5.2.1 Processor IP

- 5.2.2 Wired and Wireless Interface IP

- 5.2.3 Other IP Types

- 5.3 By End-user Vertical

- 5.3.1 Consumer Electronics

- 5.3.2 Computers, Networking and Communication

- 5.3.3 Automobile

- 5.3.4 Industrial

- 5.3.5 Other End-user Verticals

- 5.4 By Country

- 5.4.1 China

- 5.4.2 Taiwan

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 India

- 5.4.6 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Faraday Technology Corporation

- 6.1.2 Fujitsu Ltd

- 6.1.3 ARM Limited

- 6.1.4 Synopsys Inc.

- 6.1.5 Cadence Design Systems Inc.

- 6.1.6 CEVA Inc.

- 6.1.7 Andes Technology Corporation

- 6.1.8 MediaTek Inc.

- 6.1.9 Digital Media Professionals Inc.

- 6.1.10 VeriSilicon Holdings Co. Ltd

- 6.1.11 Rambus Incoporated

- 6.1.12 eMemory Technology Inc.