|

市场调查报告书

商品编码

1626893

欧洲碳纤维 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

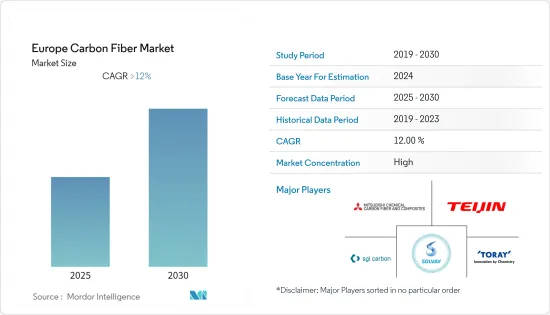

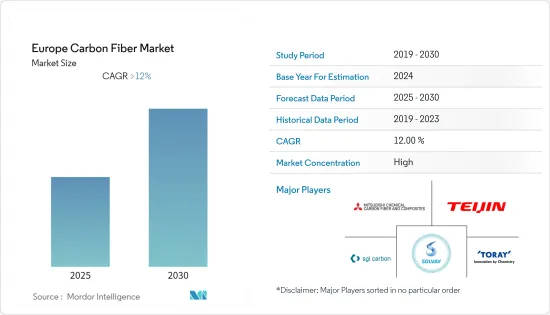

预计欧洲碳纤维市场在预测期内复合年增长率将超过 12%。

COVID-19 大流行对全球汽车和航太产业产生了重大影响,由于全球政府关闭,最终用户营运暂时停止。然而,在大流行后的情况下,预计该行业将在未来几年内復苏并大幅成长。

主要亮点

- 推动市场成长的关键因素是对节能和轻型车辆的需求不断增长以及航太和国防工业的最新进展。

- 然而,再生碳纤维供应链的安全性和替代品的可用性是市场研究的限制因素。

- 再生碳纤维的日益普及、对木质素作为碳纤维原材料的使用的重视以及风力发电领域应用的增加可能为预测期内所研究的市场带来机会。

- 德国占据最大的市场占有率,预计在预测期内将保持其主导地位。

欧洲碳纤维市场趋势

航太和国防工业主导市场

- 碳纤维是由丙烯酸树脂、石油/煤沥青原纤化,并经过一定的热处理而製成的具有细石墨结晶结构的纤维状碳材料。碳纤维的强度约为钢的 10 倍,重量不到钢的一半。它还具有高刚性。

- 碳纤维具有优异的物理和机械性能,包括重量轻、耐用、金属混合成分、耐腐蚀、耐化学性、耐衝击性和耐温性,使其具有高度可靠性和燃油效率,通常是航太和国防领域的最佳选择。这要归功于这些伟大的品质。

- 碳纤维增强聚合物 (CFRP) 用于航太工业中使用的各种零件。 CFRP 为航太工业提供轻质部件,并在飞机煞车中用作轻质复合材料和高性能隔热材料的填充材。

- 在经历了COVID-19的困难时期后,欧洲航太和国防工业以强劲的市场收益从困难时期反弹,展现了其韧性。据欧洲航太、安全与国防工业协会(ASD)称,计划在2050年实现二氧化碳净零排放的目标。

- ASD报告也预计, 与前一年同期比较总销售额将年增10%,达到约2,380亿欧元(2,820亿美元)。总销售额的主要贡献者是民用航空,约占总销售额的45%。

- 根据波音公司预测,2022年至2041年,欧洲在全球服务市场总量中的份额将达到24%,即8,500亿美元。此外,到 2041 年,该地区机队总数预计将达到约 9,360 架飞机。

- 德国航太工业协会(BDLI)还在其年度报告中提供了与航太和国防工业相关的关键数据。该国 2021 财年的销售额为 314 亿欧元(约 370 亿美元)。主要份额是民用航空,约占220亿欧元(约260亿美元)。由于COVID-19对该产业的影响,与去年相比,该国民航市场并未出现任何重大升级。

- 此外,德国是欧洲太空总署 (ESA) 的最大捐助国,2022 年捐款额为 35 亿欧元(约 41.4 亿美元),其次是法国,捐款额为 32.5 亿欧元(约 38.5 亿美元)。

- 随着航太和国防工业市场的扩大,碳纤维的消费需求也将增加,预计将在预测期内带动市场。

德国主导市场

- 作为飞机工业的主要製造地之一,德国拥有来自各个领域的製造商,包括设备製造商、材料和零件供应商、发动机製造商和系统整合商。

- 飞机内饰件、MRO(维修、修理、大修)、轻量化结构、材料等生产基地众多,主要集中在巴伐利亚州、不莱梅州、巴登符腾堡州、梅克伦堡-前波莫瑞州。

- 根据德国航太工业协会(BDLI)的数据,2021年德国的总销售额为314亿欧元(约370亿美元)。民用航空的收入份额最高,约 220 亿欧元(约 260 亿美元)。这是世界上第六架在德国组装和交付的民航机。

- 德国工业协会在报告中表示,2022年至2026年间,德国汽车工业将投资2,200亿欧元(约2,603亿美元)。

- OICA也在年报中宣布,2021年汽车(仅汽车和轻型商用车)产量为330万辆。因此,随着飞机和汽车产量的增加,预测期内碳纤维的消费量将会增加。

- 总体而言,预计各个最终用户行业需求的增加将在预测期内推动该国的市场。

欧洲碳纤维产业概况

欧洲碳纤维市场高度整合。主要企业包括(排名不分先后)三菱化学碳纤维及复合材料公司、西格里碳素公司、索尔维公司、帝人有限公司和东丽工业公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对节能和轻型车辆的需求不断增加

- 航太和国防领域的最新进展

- 抑制因素

- 再生碳纤维供应链安全

- 替代品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(金额/数量))

- 原料

- 聚丙烯腈 (PAN)

- 石油沥青和人造丝

- 类型

- 原生纤维 (VCF)

- 再生纤维(RCF)

- 目的

- 复合材料

- 纺织产品

- 微电极

- 催化剂

- 最终用户产业

- 航太/国防

- 替代能源

- 车

- 建筑基础设施

- 体育用品

- 其他的

- 地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)分析**/排名分析

- 主要企业策略

- 公司简介

- Airborne International BV

- Fairmat

- Hexcel Corporation

- HYOSUNG ADVANCED MATERIALS

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Nippon Graphite Fiber Co., Ltd.

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

第七章 市场机会及未来趋势

- 再生碳纤维越来越受欢迎

- 重视使用木质素作为碳纤维原料

- 扩大风力发电领域的应用

The Europe Carbon Fiber Market is expected to register a CAGR of greater than 12% during the forecast period.

The COVID-19 pandemic significantly impacted the worldwide automobile and aerospace industries, considering a temporary halt in end-user operations owing to government-imposed lockdowns in many parts of the world. In the post-pandemic scenario, however, the industry recovered and is anticipated to grow significantly over the next few years.

Key Highlights

- The major factors driving the market's growth are the increasing demand for fuel-efficient and lightweight vehicles and recent advancements in the aerospace and defense industry.

- However, supply chain security for recycled carbon fiber and substitutes' availability was restraining the market studied.

- The increasing popularity of recycled carbon fiber, the emphasis on using lignin as raw material for carbon fiber, and the increasing application in the wind energy sector are likely to act as opportunities for the market studied over the forecast period.

- Germany accounted for the largest market share and is expected to remain dominant during the forecast period.

Europe Carbon Fiber Market Trends

Aerospace and Defense Industry to Dominate the Market

- Carbon fiber is a fibrous carbon material with a micro graphite crystal structure made by fibrillation of acrylic resin or from oil/coal pitch and then given certain heat treatment. Carbon fiber is almost ten times stronger than steel and less than half its weight. It also exhibits high rigidity.

- Carbon fiber's excellent physical and mechanical qualities, which include its light weight, durability, metal-hybrid compositions, resistance to corrosion and chemical deterioration, impact resistance, and temperature resistance, make it a reliable, fuel-efficient, and top choice in the aerospace and defense sectors. It is due to thanks to these exceptional qualities.

- Carbon Fiber Reinforced Polymer (CFRP) is used in the different parts used in the aerospace industry. The CFRP provides lightweight components for the industry and is used in aircraft brakes as the filler for lightweight composite materials and high-performance insulation material.

- After going through a tough COVID-19 period, the European aerospace and defense industry demonstrated its resilience by rebounding from the tough period with strong revenue generated in the market. According to the Aerospace, Security, and Defence Industries Association of Europe (ASD), the organization plans to achieve the challenge of being the net zero emission of CO2 by 2050.

- The report by ASD also stated that the total turnover for the year 2021 was estimated to be around EUR 238 billion (USD 282 billion), an increase of 10% compared to the previous year. The major contributor to overall turnover is civil aeronautics which holds a share of about 45% of the total turnover.

- According to Boeing, Europe will have a share of 24% across the global services market value, accounting for USD 850 billion of the total market share for 2022-2041. The total number of fleets in the region is also expected to reach about 9,360 in 2041.

- The German Aerospace Industries Association (BDLI) also provided key figures related to the Aerospace and Defense Industry in its annual report. The country saw a total sale of EUR 31.4 billion (~USD 37 billion) during the financial year 2021. The major share is civil aviation, which accounts for about EUR 22 billion (~USD 26 billion). The country's civil aviation market had never seen a major upgrade compared to last year due to the COVID-19 effect on the industry.

- Moreover, Germany is the largest contributor to the European Space Agency (ESA), with a contribution of EUR 3.5 billion (~USD 4.14 billion) in the year 2022, followed by France, which had a contribution of EUR 3.25 billion (~USD 3.85 billion).

- With the increasing market for the aerospace and defense industry, the demand for carbon fiber consumption is also expected to enhance and thus drive the market forward for the forecast period.

Germany to Dominate the Market

- Germany, one of the leading manufacturing bases for the aircraft industry, is home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators.

- The country hosts many production bases for interior aircraft components, MRO (maintenance, repair, and overhaul), and lightweight construction and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- According to the German Aerospace Industries Association (BDLI), the country saw total sales of EUR 31.4 billion (~USD 37 billion) during the financial year 2021. Civil aviation observed the highest market share of sales, around EUR 22 billion (~USD 26 billion). Every sixth commercial aircraft worldwide is assembled in and delivered from Germany.

- The German Association of Automotive Industry stated in its report that there will be an investment of EUR 220 billion (~USD 260.3 billion) in the German automotive industry between 2022-2026.

- OICA also published in its yearly report that there was a production of 3.3 million units of automobiles (cars and LCVs only) in the year 2021. Thus, with the increased production of aircraft and automobiles production, carbon fiber consumption will increase during the forecast period.

- Overall, the growing demand from various end-user industries is projected to drive the market in the country during the forecast period.

Europe Carbon Fiber Industry Overview

The carbon fiber market in Europe is highly consolidated. The major companies include (not in particular order) Mitsubishi Chemical Carbon Fiber and Composites Inc., SGL Carbon, Solvay, TEIJIN LIMITED, and TORAY INDUSTRIES, INC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Fuel-efficient and Lightweight Vehicles

- 4.1.2 Recent Advancements in the Aerospace and Defense Sector

- 4.2 Restraints

- 4.2.1 Supply Chain Security for Recycled Carbon Fiber

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Raw Material

- 5.1.1 Polyacrtlonitrile (PAN)

- 5.1.2 Petroleum Pitch and Rayon

- 5.2 Type

- 5.2.1 Virgin Fiber (VCF)

- 5.2.2 Recycled Fiber (RCF)

- 5.3 Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Microelectrodes

- 5.3.4 Catalysis

- 5.4 End-user Industry

- 5.4.1 Aerospace & Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction & Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Airborne International BV

- 6.4.2 Fairmat

- 6.4.3 Hexcel Corporation

- 6.4.4 HYOSUNG ADVANCED MATERIALS

- 6.4.5 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.6 Nippon Graphite Fiber Co., Ltd.

- 6.4.7 SGL Carbon

- 6.4.8 Solvay

- 6.4.9 TEIJIN LIMITED

- 6.4.10 TORAY INDUSTRIES, INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Recycled Carbon Fibre

- 7.2 Emphasis on Usage of Lignin as Raw Material for Carbon Fiber

- 7.3 Increasing Application in Wind Energy Sector