|

市场调查报告书

商品编码

1626899

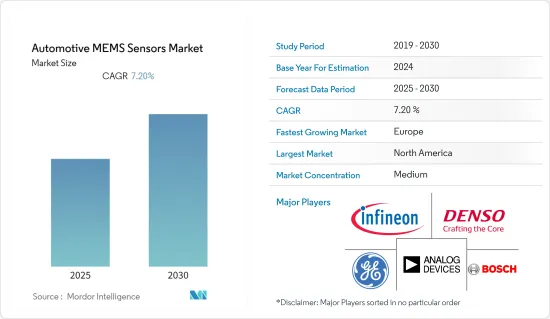

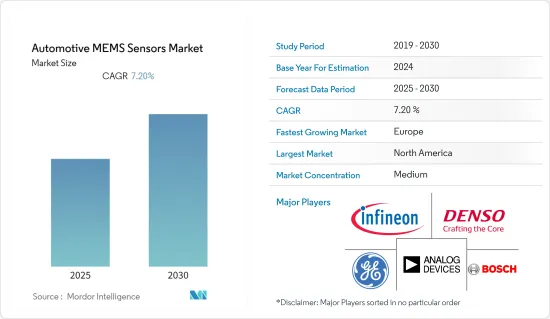

汽车MEMS感测器:市场占有率分析、产业趋势、成长预测(2025-2030)Automotive MEMS Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

汽车MEMS感测器市场预计在预测期内复合年增长率为7.2%

主要亮点

- MEMS 感测器为汽车领域的许多进步做出了贡献。汽车安全已成为世界范围内的严重问题。除了车载导航系统、侧翻检测和碰撞检测之外,MEMS 感测器还可以整合到其他一些应用中。汽车 MEMS 感测器预计将影响电子元件製造商、汽车元件製造商和最终用户。汽车 MEMS 感测器市场的标准和立法的製定引起了各国政府的极大兴趣。

- 汽车MEMS感测器市场具有高效率、小尺寸和低成本等多种优势。对汽车安全和保障的需求不断增长是在所研究的市场成长中发挥重要作用的主要因素之一。 MEMS 感测器也称为微型机器,因为它们采用与微型设备相同的技术。

- 由于汽车应用对安全性和保全的需求不断增加,对汽车 MEMS 感测器的需求也不断增加。由于物联网技术的需求不断增长以及连网型设备的普及,汽车 MEMS 感测器市场正在不断扩大。由于MEMS加速计的低成本和严格的自我测试能力,G开关在汽车生产中不再用于安全气囊控制。影响该市场成长的驱动因素是包括连网型汽车在内的智慧连网型设备的日益普及。

- 目前,汽车产业的两大趋势是电气化和自动化。汽车系统正在快速整合雷达、光达和影像处理等高价值感测模组。因此,MEMS感测器的销售量预计在预测期内将大幅成长。随着高端汽车製造商在未来几年向 L5 自动驾驶靠拢,市场研究表明,配备 IMU 的 MEMS 感测器与加速、雷射雷达和运动侦测系统相关,将存在巨大的商机。

- 此外,产业向电动车 (EV) 的过渡对压力和磁感测器的分布和需求产生了重大影响。预计这一趋势将长期持续。随着电动车销量的增加,对感测器的需求也将迅速增加。用于监控废弃电池以及定位和检测汽车各种运动部件的传感器正在兴起。

- 然而,随着联邦、州和地方政府开始建议公民尽可能留在家里,COVID-19 大流行加大了世界各地汽车製造商关闭工厂的压力。结果,各个行业都经历了供应链中断。例如,由于冠状病毒的爆发,福特和通用汽车已停止各自北美製造工厂的生产。

- 汽车 MEMS 感测器系统通常由协同工作的机械和电子组件组成。这些组件的完全整合是一项重大挑战,可能对汽车 MEMS 感测器市场的成长构成挑战。

汽车MEMS感测器市场趋势

陀螺仪显着成长

- 对安全性、舒适性、性能和稳定性的日益关注促使OEM製造商整合先进的车辆功能。这项发展的结果是,电子产品的成长正在加速,而机械部件在汽车工业中的用处却越来越小。陀螺仪感测器在时间和温度范围内高度稳定,保持先进导航系统所需的高精度和运动控制功能的可靠性。

- 汽车陀螺仪感测器可以测量或保持车辆的姿态和角速度。 ESP(电子稳定控製程式)中基于MEMS的陀螺仪是一种强大的安全系统,在汽车行业中广受认可。 ESP 系统使用角速度感测器来稳定车辆。陀螺仪感应器可侦测绕车辆轴线的角速度,并向系统提供必要的输入,使驾驶者能够保持车辆在正轨上。

- 此外,在车辆侧翻侦测中,使用陀螺仪来读取侧翻率。然而,仅靠车辆的侧倾角不足以侦测车辆是否会侧翻,因此使用低G加速计来读取垂直加速度(Z轴)。用于过度侧倾检测的陀螺仪感测器尺寸约为 VDC 系统所需尺寸的一半,但需要具有出色的抵御外部衝击和振动的能力。

- 近年来,半导体、被动元件和互连技术不断改进,以实现高精度的资料处理和资料。此外,还需要能够承受 175 度或更高高温的感测器,这使得 MEMS 感测器得到广泛接受。 MEMS陀螺仪因其尺寸小、耐高温、维护成本低而被使用。

北美地区成长显着

- 美国是世界上最大的汽车製造地之一。该地区的经济成长影响了乘用车和商用车的销售。根据美国汽车政策委员会统计,过去五年,汽车业出口额达到6,920亿美元,光是汽车业就占该地区GDP的3%,为研究市场的成长做出了贡献。

- 随着产业动态的变化,汽车製造商正在转向电动和自动驾驶汽车,以满足下一代消费者的需求。电动车在美国迅速普及,估计美国市场汽车销量的1.0%是电动车。纽瑟姆州长表示,加州在电动车 (EV) 销售方面主导美国市场。该州的零排放汽车(ZEV)计划要求该州的汽车製造商销售一定比例的电动车,从而促进了对电动车的需求。

- 2022 年 2 月,加州零排放车 (ZEV) 市场蓬勃发展,并持续领先全国。州长加文纽瑟姆 (Gavin Newsom) 称讚该州插电式电动车、摩托车、皮卡车和 SUV 的销量超过了总合其后 10 个州的销量总和。这些因素推动了电动车对 MEMS 感测器的需求。

- 在北美,人们对电动车的偏好正稳步取代传统汽车。感测器和基于 MEMS 的组件是汽车电子控制系统的关键组件。现代车辆(包括混合动力电动车和插电式混合动力汽车(PHEV))中的车载电脑系统使用来自众多感测器的资料来做出数千个决策。感测器用于汽车安全目的,因为它们在恶劣的环境下工作,包括极端温度、振动和暴露于环境污染物中。

- 此外,该地区也有望成为采用 ADAS 车辆和自动驾驶交通解决方案的先驱之一。此外,随着定位服务的使用增加,防止 GPS 或 GNSS 讯号因隧道、停车场和都市区峡谷等环境而失去变得越来越重要。因此,许多感测器解决方案公司正在努力解决这个问题。因此,该地区对汽车 MEMS 感测器的需求预计将会增加。

汽车MEMS感测器产业概况

汽车MEMS感测器市场竞争非常激烈,有几家主要公司进入该市场。从市场占有率来看,目前少数大公司占据市场主导地位。这些拥有压倒性市场占有率的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。 2022 年 10 月,义法半导体将透过先进的振动感测器滤除道路噪音,让电动车时代的车舱更加安静。该公司推出了 AIS25BA,这是一款一流的汽车 MEMS加速计,用于精确控制和安静车内的声学环境。该感测器具有市场上最低的电噪声,可帮助汽车工程师实现最安静的车内环境。 2022 年 9 月,精密计时领导者 SiTime Corporation 宣布推出基于 SiTime 尖端 MEMS 技术的新车振盪器系列。这款新型差分振盪器的耐用性提高了 10 倍,可确保 ADAS 在所有天气和道路条件下可靠运作。 AEC-Q100 SiT9396/7 汽车振盪器的推出使 SiTime 的可用市场规模 (SAM) 增加了 5000 万美元。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力——波特五力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 技术简介

- 市场驱动因素

- 更重视乘客安全及安保法规及合规性

- 客户喜爱的更多自动化功能和改进的性能

- 市场限制因素

- 由于介面设计考虑,MEMS 感测器的实施成本增加

第五章市场区隔

- 按类型

- 轮胎压力感知器

- 引擎机油感知器

- 燃烧感测器

- 燃油喷射/燃油帮浦感知器

- 安全气囊展开感应器

- 陀螺仪

- 燃油轨压力感知器

- 其他类型(气流控制、曲轴位置感知器、侧翻检测感知器、自动门锁感知器)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争状况

- 公司简介

- Analog Devices Inc.

- Delphi Automotive PLC

- Denso Corporation

- General Electric Co.

- Freescale Semiconductors Ltd

- Infineon Technologies AG

- Sensata Technologies Inc.

- STMicroelectronics NV

- Panasonic Corporation

- Robert Bosch GmbH

第七章 投资分析

第八章市场展望

The Automotive MEMS Sensors Market is expected to register a CAGR of 7.2% during the forecast period.

Key Highlights

- MEMS sensors contribute to numerous advancements in the automotive sector. The world over, vehicle safety has grown to be a serious problem. In addition to in-vehicle navigation systems, rollover detection, and crash detection, MEMS sensors could be incorporated into several other applications. Automotive MEMS sensors are anticipated to have an impact on manufacturers of electronic components, producers of auto parts, and end users. The development of standards and laws for the market for automotive MEMS sensors is of great interest to the governments of various countries.

- The MEMS sensor market for automotive provides various advantages of high efficiency, small size, and low cost. The growing demand for safety and security in automobiles is one of the main factors that has played a vital role in the growth of the market studied. MEMS sensors are also known as micromachines because they make use of the same technology as tiny devices.

- The demand for automotive MEMS sensors has increased due to the growing need for safety and security in automotive applications. The market for automotive MEMS sensors is expanding as a result of rising IoT technology demand and the widespread adoption of connected devices. As a result of MEMS accelerometers' low cost and rigorous self-testing capabilities, g-switches are no longer used in the production of automobiles for airbag control. The drivers influencing the growth of this market are the rise in smart connected device adoption, including connected cars.

- Currently, the two significant trends in the automotive industry are electrification and automation. There has been a rapid integration of high-value sensing modules, like RADAR, LIDAR, and imaging, in automotive systems. As a result, the MEMS sensor's sales volume growth is expected to be significant during the forecast period. The market investigated would create a substantial opportunity for IMU-powered MEMS sensors related to acceleration, LiDAR, and motion detection systems as the premium automakers would approach L5 autonomous driving in the following few years.

- Additionally, the industry's transition to electric vehicles (EVs) has significantly impacted the distribution and demand for pressure and magnetic sensors. It is anticipated that this trend will continue in the long run. As the number of electric vehicle sales rises, the demand for sensors also escalates. There is an increase in sensors for used battery monitoring and various positioning and detection of moving automotive parts.

- However, the COVID-19 pandemic has increased pressure on automakers across the globe to close down their factories after the federal, state, and local governments began advising citizens to spend as much time as possible at home. Various industries have experienced supply chain disruptions as a result of this. For instance, Ford and General Motors halted production at their respective North American manufacturing facilities due to the coronavirus outbreak.

- An automotive MEMS sensor system is typically made up of mechanical and electronic components that work in tandem. Perfect integration of these components is a significant challenge, which can create a challenge for the growth of the automotive MEMS sensor market.

Automotive MEMS Sensors Market Trends

Gyroscope to Witness Significant Growth

- Due to growing concerns about safety, comfort, performance, and stability, OEMs have been attempting to incorporate advanced vehicle features. As a result of this development, the convenience of mechanical components has decreased across the automotive industry while the growth of electronics has accelerated. The gyroscope maintains a higher level of accuracy needed for sophisticated navigation systems embedded in it and the dependability of motion-controlled functionalities because it offers superior stability over time and temperature.

- A gyroscope in automotive has been allowed to measure or maintain the vehicle's orientation and angular velocity. The MEMS-based gyroscope in the ESP (Electronic Stability Control Program) is a widely accepted and powerful safety system in the automotive industry. The ESP system depends on the angular rate sensors to stabilize the car. It detects the vehicle's angular rate around its axis and creates the essential input to the systems that enable the driver to keep the vehicle on track.

- Further, in the rollover detection of the vehicle, a gyroscope is applied to read the roll rate. But as only the roll angle of the vehicle is not sufficient to detect whether the vehicle is going to roll over, a low-g accelerometer is used to read vertical acceleration (Z-axis). The gyroscope used for roll overdetection is almost half the magnitude required in the VDC system but requires excellent rejection of external shock and vibration.

- To enable high-precision data processing and acquisition, semiconductors, passives, and interconnects have all undergone continuous improvement in recent years. Due to the demand for sensors that can withstand temperatures higher than 175 degrees, MEMS sensors are widely accepted. MEMS gyroscopes are used because of their small size, high-temperature tolerance, and low maintenance costs.

North America to Register Significant Growth

- The United States is one of the largest automotive manufacturing hubs in the world. The region's economic growth posed an impact on the sale of passenger and commercial vehicles. According to the American Automotive Policy Council, over the past five years, the exports from the automotive sector were valued at USD 692.0 billion, and the automotive sector alone contributes to 3% of the region's GDP, effectively contributing to the growth of the market studied.

- With changing dynamics in the industry, automotive manufacturers are moving toward electric vehicles and autonomous vehicles to meet the needs of next-generation consumers. Electric vehicle use in the United States has risen rapidly, with an estimated 1.0% of automotive sales in the United States market coming from electric vehicles. According to Governor Newsom, California dominates the United States market regarding electric vehicle (EVs) sales. Its zero-emission vehicle (ZEV) program is driving the demand for EVs by requiring automakers in the state to sell a certain percentage of electric cars.

- In February 2022, California's booming zero-emission vehicle (ZEV) market continued to lead the country. Governor Gavin Newsom praised the state for selling more plug-in electric cars, motorcycles, pickup trucks, SUVs, and SUVs than the combined sales of the following ten states. Such factors will boost the demand for MEMS sensors in Electric Vehicles.

- The preference for electric vehicles is steadily replacing conventional vehicles in North America. Sensors and MEMS-based components are crucial components of the electronic control system in cars. The on-board computer system of contemporary cars, including hybrid electric vehicles and plug-in hybrid vehicles (PHEV), uses data from numerous sensors to inform thousands of decisions. Since the sensors can function under challenging circumstances like extreme temperatures, vibrations, and exposure to environmental contaminants, they are used for security purposes in automobiles.

- Additionally, the region is also expected to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. In addition, with the increased usage of location services for turn-by-turn navigation, the importance of not losing GPS or GNSS signal due to environments like tunnels, parking garages, and urban canyons has gained more prominence. Thus, many sensor solution companies have been working toward addressing this issue. This is anticipated to augment the demand for automotive MEMS sensors in the region.

Automotive MEMS Sensors Industry Overview

The automotive MEMS sensors market is highly competitive and consists of several major players. In terms of market share, a few of the major players currently dominate the market. These major players, with a prominent market share, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. In October 2022, STMicroelectronics will enable quieter cabins for the electric-vehicle age with an advanced vibration sensor to eliminate road noise. The company announced its AIS25BA, a best-in-class automotive MEMS accelerometer for accurately controlling and quieting the in-cabin acoustic environment. The sensor has the lowest electrical noise in the market, which helps vehicle engineers achieve the calmest possible in-car environment. In September 2022, SiTime Corporation, a leader in precision timing, released a new family of automotive oscillators based on SiTime's cutting-edge MEMS technology. The new differential oscillators are 10 times more durable and guarantee dependable ADAS operation in all weather and road conditions. The AEC-Q100 SiT9396/7 automotive oscillator's introduction increases the SiTime served available market's (SAM) size by USD 50 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Technology Snapshot

- 4.4 Market Drivers

- 4.4.1 Passenger Safety and Security Regulations, and Increased Focus on Compliance

- 4.4.2 Increased Automation Features and Performance Improvements Preferred by Customers

- 4.5 Market Restraints

- 4.5.1 Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Tire Pressure Sensors

- 5.1.2 Engine Oil Sensors

- 5.1.3 Combustion Sensors

- 5.1.4 Fuel Injection and Fuel Pump Sensors

- 5.1.5 Air Bag Deployment Sensors

- 5.1.6 Gyroscopes

- 5.1.7 Fuel Rail Pressure Sensors

- 5.1.8 Other Types (Airflow Control, Crank Shaft Position Sensors, Roll-over Detection Sensors, and Automatic Door Lock Sensors)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 UK

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Analog Devices Inc.

- 6.1.2 Delphi Automotive PLC

- 6.1.3 Denso Corporation

- 6.1.4 General Electric Co.

- 6.1.5 Freescale Semiconductors Ltd

- 6.1.6 Infineon Technologies AG

- 6.1.7 Sensata Technologies Inc.

- 6.1.8 STMicroelectronics NV

- 6.1.9 Panasonic Corporation

- 6.1.10 Robert Bosch GmbH