|

市场调查报告书

商品编码

1627099

智慧马达控制中心:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Intelligent Motor Control Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

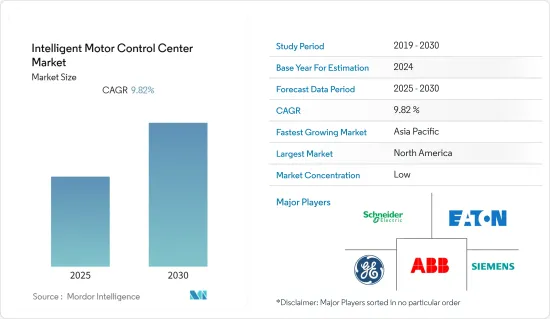

智慧马达控制中心市场预计在预测期内复合年增长率为 9.82%

主要亮点

- 人事费用上升和市场竞争加剧导致企业利润率低下,这大大增加了对具有改进控制和自动化系统的高效率马达的需求。

- 由于技术进步对IMCC的影响,使其零件(电子机械继电器、电路断流器、变频驱动器等电子装置)更加坚固,进而提高了IMCC的稳健性。 IMCC的生命週期长达20年以上,大大降低了设备更换率。即使产品有缺陷,最终用户可能只更换有缺陷的组件而不是整个设备,导致市场收益减少。

- 自动化是各行业中不断成长的趋势。 OEM、承包商以及设施和维护经理使用智慧马达控制中心来加快计划进度、提高员工安全、降低成本并获得对工厂营运的宝贵见解。

- 企业加大对智慧製造设施的投资,进一步拉动了智慧马达控制中心市场的需求。例如,2022年9月,施耐德电机为特伦甘纳邦的智慧工厂奠基。该工厂占地 18 英亩,耗资 30 亿印度卢比(约 3,674 万美元)。该设施预计将于 2023 年 9 月投入运作。

- COVID-19的疫情迫使製造业重新评估其传统生产流程,主要推动跨生产线的数位转型和智慧製造。製造商也被迫设计和实施多种新的敏捷方法来监控产品和品管。

- 疫情也迫使组织必须遵守严格的要求,同时确保员工和客户的安全。因此,对自动化解决方案的需求正在迅速增加。这可能会被视为近期的一个显着趋势。

智慧马达控制中心市场趋势

汽车终端用户占比较大

- IMCC应用于製造汽车、船舶、铁路车辆等交通运输工具的工厂。汽车製造业对IMCC的需求预计将稳定成长,特别是在汽车製造业实力雄厚、工业自动化日益普及的德国、美国和日本。

- 根据国际汽车製造商组织(OICA)的报告,2021年汽车产量为80,145,988辆。汽车需求的成长预计将在预测期结束后持续成长,从而创造对有效製造设备和技术的需求。

- 丰田、马自达、宝马和现代等汽车製造商正在扩大其在北美和亚洲地区的业务,并可能在预测期内成为 IMCC 的潜在买家。例如,2022年6月,德勤在美国堪萨斯城开设了一家智慧工厂。威奇托智能工厂致力于推动製造业的未来并透过数位转型促进创新。

- 此外,市场上的供应商正在创新新的解决方案以参与竞争。例如,Kinetic Technologies 于 2022 年 10 月宣布,将在 2022 年电子展上展示消费、通讯、工业、汽车和企业市场的电源管理、马达控制和智慧连接解决方案。

北美占据主要市场占有率

- 儘管北美市场相对成熟,但仍有充足的机会引进IMCC等新技术。美国能源资讯管理局 (EIA) 估计,美国製造业近一半的电力用于操作机械,其中机械驱动装置(马达)是最大的消耗者。

- 根据这些估计,确定了对高效能马达控制系统的需求。该地区的互联製造部门支持采用 IMCC,将其作为减少能源消耗的更好选择。石油和天然气产业预计将成为北美市场最主要的最终用户。

- 此外,该地区各国政府正在采取各种措施来提高製造业的能源效率。例如,2022年2月,政府宣布了一项针对美国清洁工业部门的倡议。为了支持这项努力,环保署将制定一项拟议规则,以加强其 CCUS 活动的温室气体报告计划,内政部将为联邦土地上的地质储存建立保障措施。

- IMCC主要应用于可再生能源产业。该地区制定了税收优惠政策来鼓励风电的发展。美国能源局发布的报告显示,风电仍然是美国增长最快的能源来源之一,占2021年美国能源装机容量增长的32%,覆盖4000万美国家庭,为美国家庭提供了足够的能源。

智慧马达控制中心产业概况

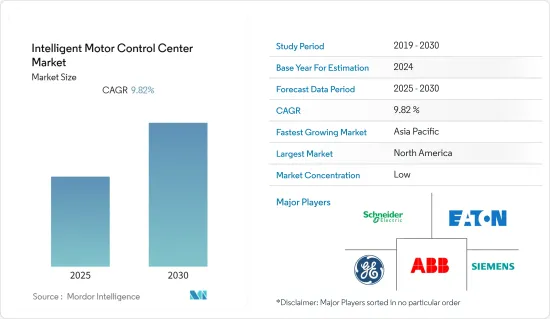

智慧马达控制中心(IMMC)市场因供应商众多而被细分。拥有压倒性市场占有率的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作计划来提高市场占有率和盈利。然而,随着技术进步和产品创新的出现,中小企业(SME)正在透过获取新契约和开发新市场来增加其在市场中的影响力。

2022 年 9 月 - 瑞萨电子公司宣布开发出针对先进运动控制解决方案进行最佳化的 RISC-V MCU。借助此新解决方案,客户可以受益于开箱即用的马达控制承包解决方案,无需开发成本。

2022 年 5 月 - 东芝电子元件及储存装置公司扩大与 MikroElektronika 的合作,并宣布推出 Clicker 4 for TMPM4K 马达控制开发板。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 提高工业自动化水平

- 与传统 MCC 相比,智慧型 MCC 具有广泛的优势

- 越来越注重开发高效率的製造/生产流程

- 市场限制因素

- 设备安装中存在隐性成本,增加了产品实施成本。

- 增加中压领域开关设备的使用

第六章 市场细分

- 按工作电压

- 低压智能MCC

- 中压智能MCC

- 按最终用户产业

- 车

- 化学/石化

- 饮食

- 矿业/金属

- 纸浆/造纸製造

- 发电

- 石油和天然气

- 其他最终用户产业(水泥製造、污水管理)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- General Electric Co.

- ABB Limited

- Schneider Electric SE

- Eaton Corporation

- Siemens AG

- Rockwell Automation Inc.

- Honeywell International

- Larson & Turbo Limited

- Technical Control Systems Limited

第八章投资分析

第九章 市场机会及未来趋势

The Intelligent Motor Control Center Market is expected to register a CAGR of 9.82% during the forecast period.

Key Highlights

- With the rising labor costs and a highly competitive market, which has led to a low-profit margin for companies, the need for high-efficiency motors with improved control and automated systems has increased considerably.

- The impact on IMCCs, due to advancements in technology, made its components (electromechanical relays, circuit breakers, electronic devices, such as variable frequency drives) more robust, and in turn, increased the robustness of the IMCCs. The lifecycle of an IMCC is more than 20 years, which tremendously reduces the replacement rate of the equipment. Even in case of product defects, end users are likely to replace only the faulty components rather than the entire equipment, which results in the depletion of revenues in the market.

- Automation is a growing trend that is witnessed across various industries. OEMs, contractors, and facility and maintenance managers use intelligent motor control centers to accelerate project timelines, enhance personnel safety, reduce cost, and gain valuable insight into plant operations.

- The growing investments by companies in smart manufacturing facilities are further boosting the demand for intelligent motor control center markets. For instance, in September 2022, Schneider Electric laid the foundation of its smart factory in Telangana. The factory is spread over 18 acres, and it is built at the cost of INR 300 Crore (~USD 36.74 million). The facility is expected to be operational by September 2023.

- The outbreak of COVID-19 has forced the manufacturing industries to re-evaluate their traditional production processes, primarily driving digital transformation and smart manufacturing practices across production lines. The manufacturers are also forced to devise and implement multiple new and agile approaches to monitor product and quality control.

- Also, the pandemic's impact forced organizations to adhere to strict requirements while ensuring the safety of their employees and customers. As a result, the need for automated solutions has witnessed a sudden spike. This could be observed as a notable trend in the foreseeable future.

Intelligent Motor Control Center Market Trends

Automotive End User to Account for Significant Share

- IMCC finds applications in the manufacturing plants of automotive and other transport vehicles, such as ships and railway carriages. IMCC demand in vehicle manufacturing is expected to increase steadily, particularly in Germany, the United States, and Japan, owing to a robust automotive manufacturing sector and higher penetration of industrial automation.

- Organisation Internationale des Constructeurs d'Automobiles (OICA) reported that the total number of cars produced in 2021 amounted to 80,145,988 units. The growing demand for automobiles is expected to continue over and beyond the forecast period, creating a demand for effective manufacturing equipment and technologies.

- Automakers like Toyota, Mazda, BMW, Hyundai, etc., are expanding their operations across North America and Asian regions, which can be potential buyers of IMCC over the forecast period. For instance, in June 2022, Deloitte opened a smart factory in the United States, Kansas City. The Smart Factory, Wichita aims to advance the future of manufacturing and spur innovation through digital transformation.

- Furthermore, the vendors in the market are innovating new solutions to have a competitive edge. For instance, in October 2022, Kinetic Technologies announced to showcase of power management, motor control, and smart connectivity solutions serving the consumer, communications, industrial, automotive, and enterprise markets at Electronica 2022.

North America to Account for Major Market Share

- The North American market is relatively mature but still presents ample opportunities to implement new technologies, such as IMCC. The Energy Information Administration (EIA) estimated that nearly half of the electricity used by US manufacturers was for operating machinery, of which machine drives (motors) consumed the most.

- Such estimates determine the need for efficient motor control systems. Connected manufacturing units in the region support the adoption of IMCC as a better alternative for reduced energy consumption. The oil and gas industry is expected to be the most prominent end-user in the North American market.

- Further, the Government in the region is taking various initiatives for energy efficiency in the manufacturing sector. For instance, in February 2022, Government announced initiatives focused on the cleaner industrial sector in the United States. To support this effort, the Environmental Protection Agency will develop proposed rule revisions to strengthen the Greenhouse Gas Reporting Program with respect to CCUS activities, and the Department of the Interior will establish safeguards for geologic sequestration on federal lands.

- IMCCs are predominantly used in the renewable energy industry. Tax incentives have been implemented to encourage the growth of wind energy in the region. According to a report published by the U.S. Department of Energy, wind power remained one of America's fastest-growing energy sources and accounted for 32% of U.S. energy capacity growth in 2021 and provided enough energy to power 40 million American homes.

Intelligent Motor Control Center Industry Overview

The Intelligent Motor Control Center (IMMC) Market is fragmented due to the presence of a large number of vendors in the market. The major players with a prominent market share are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

September 2022 - Renesas Electronics Corporation announced the development of RISC-V MCU specifically optimized for advanced motion control solutions. The new solution enables customers to benefit from a ready-to-use, turnkey solution for motor control applications with no development cost.

May 2022 - Toshiba Electronic Devices and Storage Corporation expanded its collaboration with MikroElektronika introducing the Clicker 4 for TMPM4K development board for motor control.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Level of Industrial Automation

- 5.1.2 Wide Range of Benefits Offered by Intelligent MCCs over Traditional MCCs

- 5.1.3 Increased Focus on Developing an Efficient Manufacturing/Production Processes

- 5.2 Market Restraints

- 5.2.1 Costlier Product Implementation due to Hidden Costs in Equipment Installation

- 5.2.2 Increase in the Use of Switchgears in Medium-voltage Segment

6 MARKET SEGMENTATION

- 6.1 By Operating Voltage

- 6.1.1 Low-voltage Intelligent MCCs

- 6.1.2 Medium-voltage Intelligent MCCs

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Chemicals/Petrochemicals

- 6.2.3 Food and Beverage

- 6.2.4 Mining and Metals

- 6.2.5 Pulp and Paper

- 6.2.6 Power Generation

- 6.2.7 Oil and Gas

- 6.2.8 Other End-user Industries (Cement Manufacturing, Wastewater Management)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 General Electric Co.

- 7.1.2 ABB Limited

- 7.1.3 Schneider Electric SE

- 7.1.4 Eaton Corporation

- 7.1.5 Siemens AG

- 7.1.6 Rockwell Automation Inc.

- 7.1.7 Honeywell International

- 7.1.8 Larson & Turbo Limited

- 7.1.9 Technical Control Systems Limited