|

市场调查报告书

商品编码

1627101

拉丁美洲冷冻食品包装:市场占有率分析、行业趋势和成长预测(2025-2030)LA Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

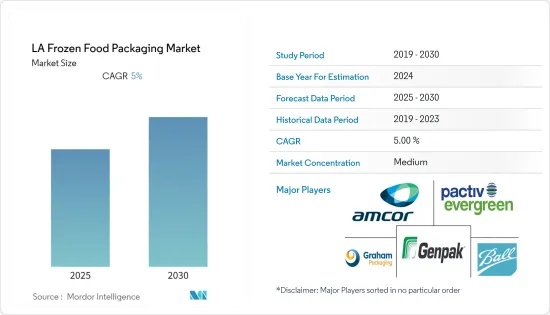

拉丁美洲冷冻食品包装市场预计在预测期内复合年增长率为 5%

主要亮点

- 消费者对食品品质的期望不断提高。随着消费者对产品品质评价的提高,冷冻食品包装市场正在扩大。随着经济成长和生活方式的改变,欧洲对冷冻食品包装的需求不断增加,预计市场在预测期内将出现高速成长。

- 活性包装、智慧包装和工程科学等新包装技术多年来不断发展,以实现柔性食品包装。该公司正在采用环保包装,使用可回收、更新和再利用的可生物分解性包装材料。

- 巴西是拉丁美洲地区经济成长率和外国直接投资额最高的国家之一。巴西对食品和工业产品有巨大的需求,这些需求透过进口来满足。冷冻食品包装对于该地区存储产品以防破损非常重要。随着中等收入族群比例的增加,对包装食品的需求将会增加,进而促进冷冻食品包装市场的成长。

- 最近爆发的新冠肺炎 (COVID-19) 疫情给冷冻食品包装製造商带来了许多问题,预计这些问题将是短暂的。封锁的影响包括供应链中断、製造过程中使用的原材料短缺、劳动力短缺、可能导致最终产品生产超出预算的价格波动以及运输问题。

拉丁美洲冷冻食品包装市场趋势

可支配所得的增加和消费行为的变化

- 多种因素推动了对冷冻食品袋的需求,包括生活方式的改变、可支配收入的增加、新兴国家的快速都市化,尤其是中等收入人口的成长。人口密度的增加整体增加了对包装食品的需求,而千禧世代对这种增长做出了贡献。

- 包装食品到达世界各地的消费者手中需要时间。包装食品在到达消费者手中之前可能不太新鲜并失去其香气和风味。食品在到达消费者手中之前变质的威胁正在日益增加,因为这意味着投资于包装的资本的损失。

- 为了克服这个问题,食品加工产业正在投资各种新的包装技术和有助于延长产品保质期的技术,例如智慧包装和工程科学。这就是为什么业界对冷冻食品需求增加的原因。除了收益之外,组织也关註消费者满意度,这会影响他们在市场上的形象和价值。

- 千禧世代客户通常推动冷冻食品包装产品的需求,千禧世代占拉丁美洲总人口的 30%。千禧世代热衷于单份外带食品和饮料。软包装是包装此类产品的流行选择,因为这些产品通常被设计为耐用、便携且轻巧。

- 冷冻食品的增加也是由于该地区零售便利性的改善。近年来,零售商店的需求显着增加。

- 这些产品通常设计为便携、耐用且轻巧。冷冻食品包装是包装此类产品的众所周知的选择。预计需求将主要由零嘴零食(包括食品和生鲜产品)需求的增加所主导。

玻璃包装引领市场

- 玻璃是注重健康和环保的消费者的首选包装材料。玻璃由天然且永续的原材料製成。玻璃包装可以保留产品的味道和风味,并保持冷冻食品的完整性和健康性。

- 玻璃是包装冷冻食品最优选的材料之一。良好的阻隔性、无菌性和再生性等特性使其成为优异的包装材料。玻璃包装的另一个优点是它可以成型为各种形状和尺寸,使其易于在各种行业中使用。

- 儘管玻璃仍然是各种产品的首选包装材料,但越来越多地使用塑胶作为玻璃的替代品可能会阻碍市场成长。用于在各种应用中安全使用的先进塑胶包装可能会限制玻璃作为包装材料。

- 由于新冠肺炎 (COVID-19)。封锁的影响包括供应链中断、製造过程中使用的原材料短缺、劳动力短缺、可能导致最终产品生产超出预算的价格波动以及运输问题。

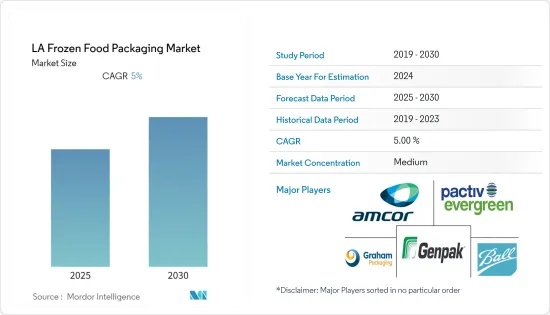

拉丁美洲冷冻食品包装产业概况

拉丁美洲冷冻食品包装市场较为分散,由几家大公司组成。在这个市场上占有重要份额的主要公司都致力于扩大海外基本客群。

- 2021 年 6 月 - Coveris Holdings SA 开发了一种新的串列班轮解决方案。 Cereal+ 内衬的开发旨在透过新开发的配方提供包装性能、保质期和消费功能。 Coveris 的 Cereal+ 内衬由完全可回收的聚乙烯製成,为盒中袋薄膜包装的谷物和干食品提供产品保护、新鲜度和保质期。

- 2021 年 4 月 - Amcor Ltd. 宣布对 ePac 软包装进行策略性投资,ePac 是软包装高品质短版数位印刷领域的领导者。该投资约为 1000 万美元至 1500 万美元,包括 ePac Holdings LLC 的少数股权以及一个或多个 ePac专利权经营店的融资。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 消费者对便利性的需求不断增加

- 可支配所得的增加和消费行为的变化

- 市场限制因素

- 政府监管和干预

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对市场的影响

- 技术概览

- 技术简介

- 冷冻食品包装产品的类型

- 冷冻食品包装使用的主要材料

- 持续发展

第五章市场区隔

- 按材质

- 玻璃

- 纸

- 金属

- 塑胶

- 其他的

- 按包装类型

- 包包

- 盒子

- 标籤和杯子

- 托盘

- 饶舌歌手

- 小袋

- 其他包装

- 依产品类型

- 准备好的饭菜

- 水果和蔬菜

- 肉

- 海鲜

- 烘焙点心

- 其他的

- 按国家/地区

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

第六章 供应商市场占有率

第七章 竞争格局

- 公司简介

- Pactiv

- Amcor Ltd

- Genpak LLC

- Graham Packaging Company, Inc.

- Ball Corporation Inc

- Crown Holdings Inc.

- Tetra Pak International

- Placon Corporation

- Toyo Seikan Group Holdings, Ltd.

- WestRock Company

- Nuconic Packaging

- The Scoular Company

- Owens-Illinois

- Rexam Company

- Alcoa Corporation

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 48962

The LA Frozen Food Packaging Market is expected to register a CAGR of 5% during the forecast period.

Key Highlights

- Consumer expectations of food quality are rising. There is an increase in the frozen food packaging market with the consumer appreciation of the product quality. With the growth in the economy and changing lifestyles, there is an increased demand for frozen food packaging in Europe, and the market is expected to grow lucratively during the forecast period.

- New packaging technologies, such as active packaging, intelligent packaging, and engineering science, have evolved over the years, which enables the flexible packaging of food products. Companies are adopting eco-friendly packaging by using biodegradable packaging material which can be recycled, renewed, and reused.

- Brazil is one of the leading countries in Latin America for economic growth and in terms of getting maximum FDI. They have a huge demand for food and industrial goods, which are catered by imports. Frozen food packaging will be important for this area to store the products from getting damaged. With the middle-income class percentage increasing, there will be more demand for packed food, and this will enable the frozen food packaging market to grow.

- With the recent outbreak of COVID 19, frozen food packaging manufacturers have been flooded with a pool of issues that are expected to be only for the short -term. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, shipping problems etc.

Latin America Frozen Food Packaging Market Trends

Increase in disposable income and changing consumer behavior

- Various factors, such as changing lifestyle, increasing disposable income, and rapid urbanization in developing countries, especially the growing middle-income population, are increasing the demand for bags for frozen food. The increase in population density has increased demand for packaged food in general, with Millenials contributing to the growth.

- After packaging, it takes time for packaged food to reach consumers across various parts of the world. The packaged food may not be fresh and might lose its aroma and taste before reaching the consumer. The threat of food being spoilt before reaching the consumer is increasing, as it would result in a loss of the capital invested in the packaging.

- To overcome this, food processing industries are investing in technologies and various new packaging techniques, such as intelligent packaging and engineering science, which help in increasing the shelf life of the product. This is the reason for the increased demand for frozen food in the industry. Organizations are focusing on consumer satisfaction, apart from revenues, as it impacts the image and value in the market.

- Millennial customers generally drive the demand for frozen food packaging products, and millennials account for 30% of the total Latin American population. These people have an ardent preference for single-serving and on-the-go style food and beverage foodstuffs. As these products are usually designed to be durable, portable, and lightweight, flexible packaging is a famous option for packing such products

- The increase in frozen food is also due to the increased convenience of retail stores in the region. The demand from retailers has increased significantly in the past few years.

- These products are generally designed to be portable, durable, and lightweight; frozen food packaging stands to be a famous option to pack such products. The increasing demand for snack foods, both in terms of processed foods and fresh items, is expected to govern the demand.

Glass Packaging to Drive the Market

- Glass is the preferred packaging material for consumers who are concerned about their health and the environment. It is made from all-natural sustainable raw materials. Glass packaging preserves the product's taste or flavor and maintains the integrity or healthiness of frozen food.

- Glass is one of the most preferred materials for packaging frozen food. Properties like excellent barrier properties, sterility, and reusability make it a superior packaging material. The other major advantage of glass packaging is that it can be molded into various shapes and sizes, facilitating its use across different industry verticals.

- Even though glass remains the preferred packaging material for a variety of products, the growing usage of plastics as a replacement for glass will hamper the market growth. Advancements in plastics for safe usage in different applications will restrict glass as a material for packaging.

- Due to Covid-19. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, shipping problems etc.

Latin America Frozen Food Packaging Industry Overview

The Latin America Frozen Food packaging market is moderately fragmented and consists of several major players. The major players with a prominent share in the market are focusing on expanding their customer base across foreign countries.

- June 2021 - Coveris Holdings SA developed a new cereal liner solution. The Cereal+ liner has been created to deliver packer performance, shelf life, and consumer functionality using a newly developed formulation. Coveris' Cereal+ liner is made from fully recyclable polyethylene and provides product protection, freshness, and shelf life for cereals and dry foods packed in bag-in-box films.

- April 2021 - Amcor Ltd announced is pleased a strategic investment in ePac Flexible Packaging, a leader in the high quality, short-run length digital printing segment for flexible packaging. The investment will range between approximately $10 to $15 million, including a minority ownership interest in ePac Holdings LLC and funding for one or more ePac franchise sites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for convenience by consumers

- 4.2.2 Increase in disposable income and changing consumer behavior

- 4.3 Market Restraints

- 4.3.1 Government Regulations and Interventions

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Covid-19 in the market

- 4.7 Technology Overview

- 4.7.1 Technology Snapshot

- 4.7.2 Type of frozen food packaging products

- 4.7.3 Primary materials used for frozen food packaging

- 4.7.4 Ongoing developments

5 MARKET SEGMENTATION

- 5.1 By Primary Material

- 5.1.1 Glass

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Plastic

- 5.1.5 Others

- 5.2 By Type of Packaging Product

- 5.2.1 Bags

- 5.2.2 Boxes

- 5.2.3 Tubs and Cups

- 5.2.4 Trays

- 5.2.5 Wrappers

- 5.2.6 Pouches

- 5.2.7 Other Types of Packaging

- 5.3 By Type of Food Product

- 5.3.1 Readymade Meals

- 5.3.2 Fruits and Vegetables

- 5.3.3 Meat

- 5.3.4 Sea Food

- 5.3.5 Baked Goods

- 5.3.6 Others

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Mexico

- 5.4.4 Rest of Latin America

6 VENDOR MARKET SHARE

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv

- 7.1.2 Amcor Ltd

- 7.1.3 Genpak LLC

- 7.1.4 Graham Packaging Company, Inc.

- 7.1.5 Ball Corporation Inc

- 7.1.6 Crown Holdings Inc.

- 7.1.7 Tetra Pak International

- 7.1.8 Placon Corporation

- 7.1.9 Toyo Seikan Group Holdings, Ltd.

- 7.1.10 WestRock Company

- 7.1.11 Nuconic Packaging

- 7.1.12 The Scoular Company

- 7.1.13 Owens-Illinois

- 7.1.14 Rexam Company

- 7.1.15 Alcoa Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219