|

市场调查报告书

商品编码

1627108

MNS(大众通知系统):市场占有率分析、产业趋势、成长预测(2025-2030)MNS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

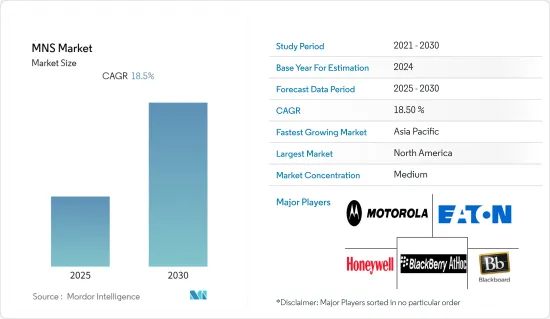

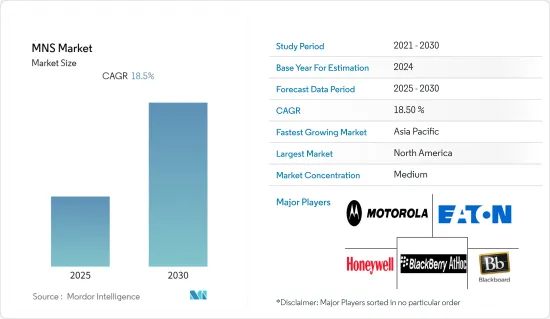

MNS(大众通知系统)市场预计在预测期内复合年增长率为 18.5%

主要亮点

- 公共是已开发国家和开发中国家的主要关注点之一,导致行动网路服务的迅速采用。 MNS 是飓风、洪水、地震和危及生命的情况等自然灾害期间的关键系统。 MNS是与居民沟通的有效、直接的手段,可以提供他们最新、准确的资讯。它可用于紧急和非紧急情况,并提供对各种威胁的回应、员工保护和法规遵循。

- 随着 COVID-19 继续在各地区传播,越来越多的人在家工作,世界各地的政府都在努力减缓病毒的传播。在这些变化中,公共卫生和安全部门希望与公众共用资讯并指导他们获得适当的资源以及该做什么和不该做什么,因此对大众通知系统的需求比以往任何时候都更高。利用这种情况,美国的几家公司已经开始免费提供他们的解决方案,以引起人们对其解决方案和平台的关注。

- 当发生重大事件时,政府和初期应变人员必须向处于危险中的每个人发出警报并提供资讯。公共警报系统有效地为来自其他国家的公民和游客提供可靠的信息,并帮助他们保持安全。到今年6月,公共电子通讯法规(EECC)第110条将要求所有欧盟国家在发生自然或人为灾难时在地理上针对受影响地区的所有行动电话用户进行操作。的紧急警报。 2020年,BEREC(欧洲电子通讯监管机构)也发布了评估透过不同方式传输的公共警报系统有效性的指南,以协助各国政府实施第110条。

- 过去十年来,随着个人面临各种危险情况(包括人为的和普通的紧急情况),公共问题日益严重。当发生破坏性事件时,生命损失和财产损失可能会很大。每个国家都有不同的管理危险物质 (HAZMAT) 和工业事故的规则和法规,并拥有单独的专用基础设施来维护公共。

- 市场竞争日益加剧。该市场中越来越多的公司正在寻求策略合作伙伴关係来开发现有系统。例如,KOVA Corp. 与着名的大众通知系统提供商 Everbridge 合作,将其专有的紧急警报通知系统 (KEANS) 与 Everbridge 首创的突破性群组通知系统整合。 KEANS 是一种基于 VoIP 的碰撞电话系统,与 Everbridge 技术相结合,使紧急管理机构和其他组织能够使用各种通讯管道高效发送通知。

大众通知系统 (MNS) 市场趋势

MNS 在医疗保健领域的采用率增加

- MNS 是一种通讯广播工具,可让您以最少的系统管理员工作量同时与大量人员联繫。在医疗保健领域,MNS 发挥双重作用:定期传达有关库存盘点等事件的讯息,并向工作人员、病患和访客通报紧急情况。

- 数位连接和高效的临床通讯已成为医疗保健领域的关键,为 MNS 的成长铺平了道路。例如,挪威卫生总局使用 Everbridge 公共警告与 540 万挪威公民通讯,其中包括数千名在行动网路上漫游的访客。挪威正在使用相同的系统通知前往 COVID-19 高风险国家的挪威人回国后检疫程序的变更。

- OnSolve 是一家着名的 MNS 供应商,去年加强了与罗德岛州紧急灾难管理署(RIEMA) 的合作关係,以加强向新符合条件的罗德岛州居民分发 COVID-19 疫苗。一旦罗德岛州 16 岁及以上的居民有资格接种 COVID-19 疫苗,这项扩大的伙伴关係将支持疫苗分发工作,现在将把资格扩大到 12 至 15 岁的居民。

- 每个国家的法规决定了医疗保健机构可以使用的大众通知系统的类型。例如,《美国残障人士法案》要求医疗机构配备适合听力或视力障碍患者的紧急通知系统。

预计北美将占据较大市场占有率

- UFC和国家消防协会等设计标准制定了紧急通讯和大众通知系统的功能和安装标准,并且成为办公室、医院和学校等非军事设施紧急通讯标准的起点。

- 基于网际网路通讯协定(IP) 的通知设备的日益普及是推动该地区市场成长的关键因素之一。 IP 连接的电脑、智慧型手机和电话越来越多地与本地 MNS 解决方案(例如火警警报器和安全感测器)整合。此外,教育机构和公司不断增长的BYOD趋势也是支持未来市场成长的主要因素。

- 情人节当天,玛乔丽·斯通曼·道格拉斯高中发生枪击事件,造成 17 人死亡。儘管大规模枪击事件尚无统一的定义,但毫无疑问,近年来此类大规模暴力行为有所增加。由于这些活动,美国政府越来越关注安全。最近,波士顿政府宣布了一系列投资,以支持这个不断发展的城市的公共安全。因此,大众通知系统是一个基本要素。

- 柯克斯维尔市议会核准从 ReGroup 购买大规模通知系统。该合约为期五年,据报道,该市今年第一年花费了 6,500 美元,随后几年花费了 5,500 美元。

- 紧急情况下对快速讯息传递的需求不断增长、开拓性技术的开发和采用以及黑莓、摩托罗拉和Honeywell等大公司在该地区的存在是推动市场的关键因素。进一步促进成长的是针对教育和医疗保健最终用户的公司越来越多地采用基于强制的解决方案。

群发通知系统产业概况

大众通知系统市场高度集中,少数主要企业占了大部分市场。市场新进入者必须与成熟的行业领导者竞争。该市场的主要企业包括霍尼韦尔国际公司、伊顿公司、摩托罗拉解决方案公司、Blackboard 公司和 OnSolve。最近的市场发展包括:

- 2022 年 12 月 -沙加缅度紧急服务部宣布推出新的紧急通知系统 Rave Mobile Safety。沙加缅度县居民将透过该系统收到紧急通知。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场驱动因素

- 更多采用基于互联网通讯协定的通知设备

- 人们对公共的兴趣日益浓厚

- MNS 在医疗保健领域的采用率增加

- 市场挑战

- 关于存取个人资料的严格隐私法规

- 评估 COVID-19 对市场的影响

第五章市场区隔

- 按成分

- 解决方案

- 服务

- 按发展

- 云

- 本地

- 按用途

- 大楼内部

- 广域

- 分散式接收

- 依介绍目的

- 业务永续营运和灾害復原

- 综合公共警报和警告

- 可互通的应急通讯

- 按行业分类

- 能源和公共产业

- 卫生保健

- 商业的

- 政府机构

- 教育

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Honeywell International Inc

- Eaton Corporation

- Motorola Solutions Inc.

- BlackBerry AtHoc Inc.

- Blackboard Inc.

- Everbridge Inc.

- OnSolve LLC

- HipLink Software

- Signal Communications Corporation

- Siemens AG

- Alertus Technologies, LLC

- Alert Media, Inc.

- F24 AG

- Rave Mobile Safety

- Regroup Mass Notification

- Singlewire Software, LLC

- Volo

- HipLink

- xMatters

- RefFlag(Pocketstop, LLC.)

- Preparis

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 49208

The MNS Market is expected to register a CAGR of 18.5% during the forecast period.

Key Highlights

- Public security is one of the primary concerns for both developed & developing countries, and it results in an upsurge in the adoption of MNS. MNS are critical systems during natural disasters, including hurricanes, floods, earthquakes, and circumstances threatening human life. It is an effective and direct way to communicate with the public, ensuring residents are up-to-date and have accurate information. It can be used for emergency and non-emergency situations and offers extensive threat response, staff protection, and regulatory compliance.

- With the COVID-19 outbreak across regions, more people are working from home, and governments worldwide are taking initiatives to slow the spread of the virus. Amid these changes, the need for a mass notification system is more than ever since the public health and safety department wants to share information with the public and guide them toward the right resources and dos & don'ts. Taking advantage of this scenario, a few players in the United States started offering their solutions for free/no cost to attract attention toward their solutions and platforms.

- Governments and first responders must warn and inform everyone at risk when critical events happen. Public warning systems effectively provide citizens and visitors from other countries with trusted information to help them stay safe. By June this year, the European Electronic Communications Code (EECC) Article 110 requires all EU countries to operate a public warning system that can send geo-targeted emergency alerts to all mobile phone users in the affected area during a natural or artificial disaster. In 2020, BEREC (the Body of European Regulators for Electronic Communications) also published its guidelines on assessing the effectiveness of public warning systems transmitted by different means to help governments implement Article 110.

- Public security concerns have risen over the last decade as individuals are defied with various hazardous situations from artificial and regular emergencies. The loss of life and damage to property can be enormous in the case of any destructive event. Each country has a different set of rules and regulations for managing Hazardous Materials (HAZMAT) incidents and industrial accidents and a separate and dedicated infrastructure to maintain public safety and security, which anticipates supporting the growth of mass notification systems.

- The market studied is witnessing an increase in competition among the players. Companies in the market are increasingly looking for strategic relationships to develop their existing systems. For instance, KOVA Corp. partnered with Everbridge, a prominent mass notification systems provider, to integrate its proprietary Emergency Alert Notification System (KEANS) with the groundbreaking group notification system pioneered by Everbridge. KEANS is a VoIP-based crash phone system that, coupled with Everbridge tech, will allow emergency management agencies and other organizations to send out notifications efficiently using various communications channels.

Mass Notification Systems Market Trends

Increasing Adoption of MNS in Healthcare Sector

- MNS is a communication broadcast tool that can simultaneously contact large numbers of people with minimal effort on the part of the system administrator. In the healthcare sector, MNS serves two purposes communicating periodic messages for events, such as inventory counts, and alerting staff, patients, and visitors to emergencies.

- The digitally connected environment and efficient clinical communication have become indispensable in the healthcare sector, which has paved the path for the growth of the MNS. For example, the Norwegian Directorate of Health uses Everbridge Public Warning to communicate with 5.4 million Norwegian citizens, including thousands of visitors roaming on mobile networks. Norway uses the same system to notify Norwegians traveling in countries with a high risk of COVID-19 of changes to quarantine procedures on their return.

- Last year, OnSolve, a prominent MNS provider, strengthened its partnership with the Rhode Island Emergency Management Agency (RIEMA) to power the distribution of COVID-19 vaccines to newly eligible Rhode Island residents. This expanded partnership supported vaccine distribution efforts when Rhode Island residents 16 years of age or older became eligible to receive the COVID-19 vaccine and will now support the expanded eligibility to residents 12 to 15 years of age.

- Country-wise regulations determine the type of mass notification system its healthcare facilities can use. For instance, America's Disabilities Act specifies that healthcare facilities must have an emergency alert system suitable for hearing-restricted and sight-restricted patients.

North America is Expected to Hold Significant Market Share

- The design standards, such as UFC and the National Fire Protection Association, address the functional criteria and installation standards for emergency communications and mass notification systems and have been the launchpad for emergency communication standards for non-military facilities, such as offices, hospitals, and schools.

- The growing adoption of Internet Protocol (IP) based notification devices is one of the key factors driving the market's growth in this region. IP-connected computers, smartphones, and telephones are increasingly integrated with on-premise MNS solutions, such as fire alarms and security sensors. Furthermore, rising BYOD trends across educational facilities and corporations are another major factor boosting the market growth in the future.

- The Valentine's Day shooting at Marjory Stoneman Douglas High School resulted in the deaths of 17 people. While there is no universally accepted definition of a mass shooting, there is no doubt that these large-scale acts of violence have increased in recent years. As a result of these activities, the US government is increasingly focusing on public safety. Recently, the Boston government announced a series of investments to support public safety for a growing city. Mass notification systems are thus an essential component.

- The Kirksville City Council approved purchasing a mass notification system from ReGroup. The agreement is a five-year deal, and the city has reportedly spent USD 6,500 for the first year and USD 5,500 in subsequent years till this year.

- The increasing demand for fast message delivery in emergency cases, the development and adoption of pioneering technologies, and the presence of major companies like Blackberry, Motorola, Honeywell, etc., in this region are the major factors driving the market. Furthermore, the rising adoption of duress-based solutions in enterprises across education and healthcare end-users contributes to the growth.

Mass Notification Systems Industry Overview

The Mass Notification Systems market is highly concentrated due to the majority of the market being occupied by a few dominant players. The new companies entering the market have to compete with prominent industry leaders. Some key players in the market are Honeywell International Inc., Eaton Corporation, Motorola Solutions Inc., Blackboard Inc., and OnSolve. Some recent developments in the market include:

- December 2022 - The Sacramento Office of Emergency Services unveiled Rave Mobile Safety as its new emergency alert system. Residents in Sacramento County will now get emergency notifications via the system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of Internet Protocol Based Notification Devices

- 4.3.2 Increasing Concerns About Public Safety

- 4.3.3 Increasing Adoption of MNS in Healthcare Sector

- 4.4 Market Challenges

- 4.4.1 Stringent Privacy Regulations Pertaining to Access to Individual Data

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Application

- 5.3.1 In-Building

- 5.3.2 Wide-Area

- 5.3.3 Distributed Recipient

- 5.4 By Purpose of Deployment

- 5.4.1 Business Continuity and Disaster Recovery

- 5.4.2 Integrated Public Alert and Warning

- 5.4.3 Interoperable Emergency Communication

- 5.5 By End-User Vertical

- 5.5.1 Energy and Utilities

- 5.5.2 Healthcare

- 5.5.3 Commercial

- 5.5.4 Government

- 5.5.5 Education

- 5.5.6 Other End User Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia Pacific

- 5.6.4 Latin America

- 5.6.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International Inc

- 6.1.2 Eaton Corporation

- 6.1.3 Motorola Solutions Inc.

- 6.1.4 BlackBerry AtHoc Inc.

- 6.1.5 Blackboard Inc.

- 6.1.6 Everbridge Inc.

- 6.1.7 OnSolve LLC

- 6.1.8 HipLink Software

- 6.1.9 Signal Communications Corporation

- 6.1.10 Siemens AG

- 6.1.11 Alertus Technologies, LLC

- 6.1.12 Alert Media, Inc.

- 6.1.13 F24 AG

- 6.1.14 Rave Mobile Safety

- 6.1.15 Regroup Mass Notification

- 6.1.16 Singlewire Software, LLC

- 6.1.17 Volo

- 6.1.18 HipLink

- 6.1.19 xMatters

- 6.1.20 RefFlag(Pocketstop, LLC.)

- 6.1.21 Preparis

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219