|

市场调查报告书

商品编码

1627134

中国石油和天然气中游 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)China Oil and Gas Midstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

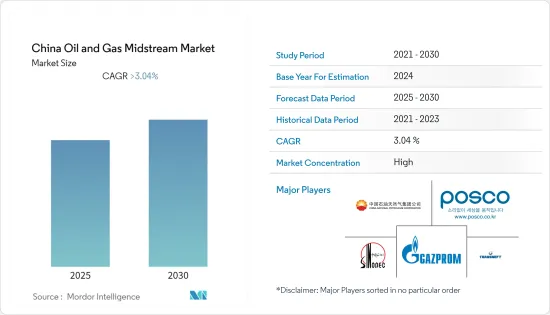

预计中国中游油气市场在预测期内将维持3.04%以上的复合年增长率。

COVID-19大流行对2020年的市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 从长远来看,天然气产量和消费量的增加预计将在预测期内提振中国石油和天然气中游市场。

- 另一方面,国内石油产量下降可能导致管道在预测期内退役,引发该领域的担忧。

- 中国政府增加石油和天然气产量的倡议预计将为石油和天然气管道开发开闢新途径,为中游产业参与企业提供机会。

中国油气中游市场趋势

交通运输业将显着成长

- 中国石油天然气中游产业由油气运输、管线和仓储设施所组成。截至2021年,中国拥有天然气管道约11万公里,石油管线约27,441公里。

- 2021年中国石油石油管线总长度约7,340公里,天然气管道总长度约17,329公里。整体而言,2021年管道长度较上年减少。

- 截至2022年,该国正在开发最大的液化天然气进口能力。该国还计划在未来几年增加每年超过2亿吨的进口能力,其中8,530万吨已处于开发阶段。这一产能高于越南和泰国等其他亚洲国家的在建计划。

- 2021年中国天然气产量为2,075.8亿立方公尺(bcm),比前一年增加15bcm以上。天然气消费量也在增加。消费量成长可能会在预测期内推动管道成长。

- 因此,由于天然气产量的增加和该行业投资的增加,预计交通运输业在预测期内将出现强劲增长。

石油和天然气消费的成长推动市场

- 中国是世界第二大石油和天然气消费国,也是世界第六大石油和天然气生产国。该国的能源市场由国家石油和天然气公司主导,这些公司开发国内蕴藏量、建造和营运管道以及管理和填充战略石油储备(SPR)。

- 2021年全国天然气消费量量达3,787亿立方公尺(bcm),较去年与前一年同期比较成长约13%。消费量的增加将奖励投资者建立必要的产能,促进未来投资并支持产业成长。

- 随着天然气需求的增加,该国计画在2030年投资约85亿美元建设23个仓储设施。仓储设施的竣工以及即将建成的天然气管道预计将在未来推动该国的中游产业发展。

- 2022年1月,中国燃气公司在中国西北部新疆维吾尔自治区塔里木盆地发现蕴藏量约1亿吨的新油气区块。中石化顺北天然气田的最新蕴藏量估计为冷凝油油8,800万吨和天然气2,900亿立方公尺。新的石油和天然气发现也支撑了国内石油和天然气需求。

- 2022年10月,中国石化西南油气公司在中国四川盆地取得页岩气新发现。金石103HF探勘井钻探后发现页岩气,估计资源量为3878亿立方公尺。天然气日产量达25.86万立方米,这项新发现将支撑国内油气需求。

- 由于这些发展和石油和天然气消费的增加,中国石油和天然气中游市场预计在预测期内将进一步成长。

中国油气中游产业概况

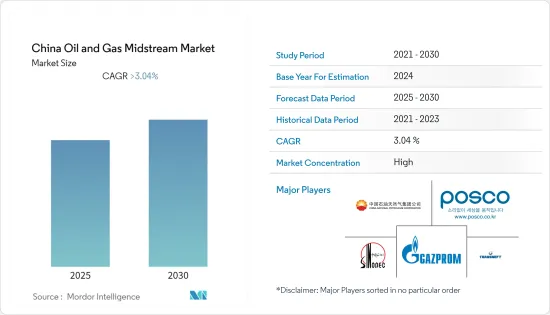

中国中游油气市场整合程度较高。主要企业包括中国石油天然气集团公司、浦项製铁公司、俄罗斯天然气工业股份公司、俄罗斯运输公司、中国石油化工股份有限公司(排名不分先后)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 至2027年石油产量与消费量预测(单位:千桶/日)

- 到 2027 年天然气产量和消费量(10 亿立方英尺/天)

- 2027年LNG接收站装置容量及预测

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 类型

- 运输

- LNG接收站

- 贮存

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- China National Petroleum Corporation

- POSCO

- PJSC Gazprom

- PJSC Transneft

- China Petroleum & Chemical Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 49913

The China Oil and Gas Midstream Market is expected to register a CAGR of greater than 3.04% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, increasing natural gas production and consumption are expected to boost the Chinese oil and gas midstream market during the forecast period.

- On the other hand, the decreasing oil production in the country has caused concern in the sector, which may lead to the possible decommissioning of pipes during the forecast period.

- The Chinese government's initiative to increase oil and gas production in the country is expected to provide an opportunity for the players in the midstream sector as new production fields would open new avenues for the development of oil and gas pipelines.

China Oil & Gas Midstream Market Trends

Transportation Sector to Witness Significant Growth

- China's oil and gas midstream consists of oil and gas transportation, pipelines, and storage facilities. As of 2021, the country had nearly 110,000 km of natural gas pipelines, while the oil pipeline accounted for almost 27,441 km.

- PetroChina's oil pipelines had a total length of about 7,340 km in 2021, while the gas pipelines had a full length of around 17,329 km. Overall, pipeline length decreased in 2021 compared to the previous year.

- As of 2022, the country has the largest LNG import capacity under development. The country is also planning to add over 200 million metric tons (MMT) in annual import capacity within the next few years, of which 85.3 million metric tons are already in the development stage. This capacity is higher than the project pipelines of other Asian countries such as Vietnam and Thailand.

- China produced 207.58 billion cubic meters (bcm) of natural gas in 2021, an increase of over 15 bcm compared to the previous year. The country is also witnessing increasing consumption of natural gas. The growing consumption may boost the growth of pipelines in the country during the forecast period.

- Hence, the transportation segment is expected to witness significant growth during the forecast period due to the rising production of gas and growing investment in the sector.

Increasing Oil and Gas Consumption to Drive the Market

- China is the second-largest consumer of oil and gas and the sixth-largest producer of oil and gas globally. The energy market in the country is dominated by state-owned oil and gas companies that develop the country's domestic reserves, build and operate pipelines, and manage and fill its strategic petroleum reserves (SPR).

- The country's natural gas consumption amounted to 378.7 billion cubic meters (bcm) in 2021, an increase of roughly 13% compared to the previous year. The increasing consumption incentivizes the investors for the required increase in capacity and boosts future investments, thereby boosting the industry's growth.

- With the rising demand for natural gas, the country is planning to build 23 gas storage facilities by 2030, with an investment of around USD 8.5 billion. The completion of the storage facilities, along with the upcoming gas pipelines, is expected to boost the midstream sector in the country in the future.

- In January 2022, Sinopec, a Chinese oil and gas enterprise, discovered a new oil and gas area with approximately 100 million ton of reserves in the Tarim Basin of northwest China's Xinjiang Uygur Autonomous region. These latest reserves in Sinopec's Shunbei oil and gas field are estimated to provide 88 million metric ton (MMT) of condensate oil and 290 billion cubic meters of natural gas. The new oil and gas discoveries also support the demand for oil and gas within the country.

- In October 2022, Sinopec Southwest Oil & Gas Company of China Petroleum & Chemical Corporation (Sinopec) made a new shale gas discovery in the Sichuan basin in China. The shale gas has been discovered following the drilling of the Jinshi 103HF exploratory well, which has an anticipated resource capacity of 387.8 billion cubic meters (bcm). With daily natural gas production reaching 258,600 cubic meters, the new discovery will support the oil and gas needs within the country.

- Owing to such developments and increasing oil and gas consumption, the Chinese oil and gas midstream market is expected to grow further during the forecast period.

China Oil & Gas Midstream Industry Overview

The Chinese oil and gas midstream market is moderately consolidated. The major companies include (in no particular order) China National Petroleum Corporation, POSCO, PJSC Gazprom, PJSC Transneft, and China Petroleum & Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Oil Production and Consumption Forecast in thousand barrels per day, till 2027

- 4.2 Natural Gas Production and Consumption in billion cubic feet per day, till 2027

- 4.3 LNG Terminals Installed Capacity and Forecast, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Transportation

- 5.1.2 LNG Terminals

- 5.1.3 Storage

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 China National Petroleum Corporation

- 6.3.2 POSCO

- 6.3.3 PJSC Gazprom

- 6.3.4 PJSC Transneft

- 6.3.5 China Petroleum & Chemical Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219