|

市场调查报告书

商品编码

1627175

环己烷 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Cyclohexane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

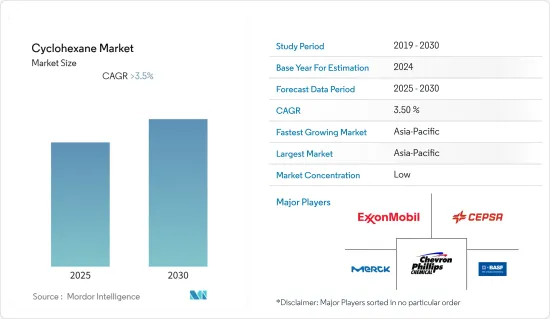

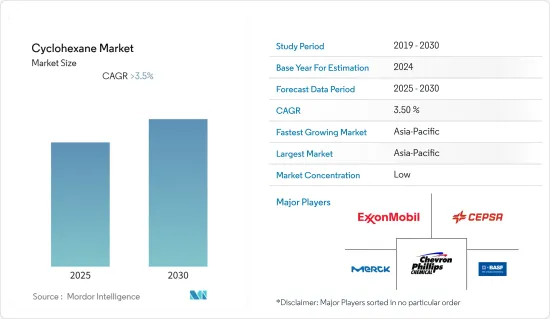

环己烷市场预计在预测期内复合年增长率将超过 3.5%。

2020 年市场受到 COVID-19 的负面影响。在大流行的情况下,汽车製造和建设活动被暂时封锁,以遏制 COVID-19 病毒的传播。封锁减少了对环己烷及其衍生物尼龙6和基于尼龙6的产品的需求,例如乘用车安全带、绳索、软管、塑胶汽车零件和地毯织物。

主要亮点

- 短期内,由于尼龙6产能的增加以及工程树脂中己内酰胺的需求不断增长,预计该市场将会成长。

- 另一方面,对环境安全和野生动物保护的日益担忧以及原材料价格的波动预计将阻碍该行业成长。预计这些因素将阻碍市场成长。

- 中国、印度和沙乌地阿拉伯等新兴国家正向尼龙66注入更多资金,环己烷市场应会受益。

环己烷市场趋势

纺织业需求增加

- 环己烷用于製造己二酸、六亚甲基二胺和己内酰胺,这些材料进一步用于製造尼龙 6、6 和 6。己内酰胺聚合产生尼龙6,己二酸和己二胺聚合产生尼龙6。

- 尼龙的典型用途包括地毯、家具、地板材料、打字机色带、尼龙绳和绳、渔网、麻线、伞布、缝线和输送机。

- 尼龙 6 是最常见的商业级尼龙。它以坚韧耐磨的材料而闻名,具有高拉伸强度。尼龙 6 树脂用于汽车应用,例如汽车座椅的衬垫和座椅表皮。此外,尼龙长丝也用于製造汽车乘客座椅安全带和软管等。多丝纤维丝尼龙线也用于增强轮胎中的橡胶。

- 根据OICA统计,2021年全球汽车销量为8,268万辆,而2020年全球汽车销量为7,877万辆,成长率约5%。 2022 年头三轮胎帘布,全球乘用车产量约为 5,000 万辆,与 2021 年同期消费量成长 9%。

- 由于尼龙6和尼龙6/6模量低、强度高、耐磨性好,用于生产服饰。可以使用尼龙製造的服饰包括女式长袜、短袜和纱丽。此外,鞋类领域也消耗尼龙布料,从内层布料到外层布料,甚至鞋底也可能由尼龙製成。

- 根据欧洲服装和服饰联合会(EURATEX)预测,2021年欧盟27国纺织服装业销售额将约为1,470亿欧元(1,656.3亿美元),与前一年同期比较%。这意味着更多的尼龙长丝和织物将用于纺织和服饰行业。

- 因此,预计上述因素将在未来几年对环己烷市场产生重大影响。

亚太地区主导市场

- 由于对己内酰胺的强劲需求,亚太地区是环己烷最大的市场,预计未来几年将快速成长。

- 中国是亚太地区最大的环己烷市场。随着己内酰胺工厂数量的增加以及汽车製造商专注于生产轻型汽车,中国可能成为亚太地区的市场驱动力。

- 中国继续在全球汽车生产中处于世界领先地位。根据OICA统计,2020年中国汽车产量为2,522万辆,2021年产量约2,608万辆,成长率约3%。

- 另外,根据OICA的数据,印度2020年产量约339万台,2021年产量为439万台,成长率约30%。这导致越来越多地使用尼龙来製造轮胎、安全带、座椅套、尼龙塑胶零件等。

- 环己烷及其衍生物在建筑业也有应用。 2021年,中国建筑产值高峰约29.3兆元(4.32兆美元),使得环己烷及其衍生物的消费量增加。

- 据纺织部称,印度纺织服装业在从纤维到纱线、面料和服装的整个价值链上都具有优势。 2021年国内纺织服装产业规模将达1,520亿美元,复合年增率为12%,2025年将达2,250亿美元。

- 此外,根据日本统计局的数据,2021年日本纺织品批发销售额约2.1兆日圆(160亿美元),较上年下降约2.3%。换句话说,日本尼龙纤维的使用量正在减少。

- 因此,预计上述因素将在未来几年对环己烷市场产生重大影响。

环己烷产业概况

环己烷市场原本是分割的。主要参与企业包括 Merck KGaA、 BASF SE、Chevron Phillips Chemical Company LLC、Exxon Mobil Corporation 和 Cepsa。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大尼龙6产能

- 工程树脂对己内酰胺的需求增加

- 抑制因素

- 苯酚在己内酰胺生产的用途

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 目的

- 己二酸

- 己内酰胺

- 其他的

- 最终用户产业

- 车

- 画

- 纤维

- 建筑学

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Cepsa

- Chevron Phillips Chemical Company LLC

- CITGO Petroleum Corporation

- Exxon Mobil Corporation

- Idemitsu Kosan Co.,Ltd.

- Merck KGaA

- PTT Global Chemical Public Company Limited

- REE ATHARVA LIFESCIENCE PVT. LTD.

- Reliance Industries Limited

第七章 市场机会及未来趋势

- 中国、印度、沙乌地阿拉伯等开发中国家加大对尼龙66的投资

- 其他机会

The Cyclohexane Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. During the pandemic scenario, automotive manufacturing and construction activities were temporarily stopped during the lockdown to curb the spread of the COVID-19 virus. The lockdown decreased the demand for cyclohexane and its derivatives, such as nylon 6 and nylon 6-based products, including passenger safety belts, ropes, hoses, plastic auto parts, and carpeting fabric.

Key Highlights

- In the short term, the market is likely to grow because of the growing ability to make Nylon 6 and the growing need for caprolactam in engineering resins.

- On the other hand, the industry's growth is expected to be hampered by rising environmental safety and wildlife protection concerns, as well as the volatility in raw material prices. These factors are expected to hinder the growth of the market studied.

- The cyclohexane market should benefit from the fact that more money is being put into Nylon 66 in developing countries like China, India, and Saudi Arabia.

Cyclohexane Market Trends

Rising Demand from the Textile Industry

- Cyclohexane is used for the manufacture of adipic acid, hexamethylenediamine, and caprolactam, which are further used to produce Nylon 6, 6, and 6. The polymerization of caprolactam makes Nylon 6, and the polymerization of adipic acid and hexamethylenediamine makes Nylon 6.

- Some of the most important ways nylon is used are in carpets, furniture, floor coverings, typewriter ribbons, nylon ropes and cordages, fishing nets, strimmer lines, umbrella cloth, sutures, conveyor belts, and other things.

- Nylon 6 is the most common commercial grade of nylon. It is known to be a tough, abrasion-resistant material that possesses high tensile strength. Nylon-6 resins are used in automotive applications, including in-car seat filling and seat covering. Furthermore, nylon filaments can be used to fabricate passenger safety belts in cars, hoses, and others. Multifilament nylon yarns are also used for reinforcing rubbers in tires.

- According to OICA, around 82.68 million vehicles were sold globally in 2021, compared to 78.77 million vehicles that were sold in 2020, reflecting an increasing growth rate of about 5%. Also, nearly 50 million passenger cars were manufactured globally during the first three quarters of 2022, up 9% compared to the same nine-month period in 2021, thus leading to an increase in the consumption of nylon used to produce nylon tire cords, safety belts, seat filling and covering, and others.

- Owing to the low modulus, high strength, and good abrasion resistance, nylon 6 and nylon 6/6 are used to manufacture various lightweight and sheer garments. Some of the apparel that can be fabricated using nylon includes ladies' stockings, socks, sarees, and others. Furthermore, nylon fabric is also consumed by the footwear segment, from the inside fabric to the outside; even the shoe bottom can be made of nylon.

- According to the European Apparel and Textile Confederation (EURATEX), the textile and clothing industry in the 27 countries of the European Union (EU) had a turnover of about EUR 147 billion (USD 165.63 billion) in 2021, which was an increase of about 11% from the year before. This meant that the textile and clothing industry used more nylon filaments and fabrics.

- Because of this, the above factors are likely to have a big effect on the cyclohexane market in the next few years.

Asia-Pacific Region to Dominate the Market

- Due to strong demand from caprolactam, Asia-Pacific is the largest market for cyclohexane, and it is expected to grow at a fast rate over the next few years.

- China is the biggest market for cyclohexane in the Asia-Pacific region. China is likely to be the market-driver in the Asia-Pacific region as the number of caprolactam plants increases and automakers focus on producing lighter cars.

- China remained the global leader in the production of automobiles across the world. According to OICA, around 26.08 million vehicles were produced in China in 2021, compared to 25.22 million vehicles that were produced in 2020, witnessing a growth rate of about 3%.

- Also, according to the OICA, India made about 3.39 million vehicles in 2020 and 4.39 million vehicles in 2021, which is a growth rate of about 30%. This led to an increase in the use of nylon to make tires, seat belts, seat covers, plastic parts made of nylon, and other things.

- Cyclohexane and its derivatives also find application in the construction industry. In 2021, the construction output value in China reached its peak at around CNY 29.3 trillion (USD 4.32 trillion), thus leading to an increase in the consumption of cyclohexane and its derivatives for the production of various construction industry products, including carpet fabrics, ropes, plumbing fittings, and others.

- According to the Ministry of Textiles of India, the textile and apparel industry in India has strengths across the entire value chain, from fiber, yarn, fabric, and apparel. The domestic textile and apparel industry stood at USD 152 bn in 2021, growing at a CAGR of 12% to reach USD 225 bn by 2025.

- Also, the Statistics Bureau of Japan says that the wholesale sales of textiles in Japan were worth about JPY 2.1 trillion (USD 0.016 trillion) in 2021, which was about 2.3% less than the year before. This means that fewer nylon-based textiles are being used in Japan.

- Because of this, the above factors are likely to have a big effect on the cyclohexane market in the next few years.

Cyclohexane Industry Overview

The cyclohexane market is fragmented by nature. Some of the key players include Merck KGaA, BASF SE, Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, and Cepsa, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Production Capacity for Nylon 6

- 4.1.2 Increasing Demand for Caprolactam for Engineering Resins

- 4.2 Restraints

- 4.2.1 Usage of Phenol for Manufacturing Caprolactam

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Adipic Acid

- 5.1.2 Caprolactam

- 5.1.3 Other Applications

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Paints and Coatings

- 5.2.3 Textile

- 5.2.4 Construction

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Cepsa

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 CITGO Petroleum Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Idemitsu Kosan Co.,Ltd.

- 6.4.7 Merck KGaA

- 6.4.8 PTT Global Chemical Public Company Limited

- 6.4.9 REE ATHARVA LIFESCIENCE PVT. LTD.

- 6.4.10 Reliance Industries Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments for Nylon 66 in Developing Nations, including China, India, and Saudi Arabia

- 7.2 Other Opportunities