|

市场调查报告书

商品编码

1627182

复合材料测试:市场占有率分析、产业趋势、成长预测(2025-2030)Composite Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

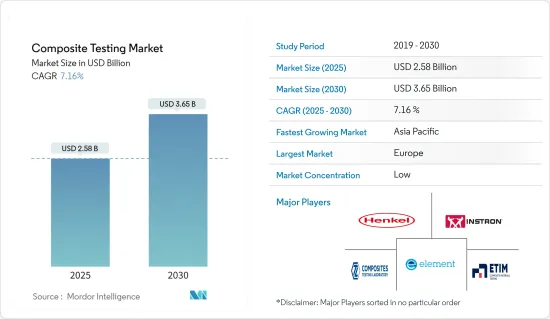

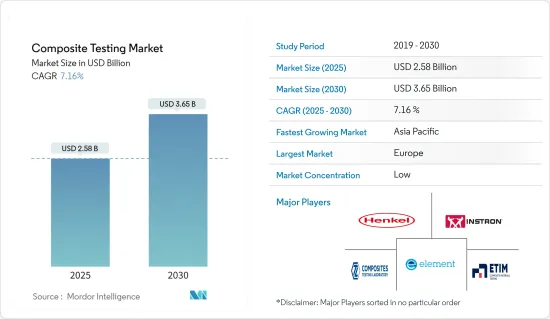

复合材料测试市场规模预计到 2025 年为 25.8 亿美元,预计到 2030 年将达到 36.5 亿美元,预测期内(2025-2030 年)复合年增长率为 7.16%。

复合材料在现代应用中变得越来越重要。其优点包括轻质特性、耐腐蚀性、提高疲劳强度和更快的组装过程。重要的是,复合材料的强度重量比超过大多数金属。例如,一立方英尺铸钢重约 490 磅,而复合材料的重量可减轻高达 70%。对轻质材料的关注正在推动复合材料测试市场的扩张,特别是在航太、汽车和建筑领域。

维持复合材料品质标准的需求为市场创造了成长机会

主要亮点

- 复合测试对于实验室的产品评估至关重要,可确保产品发挥其预期功能。复合测试不是单独评估每个产品组件,而是一起评估一组组件。该方法简化了测试过程并节省了大量时间和成本。如果复合组通过了考试,则无需重新测试各个组件。在严格测试标准的推动下,航太、国防、汽车和风力发电等产业越来越多地采用复合材料。由于其卓越的性能和强度,复合材料现在在汽车应用中至关重要。

- 复合材料的产品创新正在增强市场需求。例如,2024 年 9 月,专门从事材料技术、工艺和测试的组织 Lucideon 宣布与 Technetics Group 建立合作伙伴关係。两家公司都致力于研究 NASA 专利材料,为各种应用生产先进的动态密封件。这些先进材料可满足多个市场中承受极端温度和高转速的关键应用。其开发需要使用先进的陶瓷加工设备来确保测试条件的精确性和一致性。这增加了市场对复合材料测试解决方案的需求。

复合材料可回收性的挑战引发了对环境永续性问题的担忧

主要亮点

- 使用复合材料是因为其强度重量比和耐用性。其回收面临挑战主要是由于材料的复杂性。作为不同的、通常是化学键合的材料的混合物,在回收过程中分离这些成分是一项艰鉅的任务。此外,复合材料缺乏标准化的回收流程和法规,这可能会进一步阻碍回收并阻碍市场成长。然而,随着永续性问题的日益严重以及这些材料越来越融入循环经济,研究人员和产业领导者正在积极开拓创新的回收方法。

- 随着世界越来越关注环境问题,复合材料产业对生物基材料的采用显着增加。例如,在紧迫的环境和永续性目标的推动下,对生物基复合材料的需求不断增加,特别是在基础设施和建筑领域。此外,在汽车和航太等行业,不断增加的环境指令和不断减少的资源已经强调了创新和环保复合材料的开发。这种趋势并没有被忽视,因为它开闢了利润丰厚的途径并鼓励许多公司投资该市场。

复合材料测试市场趋势

汽车产业作为最终用户正在快速成长

- 由于先进复合材料的日益采用,复合材料测试已成为汽车行业的关键检测服务之一。先进复合材料正在改变汽车产业,透过尖端的结构设计和增强的机械性能来提高车辆性能。

- 特别是碳纤维和蜂巢结构作为先进复合材料,具有较高的强度重量比,可显着减轻车辆品质。重量的减轻提高了燃油效率并排放气体。此外,复合材料比金属具有更好的耐腐蚀性,可提高汽车零件的使用寿命和耐用性。鑑于汽车应用技术创新的不断发展以及对这些材料的需求激增,该市场有望强劲增长。

- 复合材料在汽车设计的发展中发挥关键作用,凸显了它们在提高汽车产业效率和引领创新方面的重要性。透过结合不同的元素,这些材料可以製造出坚固、轻质的零件,从而显着提高燃油效率和整体性能。随着对节能、高性能车辆的需求激增,汽车产业越来越多地转向这些先进的复合材料。这些复合材料不仅彻底改变了汽车製造,还提高了性能,同时最大限度地减少了对环境的影响。由于汽车销量的增加和汽车生产投资的增加,该市场预计将显着增长。

- 复合材料,特别是碳纤维,在汽车製造领域掀起了巨大的浪潮。汽车业越来越青睐由碳纤维和树脂製成的复合材料。这些材料的优点与汽车製造的特定需求密切相关。随着汽车应用碳纤维复合材料投资的增加,它们将显着影响市场动态。

- 电动车 (EV) 中复合材料的未来将对汽车产业产生重大影响。随着该行业转向符合低碳经济的更永续的模式,复合材料在电动车中的使用正在迅速发展。北美、亚太和欧洲等多个地区的许多国家的电动车销量都出现了显着成长。

- 例如,国际能源总署(IEA)报告称,2023年中国电动车销量将领先亚太地区,达到800万辆以上。此外,根据阿贡国家实验室的数据,2023 年美国插电式电动车 (PEV) 销量将达到 150 万辆大关,其中全电动和插电式混合动力汽车的销量都将达到高峰。

亚太地区将经历显着成长

- 亚太复合材料测试市场受到不同区域特征的影响,每个区域特征都在塑造其成长轨迹方面发挥作用。包括中国、日本和韩国等强国在内的东亚地区脱颖而出,成为领跑者。这一优势得益于最尖端科技的采用、强大的製造能力以及较高的消费者支出。值得注意的是,中国庞大的人口和快速发展的工业正在推动这项需求。

- 例如,2024年7月,福斯汽车推出ID.Unyx,推出专门针对中国的新子品牌。此举符合大众汽车「在中国,为中国」的策略。 ID.Unyx 是一款全电动电动 SUV小轿车,具有现代设计和可自订的人工智慧 3D 助理。该车型是在大众汽车位于中国合肥的最先进的工厂开发和生产的。

- 此外,2024年10月,全球综合真空製造领域的领导者ULVAC在韩国京畿道平泽市开设了技术中心PYEONGTAEK。该中心将与韩国客户密切合作,引领下一代半导体製造设备和製程的发展,并将专注于建立大规模生产技术。

- 在都市化、可支配收入增加和中产阶级扩大的推动下,东南亚对复合材料测试的需求呈现成长趋势。印尼、越南和泰国等国家吸引投资并促进创新,成为人们关注的焦点。

- 2024 年 9 月在雅加达市中心举行的重要会议等活动导致需求激增。印尼和法国相关人员与行业专家一起讨论了两艘鲉鱼级先进潜艇的建造和营运支援。这些潜艇将由印尼海军(TNI AL)营运。这次会议强调了印尼对在国内建造两艘鲉鱼级先进潜艇的承诺,凸显了双边协议的关键时刻。

复合材料测试产业概况

在市场上,不同企业之间的竞争由价格、产品、市场占有率和竞争强度决定。在复合材料测试市场中,复合材料测试实验室、Element Materials Technology和Intertek Group PLC等老牌企业占据了最大的市场占有率。市场竞争激烈,大厂商占很大份额。

这些公司在研发和整合活动方面对市场具有强大的影响力。此外,所研究市场中的综合服务的特征是市场渗透率适中。此外,很少有区域公司进入市场,利用建筑等最终用户领域的区域需求。

创新为企业带来永续的竞争优势。市场现有企业采取了基于产品差异化、市场扩张和併购的强有力的竞争策略。由于经营企业的成本高昂,退出市场的障碍很高。

预计预测期内企业集中度将稳定成长。少数现有企业的高度主导性预计将对整体市场盈利产生负面影响。总体而言,竞争公司之间的竞争非常激烈,预计在预测期内将会加剧。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 对亚太地区复合材料测试设施的重大投资

- 汽车、航太和国防领域对复合材料测试的需求不断增长

- 航太和国防应用中对测试液压框架的需求不断增加

- 市场限制因素

- 开发中地区缺乏训练有素的操作员和专业知识

- 复合材料的可回收性问题

- 宏观经济因素对市场的影响

第六章 市场细分

- 依产品类型

- 陶瓷基质复合材料

- 连续纤维复合材料

- 不连续纤维复合材料

- 高分子复合材料

- 其他复合材料

- 按测试方法

- 破坏

- 非破坏性的

- 按用途

- 航太/国防

- 车

- 建筑/施工

- 电力/电子

- 其他(运动器材、风力发电等)

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Composites Testing Laboratory

- Element Materials Technology(Temasek Holdings)

- ETIM Composites Testing Laboratory

- Henkel AG and Co. KGaA

- Instron Corporation(Illinois Tool Works Inc.)

- Intertek Group PLC

- Matrix Composites, Inc.(ITT Inc.)

- MISTRAS Group Inc.

- Westmoreland Mechanical Testing & Research, Inc.

第八章投资分析

第9章市场的未来

The Composite Testing Market size is estimated at USD 2.58 billion in 2025, and is expected to reach USD 3.65 billion by 2030, at a CAGR of 7.16% during the forecast period (2025-2030).

Composites are becoming increasingly vital in contemporary applications. Their benefits encompass lightweight characteristics, resistance to corrosion, elevated fatigue strength, and faster assembly processes. Significantly, composites boast a strength-to-weight ratio that outperforms most metals. To illustrate, a cubic foot of cast steel tips the scales at approximately 490 pounds, whereas composites can achieve a weight reduction of up to 70%. This focus on lightweight materials drives the composite testing market expansion, particularly within the aerospace, automotive, and construction sectors.

The Need For Maintaining Quality Standards Of The Composite Materials Is Creating A Growth Opportunity For The Market

Key Highlights

- Composite testing is vital for laboratory product evaluations, confirming that products fulfil their intended functions. Rather than evaluating each product component in isolation, composite testing evaluates groups of components collectively. This method streamlines the testing process and yields significant time and cost savings. Retesting the individual components becomes unnecessary when a composite group passes a test. Driven by rigorous testing standards, industries like aerospace, defense, automotive, and wind energy increasingly embrace composites. Due to their superior performance and strength, composites are now integral to vehicle applications.

- Product innovations in the composite material landscape are bolstering market demand. For instance, in September 2024, Lucideon, an organization specializing in materials technology, processes, and testing, announced a partnership with Technetics Group. Together, they are working on NASA-patented materials to craft an advanced dynamic seal across diverse applications. These advanced materials cater to critical applications, enduring extreme temperatures and rapid rotation speeds across multiple markets. Their development necessitates heightened use of advanced ceramic processing equipment, ensuring precise and consistent testing conditions. This, in turn, amplifies the demand for composite testing solutions in the market.

Recyclability Challenges Of Composite Materials Will Raise The Concern Of Environmental Sustainability Issues

Key Highlights

- Composites are used for their strength-to-weight ratio and durability. Their recycling faces challenges, primarily due to material complexity. Being a blend of various, often chemically bonded materials, separating these constituents during recycling proves to be a daunting task. Moreover, the absence of standardized recycling processes and regulations for composite materials further stifles widespread recycling efforts, potentially stunting market growth. However, with rising sustainability concerns and the push for these materials to integrate into the circular economy, researchers and industry leaders are actively pioneering innovative recycling methods.

- As global environmental concerns intensify, the composite industry is witnessing a significant rise in the adoption of bio-based materials. For instance, driven by urgent environmental and sustainability goals, there's an escalating demand for bio-based composites, especially in the infrastructure and construction sectors. Furthermore, heightened environmental mandates and dwindling resources in industries such as automotive and aerospace are steering a pronounced emphasis on developing innovative, eco-friendly composite materials. This trend is not going unnoticed, as it opens up lucrative avenues, prompting numerous companies to channel investments into the market.

Composite Testing Market Trends

Automotive Industry to be the Fastest Growing End User

- Composite testing has become one of the crucial inspection services in the automotive industry due to the growing adoption of advanced composite materials. Advanced composite materials have transformed the automotive industry, boosting vehicle performance with cutting-edge structural designs and enhanced mechanical properties.

- Notably, carbon fiber and honeycomb structures, as advanced composites, provide a high strength-to-weight ratio, allowing for a significant reduction in vehicle mass. This reduction translates to improved fuel efficiency and diminished emissions. Furthermore, composites boast superior corrosion resistance over metals, bolstering the longevity and durability of automotive components. Given the rising innovations and surging demand for these materials in automotive applications, the market is poised for robust growth.

- Composite materials play a crucial role in the evolving landscape of vehicle design, highlighting their significance in enhancing efficiency and leading innovation in the automotive sector. By combining diverse elements, these materials produce strong, lightweight components that markedly improve fuel efficiency and overall performance. As the demand for fuel-efficient and high-performing vehicles surges, the automotive industry is increasingly turning to these advanced composites. Not only are these composites transforming car manufacturing, but they're also bolstering performance while minimizing environmental footprints. With rising automotive sales and heightened investments in vehicle production, the market is poised for significant growth.

- Composite materials, especially carbon fiber, are making waves in automotive manufacturing. The automotive industry is increasingly favoring composites made from carbon fiber and resins. The benefits of these materials align closely with the specific needs of automotive manufacturing. As investments in carbon fiber composites for automotive applications rise, they're poised to significantly shape market dynamics.

- The future of composite materials in electric vehicles (EVs) is poised to significantly influence the automotive sector. As the industry shifts towards a more sustainable model aligned with a low-carbon economy, the utilization of composites in EVs is advancing swiftly. Numerous countries are observing substantial increases in EV sales across diverse regions, including North America, Asia-Pacific, Europe, and beyond.

- For example, the International Energy Agency (IEA) reported that in 2023, China led the Asia-Pacific region in electric car sales, achieving over eight million units sold. Moreover, according to Argonne National Laboratory, in 2023, the United States saw plug-in electric vehicle (PEV) sales approach the 1.5 million mark, with sales of both all-electric and plug-in hybrid electric vehicles hitting their zenith.

Asia Pacific to Register Major Growth

- The Asia-Pacific composite testing market is influenced by distinct regional traits, each playing a role in shaping its growth trajectory. East Asia, which includes powerhouses like China, Japan, and South Korea, stands out as a frontrunner. This dominance is attributed to their embrace of cutting-edge technologies, strong manufacturing prowess, and considerable consumer expenditure. Notably, China's expansive population and swiftly advancing industries are pivotal in driving this demand.

- For example, in July 2024, Volkswagen unveiled the ID. Unyx, marking the debut of its new sub-brand tailored exclusively for China. This move aligns with Volkswagen's 'In China, for China' strategy. The ID. Unyx, an all-electric e-SUV coupe, boasts a contemporary design and features a customizable AI-driven 3D assistant. Notably, this model is both developed and produced at Volkswagen's state-of-the-art facilities in Hefei, China.

- Further, In October 2024, ULVAC, Inc., a global leader in comprehensive vacuum manufacturing, inaugurated its Technology Center PYEONGTAEK in Pyeongtaek, Gyeonggi-do, South Korea. This center is set to spearhead the evolution of next-generation semiconductor manufacturing equipment and processes, working closely with South Korean clients, and is also focused on establishing mass production technologies.

- Southeast Asia's composite testing demand is on a growth trajectory, buoyed by urbanization, rising disposable incomes, and a swelling middle class. Countries like Indonesia, Vietnam, and Thailand are stepping into the limelight, drawing investments and nurturing innovation.

- Demand is surging due to activities such as a significant meeting that took place in Central Jakarta in September 2024. Indonesian and French officials, alongside industry experts, deliberated on the construction and operational support for two Scorpene Evolved submarines. These submarines are set to be operated by the Indonesian Navy (TNI AL). This gathering underscored a pivotal moment in the bilateral agreement, emphasizing Indonesia's commitment to domestically constructing the two Scorpene Evolved submarines.

Composite Testing Industry Overview

In the market studied the competitive rivalry between various firms depends on price, product, market share, and the intensity with which they compete. In the composite testing market, incumbents, such as Composites Testing Laboratory, Element Materials Technology, Intertek Group PLC, and others, account for the largest market shares. The market is highly competitive and consolidated; major vendors hold significant market shares.

These companies strongly influence the market in terms of R&D and consolidation activities. Furthermore, the composite service in the market studied can be characterized by moderate levels of market penetration. Additionally, few regional players are entering the market to leverage the local demand in the end-user sector, such as building and construction.

Innovation can give companies a sustainable competitive advantage. Market incumbents have adopted powerful competitive strategies based on product differentiation, market expansion, and mergers and acquisitions. The exit barriers in the market are high due to the high costs involved in operations.

The firm concentration ratio is projected to grow steadily over the forecast period. High dominance by a few market incumbents is expected to be detrimental to the market's overall profitability. Overall, the intensity of competitive rivalry is high and expected to increase in the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products & Services

- 4.2.5 Intensity Of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Large Investments on Composites Testing Facilities in Asia Pacific

- 5.1.2 Increasing Demand for Composite Testing From Automotive and Aerospace and Defense

- 5.1.3 Growing Demand for Testing of Hydraulic Frames in Aerospace and Defense Application

- 5.2 Market Restraints

- 5.2.1 Lack of Trained Operators and Expertise in Developing Regions

- 5.2.2 Issues Related to Recyclability of Composites

- 5.3 Impact of Macroeconomic Factors on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Ceramic Matrix Composites

- 6.1.2 Continuous Fiber Composites

- 6.1.3 Discontinuous Fiber Composites

- 6.1.4 Polymer Matrix Composites

- 6.1.5 Other Composites

- 6.2 By Testing Method

- 6.2.1 Destructive

- 6.2.2 Non-destructive

- 6.3 By Application

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Building and Construction

- 6.3.4 Electricals and Electronics

- 6.3.5 Others (Sporting Goods, Wind Energy, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Composites Testing Laboratory

- 7.1.2 Element Materials Technology (Temasek Holdings)

- 7.1.3 ETIM Composites Testing Laboratory

- 7.1.4 Henkel AG and Co. KGaA

- 7.1.5 Instron Corporation (Illinois Tool Works Inc.)

- 7.1.6 Intertek Group PLC

- 7.1.7 Matrix Composites, Inc. (ITT Inc.)

- 7.1.8 MISTRAS Group Inc.

- 7.1.9 Westmoreland Mechanical Testing & Research, Inc.

![复合材料测试市场:趋势、机会与竞争分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)