|

市场调查报告书

商品编码

1627191

美国婴儿食品包装:市场占有率分析、产业趋势与成长预测(2025-2030)United States Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

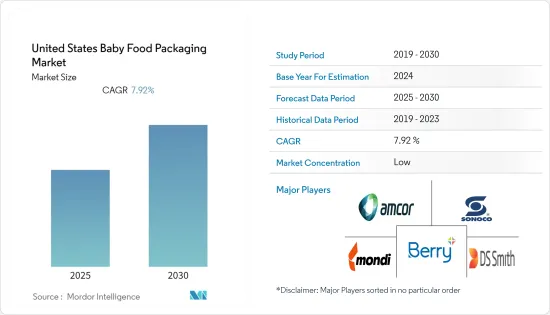

美国婴儿食品包装市场预计在预测期内复合年增长率为7.92%

主要亮点

- 美国是世界上工业化程度最高的国家之一。都市化进程显着,人们的可支配所得增加,生活方式现代化。这些问题正在推高婴儿食品的成本。

- 近年来,对可靠包装的需求以及客户对环保袋日益增长的偏好加速了软包装的采用。袋子是一种顶部有塑胶喷嘴的容器,您可以从中饮用食物。

- 由于婴儿预製食品的需求不断增加,袋装和纸盒越来越受欢迎。婴儿食品一旦打开就不能食用,因此必须非常小心地包装。包装并密封在容器中后,透过高压釜和加热进行灭菌。包装中排除氧气并避免使用防腐剂可以延长婴儿干食品的保存期限。

- 人们越来越意识到一次性塑胶对环境的影响和不可持续的商业惯例,使消费者能够要求更高的产品标准,同时降低对环境的影响。

- 儘管COVID-19对包装产业的影响较小,但由于供应链中断和部分生产设施关闭等因素,婴儿食品的生产和分销能力暂时下降。鑑于需求增加、世界各地广泛接种疫苗以及旅行限制的取消,包装行业復苏相对较快。

美国婴儿食品包装市场趋势

塑胶预计将占据最大的市场占有率

- 塑胶容器比玻璃瓶更轻,适合忙碌的生活方式,并且在婴儿食品包装中越来越受欢迎。

- 随着消费者对环保袋包装的需求,软包装越来越受欢迎。婴儿食品製造商正在不断创新,以满足不同的消费者偏好,这也是推动塑胶包装解决方案需求的因素。

- 包装企业正在选择 PET 和 PVC 等不会影响包装食品的塑料,以满足环保婴儿食品的需求。具有环保意识的父母经常选择用塑胶屏障袋或小袋包装的婴儿食品,因为这些材料可回收且易于垃圾掩埋场。

- 此外,由于婴儿食品的柔性阻隔袋对新型零售包装的接受度和需求不断增加,因此越来越受欢迎。

- 与标准罐装相比,软零售包装是婴儿食品更好的选择,因为它可以确保产品安全和新鲜。

- 最受欢迎的塑胶包装材料之一是 HDPE。 HDPE 用于製造各种瓶子和容器。无色瓶子透明、坚固且具有出色的阻隔性,使其成为包装保质期有限的产品(例如牛奶)的理想选择。

奶粉占据最大市场占有率

- 12 个月以下婴幼儿的食品包括奶粉。奶粉通常是粉末状状的,用于奶瓶餵养,通常被认为是母乳的替代品。与水或其他饮料混合。

- 奶粉的主要功能是在没有适当冷藏或储存的情况下延长其保存期限。世界各地都消费奶粉,特别是婴儿和以牛奶为主要饮食的婴儿。

- 它含有硫胺素、蛋白质、维生素B12、维生素C,是婴幼儿的主食之一。降低储存和运输成本也有助于扩大婴儿配方奶粉市场。小袋、塑胶、玻璃和纸板都是适合奶粉的包装材料。

- 此外,随着全球五岁以下儿童有机婴儿食品需求的增加,预计婴儿配方奶粉将强劲成长。儿童和婴儿营养不良的增加正在推动对婴儿奶粉的需求。

- 最近建立了母乳库,因为早产儿与正常婴儿相比需要特殊的营养。该银行提供 0.5 克或 1 克袋装母乳。这些产品完全由 100% 母乳製成。

- 由于牛奶的需求始终存在,这个行业正在急剧扩张。如今,大多数美国母亲经常带着婴儿和幼儿工作和旅行,因此很难随身携带液态奶。因此,方便携带的奶粉成为主流。

美国婴儿食品包装产业概况

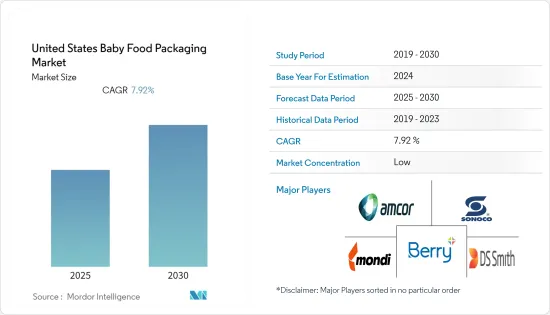

由于国内外企业众多,婴儿食品包装市场需要变得更加凝聚。市场分散,企业在价格、产品设计、产品创新等方面竞争。市场上的一些主要企业包括 Ardagh Group、Amcor Ltd、Mondi Group 和 Sonoco。

- 2022 年 4 月 - Mondi 集团宣布推出针对食品业的新包装解决方案。两托盘包装产品为生鲜食品製造商提供了可回收的选择,并有助于减少食品废弃物。执行单环和单成型聚丙烯可提供食品保护,并展示包装如何在整个供应链中发挥重要作用。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 快速的都市化和忙碌的生活方式

- 市场限制因素

- 人们对环保产品的兴趣日益浓厚

第六章 市场细分

- 按材质

- 塑胶

- 纸板

- 金属

- 玻璃

- 按包装类型

- 瓶子

- 金属罐

- 纸盒

- 瓶子

- 小袋

- 副产品

- 奶粉

- 干燥婴儿食品

- 奶粉

- 准备好的婴儿食品

第七章 竞争格局

- 公司简介

- Amcor PLC

- Sonoco Products Company

- Mondi PLC

- Berry Global Inc.

- DS Smith PLC

- Tetra Pak international(Tetra Laval Group)

- Aptar Group

- Ball Corporation

- Winpak Ltd

- Constantia Flexibles

第八章投资分析

第9章市场的未来

简介目录

Product Code: 50630

The United States Baby Food Packaging Market is expected to register a CAGR of 7.92% during the forecast period.

Key Highlights

- The United States is one of the most industrialized nations in the world. It is experiencing significant urbanization, increasing people's disposable income and encouraging them to adopt modern lifestyles. Baby food product costs increased due to these issues.

- Dependable packaging demand and the growing customer preference for eco-friendly pouches have accelerated flexible packaging adoption in recent years. Pouches, receptacles with plastic spouts on top from which food may be sipped, are becoming increasingly well-liked here.

- Pouches and cartons are becoming more popular due to the rising demand for prepared infant food. Prepared baby food requires extremely secure packaging since it should only be consumed once opened. After being packaged and sealed in containers, these goods are sterilized by autoclaving and heating. By eliminating oxygen from packaging and avoiding preservatives, dry infant food's ability to be preserved is improved.

- The increasing awareness of the environmental effect of single-use plastic and unsustainable business practices empowered consumers to demand a higher product standard with less ecological impact.

- Although the COVID-19 impact was less on the packaging industry, the factors such as supply chain disruption and partial closure of production facilities temporarily disrupted the production and distribution capacity of baby food products. The packaging industry recovered relatively quickly, considering the growing demand, widespread vaccination in various parts of the world, and removal of travel restrictions.

US Baby Food Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- The lightweight plastic containers over glass jars make them suitable for on-the-move lifestyles, favoring plastic in baby food packaging.

- The popularity of flexible packaging expanded along with consumer desire for eco-friendly pouch packaging. Baby food manufacturers are innovating to fulfill various consumer preferences, another element boosting the demand for plastic packaging solutions.

- Packaging businesses choose plastics like PET and PVC that have no impact on the packed food to meet the need for eco-friendly infant food items. Because these materials are recyclable and landfill-friendly, environmentally aware parents frequently choose baby food packaged in plastic barrier bags and pouches.

- Furthermore, flexible barrier bags for baby food are growing in popularity owing to their increased acceptance and the demand for new forms of retail packaging.

- Flexible retail packaging is a much better choice for baby food than standard jars since it ensures product safety and freshness.

- One of the most popular plastic packing materials is HDPE. It is employed to produce a range of bottles and containers. Unpigmented bottles are transparent, robust, and have good barrier qualities, making them ideal for packaging goods with limited shelf lives, like milk.

Powder Milk formula to Hold the Largest Market Share

- Foods formulated for babies and infants younger than 12 months of age include milk powders. These are often made in a powdered form for bottle feeding and are typically considered a substitute for breast milk. They are mixed with water or another beverage.

- Powdered milk's primary function is to extend shelf life without proper refrigeration or storage. It is consumed worldwide, notably by young children and babies whose main meal is milk.

- Thiamin, proteins, Vitamin B12, and Vitamin C are present, making it one of the main foods for infants. Reduced storage and transportation costs also contribute to the market expansion for infant milk powder. Sachets, plastic, glass, and paperboard are all suitable packaging materials for these.

- Moreover, strong growth is on the cards for milk powders because of the rising demand for organic baby food across the globe for children under five. Increasing malnutrition among children and infants propelled the infant formula need.

- The human milk bank was recently established since preterm infants require particular nutritional diets compared to regular babies. This bank offers human milk in 0.5 gm or 1 gm sachets. These are 100% manufactured only from human donor milk.

- Since there is always a demand for milk, the industry is expanding dramatically. Since most American mothers today work and frequently travel with their infants, carrying liquid milk is difficult. Thus powdered milk is taking over because it is simple to use and portable.

US Baby Food Packaging Industry Overview

The baby food packaging market needs to be more cohesive, owing to many domestic and international players. The market is fragmented, with the players competing in price, product design, product innovation, etc. Some of the major players in the market are Ardagh Group, Amcor Ltd, Mondi Group, and Sonoco, among others.

- April 2022 - The Mondi group announced launching new packaging solutions for the food industry. Two-tray packaging products will provide recyclable options for fresh food manufacturers and can help reduce food waste. PerFORMing mono loop and mono formable PP will provide food protection, demonstrating how packaging plays a crucial role throughout the supply chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Industry Attractiveness - Porter's Five Forces Analysis

- 4.1.1 Bargaining Power of Suppliers

- 4.1.2 Bargaining Power of Buyers

- 4.1.3 Threat of New Entrants

- 4.1.4 Threat of Substitute Products

- 4.1.5 Intensity of Competitive Rivalry

- 4.2 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Urbanization Coupled with Busy Lifestyle

- 5.2 Market Restraints

- 5.2.1 Rising Concerns over Eco-friendly Products

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paperboard

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Package Type

- 6.2.1 Bottles

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Jars

- 6.2.5 Pouches

- 6.3 By Product

- 6.3.1 Liquid Milk Formula

- 6.3.2 Dried Baby Food

- 6.3.3 Powder Milk Formula

- 6.3.4 Prepared Baby Food

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Sonoco Products Company

- 7.1.3 Mondi PLC

- 7.1.4 Berry Global Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Tetra Pak international (Tetra Laval Group)

- 7.1.7 Aptar Group

- 7.1.8 Ball Corporation

- 7.1.9 Winpak Ltd

- 7.1.10 Constantia Flexibles

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219