|

市场调查报告书

商品编码

1627199

物联网託管服务 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)IoT Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

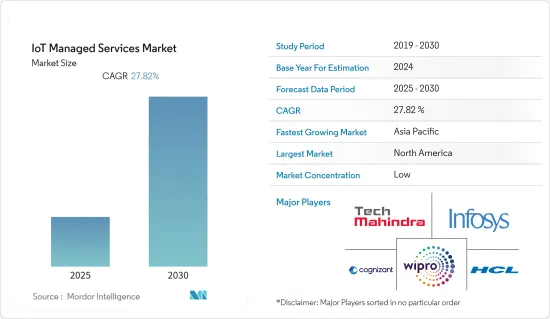

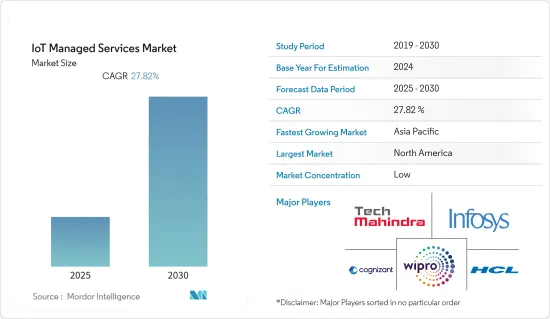

物联网託管服务市场预计在预测期内复合年增长率为 27.82%

主要亮点

- 能够提供即时资讯存取的传感器和处理器的技术发展和价格下降预计将推动市场扩张。业务扩展预计也将受到对提高营运效率和主要市场参与企业之间更好协作的需求的推动。为建立数位化和人力相结合的劳动力而开发的方法将提供重大的成长机会。

- 随着工业 4.0 成为现实,物联网技术在工业领域带来的可扩展性、成本优势和资料分析优势正在影响其采用。例如,据Tech Pro称,超过80%的工业製造商正在使用或计划部署物联网设备。

- 越来越多的企业选择物联网,世界各地的物联网 MSP 也越来越多地瞄准它们。根据 CompTIA 的 MSP 调查,MSP 将新兴技术视为重要的机会来源,超过 50% 的受访者提供物联网管理服务。

- 连网型设备的发展预计将为熟悉尖端人工智慧(AI)演算法的公司创造新的机会,以创建突破性的解决方案来解决该技术的痛点。物联网管理服务在远端监控、资产管理、预测性维护、远端服务和营运资讯等应用领域很受欢迎。

- 由于 COVID-19 的传播,由于社交距离规范,预计製造设施未来将尽可能提高自动化水准。预计连接工业IoT的物件数量将进一步增加,从而刺激对物联网管理服务的需求。

物联网 (IoT) 託管服务市场的趋势

製造业占较大市场占有率

- 工业 4.0 正在将产业从旧有系统转变为智慧组件和机器,促进数位工厂并开发互联工厂和公司的生态系统。工业 4.0 已说服OEM在其营运中实施物联网。

- 玛丽维尔大学估计,到 2025 年,全球每年将产生超过 180 兆 GB的资料。其中大部分是由工业物联网支援的产业产生的。工业IoT(IIoT) 巨头微软的一项调查发现,85% 的公司至少拥有一个 IIoT使用案例计划。这一数字有所增加,因为 94% 的受访者表示他们将在 2021 年之前实施物联网策略。

- 物联网为製造业带来的好处正在推动采用率的提高。好处包括提高机器运转率、预测性维护和生产、资料分析、监控、自动化和成本效益。

- 据资讯科技与创新基金会 (ITIF) 称,用于监控机器运转率的物联网应用可以将製造业的生产力提高 10% 至 25%。金属零件製造商 BC Machining LLC 推出了机器运作监控解决方案,以帮助提高生产率并优化电脑数值控制(CNC) 机器。 IIoT 解决方案从装置感测器撷取即时资料,并提供有关机器週期时间、停机时间和其他参数的报告。

预计亚太地区成长率最高

- 由于医疗保健、安全保障、製造、能源和农业等商业领域的蓬勃发展,亚太地区正在发展并具有巨大的扩张潜力。因此,物联网市场的成长速度正在加快。

- 随着区块链和加密流程在物联网保全服务中的集成,物联网提供了集中式网路和相关资料管理,减少了业务漏洞和安全问题,导致该地区的工程服务市场正在蓬勃发展。

- 印度、日本、中国、澳洲和韩国等国家是亚太市场的重要贡献者,该地区智慧城市的持续实施为该市场提供了各种潜在的成长机会。

- 此外,政府不断采取倡议鼓励医疗保健提供者和其他医疗保健组织采用EHR 和EMR 技术,以及非营利组织和私营部门在各种应用中的积极投资,正在将亚太地区的物联网管理服务推向新的水平。

物联网 (IoT) 託管服务产业概述

物联网託管服务市场高度分散,参与企业众多。大多数供应商都参与各种行销策略来增加市场占有率。市场上的供应商在价格、品质、品牌和产品差异化方面竞争。对较小参与企业的收购确保了在全球物联网管理服务中的最佳定位。各大主要企业包括IBM公司、埃森哲公司、Tech Mahindra有限公司等。目前的主要进展是

- 2022 年 11 月 - 阿根廷物联网商会与全球物联网 (IoT) 企业泰利特 (Telit) 结盟 (CAIoT)。 CAIoT是一个致力于推动物联网市场的会员组织。它解决法律和监管问题,促进物联网解决方案供应商和买家之间的沟通,提高所有行业的知识,并促进物联网成为阿根廷互联网的新成长引擎。

- 2022 年 8 月 - 透过最近与物联网 (IoT) 市场託管服务供应商 Integron 达成的协议,Stefanini 现在为医疗和製药行业提供电子医疗外包解决方案。该协议将 Stefanini 在 IT 外包、应用开发、解决方案部署和系统整合方面的专业知识与 Integron 成熟的託管物联网服务(包括连接、安全和设备监控)相结合。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 市场定义和范围

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 利用市场促进和市场约束因素

- 市场驱动因素

- 消费者对託管云端服务的趋势

- 扩大物联网在工业上的应用

- 物联网在製造业中的更多使用将提振市场

- 市场限制因素

- 物联网复杂性与安全问题

- 产业价值链分析

- 工业措施

- COVID-19 对市场的影响

第六章 市场细分

- 按用途

- 网管

- 设备管理

- 资料管理

- 安全管理

- 其他应用

- 按最终用户

- 能源和公共产业

- 製造业

- 零售

- 医疗保健

- BFSI

- 资讯科技与电信

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Wipro Ltd.

- Cognizant Technology Solutions Corp.

- Cisco Systems Inc.

- Tata Consultancy Services

- Tech Mahindra Ltd.

- Tieto Corporation

- Virtusa Corporation

- Infosys Ltd.

- HCL Technologies Ltd.

- Aricent Inc.

第八章投资分析

第九章 市场机会及未来趋势

The IoT Managed Services Market is expected to register a CAGR of 27.82% during the forecast period.

Key Highlights

- The expansion is anticipated to be fueled by technological developments and the rising affordability of sensors and processors that can deliver real-time information access. The need to increase operational proficiency and excellent cooperation among the key market players is also anticipated to fuel expansion. The methods developed to build a combined digital-human workforce would offer significant growth opportunities.

- The scalability, cost advantages, and data analytics benefits made possible by IoT technologies in the industrial domain are impacting the adoption as Industry 4.0 comes to fruition. For instance, Tech Pro says over 80% of industrial manufacturing organizations either use or plan to deploy IoT devices.

- Enterprises looking to opt for IoT are increasing, and global IoT MSPs are further targeting such enterprises. According to the CompTIA survey on MSPs, MSPs see emerging technology as a significant business opportunity source, and over 50% of respondents offer IoT-managed services.

- Developing connected devices is anticipated to create new opportunities for businesses with expertise in cutting-edge Artificial Intelligence (AI) algorithms to create ground-breaking solutions that may address the issues with the technology. IoT-managed services are becoming more popular in application areas like remote monitoring, asset management, predictive maintenance, remote servicing, and operational information.

- Due to the COVID-19 spread, manufacturing facilities are expected to increase the automation level in the future, wherever possible, due to social distancing norms. It would further push the number of industrial IoT-connected objects to multiply, fuelling the demand for IoT-managed services.

Internet of Things (IoT) Managed Services Market Trends

Manufacturing Sector to Hold a Significant Market Share

- Industry 4.0 is transforming industries, from legacy systems to smart components and machines, to facilitate digital factories and develop an ecosystem of connected plants and enterprises. Industry 4.0 persuaded OEMs to adopt IoT across their operations.

- Maryville University estimates that by 2025 over 180 trillion GB of data will be created worldwide every year. IIoT-enabled industries will generate a large portion of this. A survey by Industrial IoT (IIoT) giant Microsoft found that 85% of companies have at least one IIoT use case project. This number increased, as 94% of respondents said they would implement IoT strategies by 2021.

- The benefits offered by IoT in the manufacturing industry are driving the adoption rates. The benefits include increased machine utilization, predictive maintenance and production, data analytics, monitoring, automation, and cost benefits.

- According to the Information Technology and Innovation Foundation (ITIF), IoT applications for monitoring machine utilization can increase manufacturing productivity by 10% to 25%. %. BC Machining LLC, a metal parts manufacturer, onboarded a machine utilization monitoring solution that helps it improve productivity and optimize computer numerical control (CNC) machines. IIoT solutions capture real-time data from equipment sensors to provide reports on the machines' cycle times, downtime, and other parameters.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- As the Asia-Pacific region is developing, it holds significant expansion potential owing to booming commercial sectors like healthcare, safety and security, manufacturing, energy, and agriculture. It is enabling the IoT market to grow at a faster rate.

- Due to the integration of blockchain and cryptographic processes across IoT security services, IoT offers a centralized network and associated data management, reducing business vulnerabilities and security concerns and fueling the IoT in the engineering services market in this region.

- The countries such as India, Japan, China, Australia, and South Korea, are significant contributors to the Asia-Pacific market, and the growing smart city implementation in this region presents the market with varied potential growth opportunities.

- Moreover, growing government initiatives to encourage healthcare providers and other healthcare organizations to adopt EHR and EMR technologies and aggressive investments from nonprofit entities and private sectors in different applications are expected to drive IoT managed services market in the Asia-Pacific region.

Internet of Things (IoT) Managed Services Industry Overview

The IoT-managed services market is highly fragmented, owing to many players. Most vendors are participating in various marketing strategies to expand their market share. The vendors available in the market are competing on price, quality, brand, and product differentiation. The acquisition of small players ensures an optimum position in IoT-managed services globally. Various key players are IBM Corporation, Accenture PLC, Tech Mahindra Limited, etc. Key current advancements are -

- November 2022 - Argentine Chamber of IoT and Telit, a global Internet of Things (IoT) business, have formed a strategic alliance (CAIoT). CAIoT is a member organization that works to promote the IoT market. It addresses legal and regulatory issues, facilitates communication between suppliers and buyers of IoT solutions, improves knowledge of all industry verticals, and promotes IoT as a new growth engine for the Internet in Argentina.

- August 2022 - Through a recent agreement with Integron, a managed services supplier for the Internet of Things (IoT) market, Stefanini is now offering eHealth outsourcing solutions to the healthcare and pharmaceutical industries. The agreement combines Stefanini's expertise in IT outsourcing, application development, solution deployment, and systems integration with Integron's tried-and-true managed IoT services, which include connection, security, and device monitoring.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Consumer propensity Towards Managed Cloud Services

- 5.2.2 Growing Adoption of IoT from Industries

- 5.2.3 Increasing use of IOT in Manufacturing Sector to boost the market

- 5.3 Market Restraints

- 5.3.1 IoT Complexities Combined with Security Concerns

- 5.4 Industry Value Chain Analysis

- 5.5 Industry Policies

- 5.6 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Network Management

- 6.1.2 Device Management

- 6.1.3 Data Management

- 6.1.4 Security Management

- 6.1.5 Other Applications

- 6.2 By End-user

- 6.2.1 Energy and Utilities

- 6.2.2 Manufacturing

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 BFSI

- 6.2.6 IT & Telecom

- 6.2.7 Other End-users

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Rest of North America

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wipro Ltd.

- 7.1.2 Cognizant Technology Solutions Corp.

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Tata Consultancy Services

- 7.1.5 Tech Mahindra Ltd.

- 7.1.6 Tieto Corporation

- 7.1.7 Virtusa Corporation

- 7.1.8 Infosys Ltd.

- 7.1.9 HCL Technologies Ltd.

- 7.1.10 Aricent Inc.