|

市场调查报告书

商品编码

1627201

一氯乙酸 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Monochloroacetic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

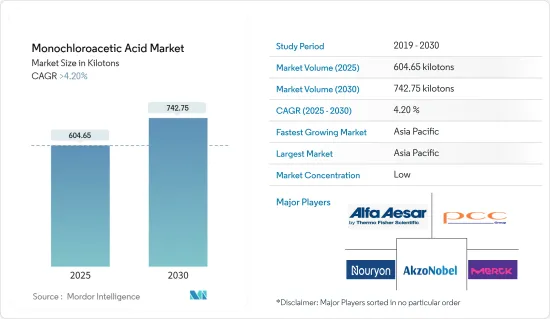

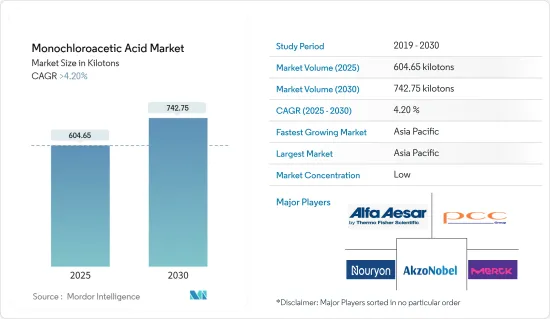

预计2025年一氯乙酸市场规模为604.65千吨,预计2030年将达到742.75千吨,预测期间(2025-2030年)复合年增长率超过4.2%。

主要亮点

- 短期来看,个人护理和製药行业需求的增加以及农化行业需求的增加是推动研究市场成长的关键因素。

- 然而,与一氯乙酸相关的严格法规是预计在预测期内抑制所涉及行业成长的主要因素。

- 氰乙酸用量的增加可能会在不久的将来为全球市场创造利润丰厚的成长机会。

- 亚太地区主导了全球市场,最大的消费来自中国和印度。

一氯乙酸市场趋势

个人护理和製药行业需求增加

- 一氯乙酸 (MCA) 是个人护理和化妆品行业中极其重要的成分。主要用于生产甜菜碱,甜菜碱是两性界面活性剂。这些甜菜碱以其发泡特性而闻名,广泛用于洗髮精中。

- MCA 的另一种衍生物,硫代乙醇酸(TGA 或巯基乙酸),是永久性头髮定型产品中必不可少的成分。不仅用于头髮定型,硫代乙醇酸及其衍生物在洗髮精、护髮素和髮膜等各种护髮产品的生产中也是必不可少的。

- 根据国家统计和地理研究所(INEGI)的资料,2023年12月墨西哥洗髮精、护髮素和护髮素产量达到4,631万套,比2022年12月的4,402万套增加5.2%。

- 此外,根据INEGI的研究,2023年12月墨西哥洗髮精和护髮素月销量为4,625万套,与前一年同期比较去年同期小幅成长4.6%。

- 此外,印度、泰国和越南等受全球化影响的国家可支配收入的增加、对美容产品的认识不断提高、消费模式不断变化以及零售格局的变化正在推动对个人保健产品的需求,预计这将增加对MCA 的需求。

- 根据加拿大统计局数据,2023年第三季加拿大化妆品和香水销售额达到约18.6亿加币(约13.8亿美元)。此外,根据国际贸易管理局和美国商务部的数据,加拿大化妆品市场的产业销售额预计每年增长1.45%,到2024年将达到18亿美元。加拿大美容和个人护理行业的復兴为美国化妆品出口商提供了利润丰厚的机会。

- 除了在个人护理中的作用外,MCA 在医学上也有重要用途,包括Ibuprofen/布洛芬、双氯芬酸钠、咖啡因、维生素(如维生素B)、甘氨酸、N-(对羟基苯基)-甘胺酸(METOL)、Maleate、及其他医药产品。

- 据印度品牌资产基金会(IBEF)称,印度丰富的原材料资源和熟练的劳动力使其成为全球第三大医药市场(按数量计算)、按金额计算第十四大医药市场。

- 由于个人护理和製药领域的需求不断增长,预计在预测期内一氯乙酸的需求将激增。

亚太地区主导市场

- 随着个人护理、医药和农化等关键产业需求的不断增长,亚太地区已牢牢确立了其在全球市场占有率中的主导地位。

- 近年来,中国和印度对一氯乙酸(MCA)的需求显着增加。这一激增主要是由于个人护理和製药行业的需求不断增长。

- 中国国家统计局资料显示,2023年,中国化妆品零售额达约4,141.7亿元人民币(约584.2亿美元),与前一年同期比较小幅增加5.2%。

- 对卫生和清洁的日益关注导致对个人保健产品、清洁剂和洗衣皂的需求增长。生产这些个人保健产品需要 MCA,这可能会推动对 MCA 的需求。

- 根据经济产业省资料显示,2023年日本洗髮精销售额为808.9亿日圆(约5.7亿美元),与前一年同期比较下降6.6%。

- 随着中国和印度人口快速成长,亚太地区个人护理和製药产业呈现显着上升趋势。

- 根据IBEF统计,23财年印度医药市场规模达497.8亿美元,与前一年同期比较增5%。值得注意的是,製药业跻身印度吸引外资的十大产业。印度药品出口遍及200多个国家,涵盖美国、西欧、日本和澳洲等艰难市场。其中,药品出口额从2023年4月的22.6亿美元增加至2024年4月的24.3亿美元,成长7.36%。

- 因此,考虑到上述因素,预计预测期内亚太地区一氯乙酸的需求将快速成长。

一氯乙酸产业概况

一氯乙酸市场因其性质而部分分割。主要参与企业(排名不分先后)包括 Nouryon、Merck KGaA、Alfa Aesar、PCC Group 和 Akzo Nobel NV。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 个人护理和製药行业需求增加

- 农化产业需求不断增加

- 其他司机

- 抑制因素

- 严格的监管阻碍市场成长

- 其他限制因素

- 产业价值链分析

- 波特五力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 透过化学应用

- 甘胺酸

- 羧甲基纤维素(CMC)

- 界面活性剂

- 2,4-二氯苯氧乙酸

- 硫代乙醇酸

- 其他的

- 按最终用户产业

- 个人护理和医药

- 农药

- 地质钻探

- 染料和清洁剂

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- Alfa Aesar

- Anugrah In-Org(P)Limited

- CABB Group GmbH

- Denak Co. Ltd

- Henan HDF Chemical Company Ltd

- Merck KGaA

- Meridian Chem Bond Pvt. Ltd

- Niacet Corporation

- Nouryon

- PCC Group

- Puyang Tiancheng Chemical Co. Ltd

- Shandong Minji New Material Technology Co. Ltd

- TerraTech Chemicals(I)Pvt. Ltd

第七章 市场机会及未来趋势

- 增加氰乙酸的用量

- 其他机会

简介目录

Product Code: 50789

The Monochloroacetic Acid Market size is estimated at 604.65 kilotons in 2025, and is expected to reach 742.75 kilotons by 2030, at a CAGR of greater than 4.2% during the forecast period (2025-2030).

Key Highlights

- Over the short term, the increasing demand from the personal care and pharmaceutical industries and the growing demand from the agrochemicals industry are the major factors driving the growth of the market studied.

- However, the stringent regulations related to monochloroacetic acid are a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the rising usage of cyanoacetic acid is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific dominated the market across the world, with the largest consumption coming from China and India.

Monochloroacetic Acid Market Trends

Increasing Demand from Personal Care and Pharmaceuticals Industries

- Monochloroacetic acid (MCA) is a pivotal component in the personal care and cosmetic industry. It is primarily utilized in the production of betaines, which are amphoteric surfactants. These betaines, known for their foaming properties, find extensive use in hair shampoos.

- Thioglycolic acid (TGA or mercaptoacetic acid), another derivative of MCA, is crucial in permanent hair styling formulations. It's not just limited to hair styling; thioglycolic acid and its derivatives are integral in the production of various hair care products, including shampoos, conditioners, and hair masks.

- According to the data from the National Institute of Statistics and Geography (INEGI), in December 2023, Mexico's production volume for shampoos, conditioners, and hair rinses hit 46.31 million units, marking a 5.2% increase from 44.02 million units in December 2022.

- INEGI's survey also highlights that the monthly sales volume of shampoos and conditioners in Mexico stood at 46.25 million units in December 2023, showing a modest 4.6% uptick from the previous year.

- Additionally, rising disposable incomes, increasing beauty product awareness, evolving consumption patterns, and the changing retail landscape in countries like India, Thailand, and Vietnam, influenced by globalization, are set to drive the demand for personal care products, subsequently boosting the demand for MCA.

- As per Statistics Canada, cosmetics and fragrance sales in Canada reached approximately CAD 1.86 billion (~USD 1.38 billion) in the third quarter of 2023. Moreover, according to the International Trade Administration and the US Department of Commerce, the industry revenue for the cosmetics market in Canada is expected to grow by 1.45% annually to reach USD 1.8 billion by 2024. This resurgence in Canada's beauty and personal care industry presents a lucrative opportunity for US cosmetic exporters.

- Besides its role in personal care, MCA finds significant use in pharmaceuticals, contributing to the production of various medications, including ibuprofen/brufen, diclofenac sodium, caffeine, vitamins (e.g., vitamin B), glycine, N-(P-hydroxyphenyl)-glycine (METOL), and maleates.

- As per the India Brand Equity Foundation (IBEF), India stands as the world's third-largest pharmaceutical market by volume and the fourteenth by value, owing to its rich raw material resources and skilled workforce.

- Given the rising demand in both the personal care and pharmaceutical sectors, the demand for monochloroacetic acid is expected to surge during the forecast period.

Asia-Pacific to Dominate the Market

- With rising demands from key sectors like personal care, pharmaceuticals, and agrochemicals, Asia-Pacific has firmly established its dominance in the global market share.

- China and India have seen a notable uptick in demand for monochloroacetic acid (MCA) in recent years. This surge is predominantly attributed to escalating needs within the personal care and pharmaceutical industries.

- As per data from the National Bureau of Statistics of China, in 2023, China's cosmetic retail sales reached approximately CNY 414.17 billion (~USD 58.42 billion), marking a modest 5.2% uptick from the previous year.

- The increasing concerns for hygiene and cleanliness have led to the growth in demand for personal care products, detergents, and washing soaps. This is likely to boost the demand for MCA, owing to its requirement in the production of these personal care products.

- According to the data from the Ministry of Economy Trade and Industry (METI), Japan's hair shampoo sales were valued at JPY 80.89 billion (~USD 0.57 billion) in 2023, reflecting a 6.6% dip from the year before.

- With burgeoning populations in China and India, the personal care and pharmaceutical sectors in Asia-Pacific are on a notable upswing.

- As per IBEF, the Indian pharmaceutical market witnessed a 5% Y-o-Y growth in FY23, reaching USD 49.78 billion. Notably, pharmaceuticals rank among the top ten sectors that are drawing foreign investments in India. India's pharmaceutical exports span over 200 countries, encompassing stringent markets like the United States, Western Europe, Japan, and Australia. Specifically, exports of drugs and pharmaceuticals climbed by 7.36%, from USD 2.26 billion in April 2023 to USD 2.43 billion in April 2024.

- Therefore, considering the aforementioned factors, the demand for monochloroacetic acid is expected to witness a rapid increase in Asia-Pacific during the forecast period.

Monochloroacetic Acid Industry Overview

The monochloroacetic acid market is partially fragmented in nature. The major players (not in any particular order) include Nouryon, Merck KGaA, Alfa Aesar, PCC Group, and Akzo Nobel NV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Personal Care and Pharmaceutical Industry

- 4.1.2 Growing Demand from the Agrochemicals Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations To Hinder Market Growth

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Chemical Application

- 5.1.1 Glycine

- 5.1.2 Carboxymethylcellulose (CMC)

- 5.1.3 Surfactants

- 5.1.4 2,4-Dichloro Phenoxy Acetic Acid

- 5.1.5 Thioglycol Acid

- 5.1.6 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Personal Care and Pharmaceuticals

- 5.2.2 Agrochemicals

- 5.2.3 Geological Drillings

- 5.2.4 Dyes and Detergents

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Alfa Aesar

- 6.4.3 Anugrah In-Org (P) Limited

- 6.4.4 CABB Group GmbH

- 6.4.5 Denak Co. Ltd

- 6.4.6 Henan HDF Chemical Company Ltd

- 6.4.7 Merck KGaA

- 6.4.8 Meridian Chem Bond Pvt. Ltd

- 6.4.9 Niacet Corporation

- 6.4.10 Nouryon

- 6.4.11 PCC Group

- 6.4.12 Puyang Tiancheng Chemical Co. Ltd

- 6.4.13 Shandong Minji New Material Technology Co. Ltd

- 6.4.14 TerraTech Chemicals (I) Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage of Cyanoacetic Acid

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219