|

市场调查报告书

商品编码

1627202

二乙醚:市场占有率分析、产业趋势、成长预测(2025-2030)Diethyl Ether - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

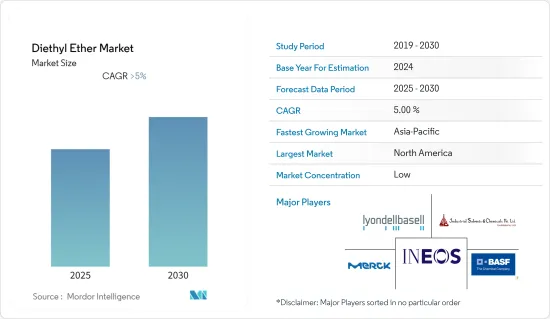

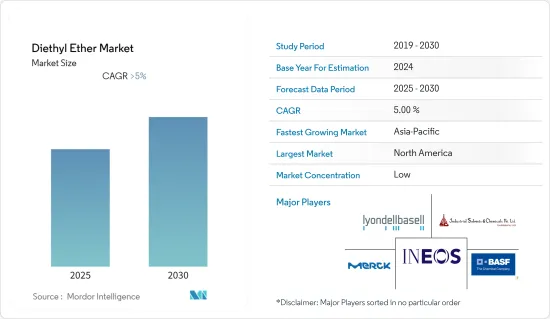

预计二乙醚市场在预测期内复合年增长率将超过 5%。

COVID-19 影响了包括乙醚在内的多个产业。由于供应链中断和终端需求下降,二乙醚的需求在疫情期间放缓。一旦疫情消退、业务恢復,市场就会復苏。新冠疫情过后,製药和化工产业的成长增加了二乙醚的消费量。

主要亮点

- 推动市场的主要因素之一是对工业和实验室溶剂的需求不断增长。

- 汽车产业正在推动市场发展,预计这一趋势将在未来几年持续下去。

- 然而,由于乙醇和异丙醇等其他溶剂的供应不断增加,二乙醚市场的成长可能会放缓。

- 使用乙醚製造具有多个壁的奈米碳管在未来可能是一个好主意。

- 北美主导全球整体市场,其中美国是最大的消费国。

乙醚市场趋势

汽车业乙醚消耗量

- 二乙醚在汽车工业中用作汽油辛烷值改良剂、氧浓度改良剂、润滑油组合药物。辛烷值衡量燃料防止引擎「爆震」和过早爆炸的能力,还可以增加汽油的含氧量,改善燃烧并减少污染物。

- 二乙醚可用作柴油启动液中的添加剂,旨在帮助柴油引擎在寒冷天气下启动。乙醚会蒸发柴油,使电热塞更容易点燃。这使得在寒冷地区启动柴油引擎变得更容易、更可靠。

- 乙醚高度易燃,因此它会使气缸内的压力增加近一倍,以快速启动引擎。

- 轻型商用车和送货卡车由于重量轻且燃油效率良好,消耗大量汽油。然而,大型商用车辆(例如牵引拖车和大型货车)通常更喜欢柴油发动机,因为它们的重量更大,更耐用。 2021年,商用车总产量为2,309万辆,较2020年的2,100万辆有所成长,成长6%。

- 2012年至2021年,商用车产量超过22857万辆。此外,根据欧洲汽车工业协会的数据,2022年1月至9月亚太地区新乘用车註册数量较去年同期增加超过7%。

- 柴油引擎技术的最新改进使柴油引擎成为商用车车主和驾驶人的更好选择,因为它们更清洁且对环境的危害更小。

- 在气候寒冷的国家,二乙醚添加剂对启动液更具吸引力,因为它们有助于在零度以下的温度下冷启动引擎。

- 汽车产业二乙醚的多元化消费可能会推动未来几年对二乙醚的需求。

北美市场占据主导地位

- 2022年,北美地区在全球市场占有率中占据主导地位。美国是世界上最大的乙醚生产国和消费国。

- 近年来,美国的药品支出增加。根据美国卫生系统药剂师协会的数据,2021 年美国药品总支出成长 7.7%,超过 5,750 亿美元。药品成本的增加可能是由于高血压和心理健康等大型慢性治疗领域所致。二乙醚在药物中用作溶剂。

- 供应链限制将在2022年严重影响美国汽车产业。 2022年全年汽车销量将比2021年下降8%以上。不过,通用汽车和丰田表示,该产业将在 2023 年復苏。例如,根据美国经济分析局的数据,2023年1月,美国汽车总销量超过1,600万辆,较2022年12月成长超过16%。

- 由于对药品和实验室试剂的需求不断增加,预计二乙醚市场在预测期内将以良好的速度成长。

二乙醚产业概况

二乙醚市场部分分散,大型企业比例较小。主要公司包括BASF SE、LyondellBasell Industries Holdings BV、Merck KGaA 和 INEOS。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对工业和实验室溶剂的需求不断增长

- 香水生产对乙醚的需求增加

- 压燃式 (CI) 引擎对乙醚的使用需求不断增长

- 抑制因素

- 形成爆炸性过氧化物

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析及趋势

- 技术简介

- 贸易分析

- 监理政策分析

第五章市场区隔

- 按用途

- 燃料和燃料添加剂

- 推进剂

- 溶剂

- 化学中间体

- 提取介质

- 其他用途

- 按最终用户产业

- 车

- 塑胶

- 药品

- 香味

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- BASF SE

- Industrial Solvents & Chemicals Pvt Ltd(ISCPL)

- INEOS

- LyondellBasell Industries Holdings BV

- Merck KGaA

- Sasol

- Standard Reagents Pvt Ltd.

- TKM Pharma Pvt Ltd.

第七章市场机会与未来趋势

- 使用乙醚生产多壁奈米碳管

The Diethyl Ether Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 affected several sectors, including diethyl ether. Due to supply chain interruptions and lower end-use demand, diethyl ether demand slowed during the pandemic. As the pandemic settled and business returned, the market recovered. growth of the pharmaceutical and chemical sectors post-COVID increased diethyl ether consumption.

Key Highlights

- One of the major factors driving the market is the growing demand for industrial and laboratory solvents.

- The automotive industry led the market, and this trend is expected to continue over the next few years.

- But the growth of the diethyl ether market can be slowed by the growing availability of other solvents like ethanol and isopropyl alcohol.

- Using diethyl ether to make carbon nanotubes with more than one wall could be a good idea in the future.

- North America dominated the market across the world, with the largest consumption coming from the United States.

Diethyl Ether Market Trends

Consumption of Diethyl Ether in Automotive Industry

- Diethyl ether is used in the automobile industry as an octane and oxygen enhancer in gasoline, as well as a lubricant oil blend. Octane rating, which evaluates a fuel's capacity to prevent "knocking" or early detonation in an engine It can also increase the oxygen content of gasoline, improving combustion and lowering pollutants.

- Diethyl ether can be used as an additive in diesel starting fluids, which are designed to aid in starting diesel engines in cold weather. The ether helps to evaporate the diesel fuel, making it easier for the glow plugs to ignite. This makes starting a cold-weather diesel engine easier and more reliable.

- Diethyl ether is very flammable, so it makes the engine start up quickly by almost doubling the pressure in the cylinder.

- Smaller commercial vehicles and delivery trucks consume more gasoline because of their reduced weight and higher fuel efficiency. However, bigger commercial vehicles, such as tractor-trailers and heavy-duty freight trucks, often prefer diesel engines due to their greater weight and durability. In 2021, the total number of commercial cars built was 23.09 million, up from 21 million in 2020 (an increase of 6%).

- In the period from 2012 to 2021, over 228.57 million commercial vehicles were manufactured. Furthermore, according to the European Automobile Manufacturers Association, during January-September 2022, new passenger car registrations in Asia Pacific increased by more than 7% as compared to a similar period last year.

- Recent improvements to diesel engine technology have made them a better choice for owners and drivers of commercial vehicles because they are cleaner and less harmful to the environment.

- The diethyl ether additive can be of higher interest in the starting fluid in countries with cold climates, as it helps in the cold-starting of an engine at sub-zero temperatures.

- The consumption of diethyl ether in diverse ways in the automotive industry is likely to drive the demand for diethyl ether in the coming years.

North American Region to Dominate the Market

- The North American region dominated the global market share in 2022. The United States is the largest producer and consumer of diethyl ether across the world.

- Pharmaceutical spending in the United States has been increasing over the past few years. According to the American Society of Health-System Pharmacists, in 2021, total drug spending in the U.S. increased by 7.7% and surpassed USD 575 billion. The increase in drug spending is most likely due to large chronic therapy areas, such as hypertension and mental health. Diethyl ether is used as a solvent for drugs.

- Supply chain constraints will severely affect the U.S. automotive industry in 2022. Annual vehicle sales in 2022 declined by more than 8% compared to 2021. However, according to General Motors and Toyota, the industry will rebound in 2023. For instance, according to the U.S. Bureau of Economic Analysis, in January 2023, total vehicle sales in the U.S. surpassed 16 million units, more than 16% as compared to December 2022.

- With an increasing demand for pharmaceutical drugs and laboratory reagents, the market for diethyl ether is likely to grow at a good pace during the forecast period.

Diethyl Ether Industry Overview

The diethyl ether market is partially fragmented, with the major players accounting for a small chunk of it. Some of these major players include BASF SE, LyondellBasell Industries Holdings BV, Merck KGaA, and INEOS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Industrial and Laboratory Solvents

- 4.1.2 Rising Demand for Diethyl Ether in the Production of Perfumes

- 4.1.3 Growing Need for Use of Diethyl Ether for Compression-Ignition (CI) Engines

- 4.2 Restraints

- 4.2.1 Formation of Explosive Peroxides

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis and Trends

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Fuel and Fuel Additives

- 5.1.2 Propellants

- 5.1.3 Solvents

- 5.1.4 Chemical Intermediates

- 5.1.5 Extractive Mediums

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Plastics

- 5.2.3 Pharmaceutical

- 5.2.4 Fragrance

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Industrial Solvents & Chemicals Pvt Ltd (ISCPL)

- 6.4.3 INEOS

- 6.4.4 LyondellBasell Industries Holdings BV

- 6.4.5 Merck KGaA

- 6.4.6 Sasol

- 6.4.7 Standard Reagents Pvt Ltd.

- 6.4.8 TKM Pharma Pvt Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Manufacturing Multi-walled Carbon Nano Tubes, Using Diethyl Ether