|

市场调查报告书

商品编码

1627203

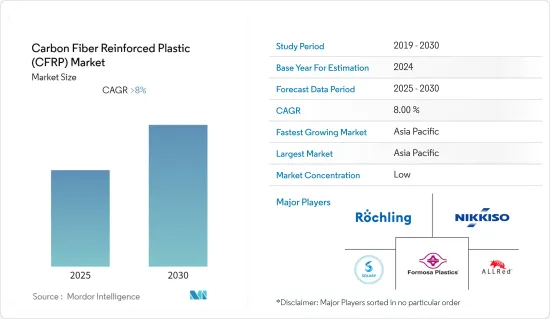

碳纤维增强塑胶(CFRP):市场占有率分析、产业趋势、成长预测(2025-2030)Carbon Fiber Reinforced Plastic (CFRP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计碳纤维增强塑胶 (CFRP) 市场在预测期内的复合年增长率将超过 8%。

由于所有消耗 CFRP 的主要行业都关闭,市场受到了 COVID-19 的负面影响。由于 COVID-19 爆发造成的破坏,包括建筑、汽车和航太的所有行业都关闭了生产工厂,减少了对 CFRP 的需求。然而,随着企业復苏,未来几年投资预计将增加并推动对 CFRP 的需求。

主要亮点

- 从长远来看,航太业不断增长的需求以及对节能和轻型车辆日益增长的偏好预计将推动市场成长。

- 然而,CFRP的高成本和产能不足预计将阻碍市场成长。

- 将重点转向低成本产品和技术的开发似乎是未来的机会。

- 亚太地区主导全球市场,其中中国和印度的消费量最高。

碳纤维增强塑胶(CFRP)市场趋势

航太业的需求增加

- CFRP是一种复合材料,由基体和增强体两部分组成。基体是聚合物树脂,增强体是碳纤维。

- 随着航太工业对性能提高的重视,CFRP 材料由于其高强度重量比和刚度而被用作金属和合金的替代品。

- 最初,CFRP用于波音787和空中巴士A350,主要是为了减轻CFRP零件的重量。最新的民航机型号,例如波音梦幻飞机和空中巴士 A350,含有高达 52% 的 CFRP。

- 2022 年 6 月,全球机队总数为 28,674 架飞机,其中现役飞机 23,513 架,地面飞机 5,161 架。这一数量意味着现役飞机数量与 2021 年 6 月相比增加了 11%,与 2020 年 6 月相比增加了 91%。

- 根据波音商业市场展望,到2041年,全球飞机持有预计将成长80%,新飞机交付市场价值将达到7.2兆美元。波音公司预计,到 2041 年,全球将总合交付41,170 架民航机。

- 由于上述因素,预计市场在预测期内将出现復苏后的成长。

亚太地区主导市场

- 由于印度、日本和中国等国家的工业、航空和汽车领域广泛采用碳纤维复合材料,亚太地区在全球碳纤维复合材料市场中占据最大份额。

- 近年来,中国对全球航空运输量的成长做出了巨大贡献。每年平均旅客成长率超过10%。这一增长主要是由于消费能力的提高和航空连通性的改善而导致的客运量增加所推动的。因此,客运量的增加预计将推动飞机需求。

- 中国的汽车製造业是全世界最大的。然而,近年来该产业增速放缓,产销量下降。中国工业协会数据显示,2022年12月中国汽车销量256万辆,年减8.4%,但2022年全年成长至2,686万辆。

- CFRP有助于提高受损建筑构件的弯曲和剪切强度,因此这种材料广泛应用于建设产业。 2021年,建设产业新签约金额186.6亿美元,较去年成长2.5%,成长速度较去年同期回落7.1个百分点。

- 2022年1月,中国宣布了「十四五」(2021-2025)期间建筑业的发展计划,为国家经济走上更绿色、更聪明、更安全的道路奠定了基础。 2022年8月,中国政府宣布将投资1兆美元用于各种建设计划,其中包括建设一条从西南省四川省到西藏首都拉萨、全长1,629公里的高铁。

- 碳纤维有助于吸收大量衝击能量,使汽车更安全。 CFRP在汽车製造上有广泛的应用。因此,对该材料的需求预计很快就会增加。

- 根据印度品牌资产基金会预测,到2027年,印度汽车市场规模预计将达到548.4亿美元,复合年增长率超过9%。印度汽车工业的目标是到2026年将汽车出口量增加五倍。 2022年印度汽车出口总量为5,617,246辆。

- 许多汽车製造商正在该行业的各个领域进行大量投资。例如,2022年11月,马鲁蒂铃木印度公司宣布将投资8.6512亿美元用于设立新设施、推出新车型等多个计划。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

碳纤维增强塑胶(CFRP)产业概况

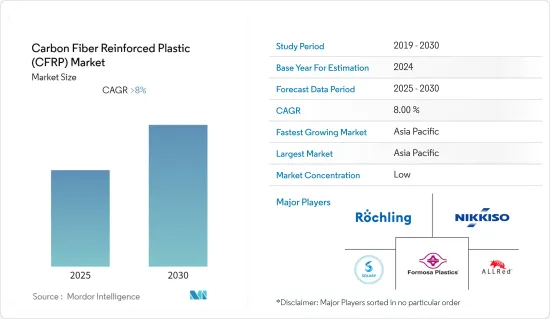

碳纤维增强塑胶(CFRP)市场部分分散,主要企业之间竞争激烈。这些主要企业包括 Solvay、Formosa M、Nikkiso、ALLRed & Associates Inc. 和 Rochling Group。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太业不断增长的需求

- 对节能和轻型车辆的需求不断增加

- 抑制因素

- CRFP高成本

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 依树脂类型

- 热固性CFRP

- 热塑性碳纤维增强塑料

- 按最终用户产业

- 航太

- 车

- 运动/休閒

- 建筑/施工

- 风电产业

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Solvay

- Hexcel Corporation

- Formosa M Co. Ltd

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd

- SABIC

- TEIJIN LIMITED

- TORAY INDUSTRIES INC.

- ALLRed & Associates Inc.

- Rochling

- Nikkiso Co. Ltd

第七章 市场机会及未来趋势

- 转向低成本产品和技术开发

The Carbon Fiber Reinforced Plastic Market is expected to register a CAGR of greater than 8% during the forecast period.

The market was negatively impacted due to COVID-19, as all the major industries that consume CFRP were put on a halt. All the industries, such as construction, automotive, aerospace, and others, shut their production plant due to the disruption caused by the COVID-19 pandemic, which reduced the demand for CFRP. However, with firms recovering, the investments are expected to grow and drive the demand for CFRP in the coming years.

Key Highlights

- Over the long term, the growing demand from the aerospace industry and a rising preference for fuel-efficient and lightweight vehicles are expected to drive market growth.

- However, the high cost of the CFRP and inadequate production capacity are expected to hinder the market's growth.

- Shifting focus on developing low-cost products and technologies will likely act as an opportunity in the future.

- Asia-Pacific dominated the market across the world, with the largest consumption from China and India.

Carbon Fiber Reinforced Plastics (CFRP) Market Trends

Increasing Demand from the Aerospace Industry

- CFRP is a composite material consisting of two parts: matrix and reinforcement. The matrix is a polymer resin, and the reinforcement is a carbon fiber, which provides high strength to the material.

- With the focus on performance improvement in the aerospace industry, CFRP material is being used as a replacement for metals and alloys, as it possesses a high strength-to-weight ratio and rigidity.

- Initially, CFRP was used in Boeing 787 and the Airbus A350, primarily driven by the weight savings of CFRP parts. The latest models in civil aviation, such as the Boeing Dreamliner and Airbus A350, are made of up to 52% CFRP.

- In June 2022, the total worldwide fleet size was 28,674, with 23,513 active and 5,161 grounded aircraft. The volume represents an expansion of 11% in operational aircraft fleet size compared to June 2021 and 91% compared to June 2020.

- According to the Boeing Commercial Market Outlook, the global fleet will increase by 80% and is expected to reach a market value of USD 7.2 trillion by 2041 for new airplane deliveries. According to Boeing forecasts, a total of 41,170 commercial airplanes will be delivered by the year 2041 globally.

- Owing to all the abovementioned factors, the market is expected to grow post-recovery during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the largest share of the global CFRP market, owing to widespread adoption in the industrial, aviation, and automotive sectors in countries like India, Japan, and China.

- China is a key contributor to global air traffic growth for the past few years. The average passenger growth rate is over 10% per year. This growth is primarily driven by rising passenger traffic due to higher spending power and better air connectivity. Thus, increasing passenger traffic is expected to boost the demand for aircraft.

- The Chinese automotive manufacturing industry is the largest in the world. However, the industry witnessed a slowdown in recent years, wherein production and sales declined. According to the China Association of Automobile Manufacturers (CAAM), automotive sales in China fell by 8.4% y-o-y to 2.56 million units in December 2022, whereas for the full year 2022, the sales grew to 26.86 million units.

- CFRP helps improve the bending and shear strength of damaged construction elements, so the material is extensively used in the construction industry. In 2021, the value of newly signed contracts in the construction industry was USD 18.66 billion, an increase of 2.5% year-on-year, and the growth rate narrowed by 7.1% points compared with the same period last year.

- In January 2022, China unveiled plans to develop its construction industry during the 14th Five-Year Plan (2021-2025), paving a pillar of the country's economy on a greener, smarter, and safer path. In August 2022, the Chinese government announced the investment of USD 1 trillion into different construction projects, including the construction of 1,629 km of high-speed rail from Sichuan province in the Southwest to the Tibetan capital Lhasa.

- The carbon fiber helps absorb large amounts of impact energy, increasing vehicle safety. CFRP includes huge applications in the manufacturing of automobiles. As a result, the demand for this material is expected to increase shortly.

- According to India Brand Equity Foundation, the Indian car market is expected to reach USD 54.84 billion by 2027 while registering a CAGR of over 9%. Indian automotive industry is targeting to increase the export of vehicles by five times by the year 2026. In 2022, total automobile exports from India stood at 5,617,246.

- Many Automakers are investing heavily in various segments of the industry. For instance, in November 2022, Maruti Suzuki India announced an investment of USD 865.12 million on various projects, including new facilities set-up and the introduction of new models.

- In turn, the abovementioned factors are projected to significantly impact the market in the coming years.

Carbon Fiber Reinforced Plastics (CFRP) Industry Overview

The carbon fiber reinforced plastic (CFRP) market is partly fragmented and is highly competitive among the major players. These major players include Solvay, Formosa M Co. Ltd, Nikkiso Co. Ltd, ALLRed & Associates Inc., and Rochling Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Aerospace Industry

- 4.1.2 Rising Demand for Fuel-efficient and Light-weight Vehicles

- 4.2 Restraints

- 4.2.1 High Cost of CRFP

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Thermosetting CFRP

- 5.1.2 Thermoplastic CFRP

- 5.2 End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Sports and Leisure

- 5.2.4 Building and Construction

- 5.2.5 Wind Power Industry

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Solvay

- 6.4.2 Hexcel Corporation

- 6.4.3 Formosa M Co. Ltd

- 6.4.4 Mitsubishi Chemical Corporation

- 6.4.5 Nippon Graphite Fiber Co. Ltd

- 6.4.6 SABIC

- 6.4.7 TEIJIN LIMITED

- 6.4.8 TORAY INDUSTRIES INC.

- 6.4.9 ALLRed & Associates Inc.

- 6.4.10 Rochling

- 6.4.11 Nikkiso Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward the Development of Low Cost Products and Technologies