|

市场调查报告书

商品编码

1627209

工作空间即服务 (WaaS):市场占有率分析、产业趋势与成长预测(2025-2030 年)Workspace As A Service (WaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

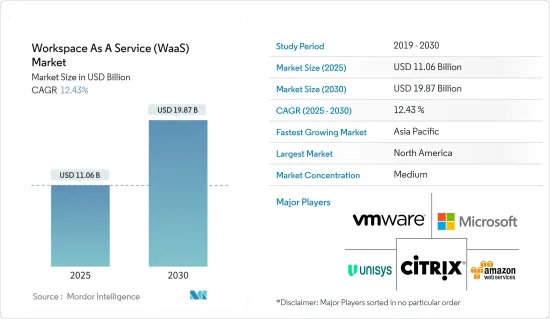

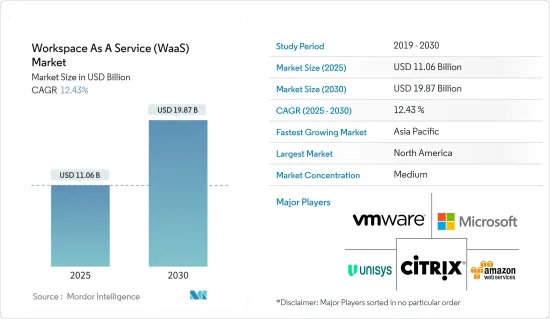

工作空间即服务市场规模预计到 2025 年为 110.6 亿美元,预计到 2030 年将达到 198.7 亿美元,预测期内(2025-2030 年)复合年增长率为 12.43%。

主要亮点

- 无论是在文书工作前工作,还是在旅途中使用平板电脑或智慧型手机工作,工作空间即服务都可以让员工存取他们需要的所有工具。这种服务能力使企业能够更灵活地运作并提高生产力,从而创造各种最终用户对服务的需求。

- 借助 WaaS,您的员工可以提高工作效率,并且无论身在何处都可以获得所需的应用程式和资料。企业正在认识到 WaaS 的价值,因为它使他们摆脱了地理限制并降低了基础设施管理成本,同时保持了员工的易用性。

- 由于各行业 BYOD 的使用不断增加,对轻鬆部署、扩充性、快速可用性和经济实惠的虚拟虚拟桌面的需求不断增加,全球 WaaS 市场预计将扩大。英特尔、SAP 和 Blackstone 等大公司也开始资助 BYOD 计画。一旦您的员工配备了行动设备,他们就可以使用您的组织设计的特定行动平台在任何地方工作。

- WaaS 解决方案允许多个使用者登入相同虚拟Windows 伺服器。 WaaS 供应商负责处理资源配置、负载平衡和网路问题,因此虚拟桌面环境不需要额外的维护或相关成本。因此,WaaS 已成为满足组织虚拟桌面需求的可行选择。

- 限制跨产业采用 WaaS 解决方案的主要挑战是该服务需要高速网路连线。 WaaS 可能不适合在不寻常环境中营运的企业,在这些环境中,员工经常分布在大片区域,无法存取高速网路。

- COVID-19 大流行迫使几乎每个人都在家工作,这对员工和企业都有利,因为 WaaS 为员工提供了在办公室外工作所需的应用程序,并加速了 WaaS 市场在全球的传播。

工作空间即服务 (WaaS) 市场趋势

电信和 IT 占据主要市场占有率

- 通讯和 IT 产业 BYOD 和云端处理的采用率很高。该领域是 WaaS 的早期采用者。受访的 IT 产业包括提供咨询以及基于 IT 的产品和服务的公司。因此,大多数製造资产都是无形的,包括许多公司。

- WaaS 经济且灵活,可满足不断变化的需求,例如业务扩张、收缩和季节性变化。企业可以根据需要进行扩展,并且只需为他们使用的服务付费。随着各行业越来越多的员工采用远端和混合工作习惯,向员工提供 WaaS 对于企业来说至关重要。

- WaaS 被世界各地的企业和中小型企业 (SMB) 采用,为最终用户提供驻留在实体办公环境中办公桌上的资源的虚拟工作空间模型。工作空间即服务(WaaS)因其成本低且易于管理而在 IT 和电讯领域也被广泛采用。

- 软体应用程式使公司能够从数位业务管道中获得收益,从而增加了自动化和发布新应用程式和功能的需求。由于其成本优势,这种需求也导致了向云端的转变。透过将软体转移到云端基础的服务,IT 和通讯公司可以更安全地运作。

- 通讯业的知名企业华为技术有限公司已将其在印度的研发中心迁移到名为「桌面云端」的云端处理平台。透过将运算和储存迁移到云端,与传统桌面环境相比,该公司能够将整体费用降低近 88%。

北美占据主要市场占有率

- 在北美,BYOD趋势的采用率相对较高。在北美,寻找经济高效的方法来保护企业资料和管理 IT 部署的需求非常突出,这正在推动北美工作空间即服务 (WaaS) 市场的发展。

- 随着北美经济的发展,公司预计将在全部区域扩张。因此,WaaS 趋势和公司发展为市场上的供应商提供了机会。 WaaS 模型提供的远端存取使员工能够在面对技术挑战时保持生产力。从任何装置登入桌面的选项可让使用者从遇到技术问题的装置切换并继续工作,而不会浪费时间进行维修。

- 该地区拥有广泛的製造业,随着美国希望为OEM製造商生产自己的供应商产品,中小微型企业部门的成长正在加速。金融科技在银行业数位化的崛起也支撑了该地区的 WaaS 市场。

- 此外,WaaS 模型可让您轻鬆地按月增加或减少设备和使用者的数量,而不会增加内部 IT 团队部署、监控和保护设备的负担。

- 让多个使用者共用一个桌面实例是云端桌面的主要好处之一。在不同时间使用相同的云端桌面对于跨多个时区工作的企业非常有用。 WaaS 还包括 DaaS,它无需额外成本即可提供对单一桌面的灵活多用户访问,并且正在推动北美市场的成长。

工作空间即服务 (WaaS) 产业概述

工作空间即服务 (WaaS) 市场竞争非常激烈,有几家大公司进入该市场。目前,这些大公司中只有少数几家在市场占有率方面占据主导地位。然而,许多公司正在透过赢得新契约、投资和现代化服务支援来扩大其市场份额。

2023 年 11 月,Kasm Technologies 与 Intersources(透过先进技术解决方案支援国际企业的跨国公司)合作,为 Masu 提供按需云端桌面、应用程式流程和 Web 隔离技术。该伙伴关係关係利用了 Kasm Workspaces 的技术组合和 Intersources 在政府服务、云端营运、产品主导成长和数位转型方面的能力。该合资企业将使大型和小型企业能够受益于现代虚拟桌面基础设施的敏捷性和效率,而无需传统虚拟桌面基础设施的复杂性和高成本。

2023 年 9 月,Salesforce 和 Google Workspace 的 Generative AI Assistant 将协助客户跨平台安全地工作,在 Google Workspace 中产生自订内容、更新记录并触发 Salesforce 中的工作流程。此次伙伴关係建立在现有 Salesforce Data Cloud 和 Google Cloud伙伴关係的基础上,旨在跨 Salesforce Customer 360 和 Google Workspace 提供互联的生成式 AI 体验。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 各行业越来越多地采用 BYOD

- 对经济实惠的虚拟桌面解决方案的需求不断增长

- 市场挑战

- 软体整合挑战

- 网路效能与频宽问题

第六章 市场细分

- 按发展

- 民众

- 私人的

- 杂交种

- 按解决方案/服务

- 桌面即服务 (DaaS)

- 应用程式即服务 (AaaS)

- 按公司

- 小型企业

- 大公司

- 按行业分类

- 银行、金融服务和保险 (BFSI)

- 教育

- 零售

- 政府机构

- 通讯/IT

- 卫生保健

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- VMware Inc.

- Citrix Systems Inc.

- Microsoft Corporation

- Getronics NV

- Unisys Corporation

- NTT DATA Corporation

- Colt Technology Services

- Cloudalize NV

- Dizzion Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Workspace As A Service Market size is estimated at USD 11.06 billion in 2025, and is expected to reach USD 19.87 billion by 2030, at a CAGR of 12.43% during the forecast period (2025-2030).

Key Highlights

- Whether working at a desk or on the go with a tablet or smartphone, employees can access all the tools they require thanks to workspace as a service. This service feature allows businesses more operational flexibility to boost productivity, creating demand for the service from various end users.

- WaaS enables employees to be more productive and capable of obtaining necessary apps and data, regardless of location. Businesses recognize the value of WaaS because it gives them freedom from geographical constraints and reduces infrastructure administration costs while maintaining employee experience.

- The global WaaS market is expected to increase due to increased BYOD usage across various industries, easy deployment, scalability, quick availability, and rising demand for reasonably priced virtual desktop virtualization. Major corporations, including Intel, SAP, and Blackstone, have also started funding BYOD programs. If staff have their mobile devices prepared, they can work from anywhere using the specific mobile platform the organization has designed.

- WaaS solutions allow businesses with several users to log into the same virtual Windows server. WaaS providers handle the supply of resources, load balancing, and network issues, so virtual desktop environments don't require additional maintenance or associated costs. WaaS has consequently emerged as a practical choice that meets the requirements of organizations for desktop virtualization.

- A major challenge restricting the adoption of WaaS solutions across industries is the requirement for a fast Internet connection for the service. WaaS could not be suitable for a business if it operates in an unusual environment where employees are frequently distributed across broad regions without access to fast Internet.

- The COVID-19 pandemic pushes almost everyone to work from home as WaaS provides employees with the applications they need for work outside the office, benefiting both employees and companies and fuelling the adoption of the WaaS market worldwide.

Workspace as a Service (WaaS) Market Trends

Telecom and IT to hold a Major Market Share

- The telecom and IT sector have witnessed a high BYOD and cloud computing penetration rate. The sector has been an early adopter of WaaS. The IT sector considered for the study includes enterprises that are into consulting and offering IT-based products and services. Therefore, most of their manufactured assets are intangible and include many enterprises.

- WaaS is flexible and economical for meeting changing demands for a company's expansion, contraction, or seasonal changes. Businesses can scale their size as necessary to only pay for the services they utilize. Offering WaaS to employees will be essential for enterprises because many workers in all sectors adopt remote and hybrid work habits.

- WaaS provides end users with a virtual workspace model of the resources end users would have at their desks within a physical office environment, adopted by enterprises and small and medium businesses (SMBs) worldwide. Low costs and easy management have also led Workspace as a Service implementation to most IT and Telecom sectors.

- Since software applications allow organizations to derive revenue from digital business channels, there is a stronger need to automate and release new applications and functionalities. This need has also led to a shift to the cloud, owing to the cost benefits. The migration of software to cloud-based services enables IT and Telecom companies to have better security in their operations.

- Huawei Technologies, a prominent player in the telecom industry, migrated its R&D center in India to its cloud computing platform called 'Desktop Cloud.' The company could save almost 88% of its overall expenses by migrating its computing and storage to the cloud compared to the traditional desktop environment.

North America to hold a Major Market Share

- North America is witnessing relatively high adoption rates of the BYOD trend. The need for securing enterprise data and finding cost-efficient ways of managing IT deployment is evident in the region, which drives North America's Workspace as a Service (WaaS) Market.

- The enterprise expansion across the region is expected with the economic development in North America. Therefore, adopting the WaaS trend and enterprise growth provides opportunities for the vendors in the market. Due to the remote access that WaaS models provide, employees can continue to be productive in the face of technological challenges. Users can switch from a device that gives them technical issues and continue working without losing any time for repairs, thanks to the option to log on to the desktop from any device.

- The region has a broad range of manufacturing industries, and the growth of the MSME sector is gearing up because the USA wants to produce in-house supplier products for its OEMs. The rising fintechs for digitalization of the banking sector also support the WaaS market in the region because SMBs only have to pay for the number of end users they need at any given time due to the monthly subscription.

- Additionally, WaaS models make it simple for the business to scale the number of devices and users up or down on a monthly cycle without burdening the internal IT team with the responsibility of deploying, monitoring, and protecting those additional devices.

- Multiple users sharing a single desktop instance is one of the main benefits of cloud desktops. Having the same cloud desktop available at different times of the day might be very helpful for businesses working in several time zones. WaaS includes DaaS, which offers a flexible, multi-user access to a single desktop without extra cost, driving the market's growth in North America.

Workspace as a Service (WaaS) Industry Overview

The workspace-as-a-service market is moderately competitive and comprises several major players. Currently, only a few of these major players dominate the market in terms of market share. However, many companies are increasing their market presence by securing new contracts, investing in, and modernizing service support.

In November 2023, Kasm Technologies has partnered with Intersources, a global player empowering international businesses with advanced tech solutions, to provide on-demand cloud desktops, application streaming, and web isolation technology for secure digital workspaces. This partnership will leverage the Kasm Workspaces technology portfolio and intersources' capabilities in government services, cloud operations, product-led growth, and digital transformation. The joint venture will enable large and small organizations to benefit from the agility and efficiency of a modern virtual desktop infrastructure without the traditional complexity and high costs.

In September 2023, Salesforce and Google Workspace generative AI assistants will let customers securely work across platforms to generate customized content in Google Workspace, update records, and trigger workflows in Salesforce. The partnership deepens existing Salesforce Data Cloud and Google Cloud partnerships to power connected generative AI experiences across Salesforce Customer 360 and Google Workspace.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of BYOD across Various Industries

- 5.1.2 Increasing Demand for Affordable Desktop Virtualization Solutions

- 5.2 Market Challenges

- 5.2.1 Software Integration Challenges

- 5.2.2 Network Performance and Bandwidth Issues

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By Solution and Service

- 6.2.1 Desktop as a Service (DaaS)

- 6.2.2 Application as a Service (AaaS)

- 6.3 By Enterprise

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Vertical

- 6.4.1 Banking, Financial Services and Insurance (BFSI)

- 6.4.2 Education

- 6.4.3 Retail

- 6.4.4 Government

- 6.4.5 Telecom and IT

- 6.4.6 Healthcare

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 VMware Inc.

- 7.1.3 Citrix Systems Inc.

- 7.1.4 Microsoft Corporation

- 7.1.5 Getronics NV

- 7.1.6 Unisys Corporation

- 7.1.7 NTT DATA Corporation

- 7.1.8 Colt Technology Services

- 7.1.9 Cloudalize NV

- 7.1.10 Dizzion Inc.